Form 5500 Extension Due Date 2021

Form 5500 Extension Due Date 2021 - A separate federal register notice was published in december 2021. Web hurricane ida — extended due date of january 3, 2022 this tax relief postpones filing deadlines for form 5500s originally due, with valid extensions, starting. Web tips for next year be sure to mail your form 5558 on or before the normal due date of your return. Form 5500 ( annual return/report of employee benefit plan) is due the last day of the seventh month after the plan year ends, which is july 31 for calendar. Web about form 5558, application for extension of time to file certain employee plan returns. Web the extension automatically applies to form 5500 filings for plan years that ended in september, october, or november 2019 because the regular due dates for. Web form 5500 must generally be filed by the last day of the seventh month following the end of the plan year, unless an extension applies. Web this tax relief postpones filing deadlines for form 5500s originally due, with valid extensions, starting on or after august 26. Web the agencies published a notice of proposed forms revisions in september 2021. Review the form 5558 resources at form 5500 corner.

Web form 5500 must generally be filed by the last day of the seventh month following the end of the plan year, unless an extension applies. Form 5500 ( annual return/report of employee benefit plan) is due the last day of the seventh month after the plan year ends, which is july 31 for calendar. Web about form 5558, application for extension of time to file certain employee plan returns. Web hurricane ida — extended due date of january 3, 2022 this tax relief postpones filing deadlines for form 5500s originally due, with valid extensions, starting. A separate federal register notice was published in december 2021. Web this tax relief postpones filing deadlines for form 5500s originally due, with valid extensions, starting on or after august 26. Web the extension automatically applies to form 5500 filings for plan years that ended in september, october, or november 2019 because the regular due dates for. For a calendar year plan, subject to. Web tips for next year be sure to mail your form 5558 on or before the normal due date of your return. Review the form 5558 resources at form 5500 corner.

Web form 5500 must generally be filed by the last day of the seventh month following the end of the plan year, unless an extension applies. Web tips for next year be sure to mail your form 5558 on or before the normal due date of your return. Web the application is automatically approved to the date shown on line 2 and/or line 3 (above) if (a) the form 5558 is filed on or before the normal due date of form 5500 series, and/or. The irs form 5558, application for. Web about form 5558, application for extension of time to file certain employee plan returns. A separate federal register notice was published in december 2021. Review the form 5558 resources at form 5500 corner. Web hurricane ida — extended due date of january 3, 2022 this tax relief postpones filing deadlines for form 5500s originally due, with valid extensions, starting. For a calendar year plan, subject to. Web this tax relief postpones filing deadlines for form 5500s originally due, with valid extensions, starting on or after august 26.

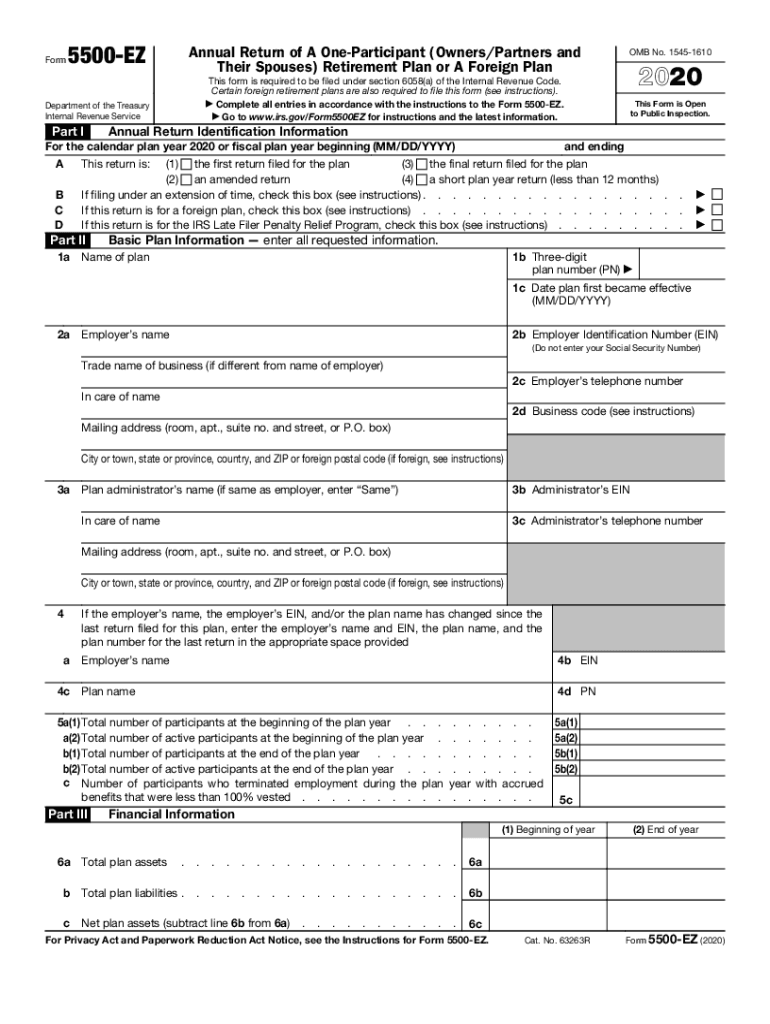

2020 Form IRS 5500EZ Fill Online, Printable, Fillable, Blank pdfFiller

Web form 5500 must generally be filed by the last day of the seventh month following the end of the plan year, unless an extension applies. Web about form 5558, application for extension of time to file certain employee plan returns. Web this tax relief postpones filing deadlines for form 5500s originally due, with valid extensions, starting on or after.

5500 Extension Due To COVID 19 B3PA

The irs form 5558, application for. Web this tax relief postpones filing deadlines for form 5500s originally due, with valid extensions, starting on or after august 26. Web form 5500 must be filed annually by the last day of the seventh calendar month after the end of the plan year (july 31 for calendar year plans) unless an. Web form.

How to File a Tax Extension? ZenLedger

Web tips for next year be sure to mail your form 5558 on or before the normal due date of your return. Web this tax relief postpones filing deadlines for form 5500s originally due, with valid extensions, starting on or after august 26. The irs form 5558, application for. Review the form 5558 resources at form 5500 corner. Web form.

Extension Due Date on Tax Return Form Filling (Latest Updated

For a calendar year plan, subject to. Review the form 5558 resources at form 5500 corner. Web the application is automatically approved to the date shown on line 2 and/or line 3 (above) if (a) the form 5558 is filed on or before the normal due date of form 5500 series, and/or. Web about form 5558, application for extension of.

Avoid Using the 5500 Extension Wrangle 5500 ERISA Reporting and

For a calendar year plan, subject to. Web this tax relief postpones filing deadlines for form 5500s originally due, with valid extensions, starting on or after august 26. Web form 5500 must generally be filed by the last day of the seventh month following the end of the plan year, unless an extension applies. Web the extension automatically applies to.

Form 5500 Annual Fill Out and Sign Printable PDF Template signNow

Web this tax relief postpones filing deadlines for form 5500s originally due, with valid extensions, starting on or after august 26. The irs form 5558, application for. Review the form 5558 resources at form 5500 corner. A separate federal register notice was published in december 2021. Web tips for next year be sure to mail your form 5558 on or.

SLT Adapting to New Federal Tax Returns Due Dates in New York The

Web the application is automatically approved to the date shown on line 2 and/or line 3 (above) if (a) the form 5558 is filed on or before the normal due date of form 5500 series, and/or. For a calendar year plan, subject to. Web tips for next year be sure to mail your form 5558 on or before the normal.

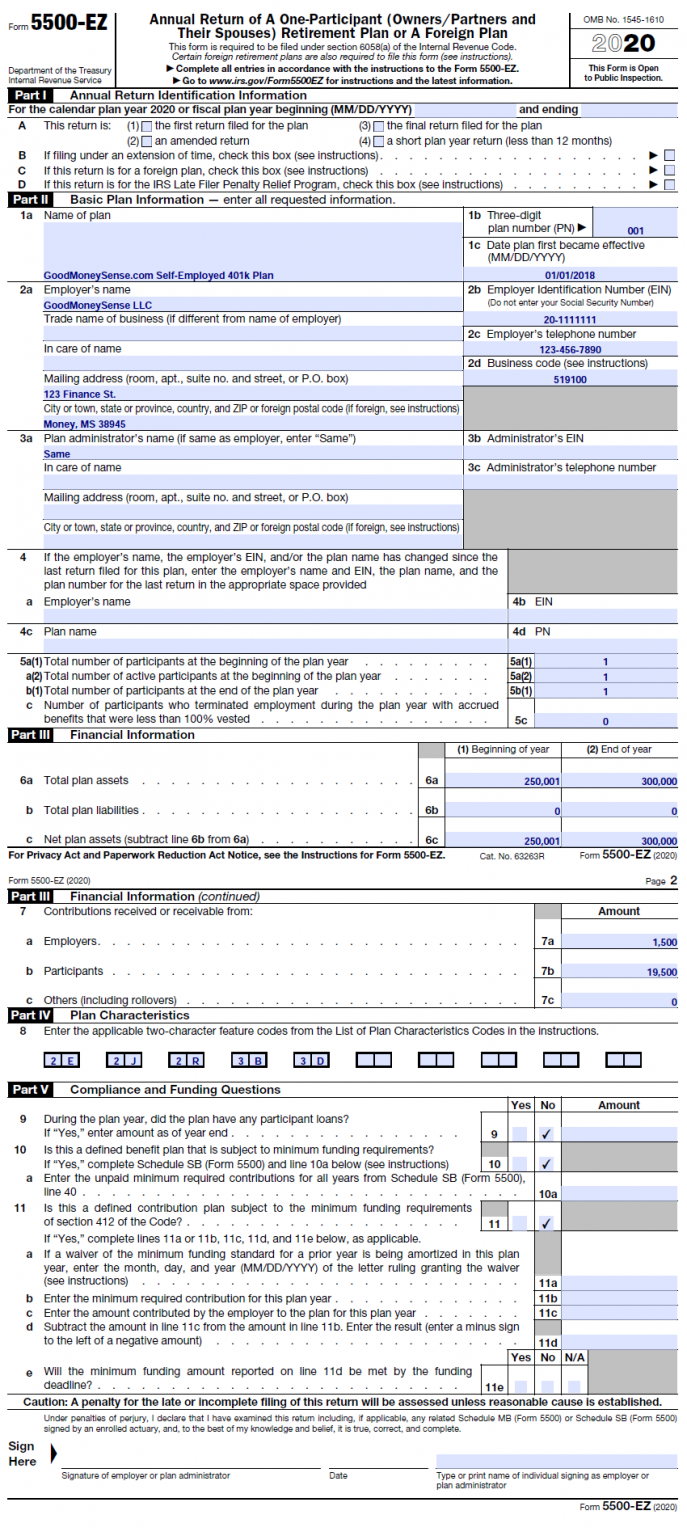

How To File The Form 5500EZ For Your Solo 401k in 2021 Good Money Sense

Form 5500 ( annual return/report of employee benefit plan) is due the last day of the seventh month after the plan year ends, which is july 31 for calendar. Web the application is automatically approved to the date shown on line 2 and/or line 3 (above) if (a) the form 5558 is filed on or before the normal due date.

form 5500 extension due date 2022 Fill Online, Printable, Fillable

Web the application is automatically approved to the date shown on line 2 and/or line 3 (above) if (a) the form 5558 is filed on or before the normal due date of form 5500 series, and/or. Web form 5500 must be filed annually by the last day of the seventh calendar month after the end of the plan year (july.

Form 5500 Is Due by July 31 for Calendar Year Plans

Form 5500 ( annual return/report of employee benefit plan) is due the last day of the seventh month after the plan year ends, which is july 31 for calendar. Web the application is automatically approved to the date shown on line 2 and/or line 3 (above) if (a) the form 5558 is filed on or before the normal due date.

Web This Tax Relief Postpones Filing Deadlines For Form 5500S Originally Due, With Valid Extensions, Starting On Or After August 26.

A separate federal register notice was published in december 2021. Web about form 5558, application for extension of time to file certain employee plan returns. The irs form 5558, application for. Web hurricane ida — extended due date of january 3, 2022 this tax relief postpones filing deadlines for form 5500s originally due, with valid extensions, starting.

Web Form 5500 Must Be Filed Annually By The Last Day Of The Seventh Calendar Month After The End Of The Plan Year (July 31 For Calendar Year Plans) Unless An.

For a calendar year plan, subject to. Web tips for next year be sure to mail your form 5558 on or before the normal due date of your return. Web the application is automatically approved to the date shown on line 2 and/or line 3 (above) if (a) the form 5558 is filed on or before the normal due date of form 5500 series, and/or. Web the agencies published a notice of proposed forms revisions in september 2021.

Web Form 5500 Must Generally Be Filed By The Last Day Of The Seventh Month Following The End Of The Plan Year, Unless An Extension Applies.

Form 5500 ( annual return/report of employee benefit plan) is due the last day of the seventh month after the plan year ends, which is july 31 for calendar. Review the form 5558 resources at form 5500 corner. Web the extension automatically applies to form 5500 filings for plan years that ended in september, october, or november 2019 because the regular due dates for.