Form 5500 Instructions 2021

Form 5500 Instructions 2021 - Web to obtain any of the irs series 5500 tax forms, visit our irs form page and download the 5500 forms you need. Certain foreign retirement plans are also required to file this form (see instructions). Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last return/report filed for this plan, enter the name, ein and the plan number from the last. The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including schedules and instructions. Penalties section 6652(e) imposes a penalty of $250 a day (up to a maximum. Web in light of the secure act authorization for pooled employer plans to begin operating in 2021, the form 5500 instructions have been amended to make clear that a pooled. If you have questions or need assistance in preparing form 5500. The form 5500 version selection tool can help determine exactly which form in the. The form 5500 annual return/ report for the 2021 plan year generally is not required to be filed until seven months after the end of the 2021 plan. Filings for plan years prior to 2009 are not displayed through this website.

In 2023 filing year, the 2022,. The form 5500 version selection tool can help determine exactly which form in the. Web to obtain any of the irs series 5500 tax forms, visit our irs form page and download the 5500 forms you need. If you have questions or need assistance in preparing form 5500. Penalties section 6652(e) imposes a penalty of $250 a day (up to a maximum. Web in light of the secure act authorization for pooled employer plans to begin operating in 2021, the form 5500 instructions have been amended to make clear that a pooled. The form 5500 annual return/ report for the 2021 plan year generally is not required to be filed until seven months after the end of the 2021 plan. Web this form is required to be filed under section 6058(a) of the internal revenue code. Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last return/report filed for this plan, enter the name, ein and the plan number from the last. Certain foreign retirement plans are also required to file this form (see instructions).

If you have questions or need assistance in preparing form 5500. Filings for plan years prior to 2009 are not displayed through this website. In 2023 filing year, the 2022,. The form 5500 annual return/ report for the 2021 plan year generally is not required to be filed until seven months after the end of the 2021 plan. Web this form is required to be filed under section 6058(a) of the internal revenue code. Certain foreign retirement plans are also required to file this form (see instructions). Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last return/report filed for this plan, enter the name, ein and the plan number from the last. Penalties section 6652(e) imposes a penalty of $250 a day (up to a maximum. Web to obtain any of the irs series 5500 tax forms, visit our irs form page and download the 5500 forms you need. The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including schedules and instructions.

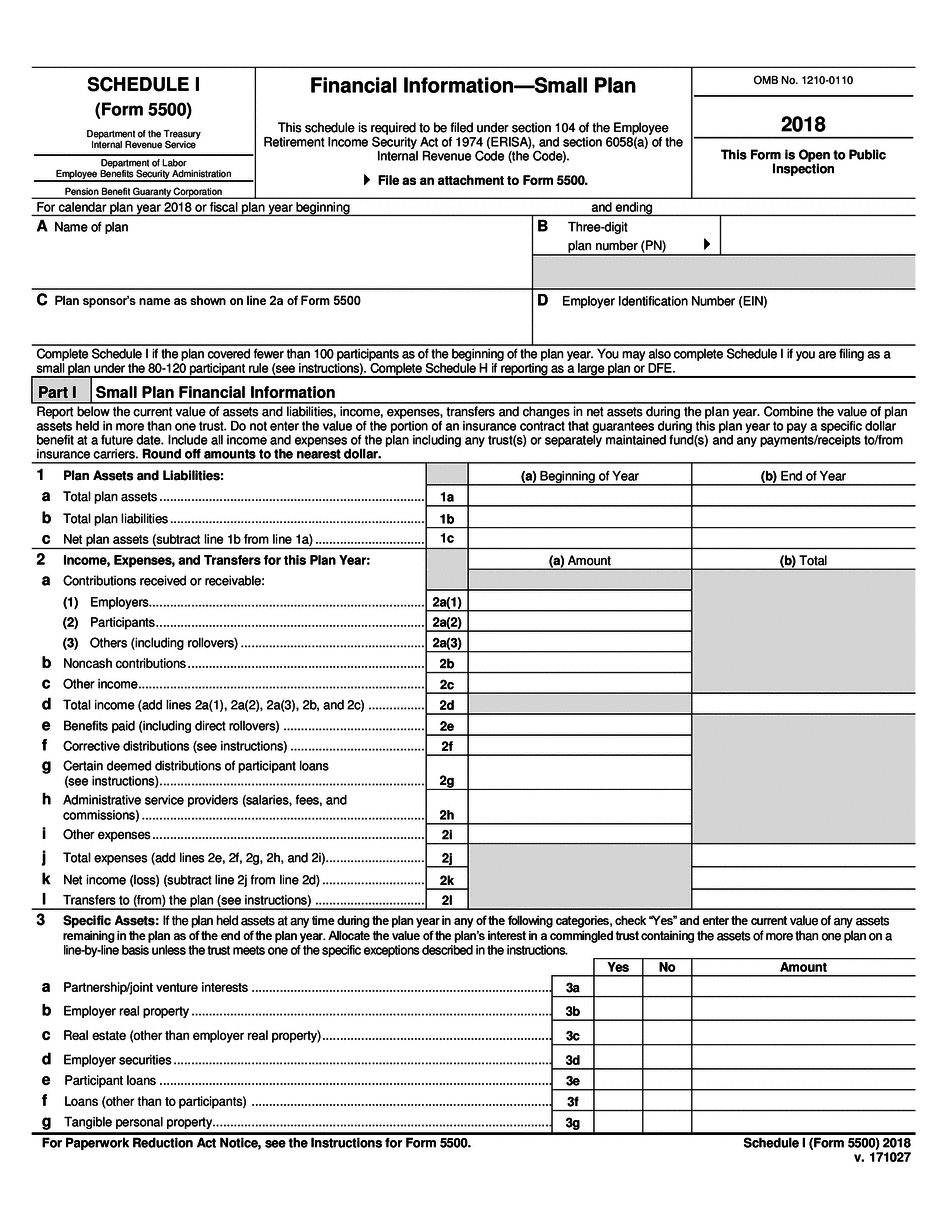

Form 5500 Fill Out and Sign Printable PDF Template signNow

Penalties section 6652(e) imposes a penalty of $250 a day (up to a maximum. In 2023 filing year, the 2022,. The form 5500 annual return/ report for the 2021 plan year generally is not required to be filed until seven months after the end of the 2021 plan. Web this form is required to be filed under section 6058(a) of.

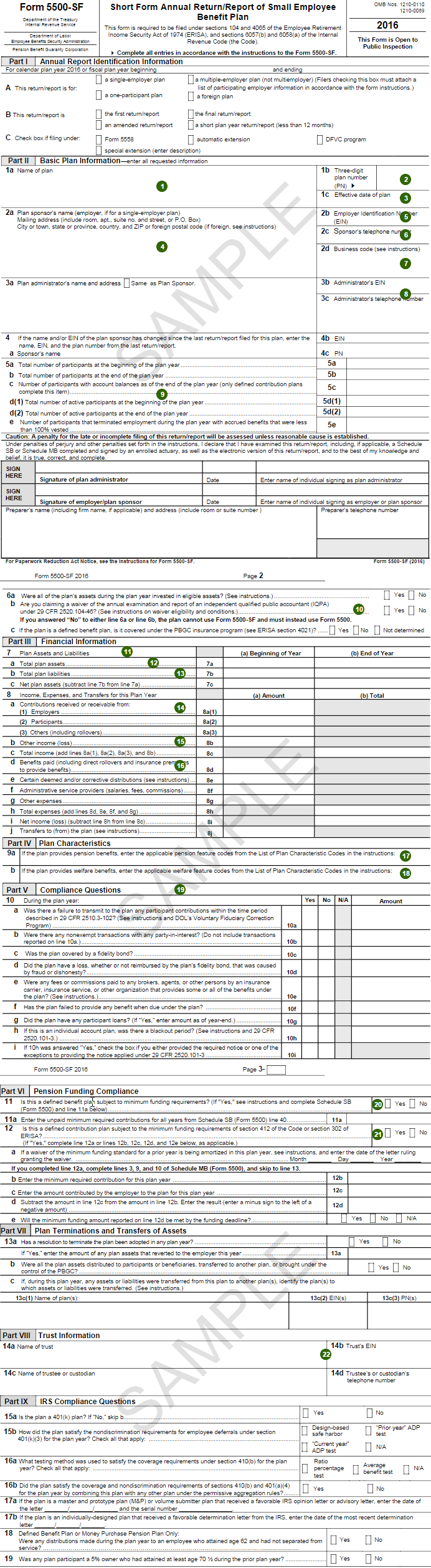

Understanding the Form 5500 for Defined Contribution Plans Fidelity

The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including schedules and instructions. Filings for plan years prior to 2009 are not displayed through this website. The form 5500 version selection tool can help determine exactly which form in the. Web official use only 4 if the name and/or ein of the plan sponsor.

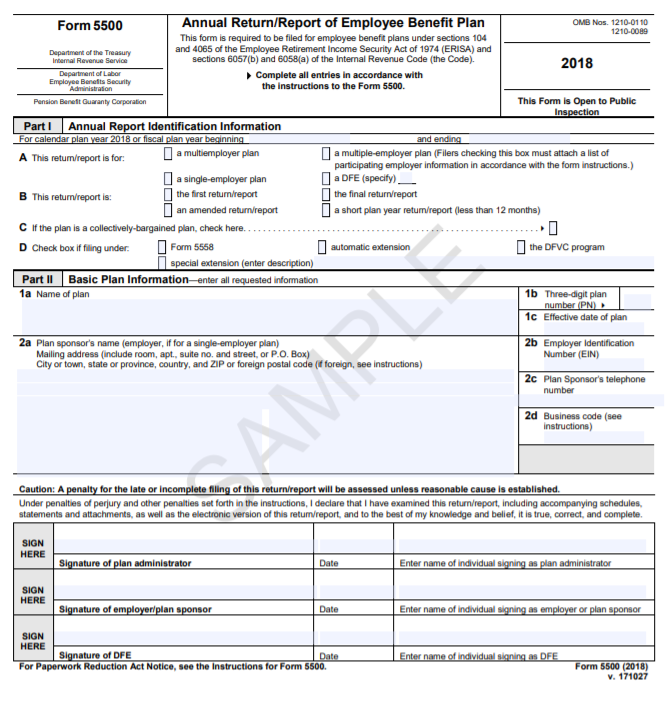

Form 5500 Is Due by July 31 for Calendar Year Plans

Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last return/report filed for this plan, enter the name, ein and the plan number from the last. If you have questions or need assistance in preparing form 5500. Certain foreign retirement plans are also required to file this form (see instructions). In.

Form 5500 Instructions 5 Steps to Filing Correctly

The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including schedules and instructions. Web to obtain any of the irs series 5500 tax forms, visit our irs form page and download the 5500 forms you need. In 2023 filing year, the 2022,. Filings for plan years prior to 2009 are not displayed through this.

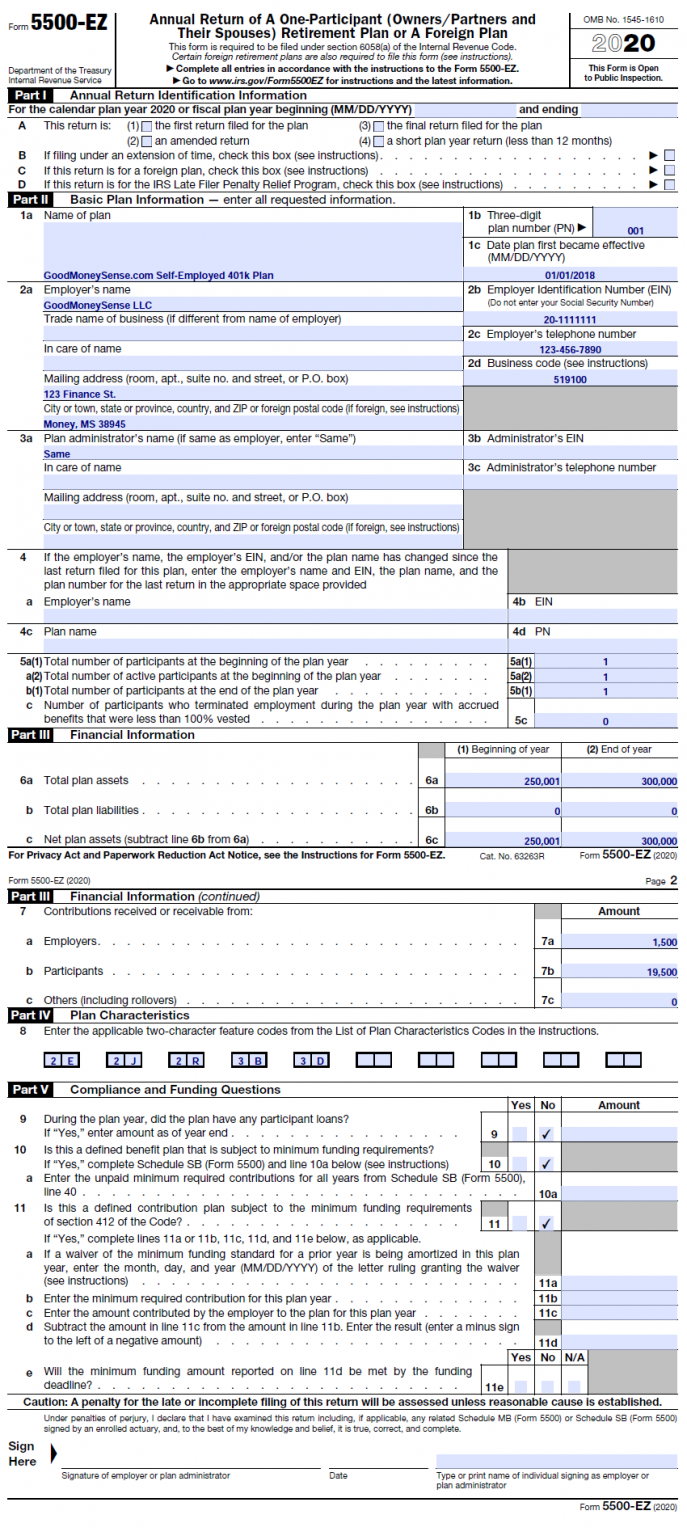

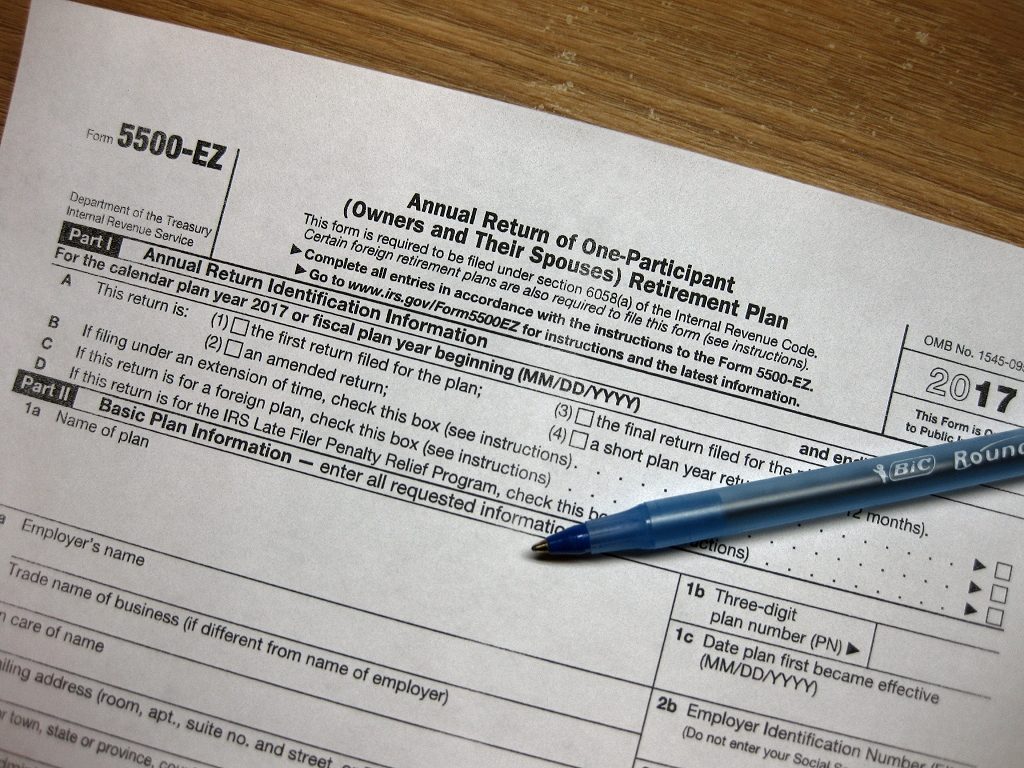

How To File The Form 5500EZ For Your Solo 401k in 2021 Good Money Sense

Web to obtain any of the irs series 5500 tax forms, visit our irs form page and download the 5500 forms you need. The form 5500 annual return/ report for the 2021 plan year generally is not required to be filed until seven months after the end of the 2021 plan. Web in light of the secure act authorization for.

How To File The Form 5500EZ For Your Solo 401k in 2022 Good Money Sense

The form 5500 annual return/ report for the 2021 plan year generally is not required to be filed until seven months after the end of the 2021 plan. The form 5500 version selection tool can help determine exactly which form in the. Web in light of the secure act authorization for pooled employer plans to begin operating in 2021, the.

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

The form 5500 annual return/ report for the 2021 plan year generally is not required to be filed until seven months after the end of the 2021 plan. The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including schedules and instructions. If you have questions or need assistance in preparing form 5500. Web official.

Form 5500 Instructions 5 Steps to Filing Correctly

Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last return/report filed for this plan, enter the name, ein and the plan number from the last. In 2023 filing year, the 2022,. If you have questions or need assistance in preparing form 5500. Web to obtain any of the irs series.

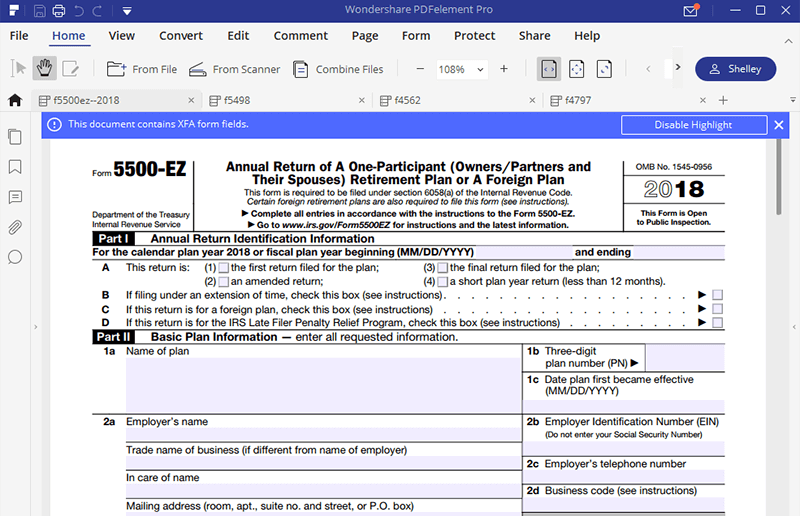

IRS Form 5500EZ Use the Most Efficient Tool to Fill it

Web this form is required to be filed under section 6058(a) of the internal revenue code. Filings for plan years prior to 2009 are not displayed through this website. Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last return/report filed for this plan, enter the name, ein and the plan.

20182021 Form DoL 5500 Fill Online, Printable, Fillable, Blank pdfFiller

Web to obtain any of the irs series 5500 tax forms, visit our irs form page and download the 5500 forms you need. In 2023 filing year, the 2022,. Filings for plan years prior to 2009 are not displayed through this website. The form 5500 annual return/ report for the 2021 plan year generally is not required to be filed.

Certain Foreign Retirement Plans Are Also Required To File This Form (See Instructions).

Filings for plan years prior to 2009 are not displayed through this website. The form 5500 annual return/ report for the 2021 plan year generally is not required to be filed until seven months after the end of the 2021 plan. Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last return/report filed for this plan, enter the name, ein and the plan number from the last. Web in light of the secure act authorization for pooled employer plans to begin operating in 2021, the form 5500 instructions have been amended to make clear that a pooled.

In 2023 Filing Year, The 2022,.

Penalties section 6652(e) imposes a penalty of $250 a day (up to a maximum. The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including schedules and instructions. Web this form is required to be filed under section 6058(a) of the internal revenue code. If you have questions or need assistance in preparing form 5500.

Web To Obtain Any Of The Irs Series 5500 Tax Forms, Visit Our Irs Form Page And Download The 5500 Forms You Need.

The form 5500 version selection tool can help determine exactly which form in the.