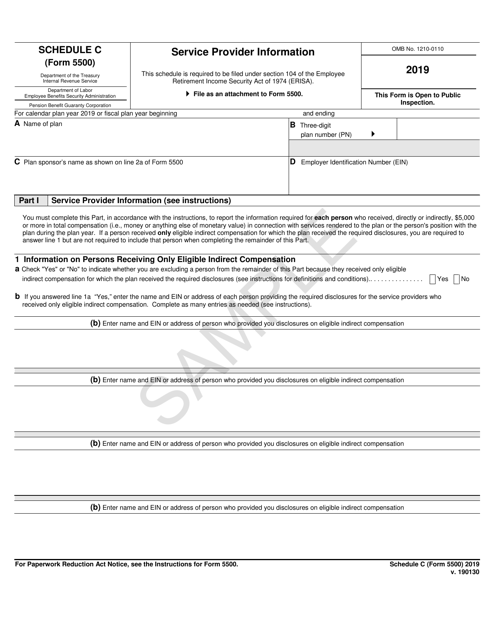

Form 5500 Schedule C Instructions

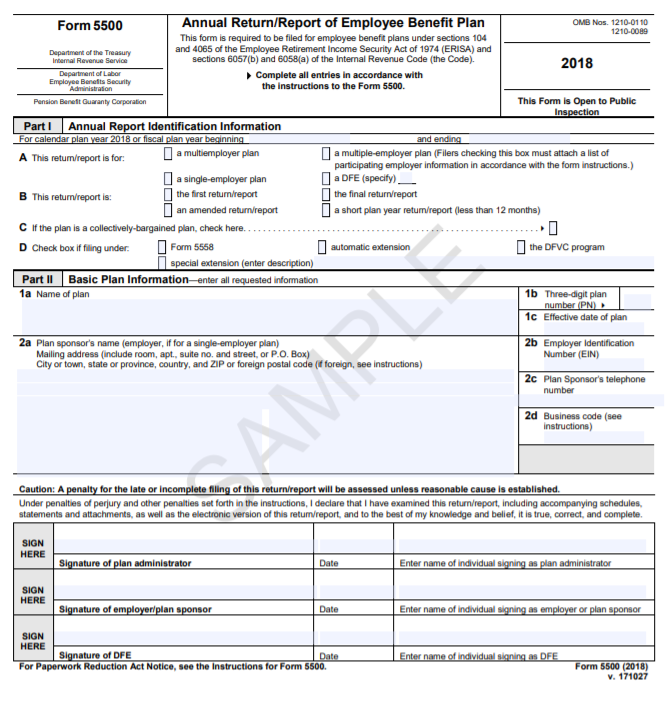

Form 5500 Schedule C Instructions - Eligible indirect compensation disclosure guide. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Remember to check the schedule c box on the form 5500 (part ii, line 10b(4)) if a schedule c is attached to the form 5500. Web form 5500 schedule c: We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. File as an attachment to form 5500. Web form 5500 is the form used to file the annual report of employee benefit plan information with the dol (department of labor). An annuity or custodial account arrangement under code sections 403(b)(1) or (7) not established or maintained by an If the employee benefit plan is subject to erisa (the employee benefit income security act of. Web plans required to file form 5500 schedule c if your plan had 100 or more eligible participants (this includes active employees who are eligible to participate and terminated employees with account balances) on the first day of the plan year, your plan is considered a large plan filer and will generally be required to file an irs schedule h,

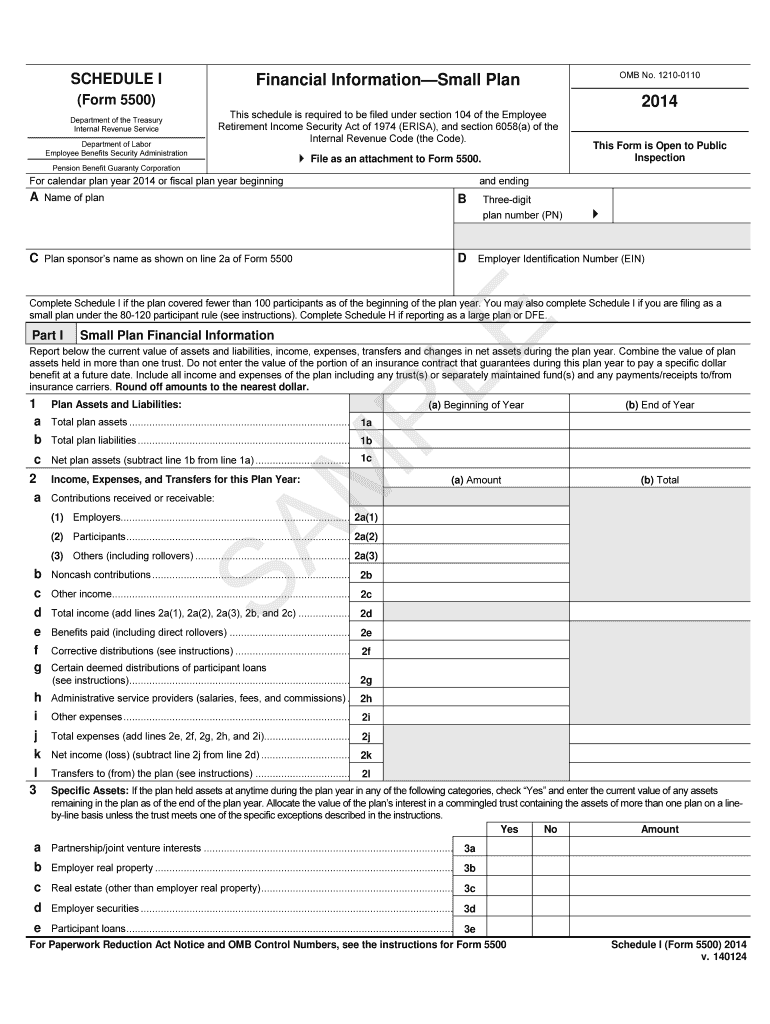

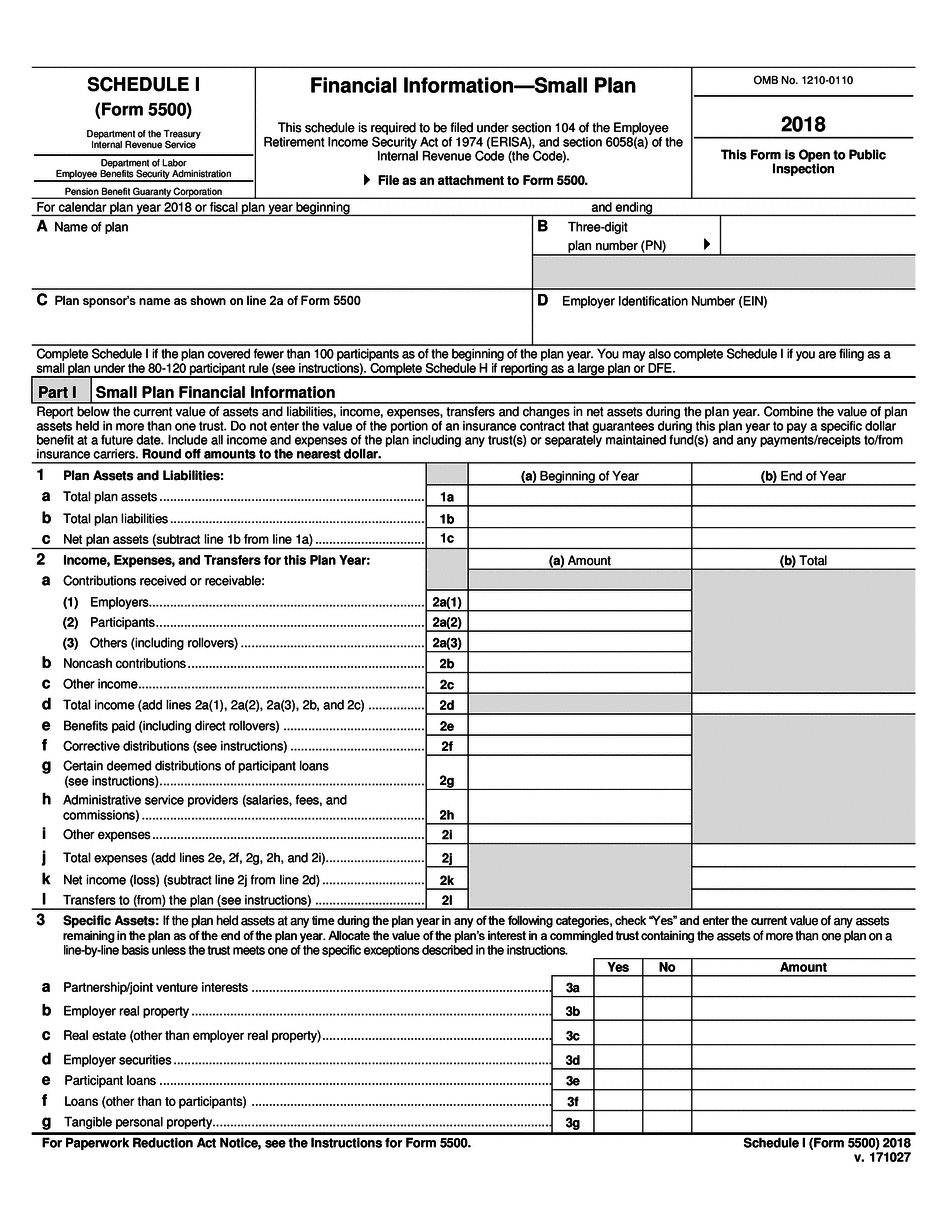

Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. Web (form 5500) department of the treasury internal revenue service department of labor employee benefits security administration pension benefit guaranty corporation this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Eligible indirect compensation disclosure guide. If the employee benefit plan is subject to erisa (the employee benefit income security act of. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An unfunded excess benefit plan. This guide is designed to help plan sponsors complete form 5500 schedule c (service provider information). Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in accordance with certain prescribed standards and that participants and beneficiaries, as well as regulators, are provided or have access to sufficient information to protect the r. Web form 5500 is the form used to file the annual report of employee benefit plan information with the dol (department of labor).

Web the form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. This guide is designed to help plan sponsors complete form 5500 schedule c (service provider information). Web form 5500 schedule c: Remember to check the schedule c box on the form 5500 (part ii, line 10b(4)) if a schedule c is attached to the form 5500. Web plans required to file form 5500 schedule c if your plan had 100 or more eligible participants (this includes active employees who are eligible to participate and terminated employees with account balances) on the first day of the plan year, your plan is considered a large plan filer and will generally be required to file an irs schedule h, If the employee benefit plan is subject to erisa (the employee benefit income security act of. An unfunded excess benefit plan. Web (form 5500) department of the treasury internal revenue service department of labor employee benefits security administration pension benefit guaranty corporation this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively.

Form 5500 Fill Out and Sign Printable PDF Template signNow

An annuity or custodial account arrangement under code sections 403(b)(1) or (7) not established or maintained by an Remember to check the schedule c box on the form 5500 (part ii, line 10b(4)) if a schedule c is attached to the form 5500. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted.

Form 5500 Instructions 5 Steps to Filing Correctly

Web form 5500 is the form used to file the annual report of employee benefit plan information with the dol (department of labor). Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. If the employee benefit plan is subject to erisa (the employee benefit.

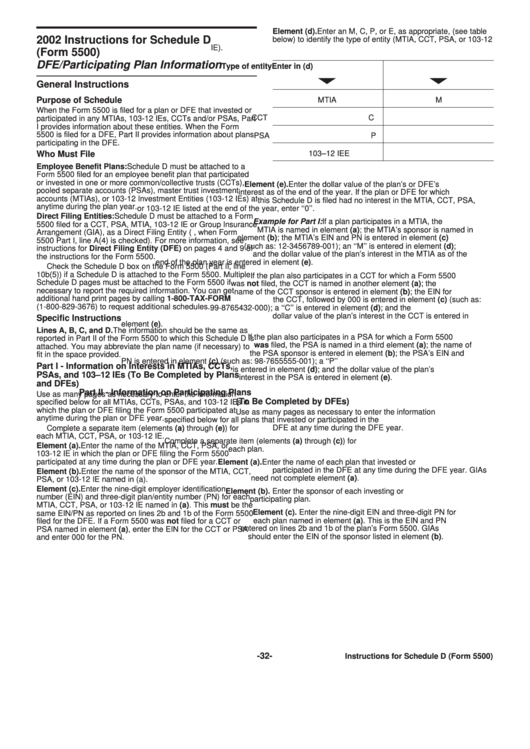

Instructions For Schedule D (Form 5500) Dfe/participating Plan

Remember to check the schedule c box on the form 5500 (part ii, line 10b(4)) if a schedule c is attached to the form 5500. Web form 5500 is the form used to file the annual report of employee benefit plan information with the dol (department of labor). An unfunded excess benefit plan. Web use schedule c (form 1040) to.

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

Web (form 5500) department of the treasury internal revenue service department of labor employee benefits security administration pension benefit guaranty corporation this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession.

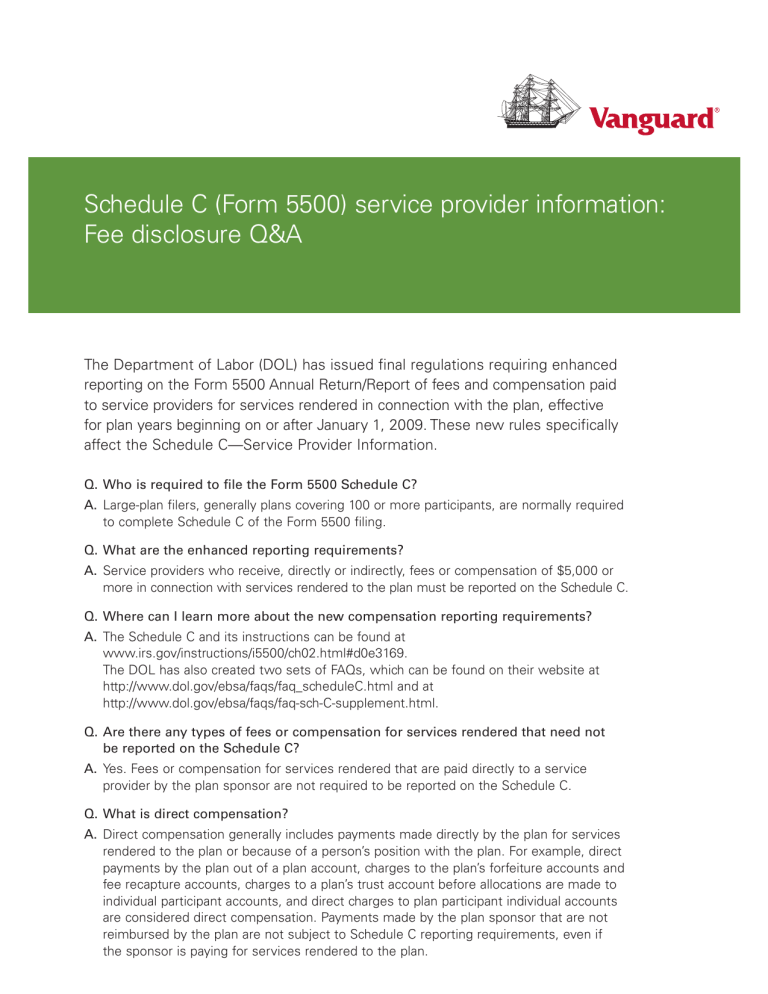

Schedule C (Form 5500) service provider

Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. This guide is designed to help plan sponsors complete form 5500 schedule c (service provider information). Remember to check the schedule c box on the form 5500 (part ii, line 10b(4)) if a schedule c is attached to the form 5500. Eligible.

Form 5500 Instructions 5 Steps to Filing Correctly

An annuity or custodial account arrangement under code sections 403(b)(1) or (7) not established or maintained by an Remember to check the schedule c box on the form 5500 (part ii, line 10b(4)) if a schedule c is attached to the form 5500. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended.

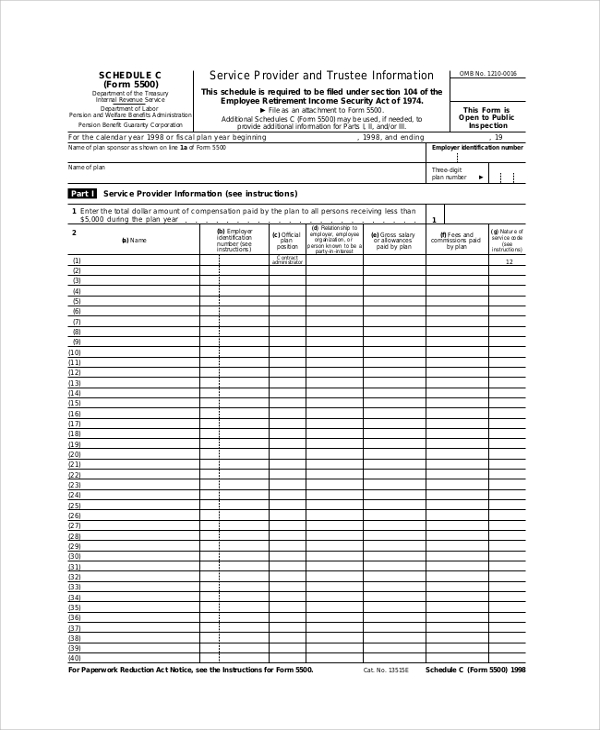

Sample Schedule C The Document Template

This guide is designed to help plan sponsors complete form 5500 schedule c (service provider information). An annuity or custodial account arrangement under code sections 403(b)(1) or (7) not established or maintained by an An unfunded excess benefit plan. Remember to check the schedule c box on the form 5500 (part ii, line 10b(4)) if a schedule c is attached.

IRS Form 5500 Schedule C Download Fillable PDF or Fill Online Service

Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in accordance with certain prescribed standards and that participants and beneficiaries, as well as regulators, are provided or have access to sufficient information to protect the r. Web form 5500 schedule c: An.

Form 5500 Fill Out and Sign Printable PDF Template signNow

Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in accordance with certain prescribed standards and that participants and beneficiaries, as well as regulators, are provided or have access to sufficient information to protect the r. An unfunded excess benefit plan. Remember.

Form 5500 Is Due by July 31 for Calendar Year Plans

File as an attachment to form 5500. Web (form 5500) department of the treasury internal revenue service department of labor employee benefits security administration pension benefit guaranty corporation this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). This guide is designed to help plan sponsors complete form 5500 schedule.

Web Plans Required To File Form 5500 Schedule C If Your Plan Had 100 Or More Eligible Participants (This Includes Active Employees Who Are Eligible To Participate And Terminated Employees With Account Balances) On The First Day Of The Plan Year, Your Plan Is Considered A Large Plan Filer And Will Generally Be Required To File An Irs Schedule H,

Remember to check the schedule c box on the form 5500 (part ii, line 10b(4)) if a schedule c is attached to the form 5500. Web form 5500 is the form used to file the annual report of employee benefit plan information with the dol (department of labor). Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. File as an attachment to form 5500.

Web The Form 5500 Series Is Documentation Designed To Satisfy The Annual Reporting Requirements Under Title I And Title Iv Of The Employee Retirement Income Security Act (Erisa) And The Internal Revenue Code.

Eligible indirect compensation disclosure guide. Web the instructions for the 2021 form 5500 will further explain the filing requirements for plans adopted retroactively. We anticipate that similar rules will apply to the retroactive adoption of a plan pursuant to section 201 of the secure act after an employer’s 2021 taxable year. Web form 5500 schedule c:

An Unfunded Excess Benefit Plan.

An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Web (form 5500) department of the treasury internal revenue service department of labor employee benefits security administration pension benefit guaranty corporation this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). An annuity or custodial account arrangement under code sections 403(b)(1) or (7) not established or maintained by an If the employee benefit plan is subject to erisa (the employee benefit income security act of.

Web The Form 5500 Series Is Part Of Erisa's Overall Reporting And Disclosure Framework, Which Is Intended To Assure That Employee Benefit Plans Are Operated And Managed In Accordance With Certain Prescribed Standards And That Participants And Beneficiaries, As Well As Regulators, Are Provided Or Have Access To Sufficient Information To Protect The R.

This guide is designed to help plan sponsors complete form 5500 schedule c (service provider information).