Form 5500 Filing Deadline 2022 With Extension

Form 5500 Filing Deadline 2022 With Extension - Web affected individual taxpayers who need more time to file beyond the july 31 deadline must file their extension requests on paper using form 4868. Form 5500, annual return/report of employee benefit plan; Web form 5500 deadline. Web advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil penalties for late filings and. Web form 5500 must be filed annually by the last day of the seventh calendar month after the end of the plan year (july 31 for calendar year plans) unless an. A refresher on form 5500 filings and options available for plan administrators and employers. Web an extension of time to file form 5500 series (form 5500, annual return/report of employee benefit plan; Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web requesting a waiver of the electronic filing requirements: What to do if your form 5500 is not complete by october.

17 2022) by filing irs form 5558 by aug. Web 2 days ago01 aug 2023, 03:55:23 pm ist itr filing live updates: Web form 5500 and its accompanying schedules must be filed with the irs and department of labor (dol) on or before the last day of the seventh month after the plan year ends. Web advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil penalties for late filings and. In this primer article we highlight who must file,. Web requesting a waiver of the electronic filing requirements: Filing this form gives you until october 15 to. Several taxpayers were asking for the extension of. What to do if your form 5500 is not complete by october. Web final permissible launch date for safe harbor 401(k) plans beginning in 2022.

A refresher on form 5500 filings and options available for plan administrators and employers. Web affected individual taxpayers who need more time to file beyond the july 31 deadline must file their extension requests on paper using form 4868. Filing this form gives you until october 15 to. Web form 5500 and its accompanying schedules must be filed with the irs and department of labor (dol) on or before the last day of the seventh month after the plan year ends. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web 2 days ago01 aug 2023, 03:55:23 pm ist itr filing live updates: Form 5500, annual return/report of employee benefit plan; Web requesting a waiver of the electronic filing requirements: Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil penalties for late filings and.

Solo 401k Reporting Requirements Solo 401k

Web affected individual taxpayers who need more time to file beyond the july 31 deadline must file their extension requests on paper using form 4868. A refresher on form 5500 filings and options available for plan administrators and employers. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web.

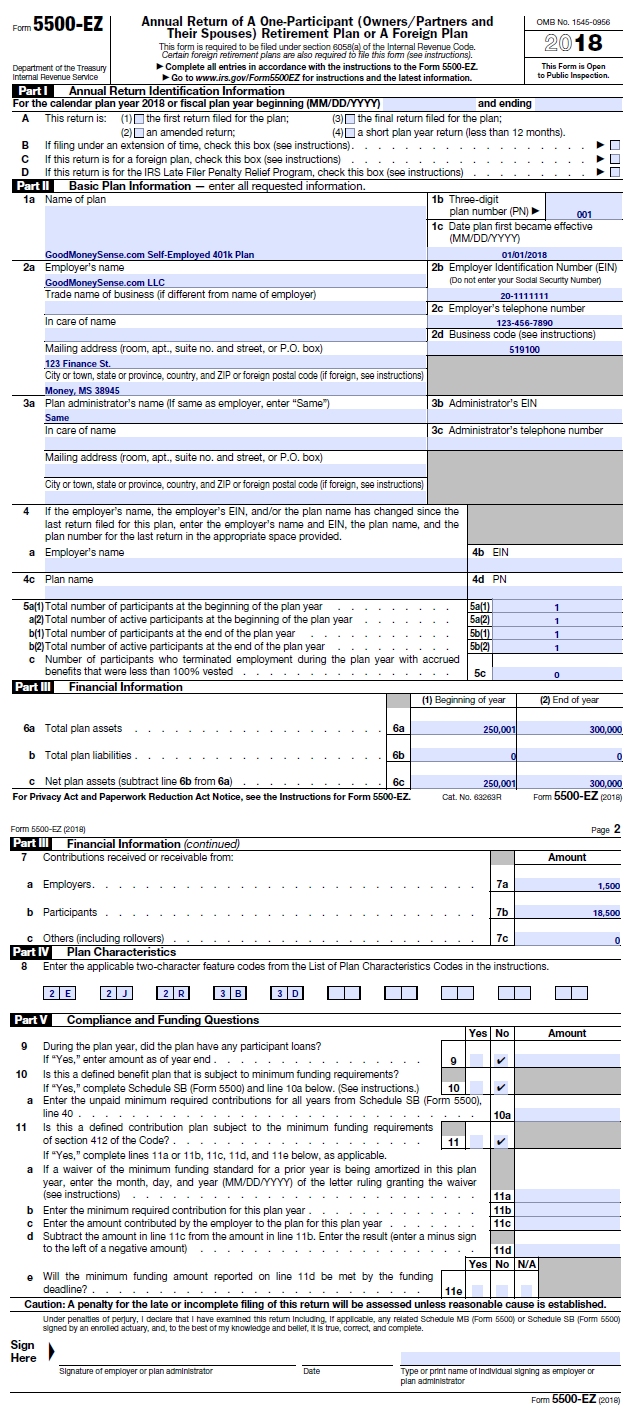

How To File The Form 5500EZ For Your Solo 401k for 2018 Good Money Sense

Deadlines and extensions applicable to the form 5500 series return. Web advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil penalties for late filings and. Web the form 5500 filing can be delayed if the form 5558 is filed with the irs by this date) 1 //.

Form 5500 Is Due by July 31 for Calendar Year Plans

Filing this form gives you until october 15 to. 17 2022) by filing irs form 5558 by aug. What to do if your form 5500 is not complete by october. A refresher on form 5500 filings and options available for plan administrators and employers. Web form 5500 must be filed annually by the last day of the seventh calendar month.

Form 5500 Sf Instructions 2018 slidesharetrick

Web form 5500 and its accompanying schedules must be filed with the irs and department of labor (dol) on or before the last day of the seventh month after the plan year ends. Web form 5500 deadline. 17 2022) by filing irs form 5558 by aug. The form 5500 must be filed by the last day of the seventh month.

Form 5500 Instructions 5 Steps to Filing Correctly

The form 5500 must be filed by the last day of the seventh month following the end of the plan year, unless an extension applies. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web requesting a waiver of the electronic filing requirements: 15th, but if the filing due.

10 Common Errors in Form 5500 Preparation Outsourcing Services

Web 2 days ago01 aug 2023, 03:55:23 pm ist itr filing live updates: Web form 5500 deadline. Web form 5500 and its accompanying schedules must be filed with the irs and department of labor (dol) on or before the last day of the seventh month after the plan year ends. Web requesting a waiver of the electronic filing requirements: Web.

LastMinute Tax Advice for 2021 Wow Gallery eBaum's World

Web extending your company tax return when a company extends the deadline to file its tax return, the form 5500 filing deadline is automatically extended to that same date. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in. 15th, but if.

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC

October 15, 2022 form 5500 extended filing deadline (where 5558 extension was filed. Web extending your company tax return when a company extends the deadline to file its tax return, the form 5500 filing deadline is automatically extended to that same date. Deadlines and extensions applicable to the form 5500 series return. Web form 5500 must be filed annually by.

2019 Form IRS 5500EZ Fill Online, Printable, Fillable, Blank pdfFiller

Why taxpayers were asking for extension of deadline. Web form 5500 and its accompanying schedules must be filed with the irs and department of labor (dol) on or before the last day of the seventh month after the plan year ends. Web affected individual taxpayers who need more time to file beyond the july 31 deadline must file their extension.

Form 5500 Deadline Is it Extended Due to COVID19? Mitchell Wiggins

Web form 5500 deadline. Web an extension of time to file form 5500 series (form 5500, annual return/report of employee benefit plan; Filing this form gives you until october 15 to. Web final permissible launch date for safe harbor 401(k) plans beginning in 2022. Why taxpayers were asking for extension of deadline.

In This Primer Article We Highlight Who Must File,.

Form 5500, annual return/report of employee benefit plan; Filing this form gives you until october 15 to. Typically, the form 5500 is due by. Since april 15 falls on a saturday, and emancipation day falls.

A Refresher On Form 5500 Filings And Options Available For Plan Administrators And Employers.

Web advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil penalties for late filings and. 15th, but if the filing due date falls on a saturday, sunday or. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in. Several taxpayers were asking for the extension of.

What To Do If Your Form 5500 Is Not Complete By October.

Web requesting a waiver of the electronic filing requirements: Web affected individual taxpayers who need more time to file beyond the july 31 deadline must file their extension requests on paper using form 4868. Web extending your company tax return when a company extends the deadline to file its tax return, the form 5500 filing deadline is automatically extended to that same date. Web the form 5500 filing can be delayed if the form 5558 is filed with the irs by this date) 1 // deadline for annual benefit statements for plans not offering participant.

Annual Personal Income Tax Filings (Form 1040) Due Tuesday, April 18, 2023.

October 15, 2022 form 5500 extended filing deadline (where 5558 extension was filed. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web form 5500 deadline. Web an extension of time to file form 5500 series (form 5500, annual return/report of employee benefit plan;