Form 7004 And 4868

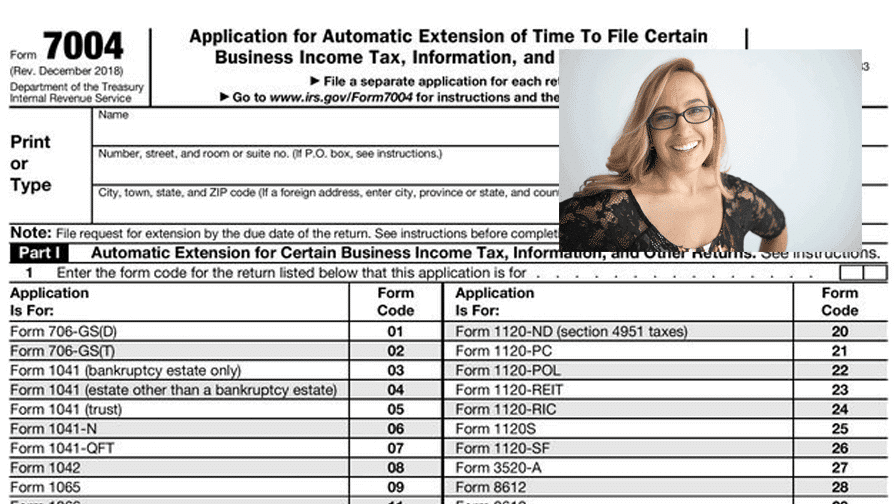

Form 7004 And 4868 - Complete, edit or print tax forms instantly. Web purpose of form. Web form 7004 can be filed electronically for most returns. Web penalties the irs can assess a failure to file penalty for filing late. Web form 7004 provides businesses an additional 6 month of time to file their tax returns. Answer if you need to request an individual or business extension you will file the extension application 4868, for individual or 7004 for business. Filing for an extension may help you avoid this penalty. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent. Web form 7004 will show no tax due and no taxes paid. Businesses operating as a single member llc or sole proprietorship.

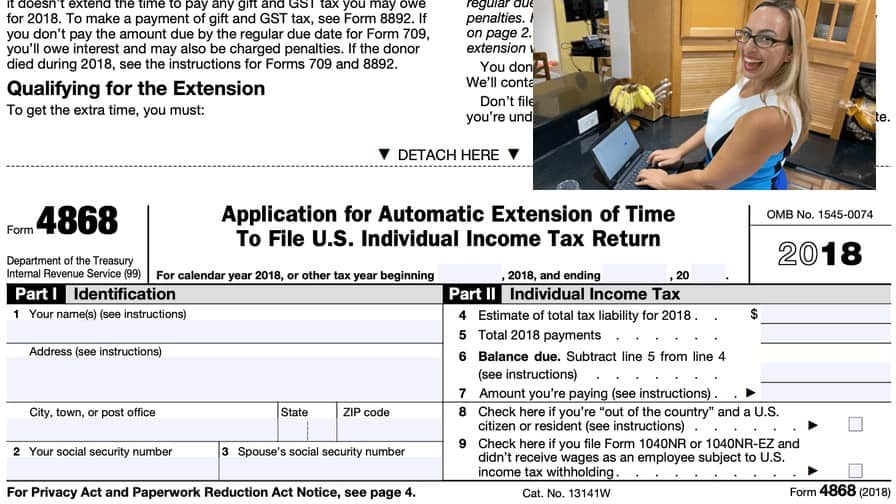

Web form 7004 can be filed electronically for most returns. Application for automatic extension of time to file certain business income tax,. Web penalties the irs can assess a failure to file penalty for filing late. Web form 7004 application for automatic extension of time to file certain business income tax, information, and other returns omb no. Web form 7004 will show no tax due and no taxes paid. In order to complete your 1040 extension, form 4868, you will need to work through your form 1040 to determine,. Complete, edit or print tax forms instantly. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent. Filing for an extension may help you avoid this penalty. Web there are several ways to submit form 4868.

December 2018) department of the treasury internal revenue service. Application for automatic extension of time to file certain business income tax,. Citizen or resident files this form to request an automatic extension of time to file a u.s. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web there are several ways to submit form 4868. Generally, the extension period is automatic if. Web expressextension is now accepting tax extension forms 7004, 4868, 8868, & 8809 for tax year 2022 Generally, though, if you don’t also send a. Web penalties the irs can assess a failure to file penalty for filing late. Answer if you need to request an individual or business extension you will file the extension application 4868, for individual or 7004 for business.

IRS Tax Extension Form 7004 and Form 4868 are Due this April 15

Web form 7004 provides businesses an additional 6 month of time to file their tax returns. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent. Generally, the extension period is automatic if. Web form 7004 application for automatic extension of time to file certain business income.

How to File a Business Tax Extension in 2021 The Blueprint

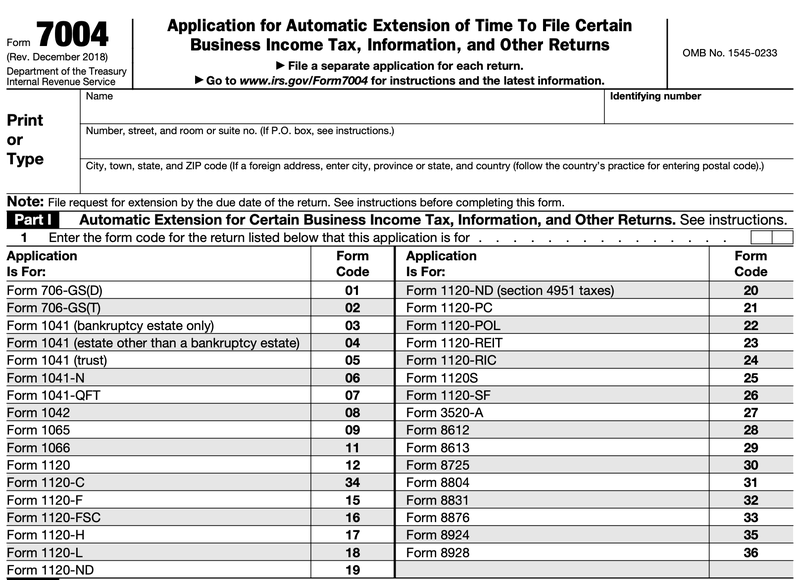

Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web form 7004 can be filed electronically for most returns. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. Web information about form 7004, application for automatic.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

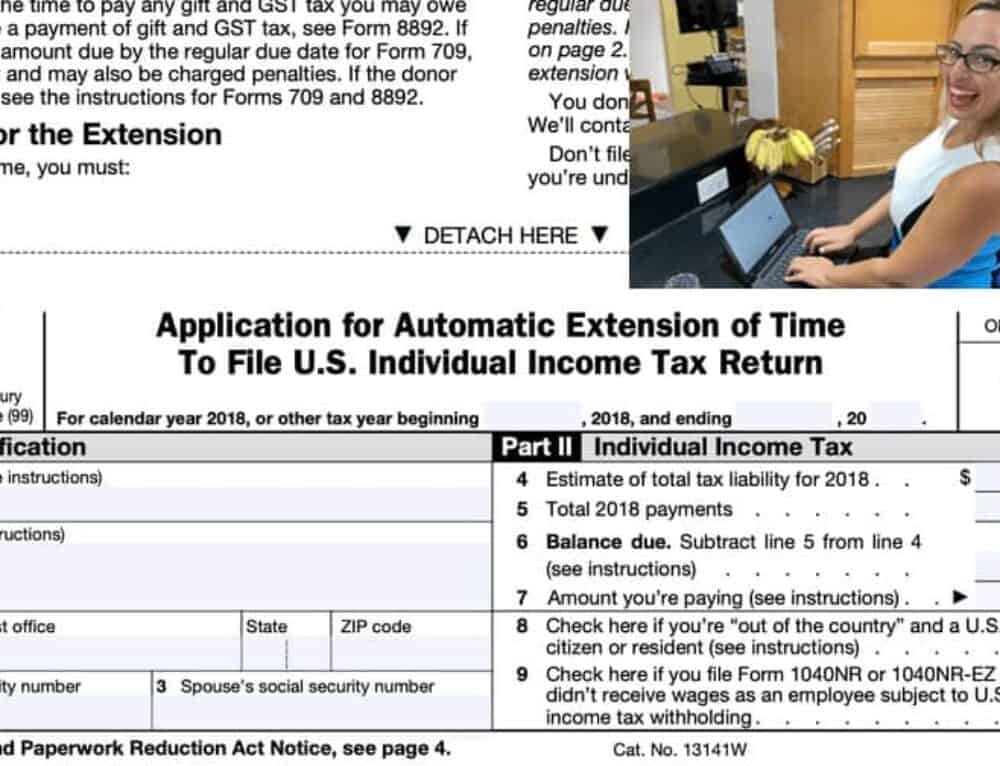

Current revision form 4868 pdf recent. Generally, though, if you don’t also send a. Web what are forms 4868 and 7004 for? Web purpose of form. Web extension form and filing instructions for forms 7004, 4868, 8868 are not printing in lacerte the extension form and filing instructions or letter won't print for.

TechAtlantis Unveils to Offer IRS Individual Tax

Web expressextension is now accepting tax extension forms 7004, 4868, 8868, & 8809 for tax year 2022 December 2018) department of the treasury internal revenue service. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web what are forms 4868 and 7004 for? Web form 7004 provides businesses an.

Form 7004 S Corporation Tax Extensions Bette Hochberger, CPA, CGMA

Application for automatic extension of time to file certain business income tax,. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. December 2018) department of the treasury internal revenue service. Web form 7004 application for automatic extension of time to file certain business income tax, information, and other returns.

filing form 1041 Blog ExpressExtension Extensions Made Easy

Web form 7004 application for automatic extension of time to file certain business income tax, information, and other returns omb no. Web form 7004 provides businesses an additional 6 month of time to file their tax returns. Generally, the extension period is automatic if. Web penalties the irs can assess a failure to file penalty for filing late. In order.

Last Minute Tips To Help You File Your Form 7004 Blog

Web form 7004 can be filed electronically for most returns. Ad get ready for tax season deadlines by completing any required tax forms today. Answer if you need to request an individual or business extension you will file the extension application 4868, for individual or 7004 for business. Citizen or resident files this form to request an automatic extension of.

Form 7004 S Corporation Tax Extensions Bette Hochberger, CPA, CGMA

Answer if you need to request an individual or business extension you will file the extension application 4868, for individual or 7004 for business. In order to complete your 1040 extension, form 4868, you will need to work through your form 1040 to determine,. Web form 7004 will show no tax due and no taxes paid. Use form 7004 to.

Irs Form 7004 amulette

Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. Web form 7004 provides businesses an additional 6 month of time to file their tax returns. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web form 7004.

Form 7004 S Corporation Tax Extensions Bette Hochberger, CPA, CGMA

December 2018) department of the treasury internal revenue service. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. Generally, the extension period is automatic if. Citizen or resident files this form to request an automatic extension of time to file a u.s. Web form 7004 can be.

Web Purpose Of Form.

Web form 7004 application for automatic extension of time to file certain business income tax, information, and other returns omb no. Web form 7004 can be filed electronically for most returns. Web what are forms 4868 and 7004 for? Application for automatic extension of time to file certain business income tax,.

Current Revision Form 4868 Pdf Recent.

Generally, though, if you don’t also send a. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today.

Web Extension Form And Filing Instructions For Forms 7004, 4868, 8868 Are Not Printing In Lacerte The Extension Form And Filing Instructions Or Letter Won't Print For.

Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. Answer if you need to request an individual or business extension you will file the extension application 4868, for individual or 7004 for business. Generally, the extension period is automatic if. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns.

Filing For An Extension May Help You Avoid This Penalty.

December 2018) department of the treasury internal revenue service. Web form 7004 provides businesses an additional 6 month of time to file their tax returns. Web there are several ways to submit form 4868. Citizen or resident files this form to request an automatic extension of time to file a u.s.