Form 568 Due Date

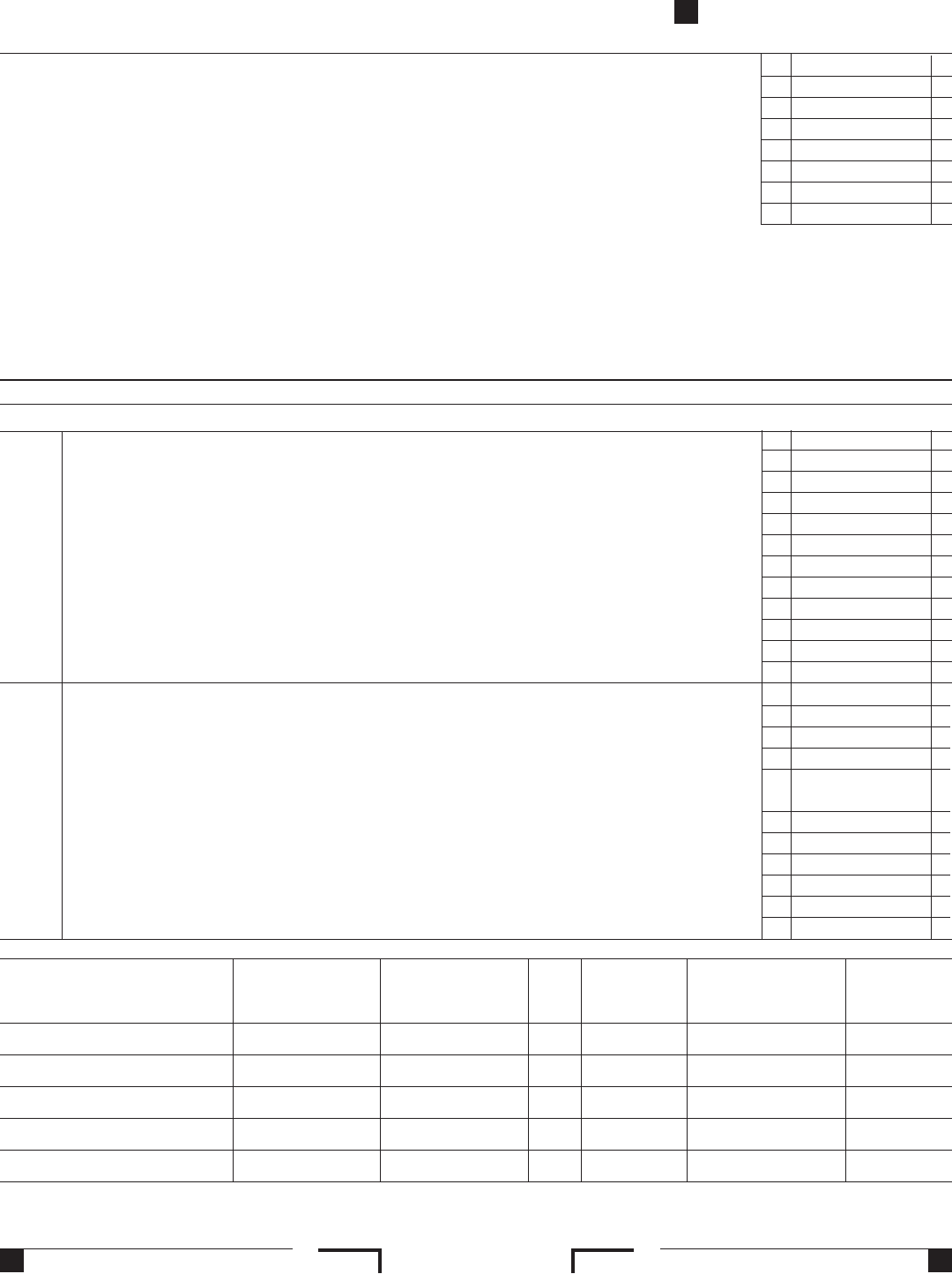

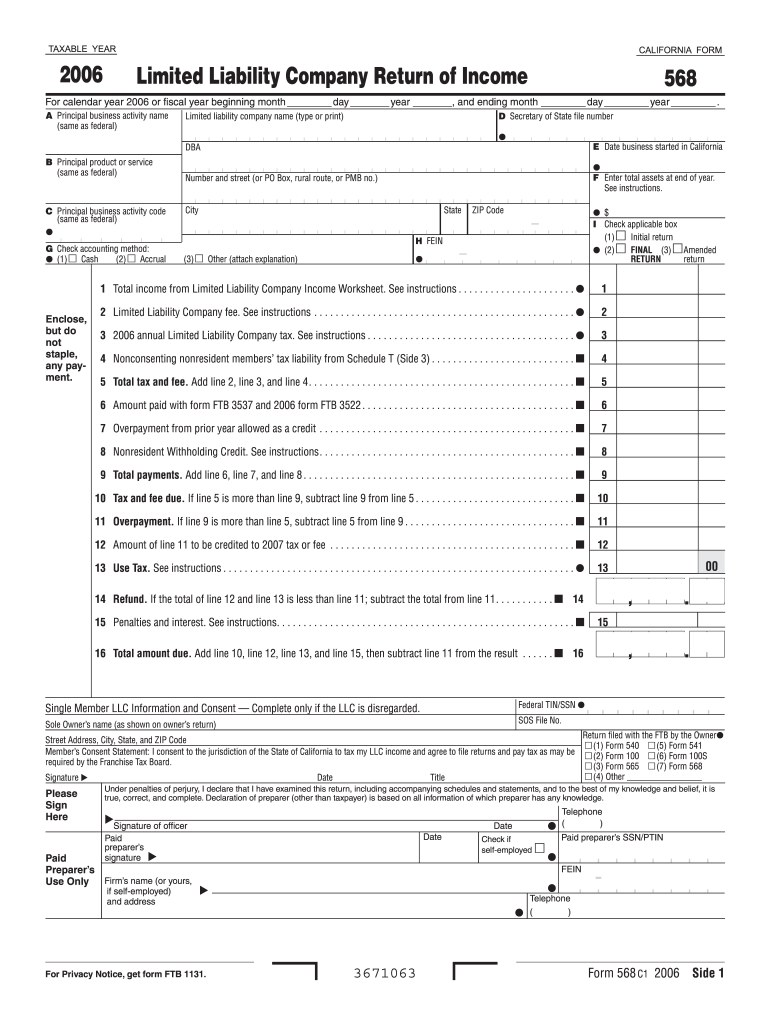

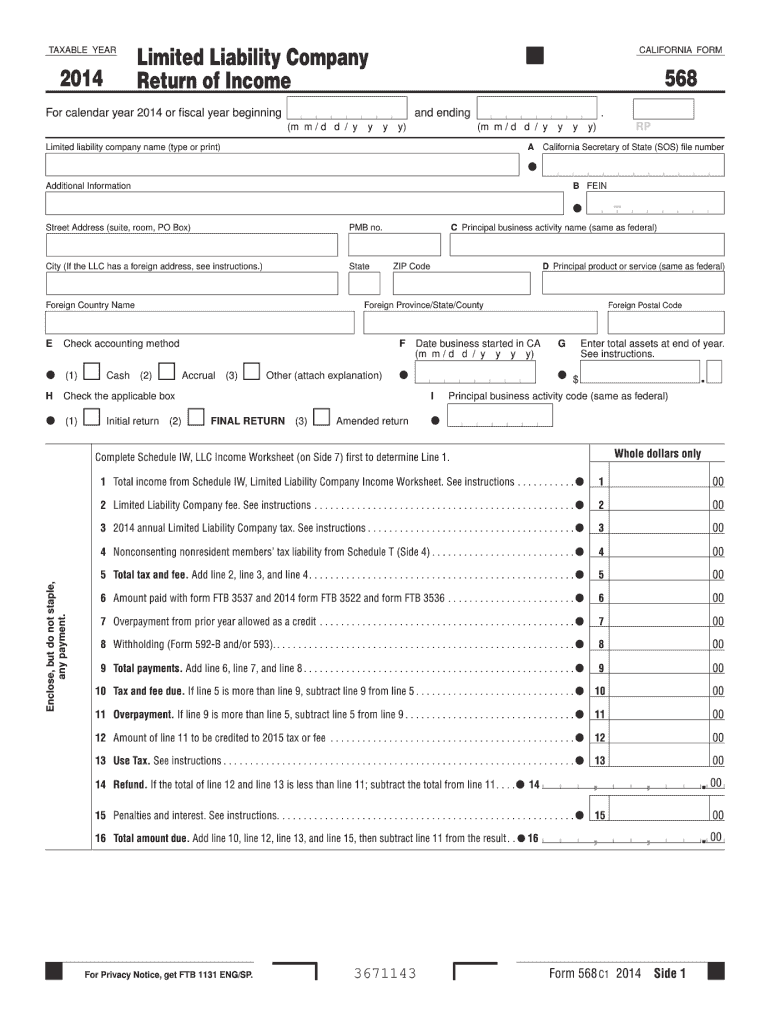

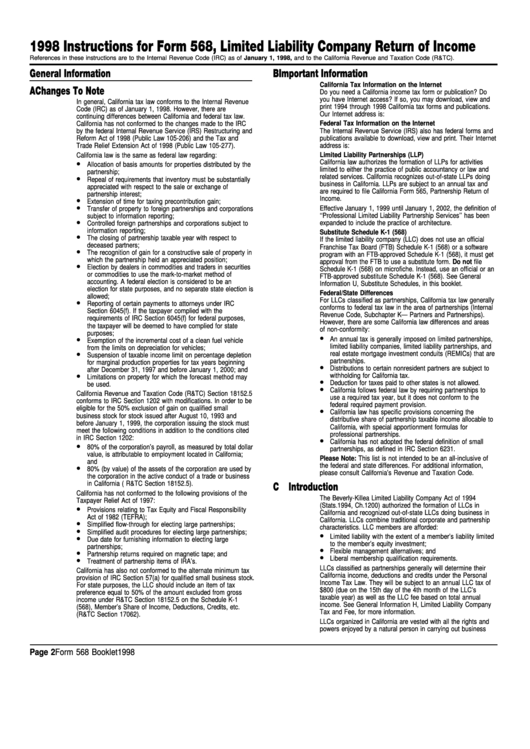

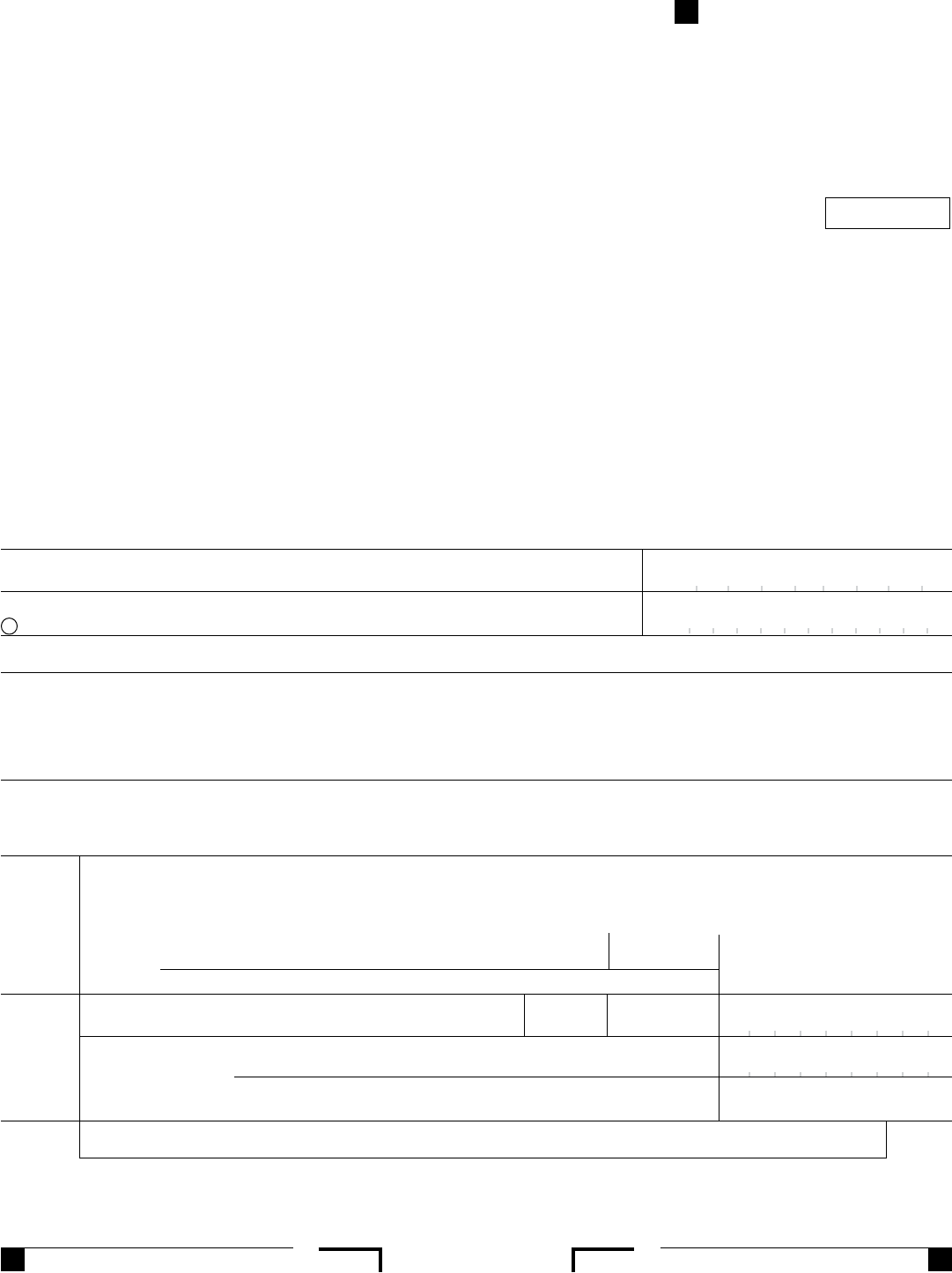

Form 568 Due Date - When is form 568 due? How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. They are subject to the annual tax, llc fee and credit limitations. Web form 568 payment due date aside from the $800 fixed tax, you are required to pay your state income taxes by april 15. You and your clients should be aware that a disregarded smllc is required to: Web when is form 568 due? Web you still have to file form 568 if the llc is registered in california. Web what is form 568? Disaster relief tax extension franchise. This form is for income earned in tax year 2022, with tax returns due in april.

They are subject to the annual tax, llc fee and credit limitations. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Web this tax amounts to $800 for every type of entity and is due on april 15 every year. Web when the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. While you can submit your state income tax return and federal income tax return by april 15, you must prepare and. Web we last updated california form 568 in february 2023 from the california franchise tax board. As the instructions state, form 568 is to be filed by april, 15th. Web when is form 568 due? You and your clients should be aware that a disregarded smllc is required to: All california llcs must file form 568 [ 3 ].

Web what is form 568? Web you still have to file form 568 if the llc is registered in california. As the instructions state, form 568 is to be filed by april, 15th. Web form 568, limited liability company return of income ftb. You can find out how much you owe in state income. Web up to $40 cash back sign and date the form, and include your title if applicable. They are subject to the annual tax, llc fee and credit limitations. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Web form 568 is due on march 31st following the end of the tax year.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

Web up to $40 cash back sign and date the form, and include your title if applicable. Web we last updated california form 568 in february 2023 from the california franchise tax board. Web file limited liability company return of income (form 568) by the original return due date. How to fill in california form 568 if you have an.

Form 568 Instructions 2022 State And Local Taxes Zrivo

If your llc files on an extension, refer to payment for automatic extension for. As the instructions state, form 568 is to be filed by april, 15th. Web when is form 568 due? While you can submit your state income tax return and federal income tax return by april 15, you must prepare and. In california, it currently sits.

Form 568 Limited Liability Company Return of Fill Out and Sign

Web form 568, limited liability company return of income ftb. Form 3522, or the llc tax voucher, needs to be filed to pay the franchise tax. They are subject to the annual tax, llc fee and credit limitations. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Web smllcs,.

CA Form 568 Due Dates 2022 State And Local Taxes Zrivo

You can then go back into your return and complete your federal and state. As the instructions state, form 568 is to be filed by april, 15th. Web form 568 is a california tax return form, and its typical due date is march 15 or april 15 each tax year. You can find out how much you owe in state.

Form 568 Instructions 2022 2023 State Tax TaxUni

The california llc tax due date is when llcs in california are required to have their tax returns filed. Web form 568 is due on march 31st following the end of the tax year. If your llc files on an extension, refer to payment for automatic extension for. Web when is form 568 due? Web you still have to file.

Form 568 Fill Out and Sign Printable PDF Template signNow

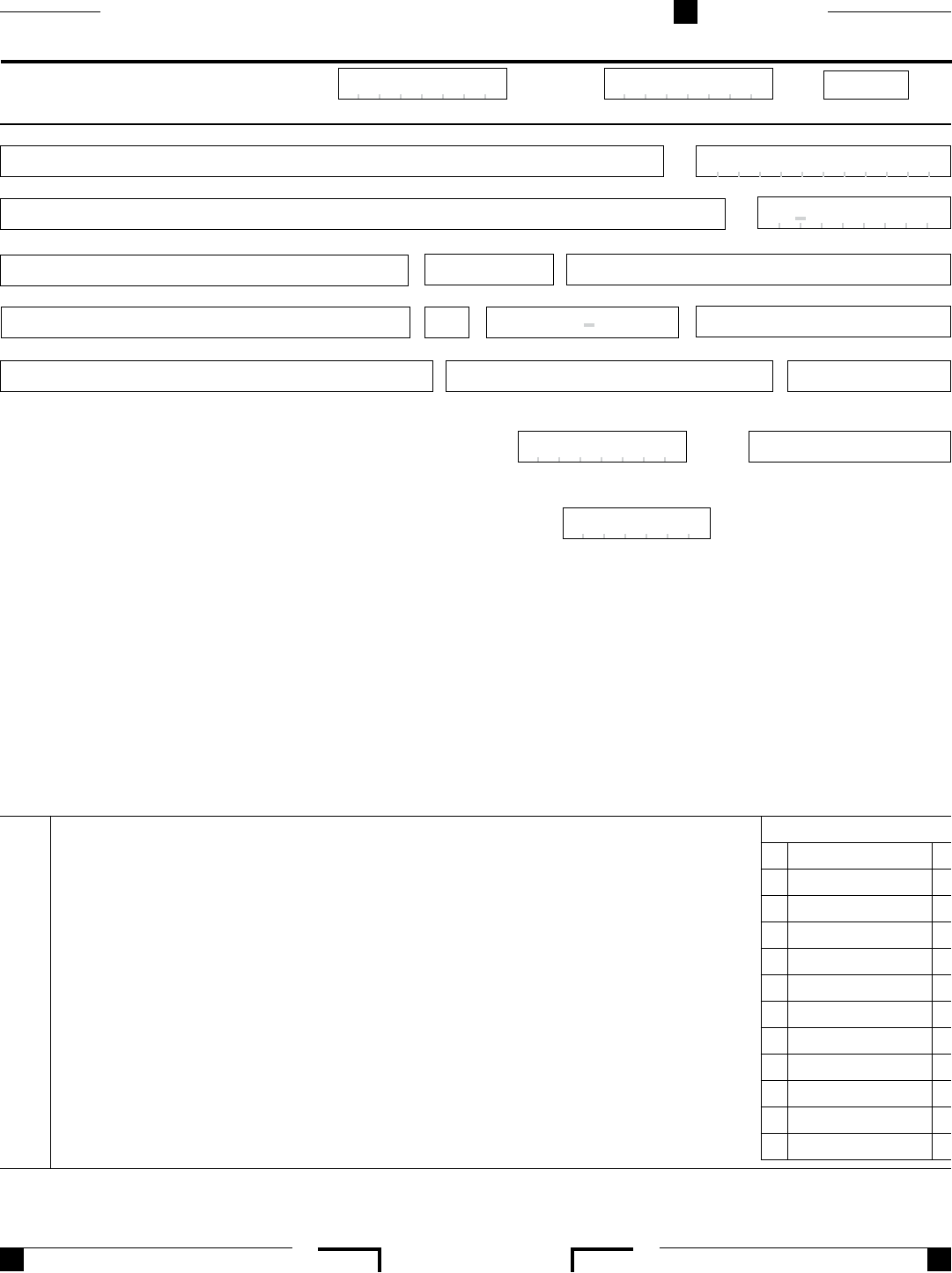

Web we last updated california form 568 in february 2023 from the california franchise tax board. Web form 568 due dates llcs classified as partnerships use form 568, due the 15th day of the 3rd month after the close of the company’s tax year. When is form 568 due? As the instructions state, form 568 is to be filed by.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

3537 (llc), payment for automatic extension for llcs. You and your clients should be aware that a disregarded smllc is required to: Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Ftb 3522, llc tax voucher. Web yes, you will be given the option to print your form 568 to meet the.

Form 568 Instructions 2022 State And Local Taxes Zrivo

You and your clients should be aware that a disregarded smllc is required to: Web form 568 is a california tax return form, and its typical due date is march 15 or april 15 each tax year. As the instructions state, form 568 is to be filed by april, 15th. Registration after the year begins. If your llc files on.

Instructions For Form 568 Limited Liability Company Return Of

Web file limited liability company return of income (form 568) by the original return due date. You can find out how much you owe in state income. Form 3522, or the llc tax voucher, needs to be filed to pay the franchise tax. Form 3522 consists of your llc’s franchise tax. While you can submit your state income tax return.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Web form 568 is due on march 31st following the end of the tax year. Web when the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. They are subject to the annual tax, llc fee and credit limitations. When is the annual tax due? How.

Web Form 568 Is Due On March 31St Following The End Of The Tax Year.

Web what is form 568? Web when is form 568 due? You and your clients should be aware that a disregarded smllc is required to: Web file limited liability company return of income (form 568) by the original return due date.

Web We Require An Smllc To File Form 568, Even Though They Are Considered A Disregarded Entity For Tax Purposes.

Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Web we last updated california form 568 in february 2023 from the california franchise tax board. You can find out how much you owe in state income. Web this tax amounts to $800 for every type of entity and is due on april 15 every year.

Form 3522, Or The Llc Tax Voucher, Needs To Be Filed To Pay The Franchise Tax.

Form 3522 consists of your llc’s franchise tax. Web up to $40 cash back sign and date the form, and include your title if applicable. As the instructions state, form 568 is to be filed by april, 15th. In california, it currently sits.

Web When The Due Date Falls On A Weekend Or Holiday, The Deadline To File And Pay Without Penalty Is Extended To The Next Business Day.

Disaster relief tax extension franchise. You can then go back into your return and complete your federal and state. What is the california llc tax due date? 3537 (llc), payment for automatic extension for llcs.