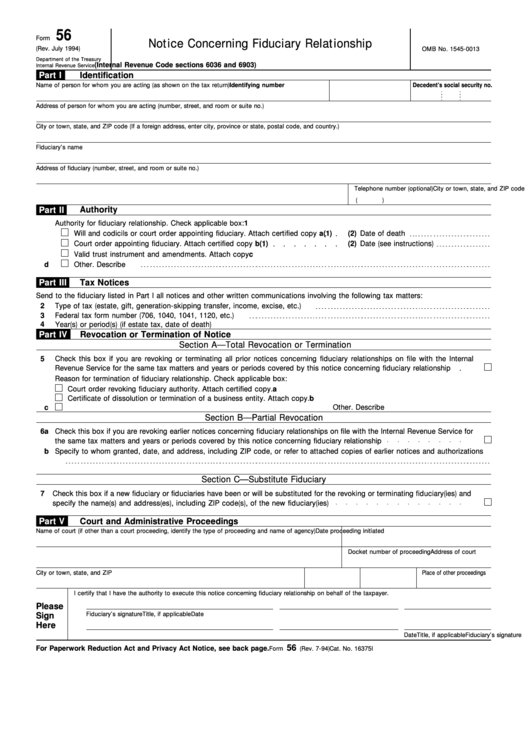

Form 56 For Deceased

Form 56 For Deceased - & more fillable forms, register and subscribe now! Web form 56 allows the personal representative to assume the powers, rights, duties and privileges of the decedent and allows the irs to mail the representative all tax. Web at the top of the tax form, the surviving spouse will write deceased, their spouse's name and the date of death. The following are the conditions whenever you. Complete, edit or print tax forms instantly. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Web the personal representative is responsible for filing any final individual income tax return (s) and the estate tax return of the decedent when due. Upload, modify or create forms. Web the main purpose of form 56 irs is to establish the fiduciary or a trustee who will be responsible for the estate accounts. Web form 56 what it is:

Web form 56 what it is: Web form 2848, power of attorney and declaration of representative, is invalid once the taxpayer dies; Web the personal representative is responsible for filing any final individual income tax return (s) and the estate tax return of the decedent when due. Try it for free now! If you're filing taxes as an executor, administrator. For example, someone who died in 2020 should have an executor or spouse. Ad access irs tax forms. To prepare the return — or provide. Web form 56 allows the personal representative to assume the powers, rights, duties and privileges of the decedent and allows the irs to mail the representative all tax. Should be filed with the decedent’s final.

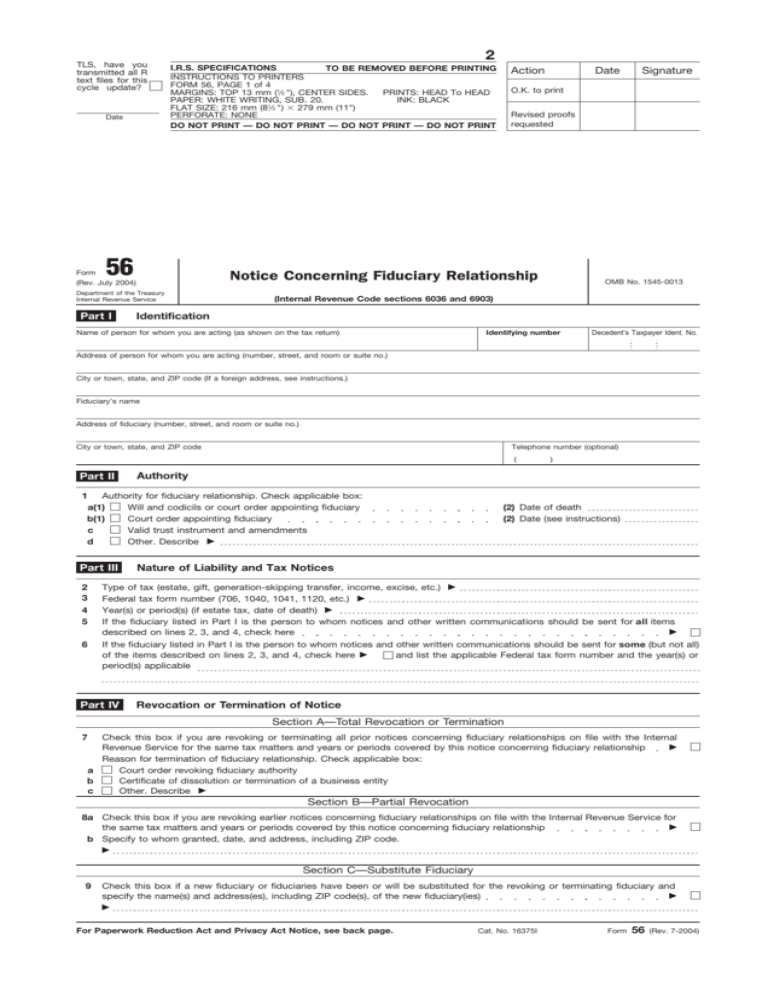

Web form 2848, power of attorney and declaration of representative, is invalid once the taxpayer dies; Upload, modify or create forms. Web 3 federal tax form number (706, 1040, 1041, 1120, etc.) ' 4 year(s) or period(s) (if estate tax, date of death) ' revocation or termination of notice section a—total revocation or. Complete irs tax forms online or print government tax documents. Web you must file the tax returns for the deceased in the tax year that corresponds to their death. Therefore form 56 or new form 2848 signed by estate executor or. Web you may also need form 56, which is used when either setting up or terminating a fiduciary relationship. Try it for free now! Web form 56 what it is: For example, if you are.

Form 56

Therefore form 56 or new form 2848 signed by estate executor or. For example, someone who died in 2020 should have an executor or spouse. Web form 56, notice concerning fiduciary relationship, include a copy of any letters of testamentary that have been approved by the court. Form 56 authorizes you to act as a fiduciary on behalf of the.

Form 56 Notice Concerning Fiduciary Relationship printable pdf download

For example, if you are. Irs form 56 should be filed with the 1040 return for the deceased. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Try it for free now! Therefore form 56 or new form 2848 signed by.

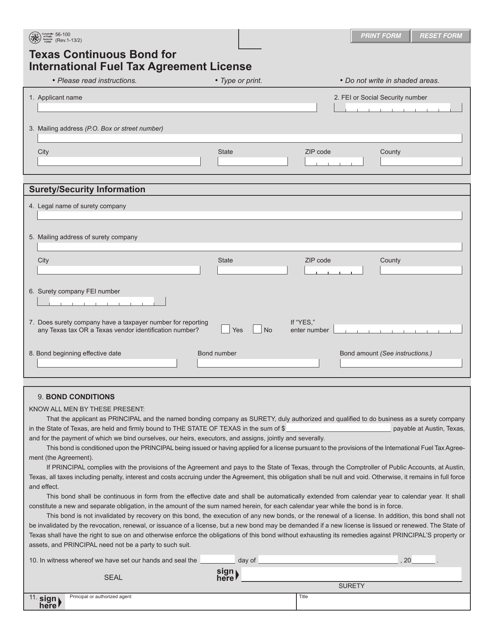

Form 56100 Download Fillable PDF or Fill Online Texas Continuous Bond

If you're filing taxes as an executor, administrator. Web form 2848, power of attorney and declaration of representative, is invalid once the taxpayer dies; Web you may also need form 56, which is used when either setting up or terminating a fiduciary relationship. Web use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section.

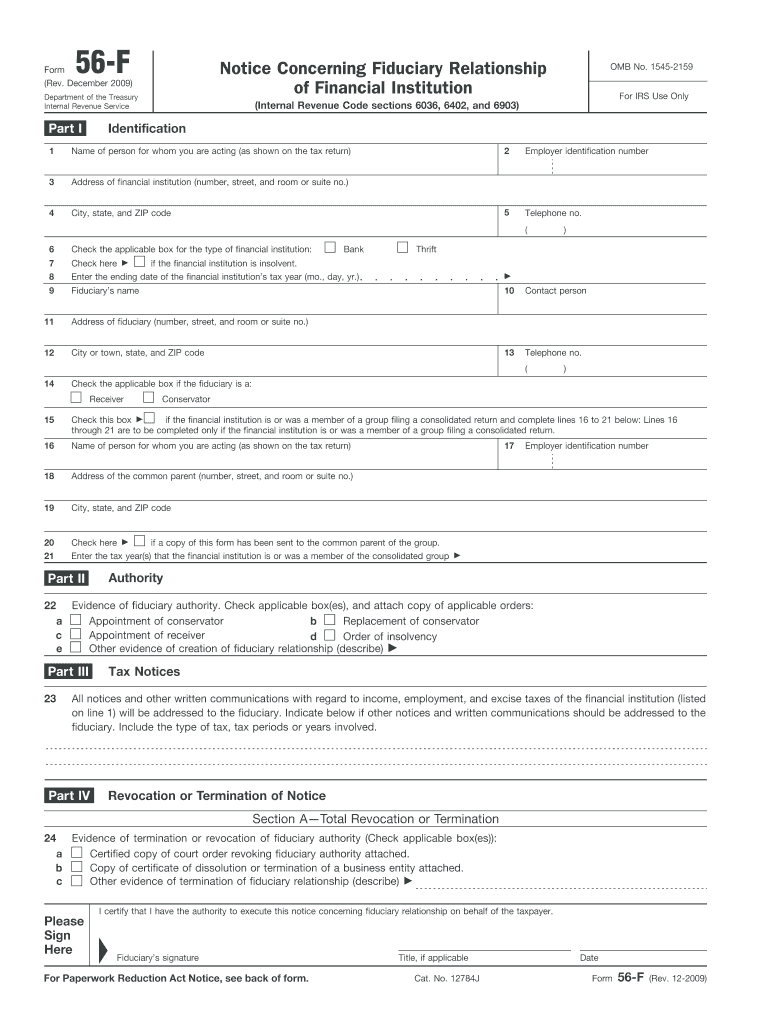

Form 56 F Fill Out and Sign Printable PDF Template signNow

Web at the top of the tax form, the surviving spouse will write deceased, their spouse's name and the date of death. Form 56 authorizes you to act as a fiduciary on behalf of the decedent or the decedent’s estate. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or.

IRS form 56Notice Concerning Fiduciary Relationship

It authorizes you to act as if you’re the taxpayer, allowing you to file income. Form 56 authorizes you to act as a fiduciary on behalf of the decedent or the decedent’s estate. For example, if you are. Web form 56 allows the personal representative to assume the powers, rights, duties and privileges of the decedent and allows the irs.

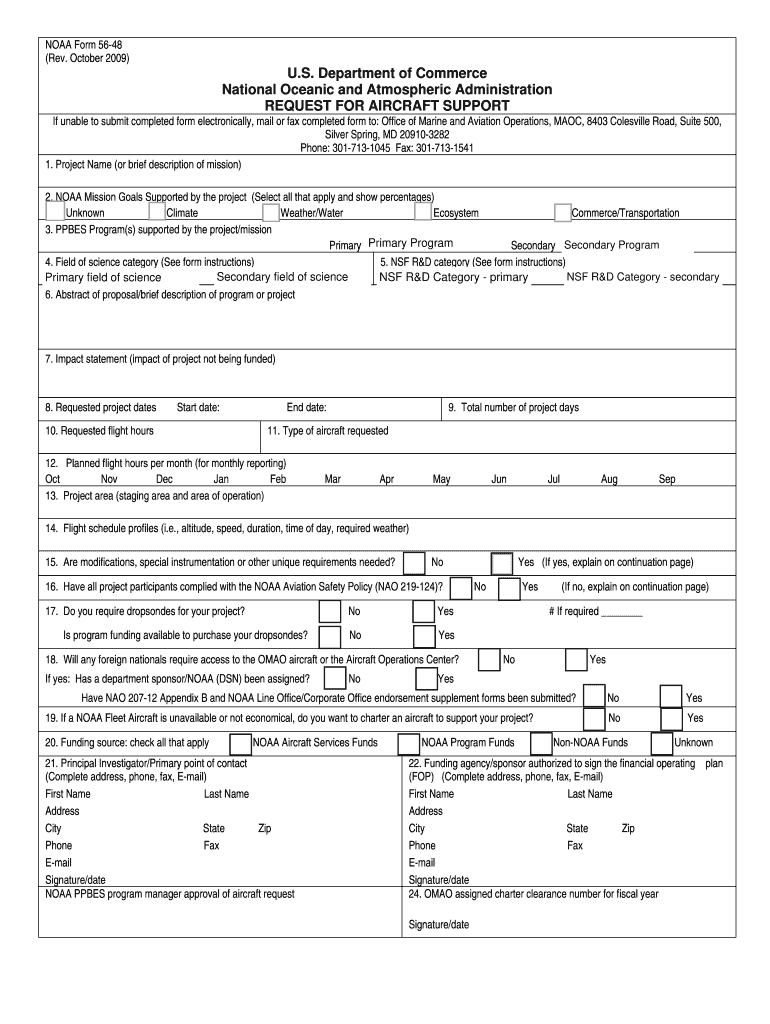

NOAA Form 56 48 Rev October US Department of Fill Out and Sign

The following are the conditions whenever you. Web you may also need form 56, which is used when either setting up or terminating a fiduciary relationship. Therefore form 56 or new form 2848 signed by estate executor or. Form 56 authorizes you to act as a fiduciary on behalf of the decedent or the decedent’s estate. For example, someone who.

FORM (456) YouTube

Form 56 authorizes you to act as a fiduciary on behalf of the decedent or the decedent’s estate. An executor must file form 56 for the individual decedent, if the executor will be filing a final. To prepare the return — or provide. Should be filed with the decedent’s final. Irs form 56 should be filed with the 1040 return.

Form 56 Notice Concerning Fiduciary Relationship (2012) Free Download

Upload, modify or create forms. Form 56 authorizes you to act as a fiduciary on behalf of the decedent or the decedent’s estate. Web personal representatives notify the irs of their right to file the tax return by including form 56 with the 1040, bonfa adds. If you're filing taxes as an executor, administrator. Web use form 56 to notify.

FORM 56 Explained and The Fiduciary Relationship Explained YouTube

Form 56 authorizes you to act as a fiduciary on behalf of the decedent or the decedent’s estate. Web you may also need form 56, which is used when either setting up or terminating a fiduciary relationship. To prepare the return — or provide. Web 3 federal tax form number (706, 1040, 1041, 1120, etc.) ' 4 year(s) or period(s).

The Following Are The Conditions Whenever You.

Web use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section 6903 and give notice of qualification under section 6036. Complete, edit or print tax forms instantly. For example, someone who died in 2020 should have an executor or spouse. Web you may also need form 56, which is used when either setting up or terminating a fiduciary relationship.

It Authorizes You To Act As If You’re The Taxpayer, Allowing You To File Income.

Web you must file the tax returns for the deceased in the tax year that corresponds to their death. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Web at the top of the tax form, the surviving spouse will write deceased, their spouse's name and the date of death. Should be filed with the decedent’s final.

To Prepare The Return — Or Provide.

Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship. An executor must file form 56 for the individual decedent, if the executor will be filing a final. Irs form 56 should be filed with the 1040 return for the deceased. Web the main purpose of form 56 irs is to establish the fiduciary or a trustee who will be responsible for the estate accounts.

Web Irs Form 56 Should Be Filed As Soon As The Ein For The Estate Is Received.

Web form 56 allows the personal representative to assume the powers, rights, duties and privileges of the decedent and allows the irs to mail the representative all tax. Therefore form 56 or new form 2848 signed by estate executor or. & more fillable forms, register and subscribe now! If you're filing taxes as an executor, administrator.