Form 7203 Instructions Stock Block

Form 7203 Instructions Stock Block - Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. A stock block is a group of stocks purchased (or allocated as you have stated) at 1 time. Web generate form 7203, s corporation shareholder stock and debt basis limitations. Web the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft instructions for comment. Web the stock block line is a description for your use, so if you have more than one form 7203, you can identify the stock that is reported on each copy. Basis limitation (7203) stock basis at. Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. To enter basis limitation info in the individual return: So, in your case, you have 1.

So, in your case, you have 1. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. How do i clear ef messages 5486 and 5851? Web the stock block line is a description for your use, so if you have more than one form 7203, you can identify the stock that is reported on each copy. To enter basis limitation info in the individual return: Web what is form 7203? Web generate form 7203, s corporation shareholder stock and debt basis limitations. Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Go to www.irs.gov/form7203 for instructions and the latest information.

Web what is form 7203? Web the stock block line is a description for your use, so if you have more than one form 7203, you can identify the stock that is reported on each copy. To enter basis limitation info in the individual return: Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Web department of the treasury internal revenue service attach to your tax return. Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. Web the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft instructions for comment. Web generate form 7203, s corporation shareholder stock and debt basis limitations. This form is required to be attached.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

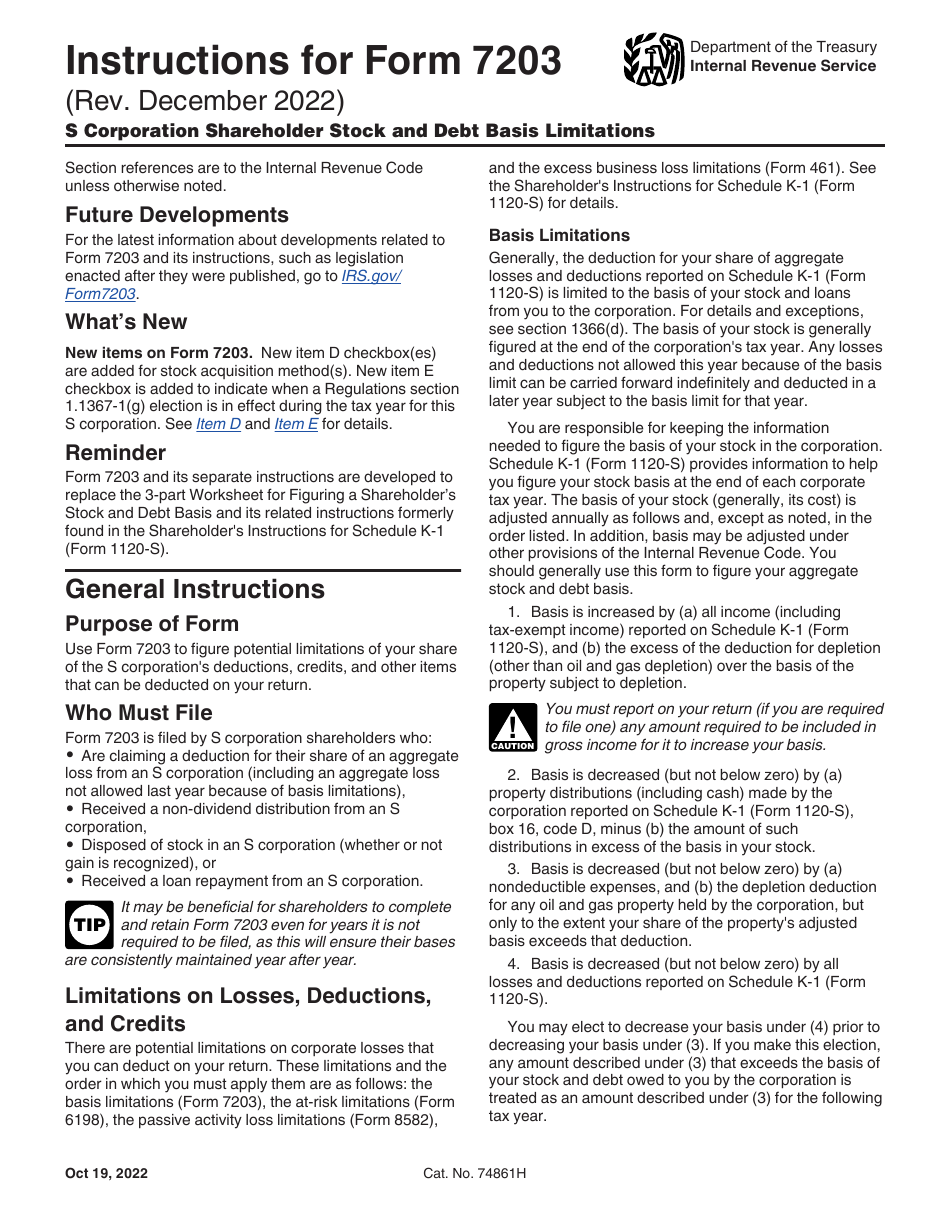

Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. To enter basis limitation info in the individual return: December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Go to www.irs.gov/form7203.

National Association of Tax Professionals Blog

Knott 11.4k subscribers join subscribe 17k views 1 year. Web generate form 7203, s corporation shareholder stock and debt basis limitations. April 14, 2022 4:36 pm. Basis limitation (7203) stock basis at. Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis.

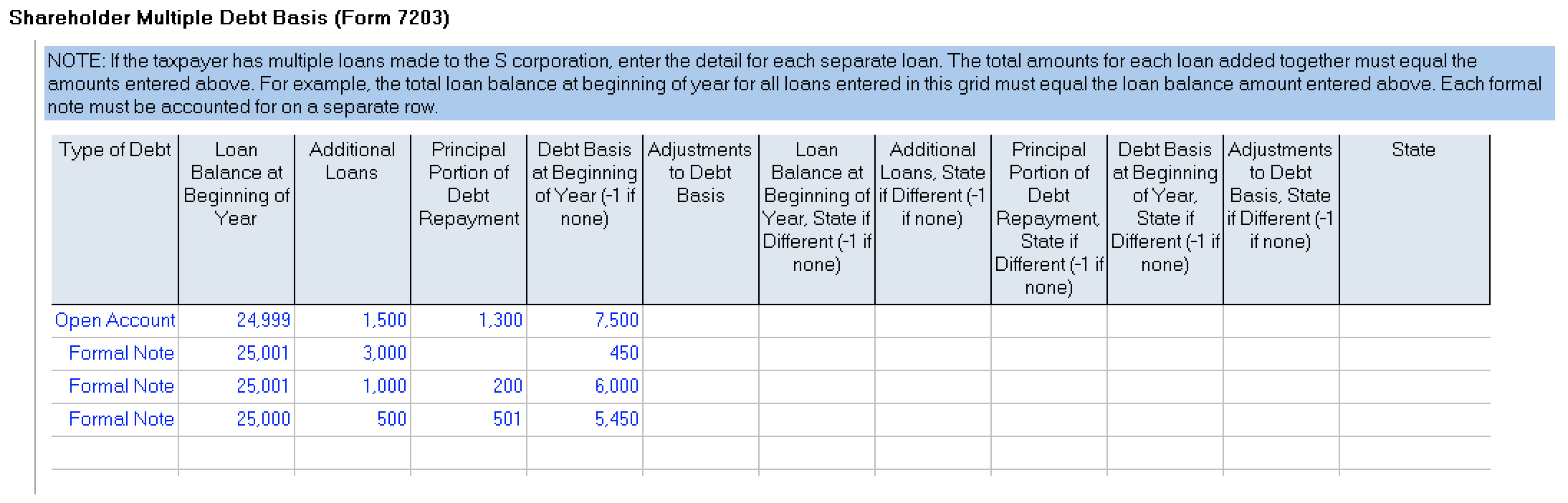

How to complete Form 7203 in Lacerte

Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. A stock block is a group of stocks purchased (or allocated as you have stated) at 1 time. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and.

Download Instructions for IRS Form 7203 S Corporation Shareholder Stock

Knott 11.4k subscribers join subscribe 17k views 1 year. April 14, 2022 4:36 pm. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Web the irs recently issued.

Form 7203 S Corporation Shareholder Stock and Debt Basis Limitations

Go to www.irs.gov/form7203 for instructions and the latest information. How do i clear ef messages 5486 and 5851? Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. Knott 11.4k subscribers join subscribe 17k views 1 year. Web generate form 7203, s corporation.

Form7203PartI PBMares

Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Go to www.irs.gov/form7203 for instructions and the latest information. Web the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft instructions for comment. December 2022) s.

IRS Issues New Form 7203 for Farmers and Fishermen

Knott 11.4k subscribers join subscribe 17k views 1 year. Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. To enter basis limitation info in the individual return: Web department of the treasury internal revenue service attach to your tax return. Starting in tax year 2021, form.

More Basis Disclosures This Year for S corporation Shareholders Need

Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. In 2022, john decides to sell 50 shares of company a stock. Knott 11.4k subscribers join subscribe 17k views 1 year. April 14, 2022 4:36 pm. Web using form 7203, john can track.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. April 14, 2022 4:36 pm. Web generate form 7203, s corporation shareholder stock and debt basis limitations. So, in your case, you have 1. To enter basis limitation info in the individual return:

National Association of Tax Professionals Blog

So, in your case, you have 1. Knott 11.4k subscribers join subscribe 17k views 1 year. To enter basis limitation info in the individual return: This form is required to be attached. Web the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft instructions for comment.

Basis Limitation (7203) Stock Basis At.

Web generate form 7203, s corporation shareholder stock and debt basis limitations. April 14, 2022 4:36 pm. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be.

Web Starting With The 2021 Tax Year, A New Form 7203 Replaces The Supplemental Worksheet For Figuring A Shareholder’s Stock And Debt Basis.

A stock block is a group of stocks purchased (or allocated as you have stated) at 1 time. Web what is form 7203? How do i clear ef messages 5486 and 5851? Web the stock block line is a description for your use, so if you have more than one form 7203, you can identify the stock that is reported on each copy.

Knott 11.4K Subscribers Join Subscribe 17K Views 1 Year.

Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. So, in your case, you have 1. To enter basis limitation info in the individual return: Web department of the treasury internal revenue service attach to your tax return.

December 2022) S Corporation Shareholder Stock And Debt Basis Limitations Department Of The Treasury Internal Revenue Service Attach To Your Tax.

This form is required to be attached. Web the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft instructions for comment. Go to www.irs.gov/form7203 for instructions and the latest information. In 2022, john decides to sell 50 shares of company a stock.