Form 720 Due Date

Form 720 Due Date - The deadlines for filing are april 30th, july 31st, october 31st, and january 31st following the respective quarter. Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st quarter 2020. Web if the due date for filing form 720 falls on a weekend or legal holiday, you can file by the next business day. Web although form 720 is a quarterly return, for pcori, form 720 is filed annually only, by july 31. June 2023) department of the treasury internal revenue service. See the instructions for form 720. For example, you must file a form 720 by april 30 for the quarter ending on march 31. For alternative method taxpayers, the report must be filed by the due date of the form 720 that includes an adjustment to the separate account for the uncollected tax. Web for regular method taxpayers, the report must be filed by the due date of the form 720 on which the tax would have been reported. Web by following these steps, you can confidently submit your irs form 720 and fulfill your reporting obligations.

Due date to file irs form 720 for 2023. The 720 tax form is due on a quarterly basis. For alternative method taxpayers, the report must be filed by the due date of the form 720 that includes an adjustment to the separate account for the uncollected tax. June 2023) department of the treasury internal revenue service. Web for regular method taxpayers, the report must be filed by the due date of the form 720 on which the tax would have been reported. Web if the due date for filing form 720 falls on a weekend or legal holiday, you can file by the next business day. See the instructions for form 720. The deadlines for filing are april 30th, july 31st, october 31st, and january 31st following the respective quarter. For instructions and the latest information. Web the form 720 is due on the last day of the month following the end of the quarter.

Paying your excise taxes you must pay excise taxes semimonthly. For instructions and the latest information. Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st quarter 2020. Web for regular method taxpayers, the report must be filed by the due date of the form 720 on which the tax would have been reported. The 720 tax form is due on a quarterly basis. Quarterly federal excise tax return. Due date to file irs form 720 for 2023. Web dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date (weekends and holidays considered) tax year For alternative method taxpayers, the report must be filed by the due date of the form 720 that includes an adjustment to the separate account for the uncollected tax. For example, you must file a form 720 by april 30 for the quarter ending on march 31.

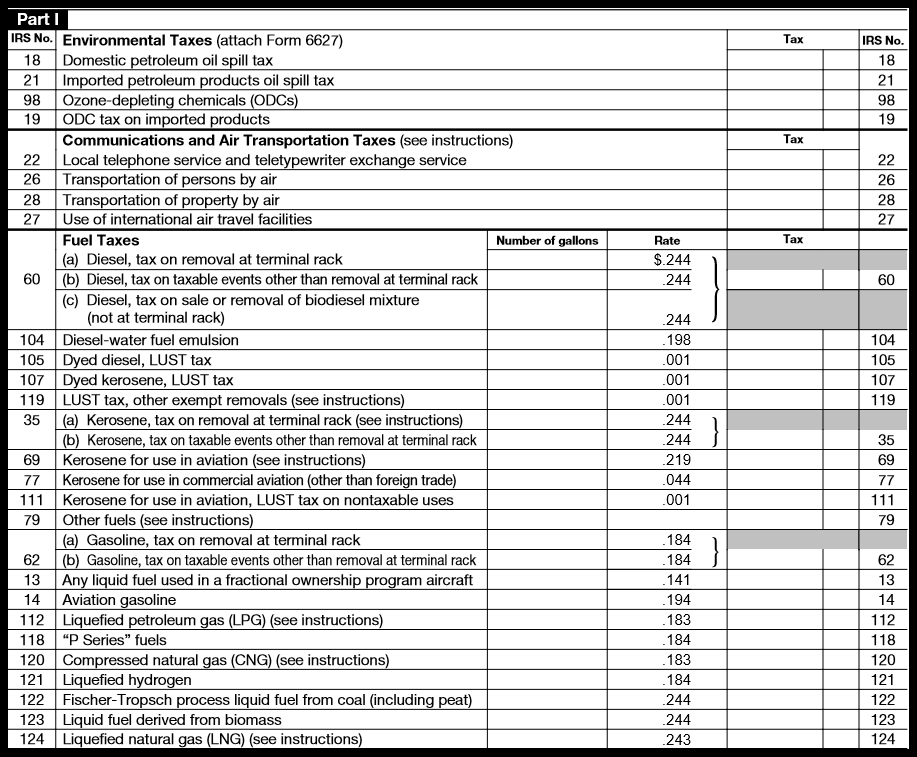

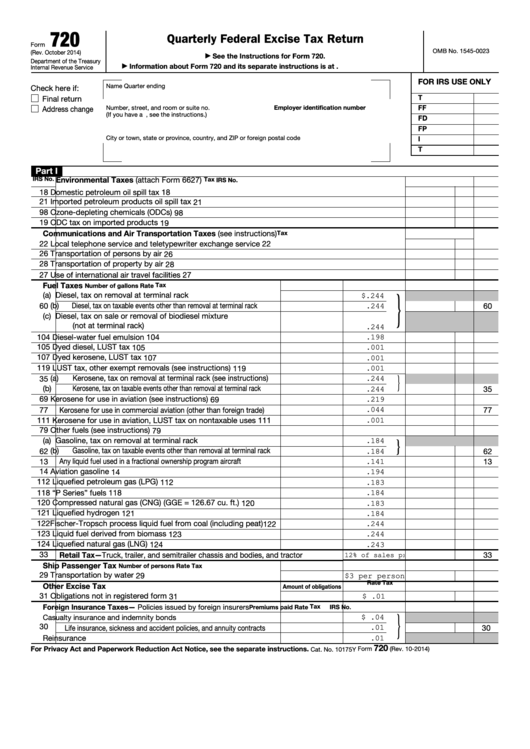

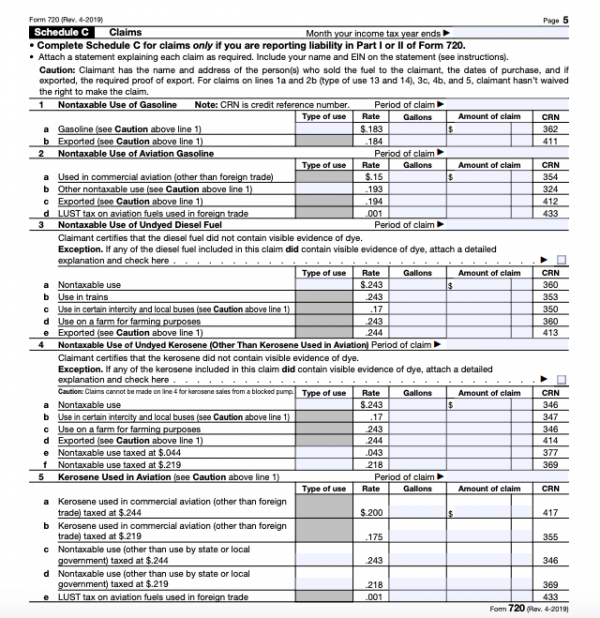

How to Complete Form 720 Quarterly Federal Excise Tax Return

For example, you must file a form 720 by april 30 for the quarter ending on march 31. June 2023) department of the treasury internal revenue service. Web by following these steps, you can confidently submit your irs form 720 and fulfill your reporting obligations. See the instructions for form 720. Deferral until october 31, 2020, for filing and paying.

Form 720 IRS Authorized Electronic Filing Service

June 2023) department of the treasury internal revenue service. The deadlines for filing are april 30th, july 31st, october 31st, and january 31st following the respective quarter. Web form 720 is a quarterly return that comes due one month after the end of the quarter for which you’re reporting excise taxes. Due date to file irs form 720 for 2023..

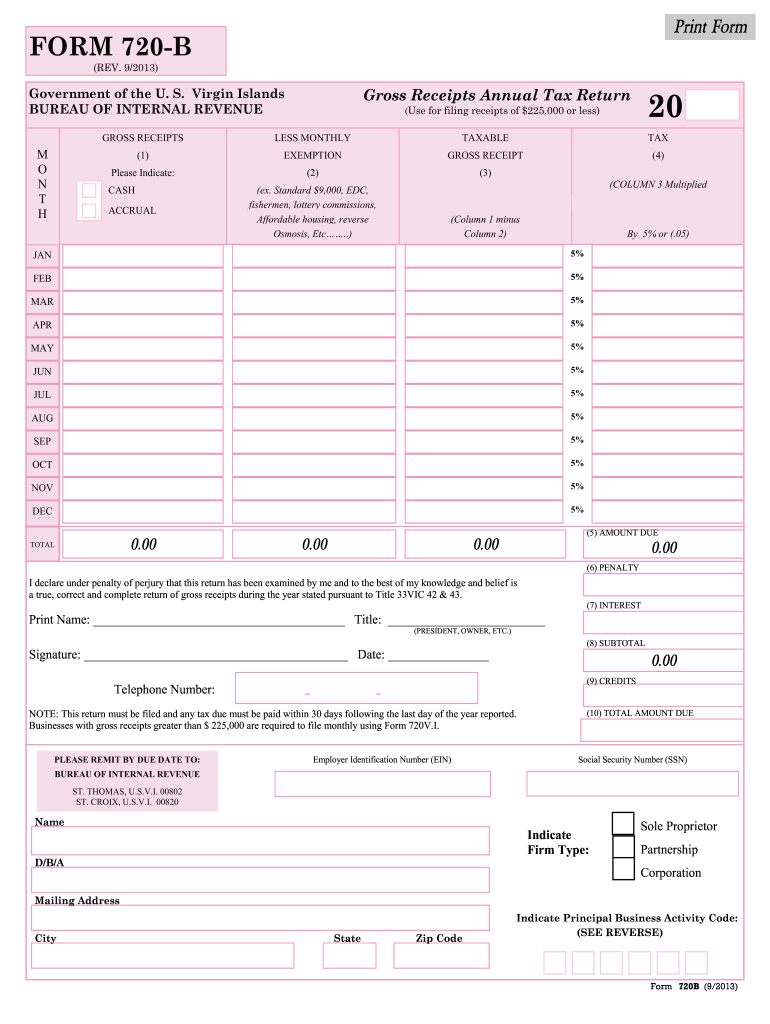

20132022 Form VI 720B Fill Online, Printable, Fillable, Blank pdfFiller

Web for regular method taxpayers, the report must be filed by the due date of the form 720 on which the tax would have been reported. Web if the due date for filing form 720 falls on a weekend or legal holiday, you can file by the next business day. See the instructions for form 720. Quarterly federal excise tax.

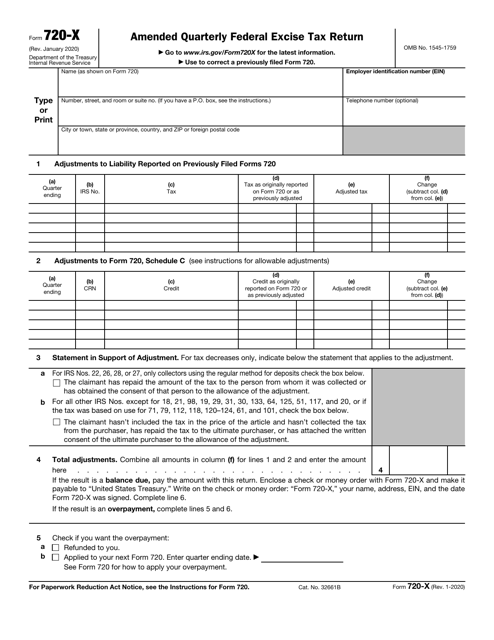

Fill Free fillable Form 720X Amended Quarterly Federal Excise Tax

Web although form 720 is a quarterly return, for pcori, form 720 is filed annually only, by july 31. Web form 720 is a quarterly return that comes due one month after the end of the quarter for which you’re reporting excise taxes. Paying your excise taxes you must pay excise taxes semimonthly. Deferral until october 31, 2020, for filing.

IRS Form 720 Instructions for the PatientCentered Research

Web if the due date for filing form 720 falls on a weekend or legal holiday, you can file by the next business day. Quarterly federal excise tax return. Web although form 720 is a quarterly return, for pcori, form 720 is filed annually only, by july 31. Web form 720 is a quarterly return that comes due one month.

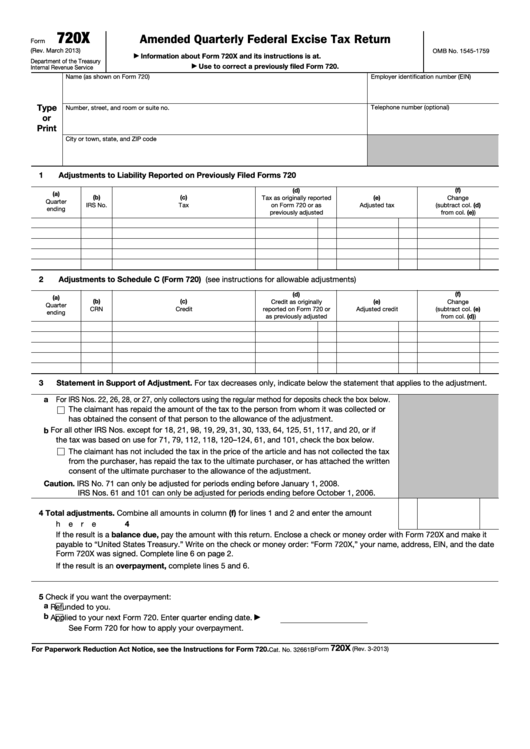

IRS Form 720X Download Fillable PDF or Fill Online Amended Quarterly

For example, you must file a form 720 by april 30 for the quarter ending on march 31. Due date to file irs form 720 for 2023. Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st quarter 2020. Web form 720 is a quarterly return that comes due one month after the end of the.

Form 720 Quarterly Federal Excise Tax Return

Due date to file irs form 720 for 2023. Web if the due date for filing form 720 falls on a weekend or legal holiday, you can file by the next business day. Web by following these steps, you can confidently submit your irs form 720 and fulfill your reporting obligations. For instructions and the latest information. Quarterly federal excise.

Fillable Form 720X Amended Quarterly Federal Excise Tax Return

Web dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date (weekends and holidays considered) tax year Web although form 720 is a quarterly return, for pcori, form 720 is filed annually only, by july 31. For alternative method taxpayers, the report must be filed by the due date of the form 720.

Fillable Form 720 Quarterly Federal Excise Tax Return printable pdf

The deadlines for filing are april 30th, july 31st, october 31st, and january 31st following the respective quarter. Web the form 720 is due on the last day of the month following the end of the quarter. Web form 720 is a quarterly return that comes due one month after the end of the quarter for which you’re reporting excise.

Form 720 Instructions Where to Get IRS Form 720 and How to Fill It Out

Web form 720 is a quarterly return that comes due one month after the end of the quarter for which you’re reporting excise taxes. Web although form 720 is a quarterly return, for pcori, form 720 is filed annually only, by july 31. Web if the due date for filing form 720 falls on a weekend or legal holiday, you.

For Example, You Must File A Form 720 By April 30 For The Quarter Ending On March 31.

See the instructions for form 720. Quarterly federal excise tax return. Web for regular method taxpayers, the report must be filed by the due date of the form 720 on which the tax would have been reported. For alternative method taxpayers, the report must be filed by the due date of the form 720 that includes an adjustment to the separate account for the uncollected tax.

Paying Your Excise Taxes You Must Pay Excise Taxes Semimonthly.

Web form 720 is a quarterly return that comes due one month after the end of the quarter for which you’re reporting excise taxes. Deferral until october 31, 2020, for filing and. Web by following these steps, you can confidently submit your irs form 720 and fulfill your reporting obligations. The deadlines for filing are april 30th, july 31st, october 31st, and january 31st following the respective quarter.

Deferral Until October 31, 2020, For Filing And Paying Certain Excise Taxes For 1St Quarter 2020.

Web the form 720 is due on the last day of the month following the end of the quarter. Due date to file irs form 720 for 2023. Web if the due date for filing form 720 falls on a weekend or legal holiday, you can file by the next business day. Web although form 720 is a quarterly return, for pcori, form 720 is filed annually only, by july 31.

Web Dates Form 720 Tax Period Due Date (Weekends And Holidays Considered) Six (6) Months Extension Due Date (Weekends And Holidays Considered) Tax Year

June 2023) department of the treasury internal revenue service. For instructions and the latest information. The 720 tax form is due on a quarterly basis.