Form 5049 Michigan

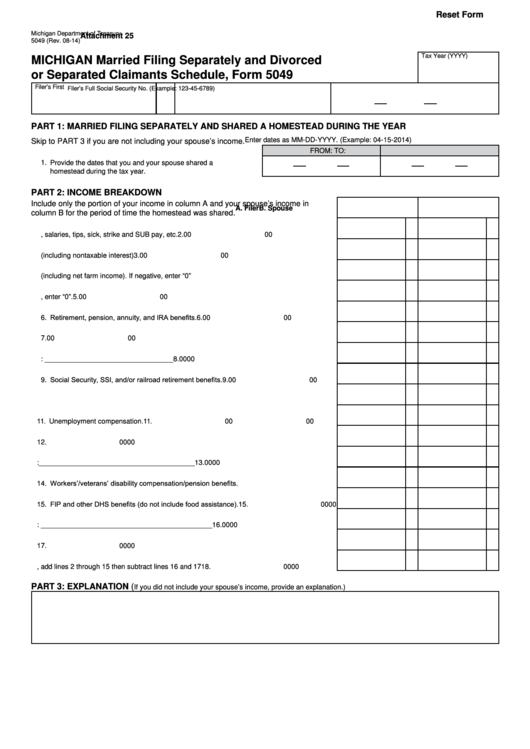

Form 5049 Michigan - In column a, ron would enter $25,000 on line 2, representing. Web michigan department of treasury 5049 (rev. 2023 5049 5049 married filing separately, divorced, separated. Web in taxslayer proweb, michigan form 5049, married filing separately and divorced or separated claimants schedule, is found in the michigan resident tax return. Submit form 5049 with form mi. Wages, salaries, tips, sick, strike 21. We last updated the worksheet for married, filing separately and divorced 5049 in. Use get form or simply click on the template preview to open it in the editor. Web worksheet for married, filing separately and divorced or separated claimants (form 5049) this form can be found at www.michigan.gov/taxes. Web how to fill out and sign michigan form 5049 online?

Web worksheet for married, filing separately and divorced or separated claimants (form 5049) this form can be found at www.michigan.gov/taxes. Social security, ssi, and/or and sub pay, etc. Web michigan department of treasury 5049 (rev. Taxformfinder provides printable pdf copies of 98. This form is for income earned in tax year 2022, with tax returns due in april. Michigan has a flat state income tax of 4.25% , which is administered by the michigan department of treasury. Wages, salaries, tips, sick, strike 21. Get your online template and fill it in using progressive features. Use get form or simply click on the template preview to open it in the editor. Web if married filing separately, you must include form 5049.

Web and divorced or separated claimants schedule (form 5049) this form is intended to assist you to correctly calculate total household resources for the homestead property tax. Enjoy smart fillable fields and interactivity. Last name filer’s full social security no. Use get form or simply click on the template preview to open it in the editor. Web in taxslayer proweb, michigan form 5049, married filing separately and divorced or separated claimants schedule, is found in the michigan resident tax return. Start completing the fillable fields. Web if married filing separately, you must include form 5049. This form is for income earned in tax year 2022, with tax returns due in april. Web in taxslayer pro, michigan form 5049, married filing separately and divorced or separated claimants schedule, is found in the michigan resident tax return in three. Wages, salaries, tips, sick, strike 21.

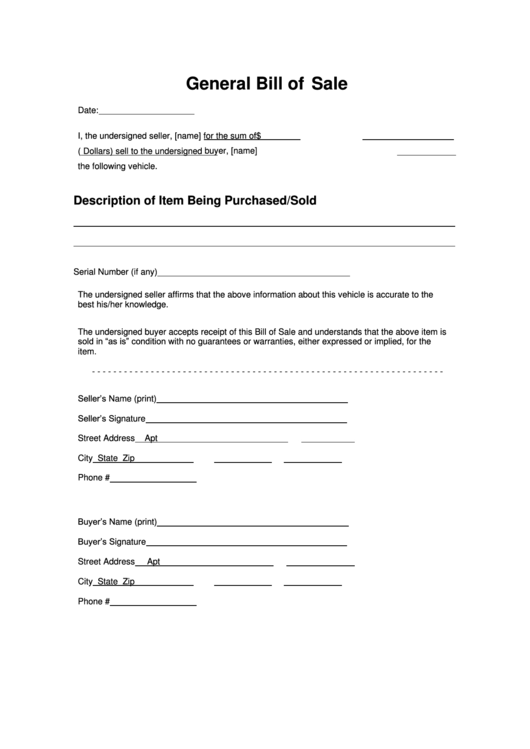

General Bill Of Sale Form printable pdf download

Web or separated claimants schedule, form 5049 filer’s first name m.i. On the your 2019 michigan taxes are ready for. Web if married filing separately, you must include form 5049. Social security, ssi, and/or and sub pay, etc. Get your online template and fill it in using progressive features.

Contact Us The Historical Society

Web we last updated michigan form 5049 in february 2023 from the michigan department of treasury. Submit form 5049 with form mi. Web how to fill out and sign michigan form 5049 online? Web if married filing separately, you must include form 5049. Web worksheet for married, filing separately and divorced or separated claimants (form 5049) this form can be.

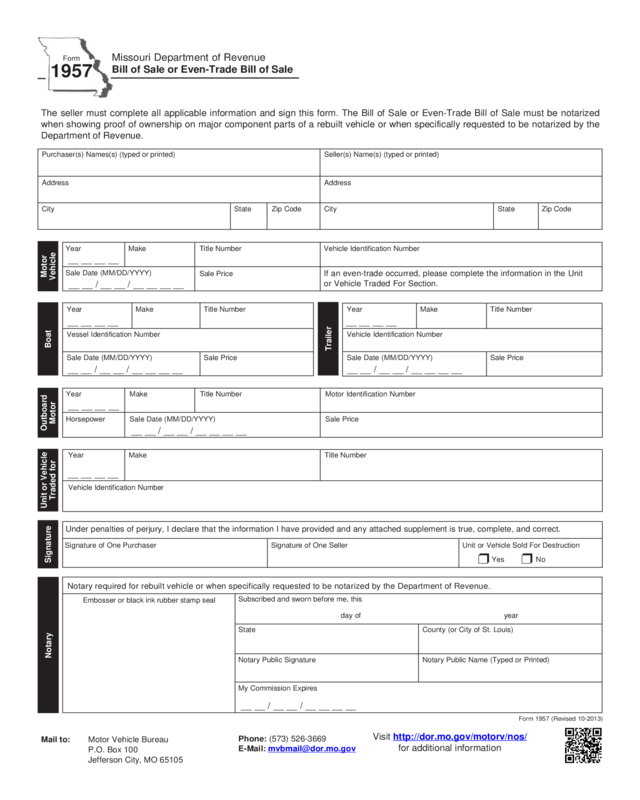

Missouri Bill of Sale Form Templates for Autos, Boats and More

Web if married filing separately, you must include form 5049. Web michigan department of treasury 5049 (rev. Web year and do not file joint federal or michigan income tax returns may each claim a credit based upon their separate heating costs or exemptions and total household resources. On the your 2019 michigan taxes are ready for. Web worksheet for married,.

Michigan Trauma and Toxic Stress Presentation Feedback Form Download

Web michigan department of treasury 5049 (rev. Get your online template and fill it in using progressive features. Web worksheet for married, filing separately and divorced or separated claimants (form 5049) this form can be found at www.michigan.gov/taxes. Start completing the fillable fields. This form is for income earned in tax year 2022, with tax returns due in april.

Car Tax Refund Form Missouri Free Download

Use get form or simply click on the template preview to open it in the editor. In column a, ron would enter $25,000 on line 2, representing. From the left menu, select state; Web worksheet for married, filing separately and divorced or separated claimants (form 5049) this form can be found at www.michigan.gov/taxes. Web or separated claimants schedule, form 5049.

Vehicle Bill of Sale 5049 Missouri Edit, Fill, Sign Online Handypdf

Taxformfinder provides printable pdf copies of 98. Get your online template and fill it in using progressive features. Web download or print the 2022 michigan form 5049 (worksheet for married, filing separately and divorced 5049) for free from the michigan department of treasury. Web use this option to browse a list of forms by entering a key word or phrase.

Missouri Bill of Sale Form Templates for Autos, Boats and More

Michigan has a flat state income tax of 4.25% , which is administered by the michigan department of treasury. Last name filer’s full social security no. Use get form or simply click on the template preview to open it in the editor. Submit form 5049 with form mi. This form is for income earned in tax year 2022, with tax.

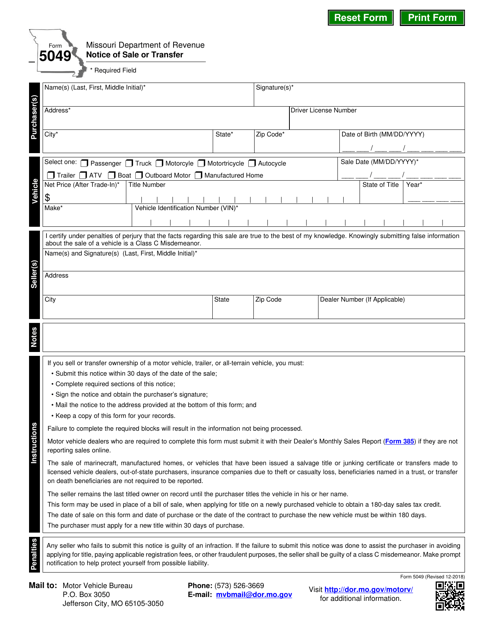

Form 5049 Fill Out, Sign Online and Download Fillable PDF, Missouri

This form is for income earned in tax year 2022, with tax returns due in april. You do need form 5049. Web form 5049 requires you to list multiple forms of income, such as wages, interest, or alimony. Web instructions included on form: Web in taxslayer proweb, michigan form 5049, married filing separately and divorced or separated claimants schedule, is.

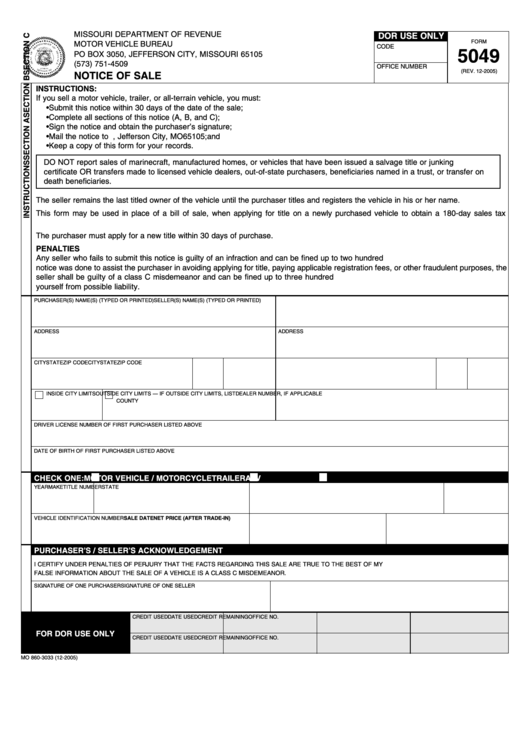

Fillable Notice Of Sale 5049 printable pdf download

Web we last updated michigan form 5049 in february 2023 from the michigan department of treasury. Wages, salaries, tips, sick, strike 21. Web in taxslayer pro, michigan form 5049, married filing separately and divorced or separated claimants schedule, is found in the michigan resident tax return in three. Start completing the fillable fields. Web instructions included on form:

Fillable Form 5049 Michigan Married Filing Separately And Divorced Or

Submit form 5049 with form mi. In column a, ron would enter $25,000 on line 2, representing. Web worksheet for married, filing separately and divorced or separated claimants (form 5049) this form can be found at www.michigan.gov/taxes. Web michigan department of treasury 5049 (rev. Get your online template and fill it in using progressive features.

Web Worksheet For Married, Filing Separately And Divorced Or Separated Claimants (Form 5049) This Form Can Be Found At Www.michigan.gov/Taxes.

Submit form 5049 with form mi. We last updated the worksheet for married, filing separately and divorced 5049 in. You do need form 5049. Use get form or simply click on the template preview to open it in the editor.

Web Michigan Department Of Treasury 5049 (Rev.

From the left menu, select state; Wages, salaries, tips, sick, strike 21. Web download or print the 2022 michigan form 5049 (worksheet for married, filing separately and divorced 5049) for free from the michigan department of treasury. Web how to fill out and sign michigan form 5049 online?

Enjoy Smart Fillable Fields And Interactivity.

2023 5049 5049 married filing separately, divorced, separated. Web 5049 tax form download for michigan | tax rate info tax forms michigan tax forms 5049 last updated: Get your online template and fill it in using progressive features. Web form 5049 requires you to list multiple forms of income, such as wages, interest, or alimony.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Web instructions included on form: Web year and do not file joint federal or michigan income tax returns may each claim a credit based upon their separate heating costs or exemptions and total household resources. Web in taxslayer proweb, michigan form 5049, married filing separately and divorced or separated claimants schedule, is found in the michigan resident tax return. Web and divorced or separated claimants schedule (form 5049) this form is intended to assist you to correctly calculate total household resources for the homestead property tax.