Form 5500 Due Date

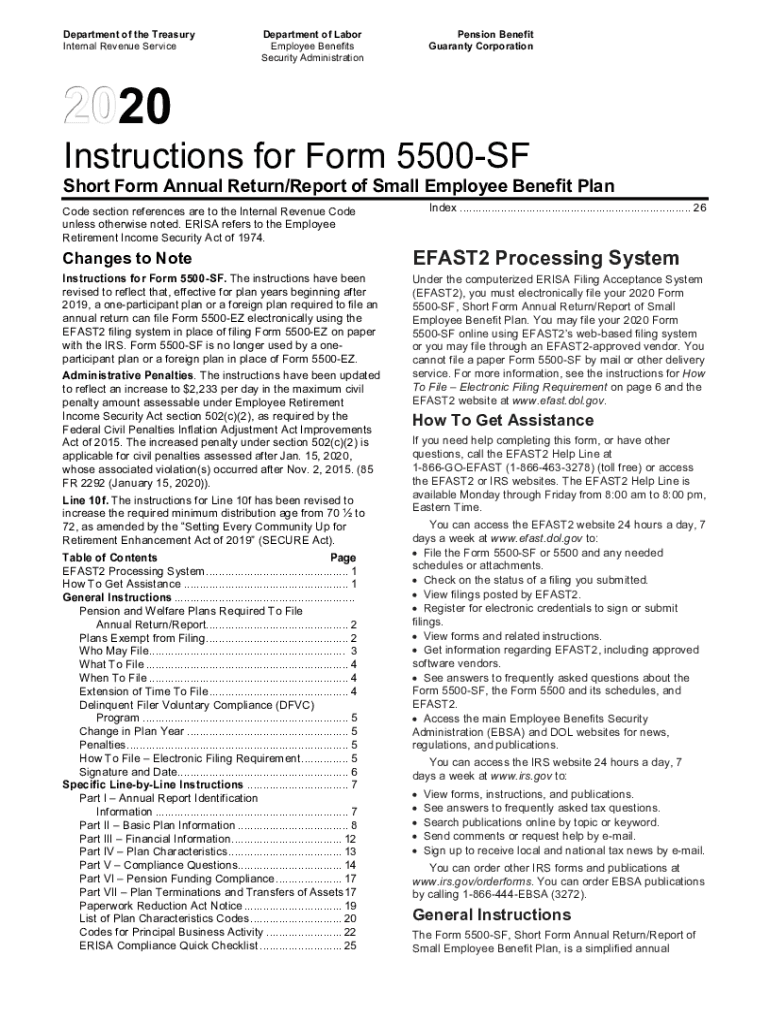

Form 5500 Due Date - Web the general rule is that form 5500s must be filed by the last day of the seventh month after the plan year ends, unless filing an extension. Web today, the u.s. Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. Plan sponsors can request an. (updated may 18, 2022) tips for next year be sure to mail your form 5558 on or before the normal due date of your return. Department of labor, internal revenue service, and the pension benefit guaranty corporation jointly developed the form 5500 series so employee benefit plans could utilize the form 5500 series forms to satisfy annual reporting requirements under title i and title iv of erisa and under the internal revenue code. Notes there is no limit for the grace period on a rejected 5500 return, but you should resubmit the return as soon as possible. Who should i contact with questions about a cp216h notice? The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Web what you need to do you may want to frequently asked questions where can i get more information about employee benefit plans?

Web this topic provides electronic filing opening day information and information about relevant due dates for 5500 returns. Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. Department of labor, internal revenue service, and the pension benefit guaranty corporation jointly developed the form 5500 series so employee benefit plans could utilize the form 5500 series forms to satisfy annual reporting requirements under title i and title iv of erisa and under the internal revenue code. Web the general rule is that form 5500s must be filed by the last day of the seventh month after the plan year ends, unless filing an extension. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on the next business day that is not a saturday, sunday, or federal holiday. Notes there is no limit for the grace period on a rejected 5500 return, but you should resubmit the return as soon as possible. Web what you need to do you may want to frequently asked questions where can i get more information about employee benefit plans? Web today, the u.s. Who should i contact with questions about a cp216h notice?

The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). (updated may 18, 2022) tips for next year be sure to mail your form 5558 on or before the normal due date of your return. Web today, the u.s. Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. Who should i contact with questions about a cp216h notice? Calendar year plans have a form 5500 due date of july 31 st. Notes there is no limit for the grace period on a rejected 5500 return, but you should resubmit the return as soon as possible. Must file electronically through efast2. Web what you need to do you may want to frequently asked questions where can i get more information about employee benefit plans? Web the general rule is that form 5500s must be filed by the last day of the seventh month after the plan year ends, unless filing an extension.

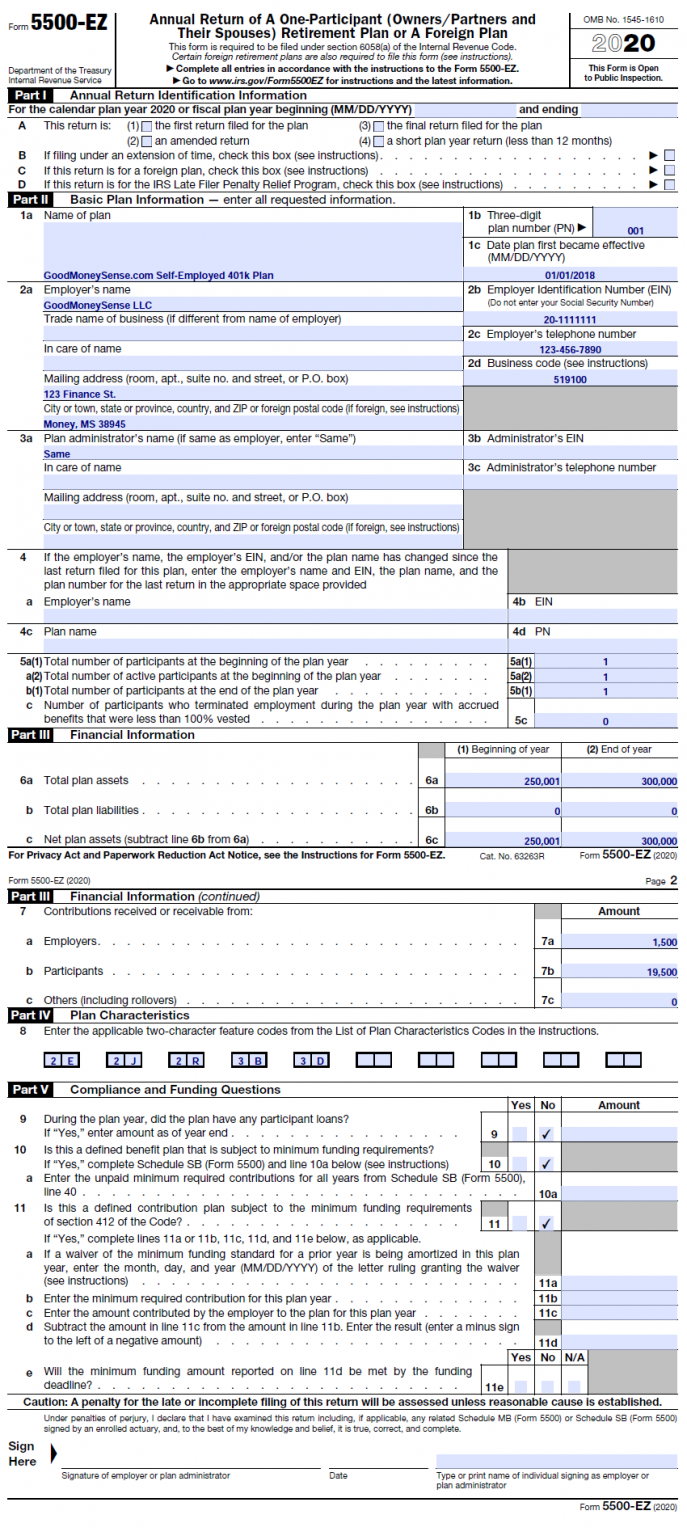

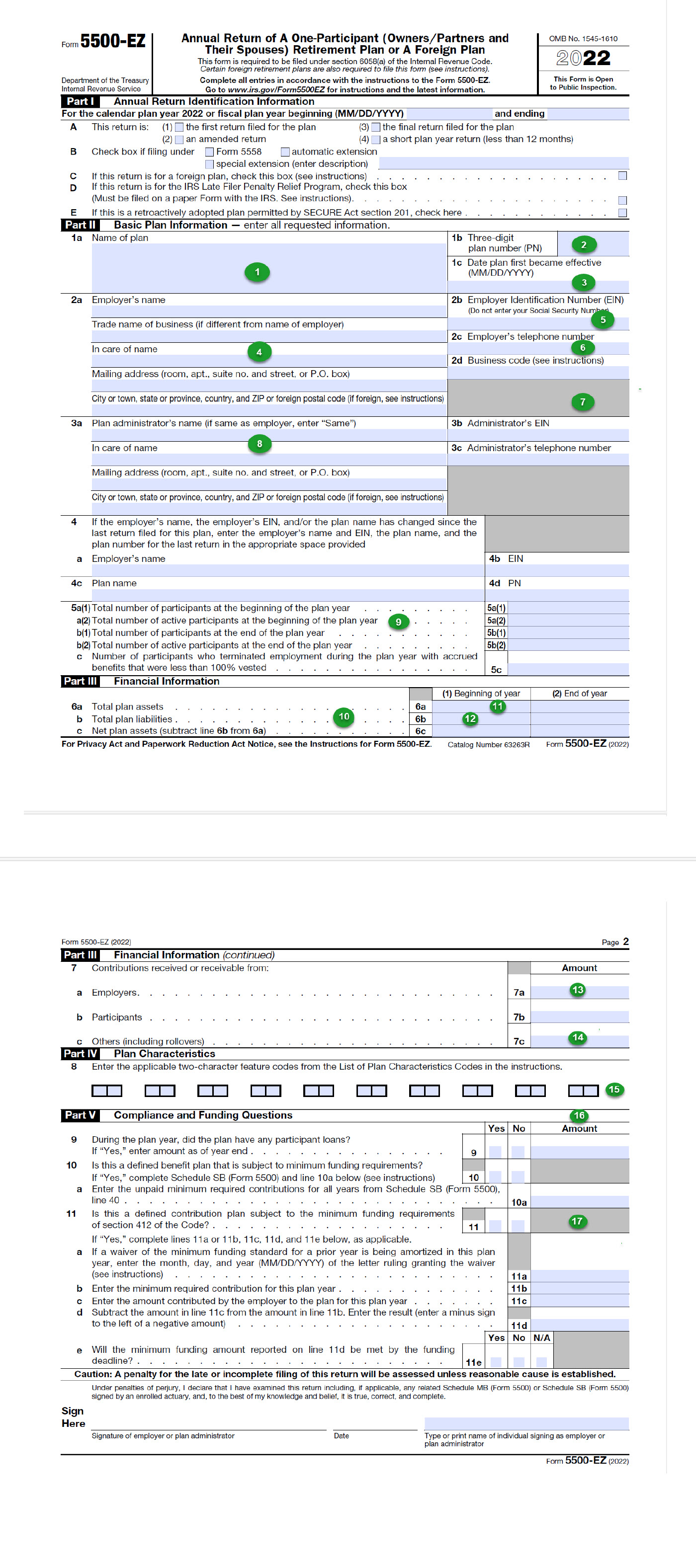

How To File The Form 5500EZ For Your Solo 401k in 2021 Good Money Sense

Plan sponsors can request an. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on the next business day that is not a saturday, sunday, or federal holiday. Web this topic provides electronic filing opening day information and information about relevant due dates for 5500 returns. Calendar year plans have a form 5500.

Form 5500 Due Date Avoid Serious Late Filing Penalties BASIC

Web what you need to do you may want to frequently asked questions where can i get more information about employee benefit plans? (updated may 18, 2022) tips for next year be sure to mail your form 5558 on or before the normal due date of your return. Calendar year plans have a form 5500 due date of july 31.

form 5500 extension due date 2022 Fill Online, Printable, Fillable

(updated may 18, 2022) tips for next year be sure to mail your form 5558 on or before the normal due date of your return. Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. The last day of the seventh month after the plan year ends.

Form 5500 Annual Fill Out and Sign Printable PDF Template signNow

Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. Web the due date for every type of form 5500 is the last day of the seventh month after the plan year ends. Web today, the u.s. Web this topic provides electronic filing opening day information and.

form 5500 instructions 2022 Fill Online, Printable, Fillable Blank

Web what you need to do you may want to frequently asked questions where can i get more information about employee benefit plans? The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Web the general rule is that form 5500s must be filed by the last day of the seventh.

How to File Form 5500EZ Solo 401k

Web the due date for every type of form 5500 is the last day of the seventh month after the plan year ends. Web the general rule is that form 5500s must be filed by the last day of the seventh month after the plan year ends, unless filing an extension. Department of labor, internal revenue service, and the pension.

2018 Updated Form 5500EZ Guide Solo 401k

Web what you need to do you may want to frequently asked questions where can i get more information about employee benefit plans? Calendar year plans have a form 5500 due date of july 31 st. Web the due date for every type of form 5500 is the last day of the seventh month after the plan year ends. Notes.

August 1st Form 5500 Due Matthews, Carter & Boyce

Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. Web the general rule is that form 5500s must be filed by the last day of the seventh month after the plan year ends, unless filing an extension. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on.

Retirement plan 5500 due date Early Retirement

Web today, the u.s. If the plan follows the calendar year, this date would be july 31. Notes there is no limit for the grace period on a rejected 5500 return, but you should resubmit the return as soon as possible. Web what you need to do you may want to frequently asked questions where can i get more information.

Understanding the Form 5500 for Defined Contribution Plans Fidelity

(updated may 18, 2022) tips for next year be sure to mail your form 5558 on or before the normal due date of your return. Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. Calendar year plans have a form 5500 due date of july 31.

Web The Due Date For Every Type Of Form 5500 Is The Last Day Of The Seventh Month After The Plan Year Ends.

(updated may 18, 2022) tips for next year be sure to mail your form 5558 on or before the normal due date of your return. The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. Web today, the u.s.

If The Deadline Falls On A Saturday, Sunday, Or Federal Holiday, The Filing May Be Submitted On The Next Business Day That Is Not A Saturday, Sunday, Or Federal Holiday.

Web what you need to do you may want to frequently asked questions where can i get more information about employee benefit plans? Department of labor, internal revenue service, and the pension benefit guaranty corporation jointly developed the form 5500 series so employee benefit plans could utilize the form 5500 series forms to satisfy annual reporting requirements under title i and title iv of erisa and under the internal revenue code. Must file electronically through efast2. Web the general rule is that form 5500s must be filed by the last day of the seventh month after the plan year ends, unless filing an extension.

Plan Sponsors Can Request An.

If the plan follows the calendar year, this date would be july 31. Notes there is no limit for the grace period on a rejected 5500 return, but you should resubmit the return as soon as possible. Web this topic provides electronic filing opening day information and information about relevant due dates for 5500 returns. Calendar year plans have a form 5500 due date of july 31 st.

Who Should I Contact With Questions About A Cp216H Notice?

Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp.