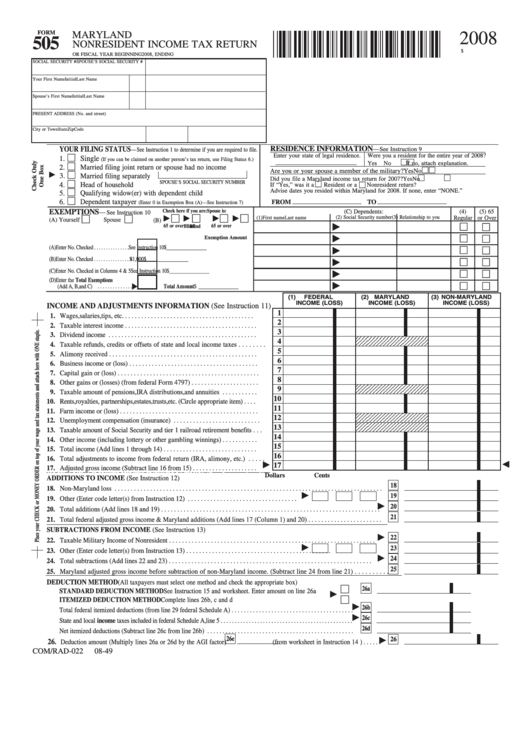

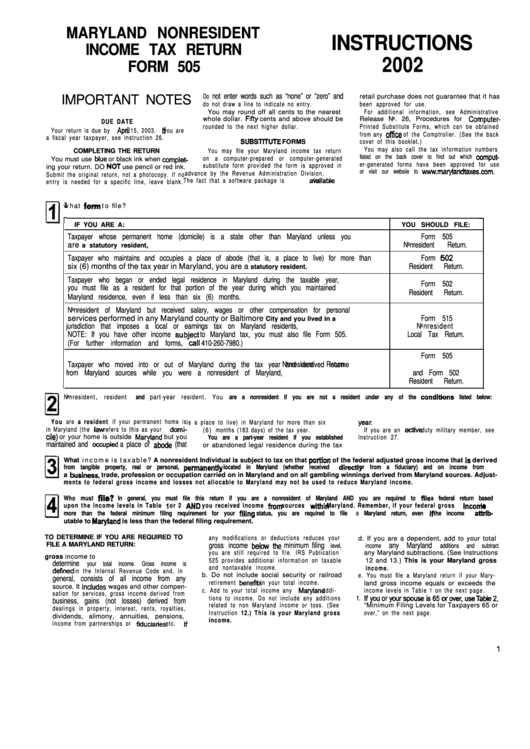

Form 505 Maryland Instructions

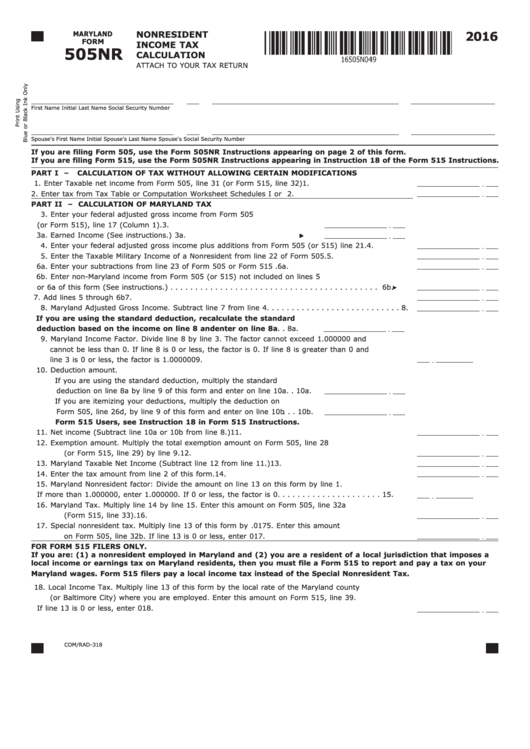

Form 505 Maryland Instructions - Web if you are filing form 505, use the form 505nr instructions appearing on page two of this form. This form is for income earned in tax year 2022, with tax returns due in april. Web 3 rows form 505 requires you to list multiple forms of income, such as wages, interest, or alimony. From to check here for maryland taxes withheld in error. Enter the taxable net income from form 505,. Web more about the maryland form 505nr individual income tax nonresident ty 2022. Direct deposit of refund (see instruction 22.) be sure the account information is. Web we last updated maryland form 505nr in january 2023 from the maryland comptroller of maryland. Form and instructions for amending any item of a. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil.

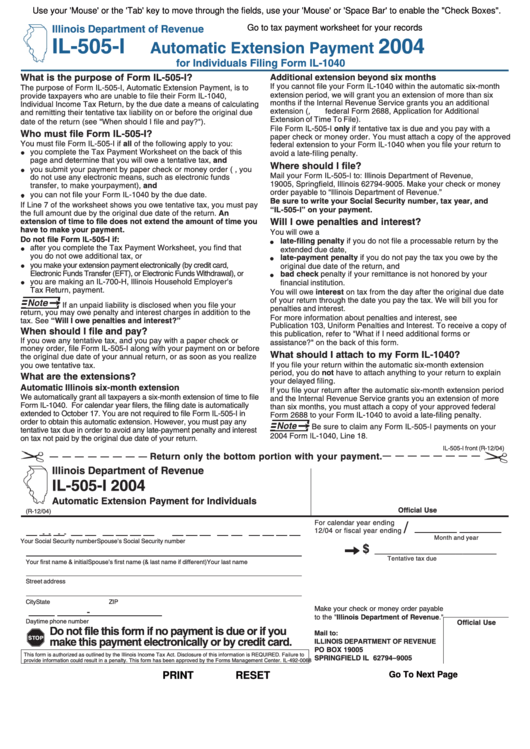

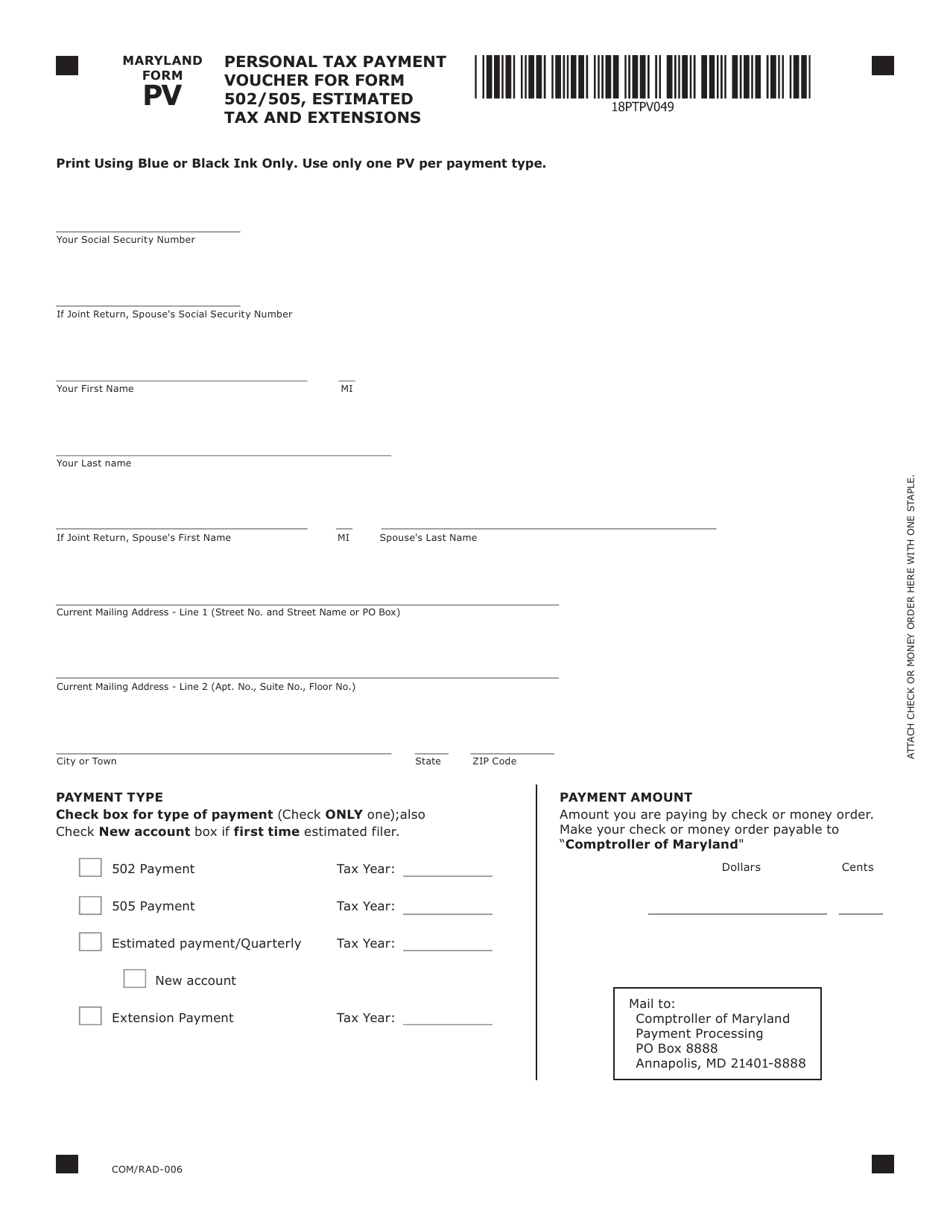

Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax. From to check here for maryland taxes withheld in error. Web more about the maryland form 505nr individual income tax nonresident ty 2022. (see instruction 4.) or a nonresident return?. Web if you are filing form 505, use the form 505nr instructions appearing on page two of this form. Read the instructions and complete page 3 first. Web maryland 2022 form 505 nonresident income tax return direct deposit of refund (see instruction 22.) verify that all account information is correct and. Web 2022 individual income tax instruction booklets. Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. Form and instructions for amending any item of a.

Web 3 rows form 505 requires you to list multiple forms of income, such as wages, interest, or alimony. Web if you work in maryland but reside in delaware, you must file form 505 (maryland nonresident income tax return) and form 505nr (maryland nonresident income tax. Web if you are filing form 505, use the form 505nr instructions appearing on page two of this form. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. If you are filing form 515, use the form 505nr instructions appearing in. Web maryland tax, you must also file form 505. Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. Form and instructions for amending any item of a. Direct deposit of refund (see instruction 22.) be sure the account information is. If you are filing form 515, use the form 505nr instructions appearing in.

Fillable Nonresident Tax Calculation Maryland Form 505nr

Web if you are filing form 505, use the form 505nr instructions appearing on page two of this form. If you are filing form 515, use the form 505nr instructions appearing in. Web maryland 2021 form 505 nonresident income tax return direct deposit of refund (see instruction 22.) be sure the account information is correct. If you are filing form.

Fillable Form Il505I Automatic Extension Payment For Individuals

Web we last updated maryland form 505nr in january 2023 from the maryland comptroller of maryland. Web more about the maryland form 505nr individual income tax nonresident ty 2022. Web if you are filing form 505, use the form 505nr instructions appearing on page two of this form. How it works open the form 505 maryland and follow the instructions.

Fillable Form 505 Maryland Nonresident Tax Return 2008

I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. This form is for income earned in tax year 2022, with tax returns due in april. Read the instructions and complete page 3 first. How it works open the form 505.

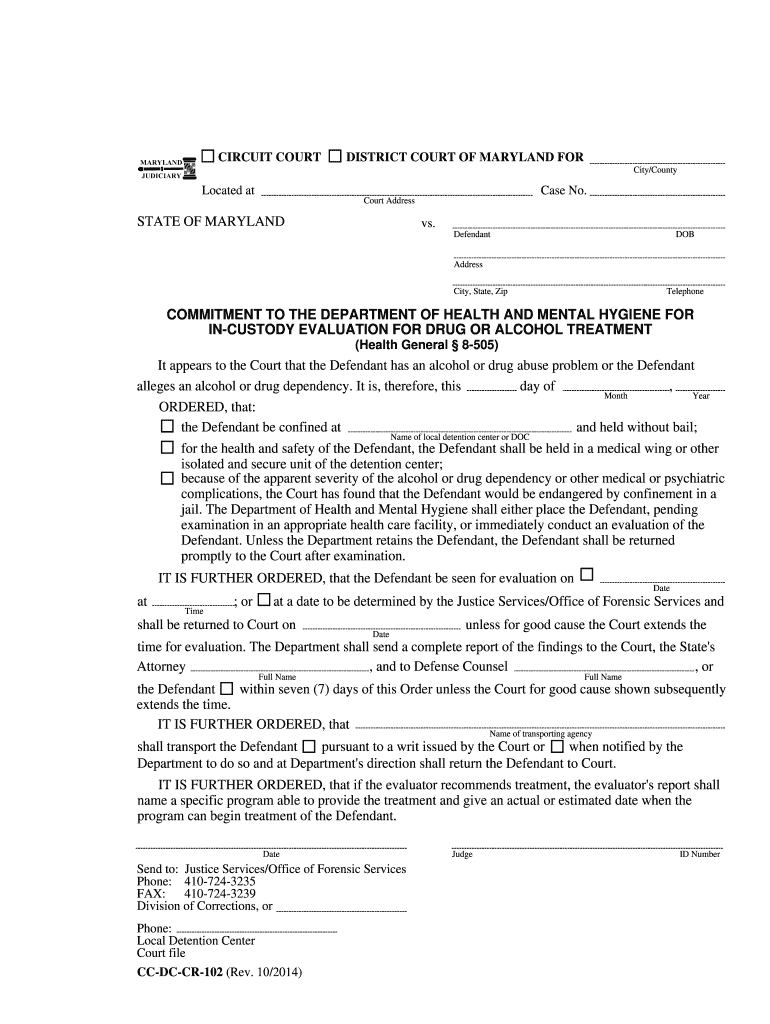

8505 Inmate Program Form Fill Out and Sign Printable PDF Template

Enter the taxable net income from form 505,. This form is for income earned in tax year 2022, with tax returns due in april. Web maryland 2022 form 505 nonresident income tax return direct deposit of refund (see instruction 22.) verify that all account information is correct and. Web maryland nonresident amended tax return 505x_49 011723 b [email protected]. Web.

Form 505 Download Fillable PDF, Injured Spouse Claim and Allocation

Web maryland nonresident amended tax return 505x_49 011723 b [email protected]. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. If you are filing form 515, use the form 505nr instructions appearing in. Web resident dates you resided in maryland.

Maryland Form PV Download Fillable PDF or Fill Online

This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated maryland form 505nr in january 2023 from the maryland comptroller of maryland. Web if you are filing form 505, use the form 505nr instructions appearing on page two of this form. Enter the taxable net income from form 505,. From.

Md 502up form Fill out & sign online DocHub

This form is for income earned in tax year 2022, with tax returns due in april. Web maryland 2021 form 505 nonresident income tax return direct deposit of refund (see instruction 22.) be sure the account information is correct. Enter the taxable net income from form 505,. Web we last updated maryland form 505 in january 2023 from the maryland.

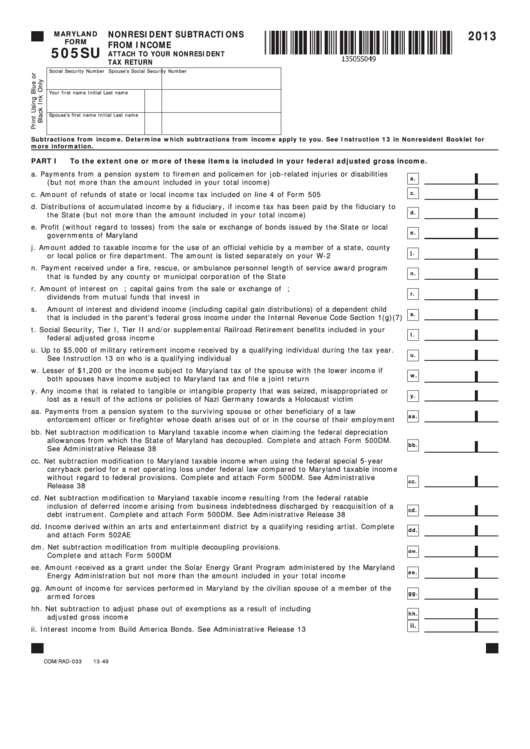

Fillable Maryland Form 505su Nonresident Subtractions From

(see instruction 4.) or a nonresident return?. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax. This form is for income earned in tax year 2022, with tax returns due in april. Web if you are filing form 505, use the form.

Instructions For Maryland Nonresident Tax Return Form 505 2002

From to check here for maryland taxes withheld in error. Web 2022 individual income tax instruction booklets. This form is for income earned in tax year 2022, with tax returns due in april. Web resident dates you resided in maryland for 2017. Web overview use this screen to enter residency information for maryland forms 502 and 505, and also enter.

If you are a nonresident, you must file Form 505 and Form 505NR.

Web maryland form 505x 2021 you must use form 502x if you are changing to resident status. Enter the taxable net income from form 505,. Web maryland nonresident amended tax return 505x_49 011723 b [email protected]. Web maryland 2021 form 505 nonresident income tax return direct deposit of refund (see instruction 22.) be sure the account information is correct. Web.

Form And Instructions For Amending Any Item Of A.

If you are filing form 515, use the form 505nr instructions appearing in. We last updated the nonresident income tax computation in january 2023, so this is the. Web if you are filing form 505, use the form 505nr instructions appearing on page two of this form. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil.

Direct Deposit Of Refund (See Instruction 22.) Be Sure The Account Information Is.

Web 3 rows form 505 requires you to list multiple forms of income, such as wages, interest, or alimony. Web we last updated maryland form 505nr in january 2023 from the maryland comptroller of maryland. Return taxpayer who moved into or out of. Web if you are filing form 505, use the form 505nr instructions appearing on page two of this form.

From To Check Here For Maryland Taxes Withheld In Error.

(see instruction 4.) or a nonresident return?. Web show details we are not affiliated with any brand or entity on this form. Web maryland nonresident amended tax return 505x_49 011723 b [email protected]. Web 2022 individual income tax instruction booklets.

How It Works Open The Form 505 Maryland And Follow The Instructions Easily Sign The Maryland 505Nr With.

Read the instructions and complete page 3 first. This form is for income earned in tax year 2022, with tax returns due in april. Web if you work in maryland but reside in delaware, you must file form 505 (maryland nonresident income tax return) and form 505nr (maryland nonresident income tax. If you are filing form 515, use the form 505nr instructions appearing in.