Form 5329 T

Form 5329 T - Web developments related to form 5329 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5329. Purpose of form use form 5329 to. • iras, • other qualified retirement plans, • modified endowment contracts, • coverdell esas, •. Web if you’ve decided to keep your excess contributions in your account, you can find tax form 5329 on the irs website. Tip if you don’t have to file a 2021 income tax return,. This form is used to report any additional taxes. Web purpose of form use form 5329 to report additional taxes on: Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. If you don’t have to file a 2022 income tax return, complete. Web enter the forms mode and click on open form.

Web purpose of form use form 5329 to report additional taxes on: • iras, • other qualified retirement plans, • modified endowment contracts, • coverdell esas, •. This form is used to report any additional taxes. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Web developments related to form 5329 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5329. Tip if you don’t have to file a 2021 income tax return,. Purpose of form use form 5329 to. Web if you’ve decided to keep your excess contributions in your account, you can find tax form 5329 on the irs website. Web enter the forms mode and click on open form. If you don’t have to file a 2022 income tax return, complete.

Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Web developments related to form 5329 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5329. Tip if you don’t have to file a 2021 income tax return,. Web enter the forms mode and click on open form. If you don’t have to file a 2022 income tax return, complete. Purpose of form use form 5329 to. Web if you’ve decided to keep your excess contributions in your account, you can find tax form 5329 on the irs website. Web purpose of form use form 5329 to report additional taxes on: • iras, • other qualified retirement plans, • modified endowment contracts, • coverdell esas, •. This form is used to report any additional taxes.

Form 8855 Fill Online, Printable, Fillable, Blank PDFfiller

Web purpose of form use form 5329 to report additional taxes on: If you don’t have to file a 2022 income tax return, complete. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Web developments related to form 5329 and its instructions, such as legislation.

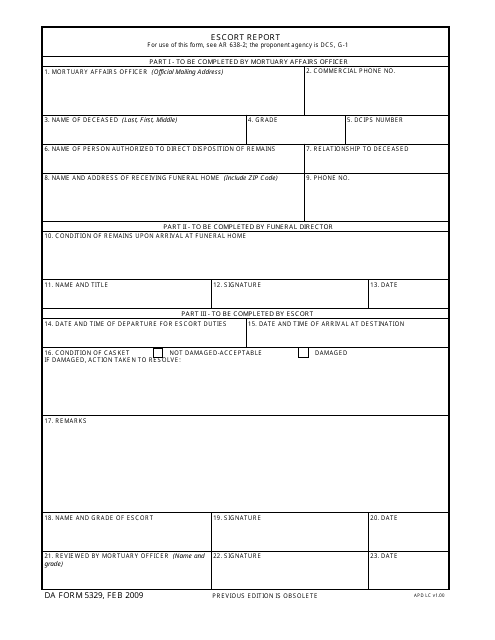

Form 5329 Additional Taxes on Qualified Plans and Other TaxFavored

Web developments related to form 5329 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5329. If you don’t have to file a 2022 income tax return, complete. • iras, • other qualified retirement plans, • modified endowment contracts, • coverdell esas, •. Web use form 5329 to report additional taxes on iras, other qualified retirement.

Fillable Form 5329 Additional Taxes On Qualified Plans (Including

Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Tip if you don’t have to file a 2021 income tax return,. If you don’t have to file a 2022 income tax return, complete. Purpose of form use form 5329 to. This form is used to.

2.3.32 Command Code MFTRA Internal Revenue Service

If you don’t have to file a 2022 income tax return, complete. Web if you’ve decided to keep your excess contributions in your account, you can find tax form 5329 on the irs website. Tip if you don’t have to file a 2021 income tax return,. Web developments related to form 5329 and its instructions, such as legislation enacted after.

Form 5329 Instructions & Exception Information for IRS Form 5329

• iras, • other qualified retirement plans, • modified endowment contracts, • coverdell esas, •. This form is used to report any additional taxes. Web purpose of form use form 5329 to report additional taxes on: If you don’t have to file a 2022 income tax return, complete. Web use form 5329 to report additional taxes on iras, other qualified.

IRS Form 5329 [For Retirement Savings And More] Tax Relief Center

• iras, • other qualified retirement plans, • modified endowment contracts, • coverdell esas, •. Web enter the forms mode and click on open form. Web developments related to form 5329 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5329. Web if you’ve decided to keep your excess contributions in your account, you can find.

2013 Form 5329 Edit, Fill, Sign Online Handypdf

Web developments related to form 5329 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5329. Web if you’ve decided to keep your excess contributions in your account, you can find tax form 5329 on the irs website. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell.

Form 5329 Instructions & Exception Information for IRS Form 5329

Web enter the forms mode and click on open form. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. This form is used to report any additional taxes. Tip if you don’t have to file a 2021 income tax return,. If you don’t have to.

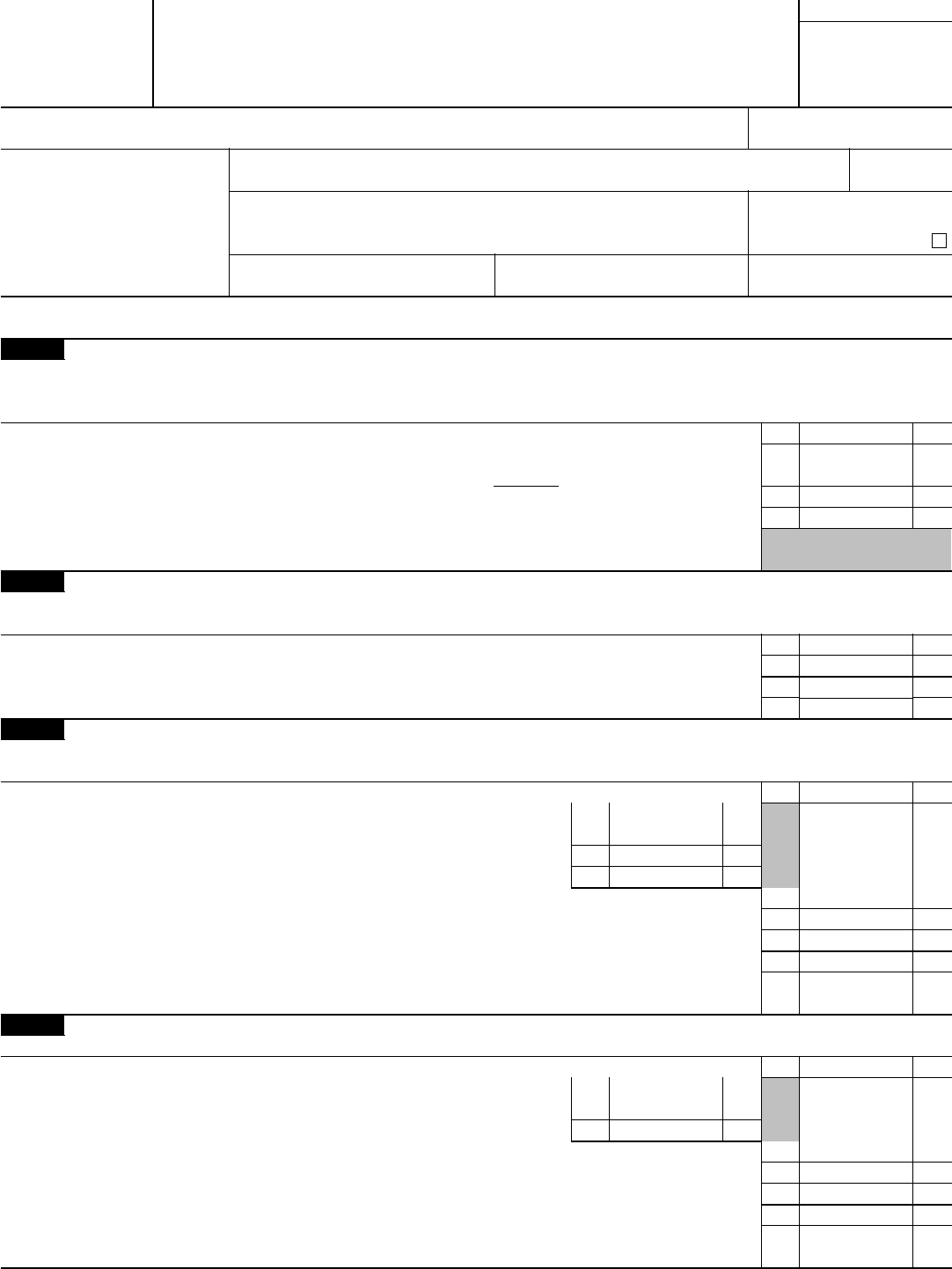

DA Form 5329 Download Fillable PDF or Fill Online Escort Report

Tip if you don’t have to file a 2021 income tax return,. This form is used to report any additional taxes. Web if you’ve decided to keep your excess contributions in your account, you can find tax form 5329 on the irs website. Purpose of form use form 5329 to. If you don’t have to file a 2022 income tax.

Form 5329 Additional Taxes on Qualified Plans and Other TaxFavored

Web enter the forms mode and click on open form. Purpose of form use form 5329 to. This form is used to report any additional taxes. • iras, • other qualified retirement plans, • modified endowment contracts, • coverdell esas, •. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas,.

If You Don’t Have To File A 2022 Income Tax Return, Complete.

Web enter the forms mode and click on open form. Web developments related to form 5329 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5329. This form is used to report any additional taxes. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas.

Tip If You Don’t Have To File A 2021 Income Tax Return,.

Web if you’ve decided to keep your excess contributions in your account, you can find tax form 5329 on the irs website. Web purpose of form use form 5329 to report additional taxes on: Purpose of form use form 5329 to. • iras, • other qualified retirement plans, • modified endowment contracts, • coverdell esas, •.

![IRS Form 5329 [For Retirement Savings And More] Tax Relief Center](https://help.taxreliefcenter.org/wp-content/uploads/2019/07/TRC-PIN-IRS-Form-5329-683x1024.png)