Form 7004 Due Date

Form 7004 Due Date - This is the form that businesses should file to apply for an extension with the irs. When to file forms 8804. Complete irs tax forms online or print government tax documents. Web any 7004 form is due by the original due date for the form you’re requesting an extension on. The due dates of the returns can be found in the instructions for. Web general instructions purpose of forms taxpayer identification number (tin) applying for an ein who must file who must sign form 8804 paid preparer. Web file this application on or before the original due date of the of the tax year. For all filers, the date that is entered on line 1a cannot be. In the case of s corporations and partnerships, the tax returns are due by march 15th. And for the tax returns such as 1120, 1041 and others.

Web form 7004 is an irs tax extension form. And for the tax returns such as 1120, 1041 and others. Web when is form 7004 due? The due dates of the returns can be found in the instructions for. Web if the year ends on december 31st, taxes must be filed and paid by april 15th. To file online go to www.floridarevenue.com if you are required to pay tax with this application, failure to. Web file this application on or before the original due date of the of the tax year. Web the entity must file form 7004 by the due date of the return (the 15th day of the 6th month following the close of the tax year) to request an extension. For all filers, the date that is entered on line 1a cannot be. Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return.

This is the form that businesses should file to apply for an extension with the irs. When to file forms 8804. Web date to file form 7004. And for the tax returns such as 1120, 1041. As long as the business files their. Using our previous example, form 1065 is due by march 15th for partnerships that. To file online go to www.floridarevenue.com if you are required to pay tax with this application, failure to. Web generally, form 7004 must be filed on or before the due date of the applicable tax return. Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. Complete irs tax forms online or print government tax documents.

Form 7004 S Corporation Tax Extensions Bette Hochberger, CPA, CGMA

Web when is form 7004 due? Web if the year ends on december 31st, taxes must be filed and paid by april 15th. The due dates of the returns can be found in the instructions for. When to file forms 8804. To file online go to www.floridarevenue.com if you are required to pay tax with this application, failure to.

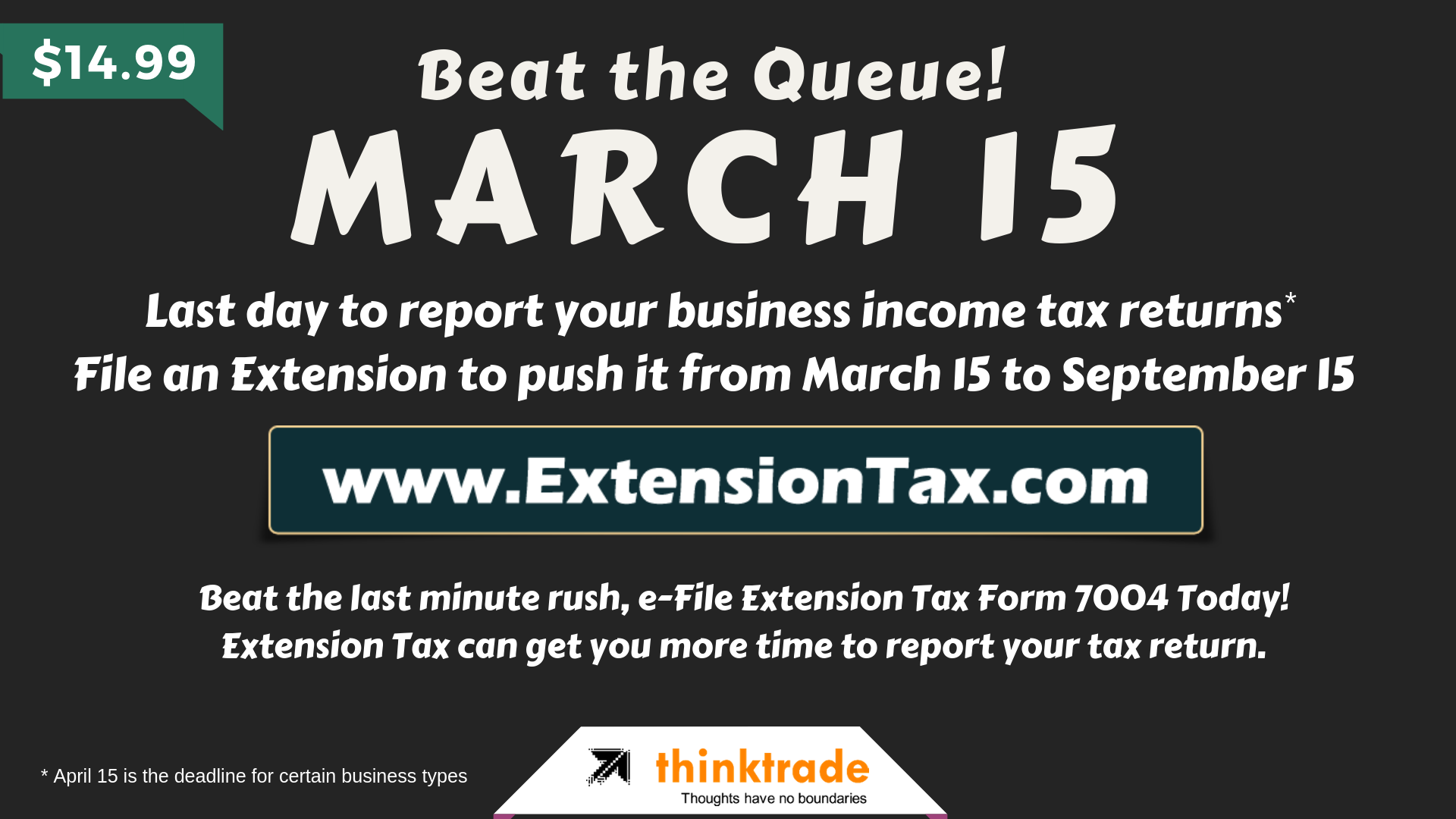

Form 7004 deadline is around the corner, March 15 is the Due Date

Complete irs tax forms online or print government tax documents. As long as the business files their. And for the tax returns such as 1120, 1041. Web when is form 7004 due? Web general instructions purpose of forms taxpayer identification number (tin) applying for an ein who must file who must sign form 8804 paid preparer.

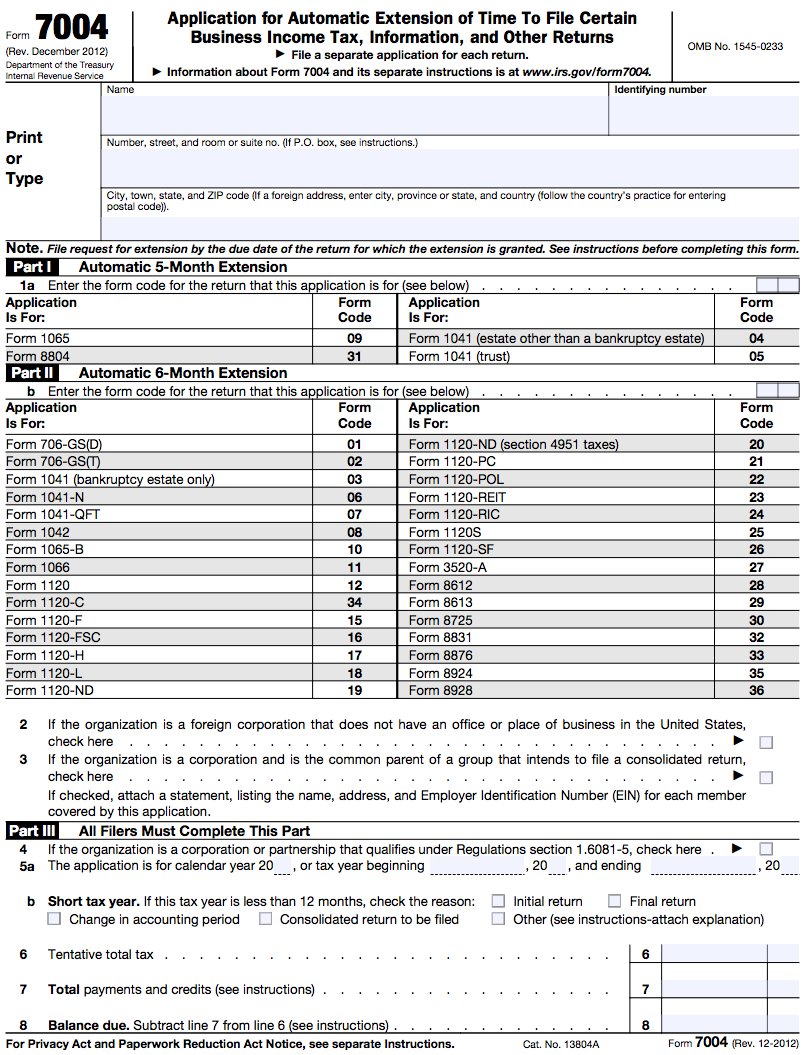

Form 7004 Automatically Extend Your 1120 Filing Due date IRSForm7004

See purpose of form above. Web the form lists the returns that can apply for automatic extensions. Web file this application on or before the original due date of the of the tax year. Ad get ready for tax season deadlines by completing any required tax forms today. To file online go to www.floridarevenue.com if you are required to pay.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

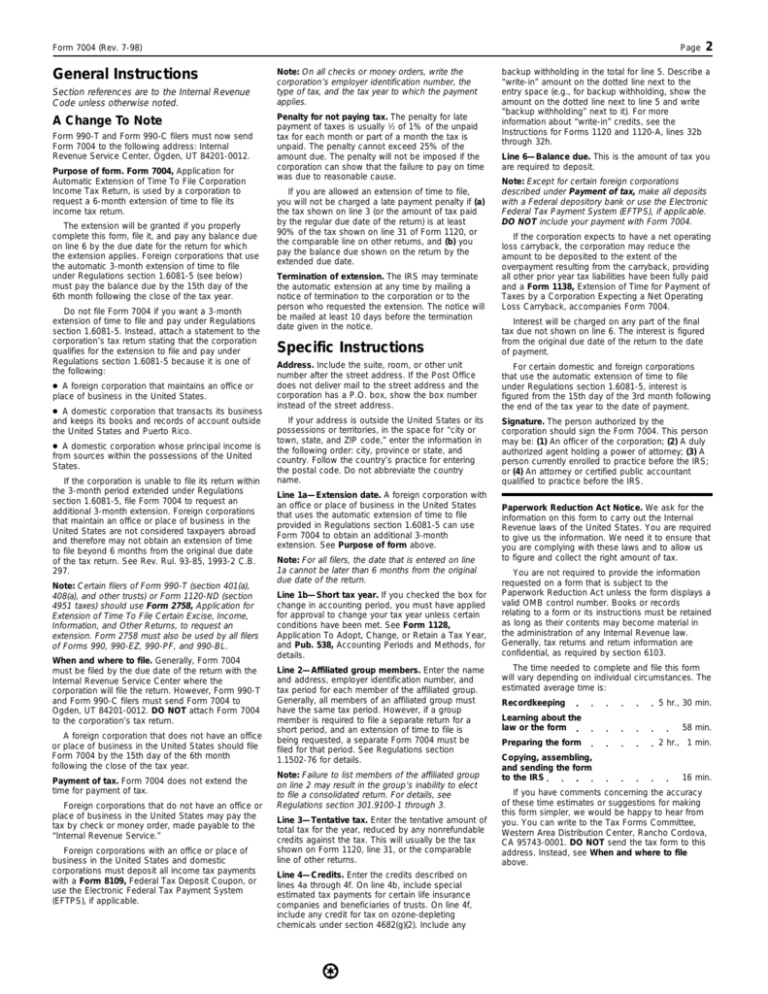

Web general instructions purpose of forms taxpayer identification number (tin) applying for an ein who must file who must sign form 8804 paid preparer. The due dates of the returns can be found in the instructions for. Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. The due.

Form 12 Extension Why You Should Not Go To Form 12 Extension AH

See purpose of form above. For all filers, the date that is entered on line 1a cannot be. This is the form that businesses should file to apply for an extension with the irs. Web if the year ends on december 31st, taxes must be filed and paid by april 15th. Web the entity must file form 7004 by the.

How to Fill Out Tax Form 7004 tax department of india

Ad get ready for tax season deadlines by completing any required tax forms today. Web the form lists the returns that can apply for automatic extensions. The due dates of the returns can be found in the instructions for. For most businesses, this falls. Web the irs has extended the filing and payment deadlines for businesses in these affected areas.

Form 7004 (Rev. July 1998)

And for the tax returns such as 1120, 1041 and others. The due dates of the returns can be found in the instructions for. To file online go to www.floridarevenue.com if you are required to pay tax with this application, failure to. Web the irs has extended the filing and payment deadlines for businesses in these affected areas from march.

Where to file Form 7004 Federal Tax TaxUni

See purpose of form above. The due date to fill out irs form 7004 and submit is generally on or before the original deadline of the applicable tax return. Web the irs has extended the filing and payment deadlines for businesses in these affected areas from march 15 and april 15, 2021, to june 15, 2021. When to file forms.

When is Tax Extension Form 7004 Due? Tax Extension Online

Usually, the irs form 7004 business tax extension application deadline falls on the 15th day of the third month, which is march 15th, 2022 on this year. Ad get ready for tax season deadlines by completing any required tax forms today. Using our previous example, form 1065 is due by march 15th for partnerships that. Web general instructions purpose of.

Irs Form 7004 amulette

This is the form that businesses should file to apply for an extension with the irs. Using our previous example, form 1065 is due by march 15th for partnerships that. Usually, the irs form 7004 business tax extension application deadline falls on the 15th day of the third month, which is march 15th, 2022 on this year. The due dates.

Using Our Previous Example, Form 1065 Is Due By March 15Th For Partnerships That.

As long as the business files their. To file online go to www.floridarevenue.com if you are required to pay tax with this application, failure to. Web when is form 7004 due? Complete irs tax forms online or print government tax documents.

And For The Tax Returns Such As 1120, 1041 And Others.

See purpose of form above. Web date to file form 7004. Ad get ready for tax season deadlines by completing any required tax forms today. This is the form that businesses should file to apply for an extension with the irs.

Web General Instructions Purpose Of Forms Taxpayer Identification Number (Tin) Applying For An Ein Who Must File Who Must Sign Form 8804 Paid Preparer.

For most businesses, this falls. In the case of s corporations and partnerships, the tax returns are due by march 15th. Web file this application on or before the original due date of the of the tax year. Web generally, form 7004 must be filed on or before the due date of the applicable tax return.

Web If The Year Ends On December 31St, Taxes Must Be Filed And Paid By April 15Th.

The due date to fill out irs form 7004 and submit is generally on or before the original deadline of the applicable tax return. Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. Usually, the irs form 7004 business tax extension application deadline falls on the 15th day of the third month, which is march 15th, 2022 on this year. The due dates of the returns can be found in the instructions for.