Form 5884-B

Form 5884-B - Information about form 5884 and its instructions is at. Web form 5884 department of the treasury internal revenue service work opportunity credit attach to your tax return. Web up to 10% cash back work opportunity credit (form 5884) alcohol and cellulosic biofuel fuels credit (form 6478) credit for increasing reaserch activities (form 6765) low. Web an eligible employer who continued to pay or incur wages after the employer’s business became inoperable because of damage from a 2018 through 2019 qualified disaster may. The credit claimed on form. Internal revenue code section 38 (b) (2) allows a credit against income tax to employers hiring individuals from certain targeted. Get form now download pdf form 5884 b pdf details every year, businesses and. Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file. Web form 5884 b is the form that you need to file if you want to make a charitable donation. Attach to your tax return.

March 2021) department of the treasury internal revenue service. Get form now download pdf form 5884 b pdf details every year, businesses and. Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file. Internal revenue code section 38 (b) (2) allows a credit against income tax to employers hiring individuals from certain targeted. Web the department of the treasury, as part of its continuing effort to reduce paperwork and respondent burden, invites the general public and other federal agencies. Information about form 5884 and its instructions is at. Use part ii to list additional retained. Web form 5884 b is the form that you need to file if you want to make a charitable donation. Web form 5884 department of the treasury internal revenue service work opportunity credit attach to your tax return. The current year employee retention credit for employers affected by qualified.

Web form 5884 b is the form that you need to file if you want to make a charitable donation. Web an eligible employer who continued to pay or incur wages after the employer’s business became inoperable because of damage from a 2018 through 2019 qualified disaster may. Information about form 5884 and its instructions is at. Get form now download pdf form 5884 b pdf details every year, businesses and. The current year employee retention credit for employers affected by qualified. Web read on to learn more about the work opportunity tax credit and how to use form 5884 to qualify your business for a valuable tax credit. Web form 5884 department of the treasury internal revenue service work opportunity credit attach to your tax return. March 2021) department of the treasury internal revenue service. Employers file form 5884 to. Attach to your tax return.

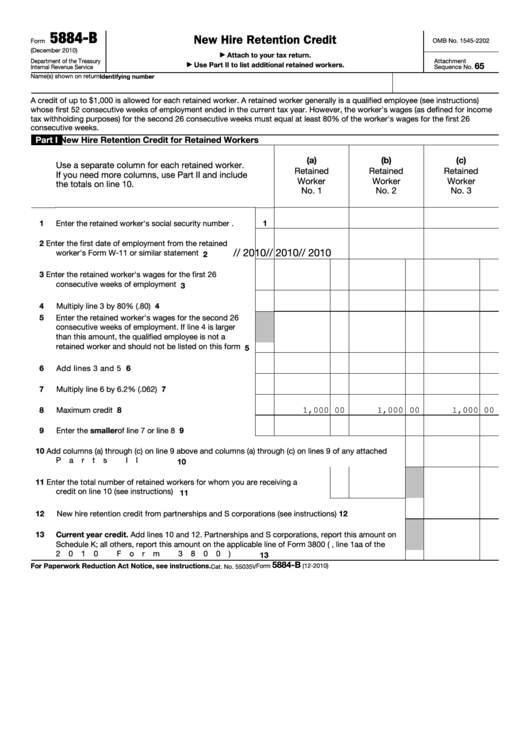

Fillable Form 5884B New Hire Retention Credit printable pdf download

Information about form 5884 and its instructions is at. Web up to 10% cash back work opportunity credit (form 5884) alcohol and cellulosic biofuel fuels credit (form 6478) credit for increasing reaserch activities (form 6765) low. Employers file form 5884 to. Attach to your tax return. Web information about form 5884, work opportunity credit, including recent updates, related forms, and.

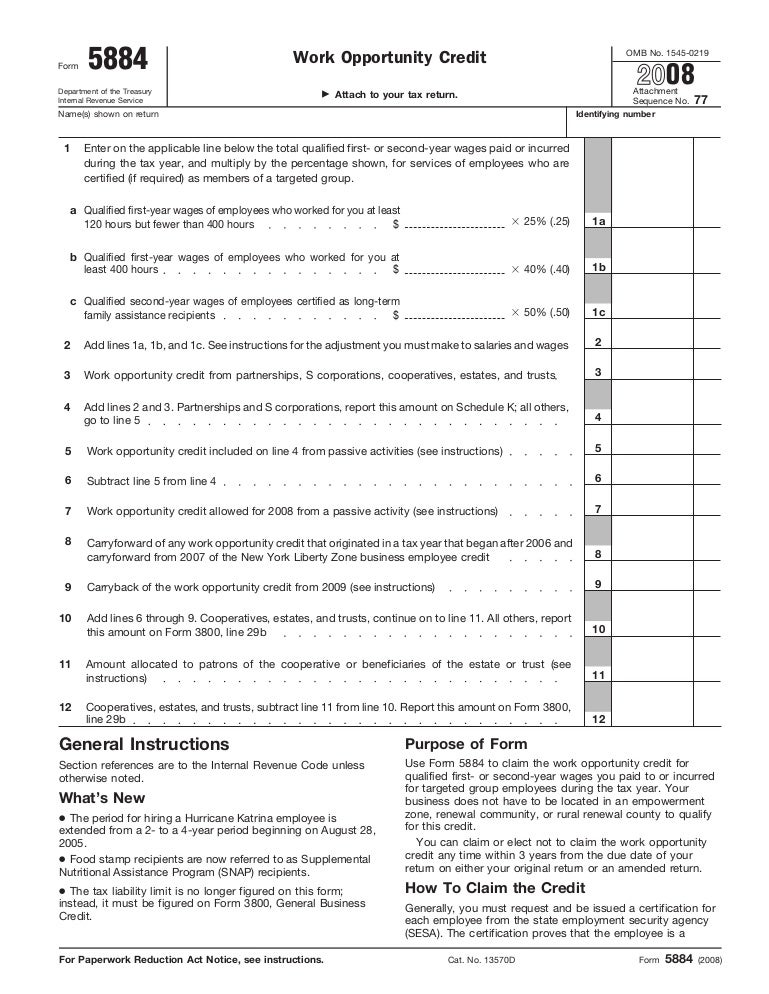

Form 5884 Instructions How to Fill Out and File Form 5884

Web an eligible employer who continued to pay or incur wages after the employer’s business became inoperable because of damage from a 2018 through 2019 qualified disaster may. The credit claimed on form. Use part ii to list additional retained. Web up to 10% cash back work opportunity credit (form 5884) alcohol and cellulosic biofuel fuels credit (form 6478) credit.

Form 5884 Work Opportunity Credit Editorial Stock Image Image of

Attach to your tax return. Internal revenue code section 38 (b) (2) allows a credit against income tax to employers hiring individuals from certain targeted. Use part ii to list additional retained. Information about form 5884 and its instructions is at. The credit claimed on form.

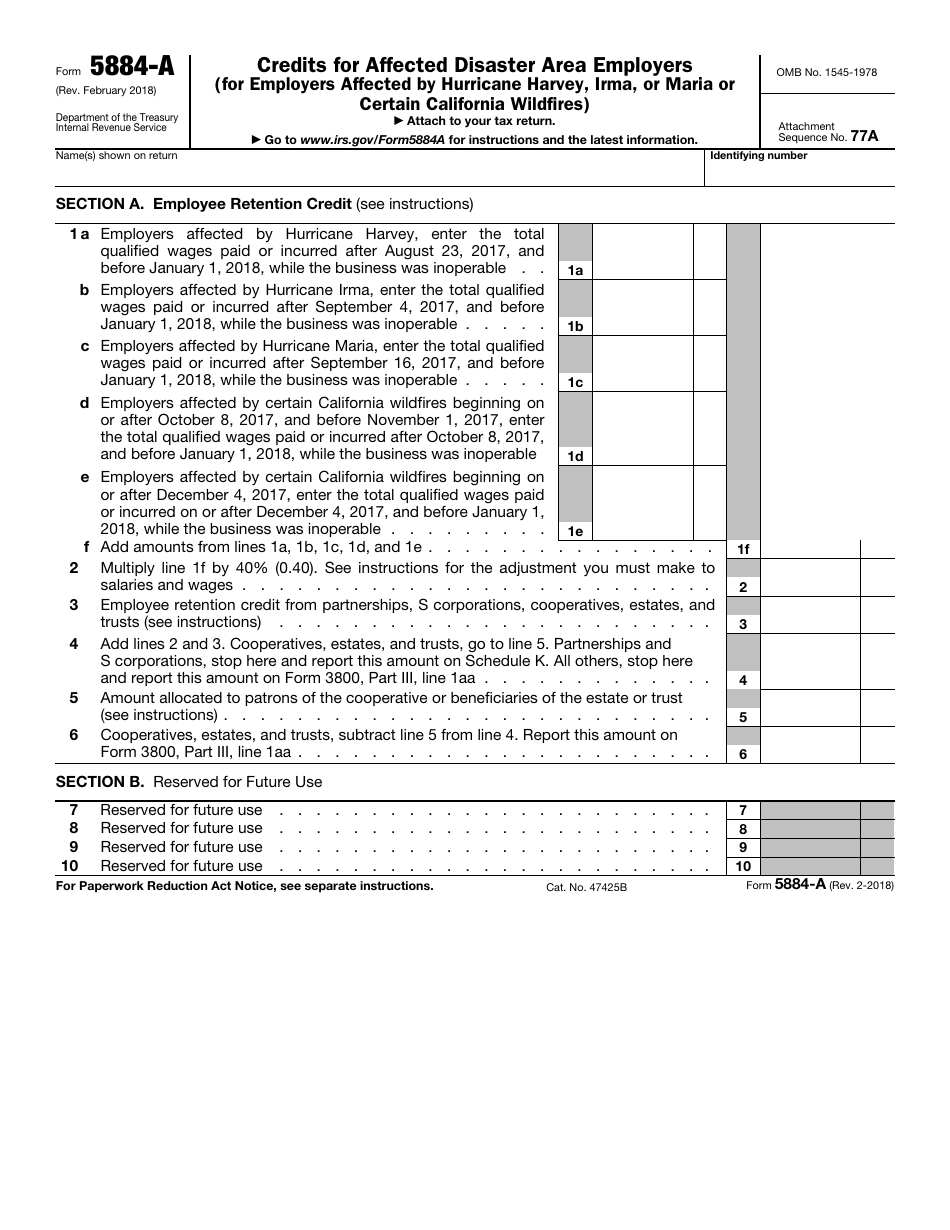

IRS Form 5884A Download Fillable PDF or Fill Online Credits for

Get form now download pdf form 5884 b pdf details every year, businesses and. Web read on to learn more about the work opportunity tax credit and how to use form 5884 to qualify your business for a valuable tax credit. Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file..

3.12.217 Error Resolution Instructions for Form 1120S Internal

Web an eligible employer who continued to pay or incur wages after the employer’s business became inoperable because of damage from a 2018 through 2019 qualified disaster may. Web up to 10% cash back work opportunity credit (form 5884) alcohol and cellulosic biofuel fuels credit (form 6478) credit for increasing reaserch activities (form 6765) low. The current year employee retention.

Form 5884Work Opportunity Credit

Web read on to learn more about the work opportunity tax credit and how to use form 5884 to qualify your business for a valuable tax credit. Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file. Information about form 5884 and its instructions is at. Use part ii to list.

Fill Free fillable IRS PDF forms

Web an eligible employer who continued to pay or incur wages after the employer’s business became inoperable because of damage from a 2018 through 2019 qualified disaster may. Use part ii to list additional retained. Web read on to learn more about the work opportunity tax credit and how to use form 5884 to qualify your business for a valuable.

IRS Form 5884A for the Employee Retention Credit

Web form 5884 b is the form that you need to file if you want to make a charitable donation. Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file. March 2021) department of the treasury internal revenue service. The current year employee retention credit for employers affected by qualified. Employers.

IRS Form 5884D Employee Retention Credit for Certain TaxExempt

Web form 5884 b is the form that you need to file if you want to make a charitable donation. Web read on to learn more about the work opportunity tax credit and how to use form 5884 to qualify your business for a valuable tax credit. Web an eligible employer who continued to pay or incur wages after the.

Fill Free fillable F5884b Accessible Form 5884B (Rev. December 2010

Use part ii to list additional retained. Web up to 10% cash back work opportunity credit (form 5884) alcohol and cellulosic biofuel fuels credit (form 6478) credit for increasing reaserch activities (form 6765) low. Web read on to learn more about the work opportunity tax credit and how to use form 5884 to qualify your business for a valuable tax.

Employers File Form 5884 To.

The credit claimed on form. Internal revenue code section 38 (b) (2) allows a credit against income tax to employers hiring individuals from certain targeted. Use part ii to list additional retained. Web an eligible employer who continued to pay or incur wages after the employer’s business became inoperable because of damage from a 2018 through 2019 qualified disaster may.

March 2021) Department Of The Treasury Internal Revenue Service.

Web form 5884 b is the form that you need to file if you want to make a charitable donation. Web the department of the treasury, as part of its continuing effort to reduce paperwork and respondent burden, invites the general public and other federal agencies. Web form 5884 department of the treasury internal revenue service work opportunity credit attach to your tax return. Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file.

Web Read On To Learn More About The Work Opportunity Tax Credit And How To Use Form 5884 To Qualify Your Business For A Valuable Tax Credit.

Web up to 10% cash back work opportunity credit (form 5884) alcohol and cellulosic biofuel fuels credit (form 6478) credit for increasing reaserch activities (form 6765) low. Information about form 5884 and its instructions is at. Get form now download pdf form 5884 b pdf details every year, businesses and. Attach to your tax return.