Form 5227 Extension

Form 5227 Extension - Select the pin authorization indicator, and then. Used to report information on. There are two different scenarios that need to be reviewed: These types of trusts file. Web go to www.irs.gov/form5227 for instructions and the latest information. Web the program only calculates form 5227 for charitable remainder trusts and won't compute for charitable lead trusts. Select the links below to see solutions for frequently asked questions concerning form 5227. Do not enter social security numbers on this form (except on schedule a) as it may be made public. Form 1041 may be electronically filed, but form 5227 must be filed on paper. Information return trust accumulation of charitable amounts.

For calendar year 2022, file form 5227 by april 18, 2023. Web the program only calculates form 5227 for charitable remainder trusts and won't compute for charitable lead trusts. Form 5227 faqs the following includes answers to. Information return trust accumulation of charitable amounts. The due date is april 18, instead of april 15, because of the emancipation day holiday in the district of. Extension form 8868 for form 5227 can be electronically filed. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Charitable lead trusts will usually not generate. Form 6069 returns of excise. Web tax exempt bonds.

Form 1041 may be electronically filed, but form 5227 must be filed on paper. Form 6069 returns of excise. Select the links below to see solutions for frequently asked questions concerning form 5227. Do not enter social security numbers on this form (except on schedule a) as it may be made public. Web tax exempt bonds. Select the pin authorization indicator, and then. You can download or print. Information return trust accumulation of charitable amounts. Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020. 5227 (2022) form 5227 (2022) page.

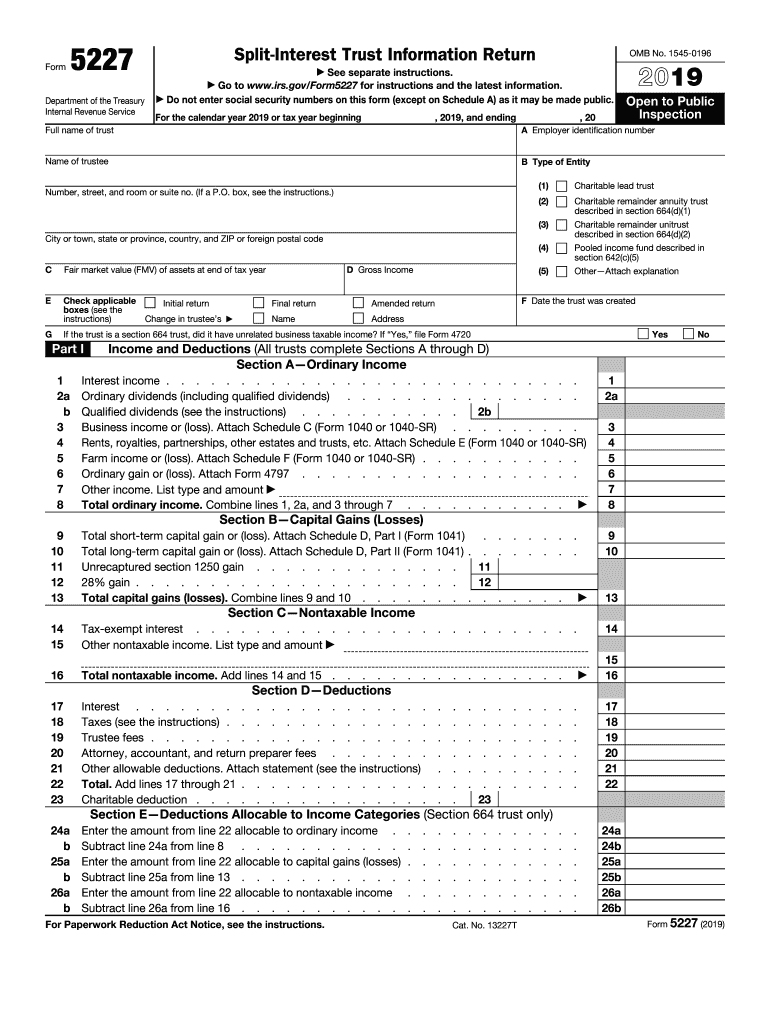

Fill Free fillable F5227 2019 Form 5227 PDF form

5227 (2022) form 5227 (2022) page. Form 6069 returns of excise. Web use form 5227 to: Code notes (a) general rule the secretary may grant a reasonable extension of time for filing any return, declaration, statement, or other document required by this title or by. Web common questions about form 5227 in lacerte.

Instructions For Form 5227 printable pdf download

Web is there an extension? Income tax return for estates and trusts; Select the pin authorization indicator, and then. Code notes (a) general rule the secretary may grant a reasonable extension of time for filing any return, declaration, statement, or other document required by this title or by. 5227 (2022) form 5227 (2022) page.

Fill Free fillable F5227 2019 Form 5227 PDF form

Used to report information on. Form 1041 may be electronically filed, but form 5227 must be filed on paper. Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020. Code notes (a) general rule the secretary may grant a reasonable extension of time for filing any return, declaration, statement, or other document.

Instructions For Form 5227 printable pdf download

Web go to www.irs.gov/form5227 for instructions and the latest information. Web is there an extension? You can download or print. Web screen 48.1, form 5227; Web common questions about form 5227 in lacerte.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Form 1041 may be electronically filed, but form 5227 must be filed on paper. Income tax return for estates and trusts; Charitable lead trusts will usually not generate. Web screen 48.1, form 5227; Code notes (a) general rule the secretary may grant a reasonable extension of time for filing any return, declaration, statement, or other document required by this title.

Instructions For Form 5227 printable pdf download

Form 5227 faqs the following includes answers to. Form 1041 may be electronically filed, but form 5227 must be filed on paper. Extension form 8868 for form 5227 can be electronically filed. Web tax exempt bonds. Code notes (a) general rule the secretary may grant a reasonable extension of time for filing any return, declaration, statement, or other document required.

Instructions For Form 5227 printable pdf download

Extension form 8868 for form 5227 can be electronically filed. Information return trust accumulation of charitable amounts. Income tax return for estates and trusts; Form 6069 returns of excise. Select the pin authorization indicator, and then.

5227 Instructions Form Fill Out and Sign Printable PDF Template signNow

Web go to www.irs.gov/form5227 for instructions and the latest information. For calendar year 2022, file form 5227 by april 18, 2023. Web common questions about form 5227 in lacerte. Information return trust accumulation of charitable amounts. The due date is april 18, instead of april 15, because of the emancipation day holiday in the district of.

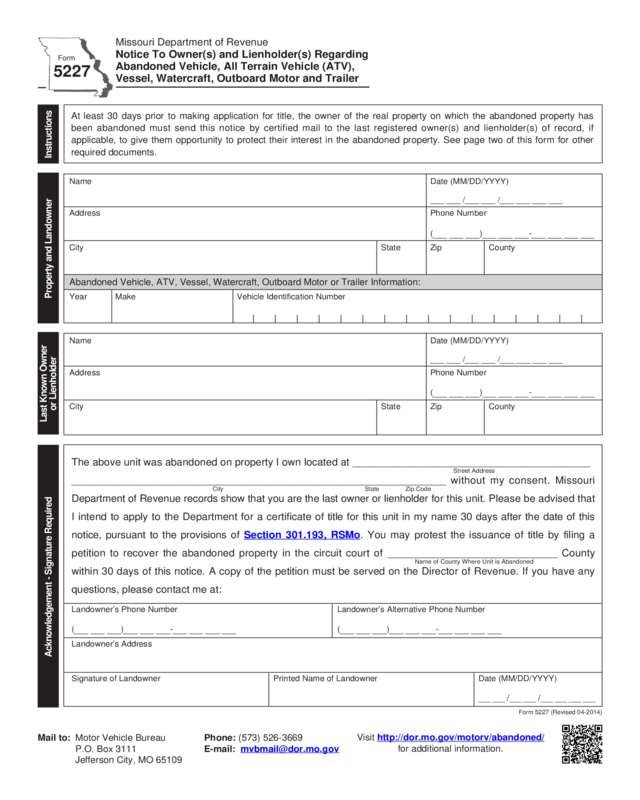

Form 5227 Missouri Department Of Revenue Edit, Fill, Sign Online

Web use form 5227 to: Web screen 48.1, form 5227; Web common questions about form 5227 in lacerte. Web tax exempt bonds. Do not enter social security numbers on this form (except on schedule a) as it may be made public.

There Are Two Different Scenarios That Need To Be Reviewed:

Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020. Web is there an extension? 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Used to report information on.

Income Tax Return For Estates And Trusts;

Code notes (a) general rule the secretary may grant a reasonable extension of time for filing any return, declaration, statement, or other document required by this title or by. Web go to www.irs.gov/form5227 for instructions and the latest information. Form 5227 faqs the following includes answers to. Select the pin authorization indicator, and then.

You Can Download Or Print.

For calendar year 2022, file form 5227 by april 18, 2023. Form 1041 may be electronically filed, but form 5227 must be filed on paper. Charitable lead trusts will usually not generate. Information return trust accumulation of charitable amounts.

The Due Date Is April 18, Instead Of April 15, Because Of The Emancipation Day Holiday In The District Of.

Form 6069 returns of excise. Web common questions about form 5227 in lacerte. Web use form 5227 to: Select the links below to see solutions for frequently asked questions concerning form 5227.