Form 5713 Instructions

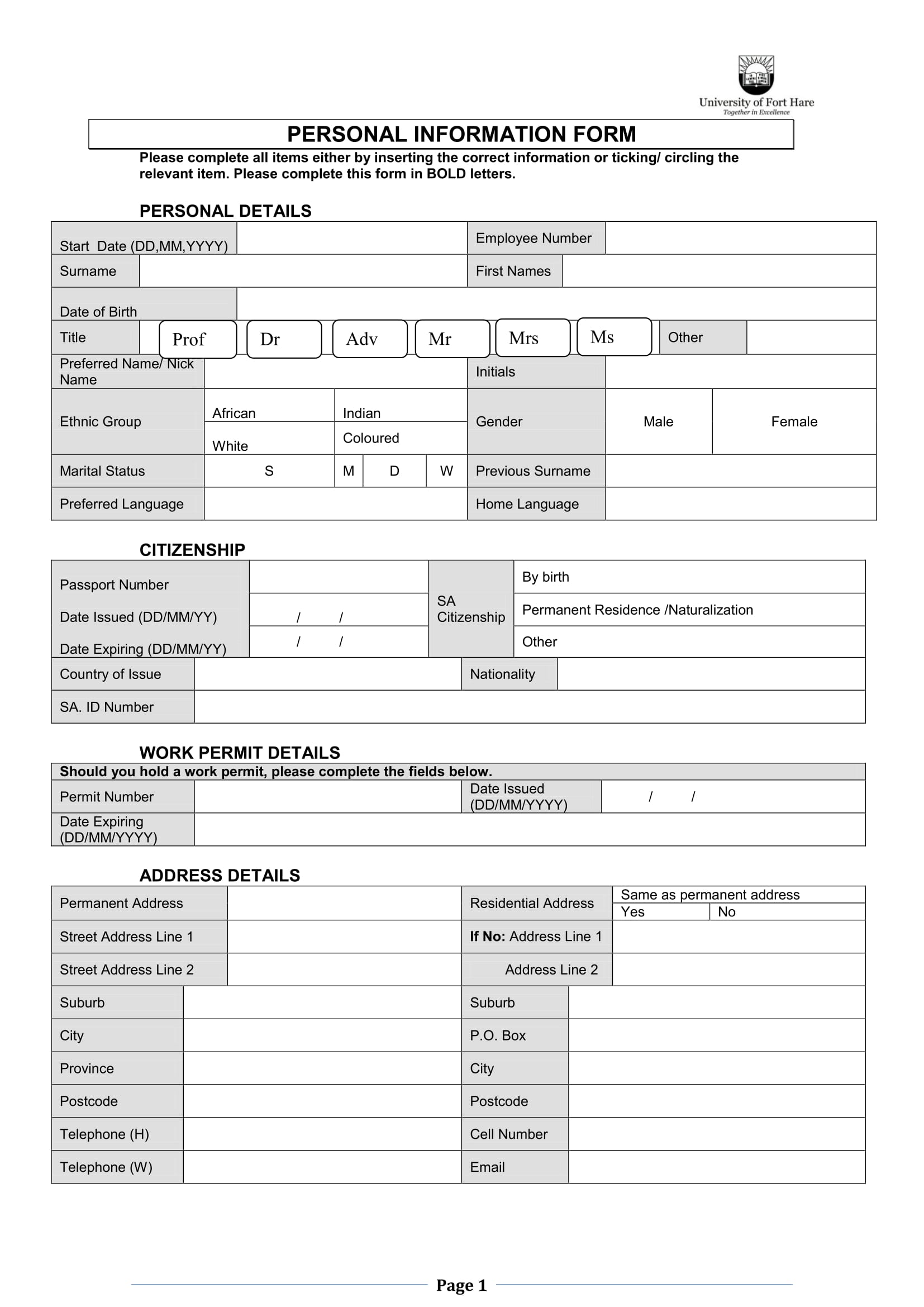

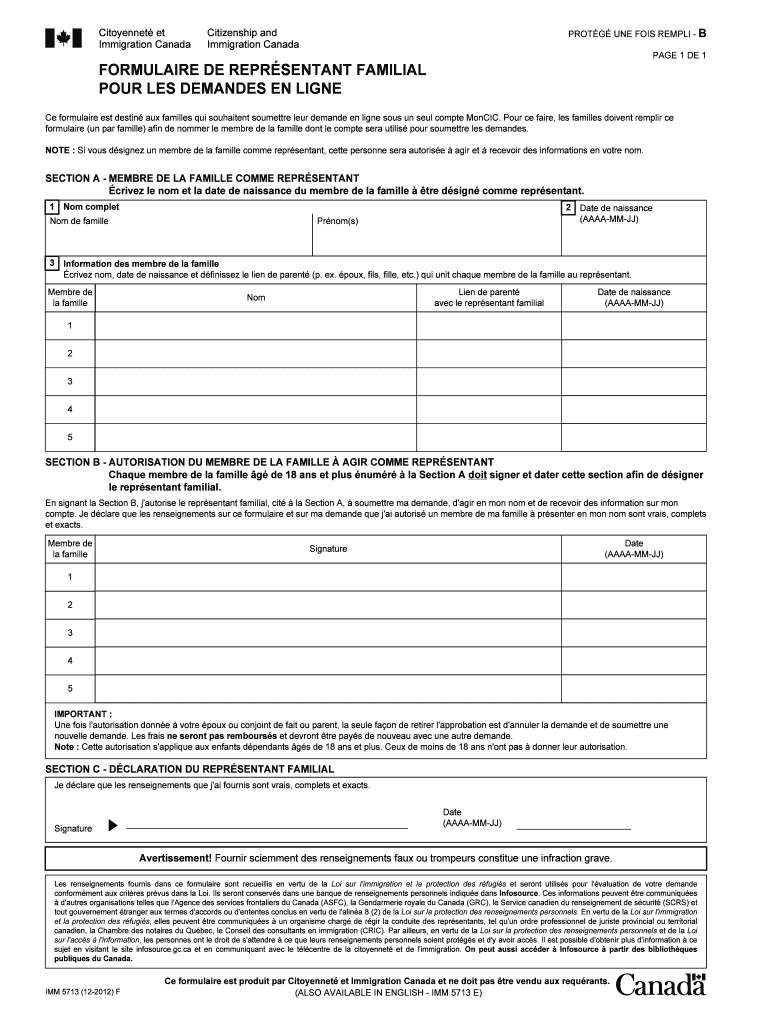

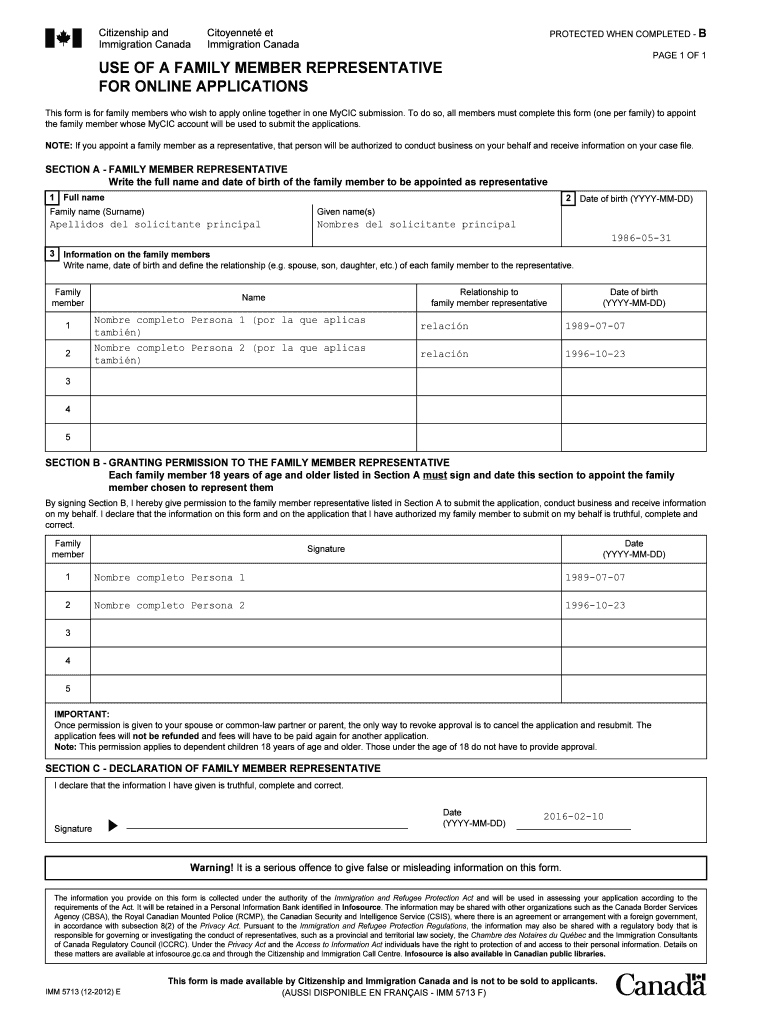

Form 5713 Instructions - Reduction of foreign trade income qualifying for the extraterritorial income exclusion. Income tax return, each member of the sister corporation. Web this form is for family members who wish to apply online together in one mycic submission. Subsidiary or sister countries (see list on page 2) and separately. Schedule c (form 5713) (rev. The irs goes into a little more detail on a. Who must file you must file form 5713 if you: A member of a controlled group (as The receipt of boycott requests and boycott agreements made. To do so, all members must complete this form (one per family) to appoint the family member whose mycic account will be used to submit the applications.

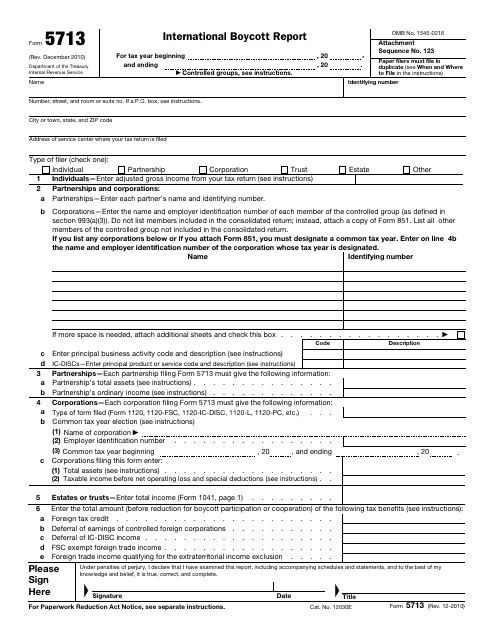

Form 5713 is used by u.s. • operations in or related to boycotting controlled group must file form 5713 • the u.s. Who must file you must file form 5713 if you: A member of a controlled group (as To do so, all members must complete this form (one per family) to appoint the family member whose mycic account will be used to submit the applications. Have operations (defined on page 2); Web irs form 5713, international boycott report, is the tax form that u.s. The receipt of boycott requests and boycott agreements made. Web you must file form 5713 if you are a u.s. Persons also must file form 5713.

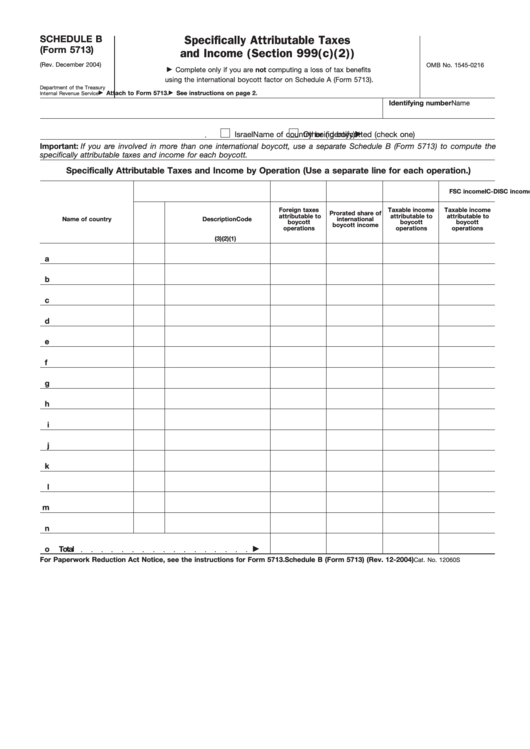

Persons also must file form 5713. Web irs form 5713, international boycott report, is the tax form that u.s. Person (defined in section 7701(a)(30)) that has operations (defined later) in or related to a boycotting country, or with the government, a company, or a national of a boycotting country. Corporation agrees to forfeit the benefits of the foreign tax credit, deferral of Operations in or related to boycotting countries (see list on page 2); Income tax return, each member of the sister corporation. • operations in or related to boycotting controlled group must file form 5713 • the u.s. Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how to file. Schedule c (form 5713) (rev. Web for paperwork reduction act notice, see instructions for form 5713.

IRS Form 5713 Download Fillable PDF or Fill Online International

123 paper filers must file in duplicate (see when and where to file in the instructions) The receipt of boycott requests and boycott agreements made. Operations in or related to boycotting countries (see list on page 2); Form 5713 is used by u.s. Corporation agrees to forfeit the benefits of the foreign tax credit, deferral of

Form 3903 Instructions 2017

The irs goes into a little more detail on a. The receipt of boycott requests and boycott agreements made. To do so, all members must complete this form (one per family) to appoint the family member whose mycic account will be used to submit the applications. Web general instructions purpose of form use form 5713 to report: Web this form.

Imm Online Fill Online, Printable, Fillable, Blank pdfFiller

The irs goes into a little more detail on a. Are a member of a controlled group (as Web you must file form 5713 if you are a u.s. Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how to file. The receipt of boycott requests and boycott agreements made.

Form 5713 (Schedule B) Specifically Attributable Taxes and

Persons also must file form 5713. Are a member of a controlled group (as A member of a controlled group (as And the receipt of boycott requests and boycott agreements made. The irs goes into a little more detail on a.

Inst 5713Instructions for Form 5713, International Boycott Report

• operations in or related to boycotting controlled group must file form 5713 • the u.s. Web use form 5713 to report: Are a member of a controlled group (as Form 5713 is used by u.s. The irs goes into a little more detail on a.

Fillable Form 5713 (Schedule B) Specifically Attributable Taxes And

• operations in or related to boycotting controlled group must file form 5713 • the u.s. Operations in or related to boycotting countries (see list on page 2); Web this form is for family members who wish to apply online together in one mycic submission. Operations in or related to boycotting countries. 123 paper filers must file in duplicate (see.

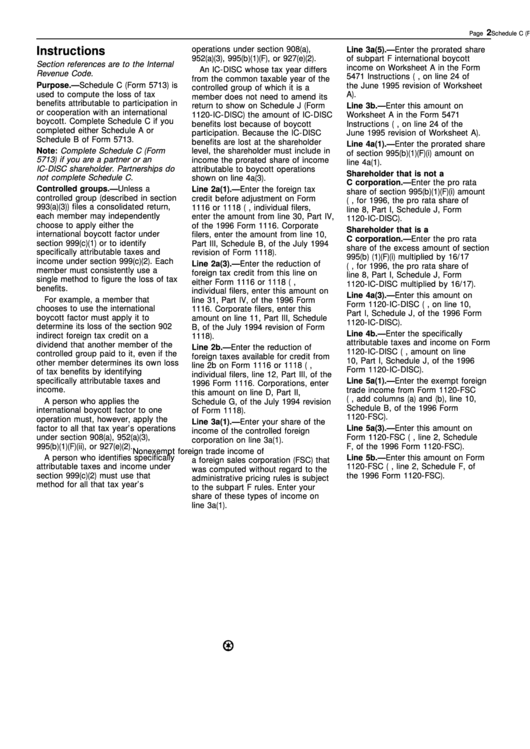

Instructions For Form 5713 Schedule C Tax Effect Of The International

Web you must file form 5713 if you are a u.s. Operations in or related to boycotting countries (see list on page 2); And the receipt of boycott requests and boycott agreements made. Have operations (defined on page 2); Reduction of foreign trade income qualifying for the extraterritorial income exclusion.

Form 5713 (Schedule C) Tax Effect of the International Boycott

The irs goes into a little more detail on a. Subsidiary or sister countries (see list on page 2) and separately. 123 paper filers must file in duplicate (see when and where to file in the instructions) Web use form 5713 to report: Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how.

Inst 5713Instructions for Form 5713, International Boycott Report

Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how to file. Persons having operations in or related to countries that require participation in or. Operations in or related to boycotting countries. The receipt of boycott requests and boycott agreements made. Web general instructions purpose of form use form 5713 to report:

Web This Form Is For Family Members Who Wish To Apply Online Together In One Mycic Submission.

A member of a controlled group (as Operations in or related to boycotting countries (see list on page 2); And the receipt of boycott requests and boycott agreements made. Web you must file form 5713 if you are a u.s.

Have Operations (Defined On Page 2);

Are a member of a controlled group (as December 2010) department of the treasury internal revenue service international boycott report for tax year beginning , 20 , and ending , 20. Web irs form 5713, international boycott report, is the tax form that u.s. • operations in or related to boycotting controlled group must file form 5713 • the u.s.

Web Use Form 5713 To Report:

The receipt of boycott requests and boycott agreements made. Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how to file. Reduction of foreign trade income qualifying for the extraterritorial income exclusion. The irs goes into a little more detail on a.

Operations In Or Related To Boycotting Countries.

Schedule c (form 5713) (rev. Form 5713 is used by u.s. Persons having operations in or related to countries that require participation in or. Corporation agrees to forfeit the benefits of the foreign tax credit, deferral of