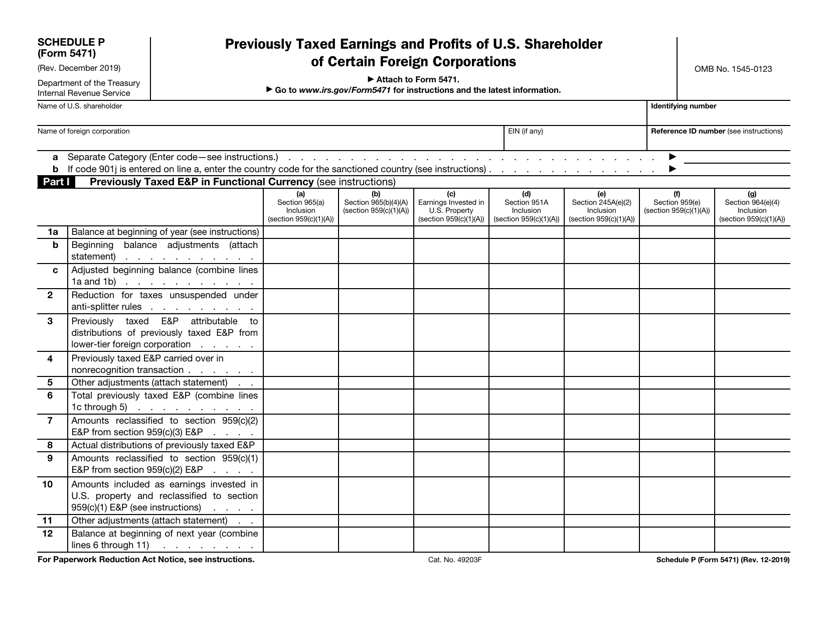

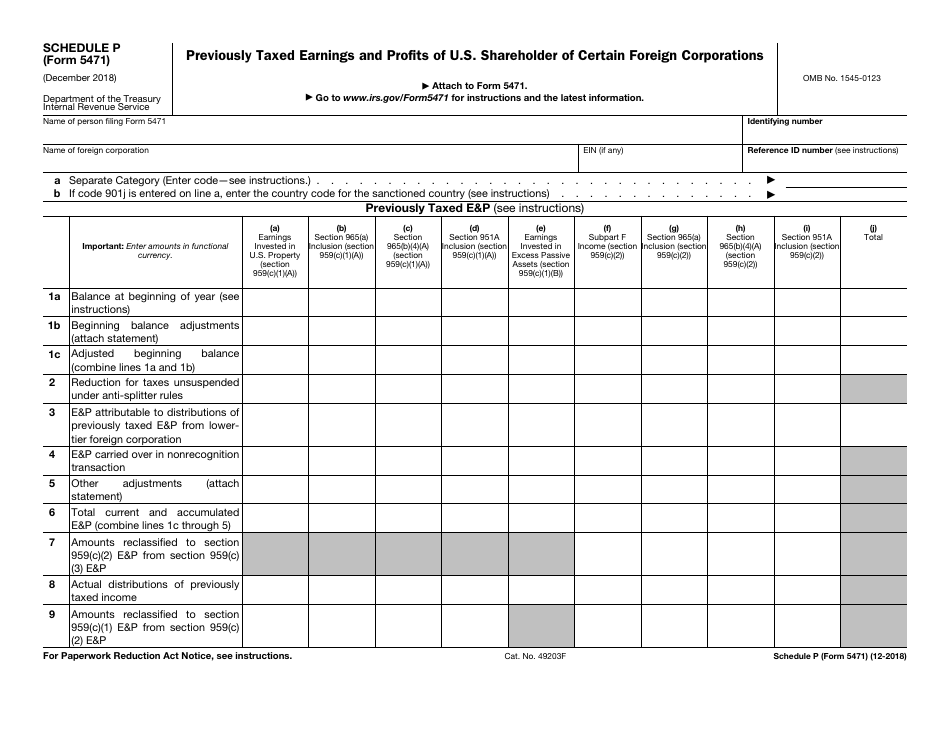

Form 5471 Sch P

Form 5471 Sch P - Specific schedule p reporting rules For instructions and the latest information. Web schedule p (form 5471) (december 2018) department of the treasury internal revenue service. Select the add button within section 22 to create a new sheet assigned to the same 5471 entity. Web information about form 5471, information return of u.s. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously taxed earnings and profits of u.s. Web future developments for the latest information about developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471. Let’s go through the basics of schedule p and ptep: Web schedule p is used to report the previously taxed earnings and profits (“ptep”) of the u.s. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations.

This schedule is also used to report the ptep of the u.s. Or the category 1 filer has previously taxed e&p related to section 965 that is reportable on schedule p (form 5471). Previously taxed earnings and profits of u.s. The term ptep refers to earnings and profits (“e&p”) of a foreign corporation. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Let’s go through the basics of schedule p and ptep: Shareholder of a controlled foreign corporation (“cfc”). Web schedule p is used to report the previously taxed earnings and profits (“ptep”) of the u.s. December 2020) department of the treasury internal revenue service. Name of person filing form.

Select the add button within section 22 to create a new sheet assigned to the same 5471 entity. For instructions and the latest information. Web schedule p is used to report the previously taxed earnings and profits (“ptep”) of the u.s. Shareholder of certain foreign corporations. Web schedule p (form 5471) (rev. Web select the applicable 5471 entity. What’s new changes to form 5471. December 2022) department of the treasury internal revenue service. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously taxed earnings and profits of u.s. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations.

The Tax Times New Form 5471, Sch Q You Really Need to Understand

Persons with respect to certain foreign corporations. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Web information about form 5471, information return of u.s. Web select the applicable 5471 entity. Shareholder of certain foreign corporations.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Let’s go through the basics of schedule p and ptep: Previously taxed earnings and profits of u.s. Web information about form 5471, information return of u.s. Shareholder of certain foreign corporations.

IRS Issues Updated New Form 5471 What's New?

What’s new changes to form 5471. Persons with respect to certain foreign corporations. Web schedule p (form 5471) (december 2018) department of the treasury internal revenue service. For instructions and the latest information. Shareholder of certain foreign corporations.

form 5471 schedule i1 instructions Fill Online, Printable, Fillable

Web schedule p (form 5471) (december 2018) department of the treasury internal revenue service. Shareholder of certain foreign corporations. Shareholder of a controlled foreign corporation (“cfc”) in the cfc’s functional currency (part i) and in u.s. Shareholder of a controlled foreign corporation (“cfc”). In lines 3 and 4, input a shareholder name and ein.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

The term ptep refers to earnings and profits (“e&p”) of a foreign corporation. Let’s go through the basics of schedule p and ptep: For instructions and the latest information. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Shareholder of a controlled foreign corporation (“cfc”) in the cfc’s functional currency (part i).

Demystifying the Form 5471 Part 7. Schedule P SF Tax Counsel

Schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s. Let’s go through the basics of schedule p and ptep: Web information about form 5471, information return of u.s. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. For instructions and the latest.

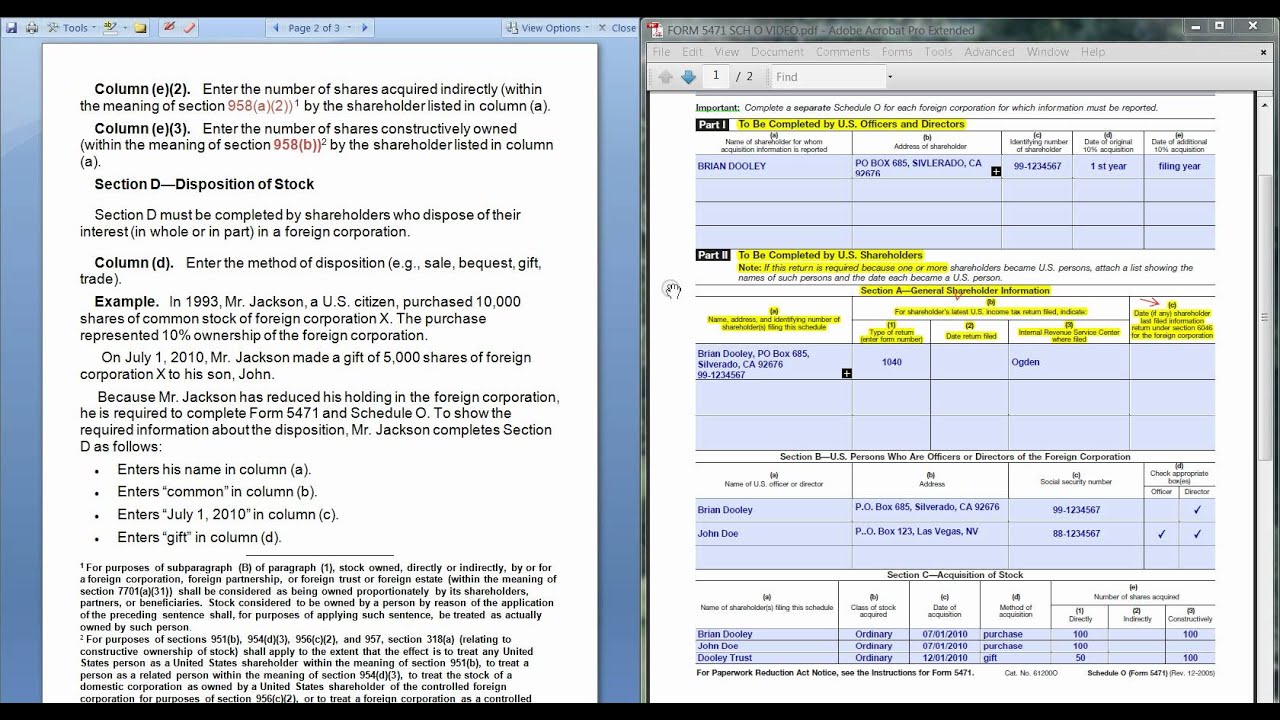

FORM 5471 SCHEDULE O CONTROLLED FOREIGN CORPORATION.avi YouTube

In lines 3 and 4, input a shareholder name and ein. Web select the applicable 5471 entity. Or the category 1 filer has previously taxed e&p related to section 965 that is reportable on schedule p (form 5471). December 2020) department of the treasury internal revenue service. The term ptep refers to earnings and profits (“e&p”) of a foreign corporation.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Shareholder of certain foreign corporations. For instructions and the latest information. Schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s. For instructions and the latest information.

IRS Form 5471 Carries Heavy Penalties and Consequences

Web information about form 5471, information return of u.s. Select the add button within section 22 to create a new sheet assigned to the same 5471 entity. Schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s. What’s new changes to form 5471. Name of person filing form.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

In lines 3 and 4, input a shareholder name and ein. Persons with respect to certain foreign corporations. Select the add button within section 22 to create a new sheet assigned to the same 5471 entity. What’s new changes to form 5471. This schedule is also used to report the ptep of the u.s.

Select The Add Button Within Section 22 To Create A New Sheet Assigned To The Same 5471 Entity.

Web schedule p (form 5471) (december 2018) department of the treasury internal revenue service. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Let’s go through the basics of schedule p and ptep: Shareholder of a controlled foreign corporation (“cfc”).

Name Of Person Filing Form.

Shareholder of a specified foreign corporation (“sfc. Or the category 1 filer has previously taxed e&p related to section 965 that is reportable on schedule p (form 5471). Shareholder of a controlled foreign corporation (“cfc”) in the cfc’s functional currency (part i) and in u.s. Web future developments for the latest information about developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to irs.gov/form5471.

December 2022) Department Of The Treasury Internal Revenue Service.

Web schedule p is used to report the previously taxed earnings and profits (“ptep”) of the u.s. For instructions and the latest information. What’s new changes to form 5471. Web schedule p (form 5471) (rev.

December 2020) Department Of The Treasury Internal Revenue Service.

Shareholder of certain foreign corporations. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously taxed earnings and profits of u.s. In lines 3 and 4, input a shareholder name and ein. Persons with respect to certain foreign corporations.