Form 568 Instructions

Form 568 Instructions - Web your llc in california will need to file form 568 each year. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute the beginning tax basis capital account. The llc must file the appropriate california tax return for its classification: This form accounts for the income, withholding, coverages, taxes, and more of your llc. Llcs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. The llc must pay a fee if the total california income is equal to or greater than $250,000. You can view form 568 as the master tax form. Line 1—total income from schedule iw. Web 2021 instructions for form 568, limited liability company return of income. They are subject to the annual tax, llc fee and credit limitations.

Web your llc in california will need to file form 568 each year. This form accounts for the income, withholding, coverages, taxes, and more of your llc. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35. The llc must pay a fee if the total california income is equal to or greater than $250,000. Web if you have an llc, here’s how to fill in the california form 568: References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Web visit limited liability company tax booklet (568 booklet) for more information; The llc fee and franchise tax will be taken into consideration.

References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). This form accounts for the income, withholding, coverages, taxes, and more of your llc. They are subject to the annual tax, llc fee and credit limitations. Line 1—total income from schedule iw. If you have income or loss inside and outside california, use apportionment and allocation of income (schedule r) to determine california source income. Enter the amount of the llc fee. References in these instructions are to the internal revenue code (irc) as of. Web 2022 instructions for form 568, limited liability company return of income. You can view form 568 as the master tax form. January 1, 2015, and to the california revenue and taxation code (r&tc).

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

Web 2022 instructions for form 568, limited liability company return of income. Web your llc in california will need to file form 568 each year. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Web visit limited liability company tax booklet (568 booklet) for more information; Web if you.

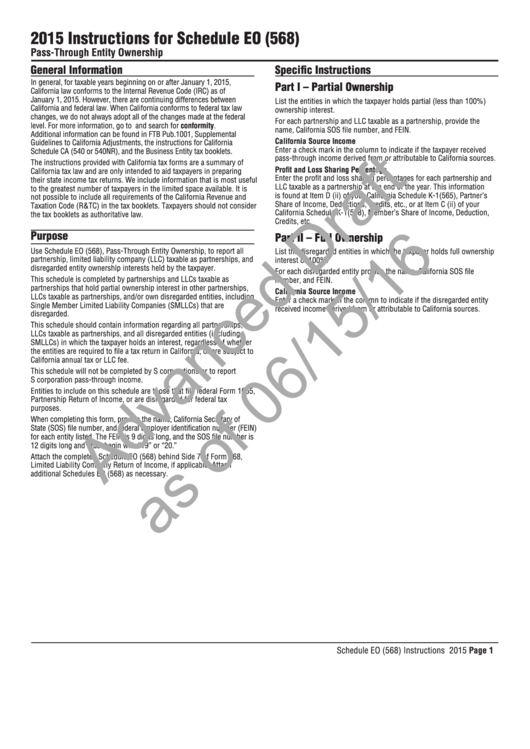

Download Instructions for Form 568 Schedule EO PassThrough Entity

Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. This form accounts for the income, withholding, coverages, taxes, and more of your llc. Web your llc in california will need to file form 568 each year. References in these instructions are to the internal revenue code (irc) as of..

Form 568 Instructions 2022 2023 State Tax TaxUni

January 1, 2015, and to the california revenue and taxation code (r&tc). Line 1—total income from schedule iw. The llc must file the appropriate california tax return for its classification: This form accounts for the income, withholding, coverages, taxes, and more of your llc. Web your llc in california will need to file form 568 each year.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. To enter the information for form 568 in the 1040 taxact ® program: Web visit limited liability company tax booklet (568 booklet) for more information; Web if you have an llc, here’s how to fill in the california form 568:.

Instructions For Schedule Eo (568) Draft PassThrough Entity

You can view form 568 as the master tax form. If you have income or loss inside and outside california, use apportionment and allocation of income (schedule r) to determine california source income. Enter the amount of the llc fee. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies,.

Form 568 instructions 2013

Llcs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Web visit limited liability company tax booklet (568 booklet) for more information; Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Web 2022 instructions for form 568, limited liability company return of income..

Hot Stone Massage Instructions

The methods are similar to those provided in the 2020 irs form 1065 instructions. Llcs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. January 1, 2015, and to the california revenue and taxation code (r&tc). Web we require an smllc to file form 568, even though they are considered a disregarded entity for.

Form 568 instructions 2013

To enter the information for form 568 in the 1040 taxact ® program: Line 1—total income from schedule iw. However, you cannot use form 568 to pay these taxes. They are subject to the annual tax, llc fee and credit limitations. Web visit limited liability company tax booklet (568 booklet) for more information;

Form 568 Instructions 2022 2023 State Tax TaxUni

The llc must file the appropriate california tax return for its classification: Web your llc in california will need to file form 568 each year. The llc must pay a fee if the total california income is equal to or greater than $250,000. To enter the information for form 568 in the 1040 taxact ® program: Line 1—total income from.

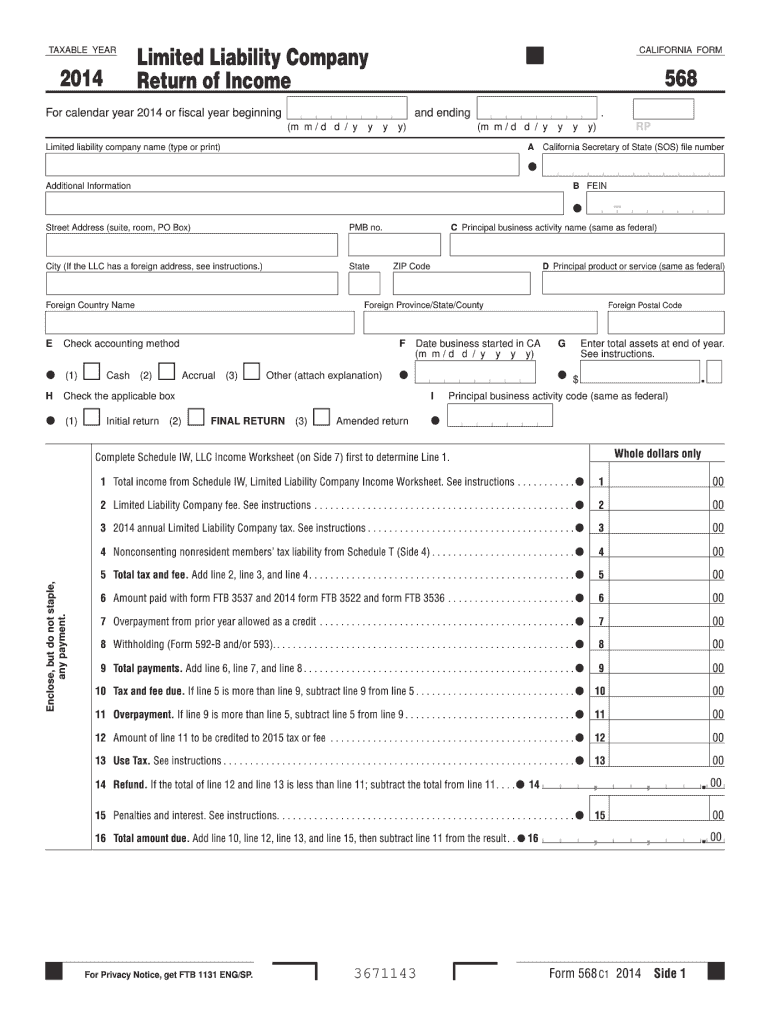

CA FTB 568 2014 Fill out Tax Template Online US Legal Forms

The llc fee and franchise tax will be taken into consideration. Web your llc in california will need to file form 568 each year. Only llcs classified as partnerships file form 568. Web if you have an llc, here’s how to fill in the california form 568: I (1) during this taxable year, did another person or legal entity acquire.

Web 2022 Instructions For Form 568, Limited Liability Company Return Of Income.

Web if you have an llc, here’s how to fill in the california form 568: They are subject to the annual tax, llc fee and credit limitations. The llc must file the appropriate california tax return for its classification: To enter the information for form 568 in the 1040 taxact ® program:

Web The Notice Provides That The 2022 California Forms 565 And Form 568 Instructions, For Partnership And Limited Liability Companies, Provide Methods To Compute The Beginning Tax Basis Capital Account.

However, you cannot use form 568 to pay these taxes. Only llcs classified as partnerships file form 568. Line 1—total income from schedule iw. Web your llc in california will need to file form 568 each year.

This Form Accounts For The Income, Withholding, Coverages, Taxes, And More Of Your Llc.

References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue. References in these instructions are to the internal revenue code (irc) as of. You can view form 568 as the master tax form.

I (1) During This Taxable Year, Did Another Person Or Legal Entity Acquire Control Or Majority Ownership (More Than A 50% Interest) Of This Llc Or Any Legal Entity In Which The Llc Holds A Controlling Or Majority Interest That Owned California Real Property (I.e., Land, Buildings), Leased Such Property For A Term Of 35.

January 1, 2015, and to the california revenue and taxation code (r&tc). Partnership (1065) file form 568, limited liability. Enter the amount of the llc fee. In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue.