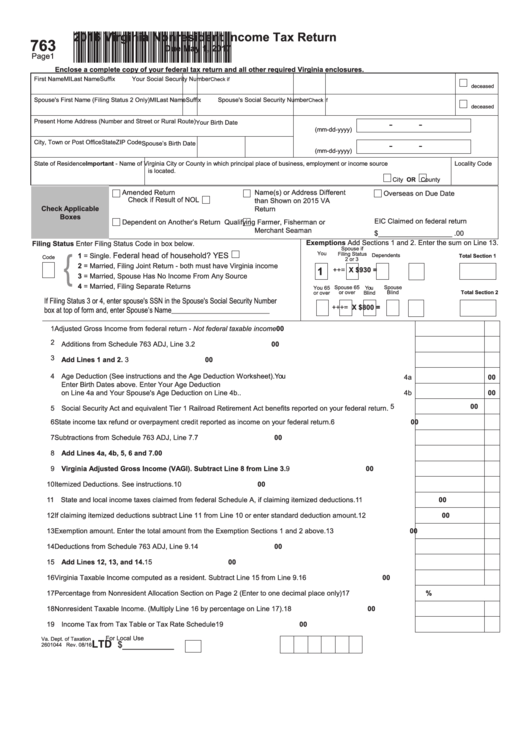

Form 763 Va

Form 763 Va - Web enter the amount of disability income reported as wages (or payments in lieu of wages) on your federal return for permanent and total disability. (a person is considered a resident if they have been living in virginia for more than 183 days in a calendar year). Of taxation 2601045 763adj rev. Save or instantly send your ready documents. Based on the information you have provided, it appears you should file form 763s claim for individual income tax withheld. Web nonresidents of virginia need to file form 763 for their virginia income taxes. Web we last updated virginia form 763 instructions in march 2023 from the virginia department of taxation. Web virginia schedule 763 adj page 1 *va3adj120888* your name your ssn va dept. Web search for va forms by keyword, form name, or form number. Easily fill out pdf blank, edit, and sign them.

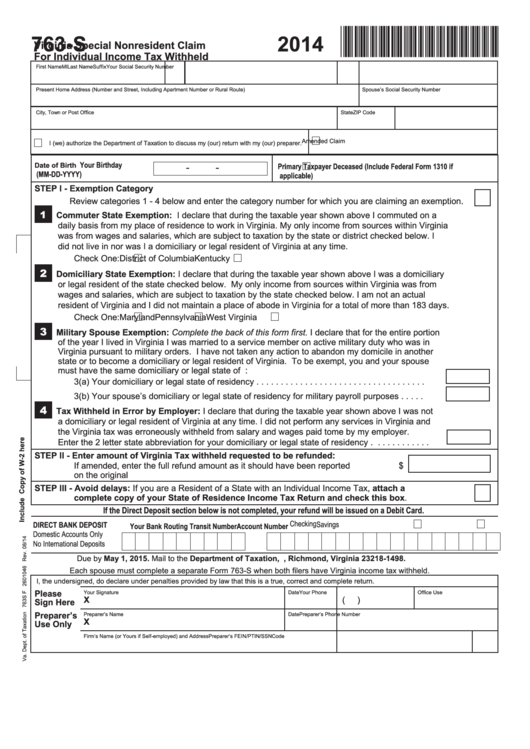

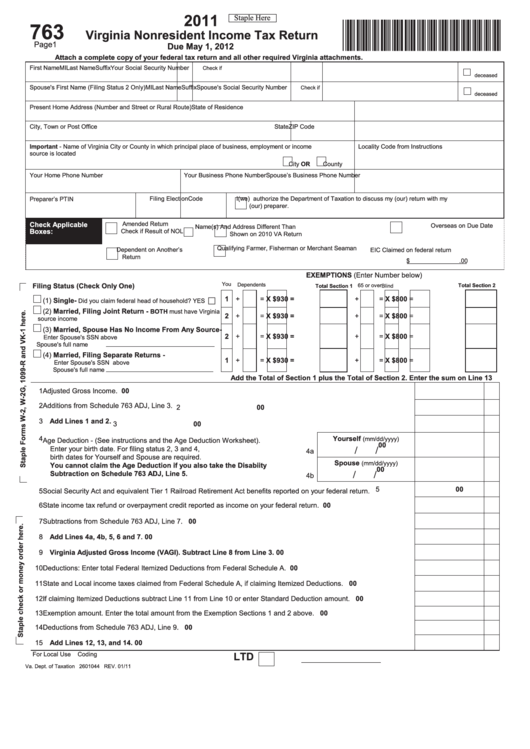

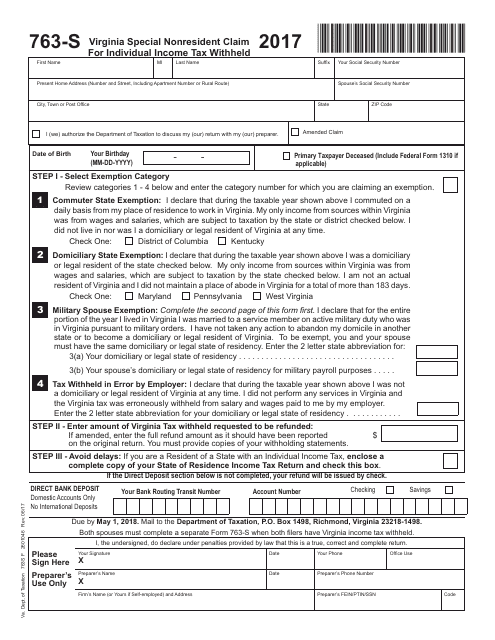

Of taxation 763s f 2601046 rev. Web nonresidents of virginia need to file form 763 for their virginia income taxes. Save or instantly send your ready documents. Ad download or email va 763 & more fillable forms, register and subscribe now! Web the data in your state of virginia return is populated by the data you enter for your federal return. Web virginia schedule 763 adj page 1 *va3adj120888* your name your ssn va dept. 06/21 virginia special nonresident claim *va763s121888* for individual income tax withheld. Complete, edit or print tax forms instantly. Residents of virginia must file a form 760. This form is for income earned in tax year 2022, with tax returns due in april.

Web which form to file: Get ready for tax season deadlines by completing any required tax forms today. Residents of virginia must file a form 760. 06/20 additions to adjusted gross income 1. This form is for income earned in tax year 2022, with tax returns due in april. U filing on paper means waiting. Web 763 due may 1, 2023 *va0763122888* enclose a complete copy of your federal tax return and all other required virginia enclosures. (a person is considered a resident if they have been living in virginia for more than 183 days in a calendar year). This form is for income earned in tax year 2022, with tax returns due in april. Web search for va forms by keyword, form name, or form number.

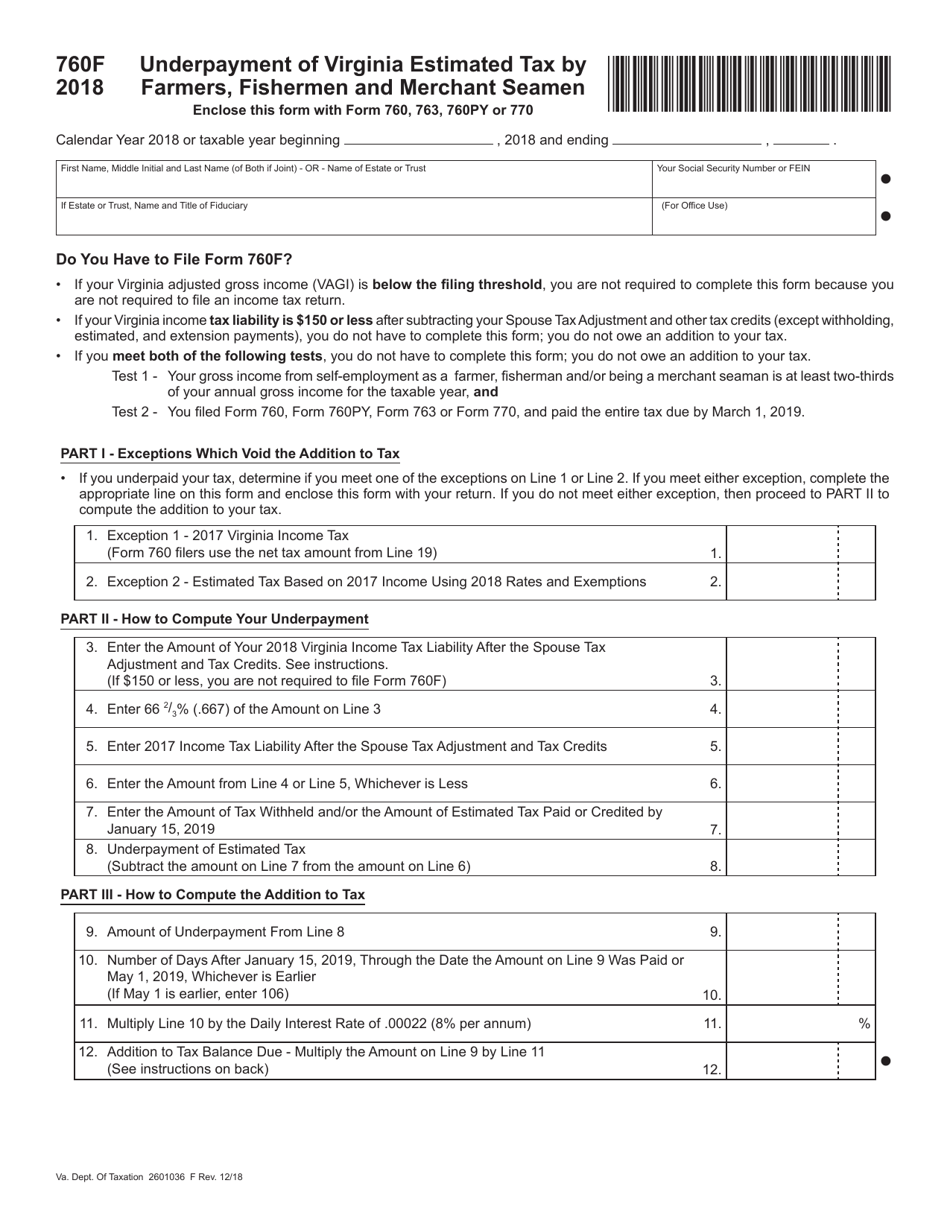

Form 760F Download Fillable PDF or Fill Online Underpayment of Virginia

Get ready for tax season deadlines by completing any required tax forms today. Web virginia schedule 763 adj page 1 *va3adj120888* your name your ssn va dept. Easily fill out pdf blank, edit, and sign them. Web enter the amount of disability income reported as wages (or payments in lieu of wages) on your federal return for permanent and total.

Virginia Form 763 designingreflections

Web nonresidents of virginia need to file form 763 for their virginia income taxes. Web what form should i file | 763s. Use this booklet to help you fill out and file your nonresident income tax form. Web which form to file: Web we last updated virginia form 763s in february 2023 from the virginia department of taxation.

Fillable Form 763S Virginia Special Nonresident Claim For Individual

Save or instantly send your ready documents. Of taxation 2601045 763adj rev. On joint returns, each spouse can. Web we last updated virginia form 763 instructions in march 2023 from the virginia department of taxation. Web the data in your state of virginia return is populated by the data you enter for your federal return.

Irs.gov Forms 941c Form Resume Examples EVKY9MXK06

Web search for va forms by keyword, form name, or form number. Ad download or email va 763 & more fillable forms, register and subscribe now! 06/20 additions to adjusted gross income 1. Easily fill out pdf blank, edit, and sign them. Complete, edit or print tax forms instantly.

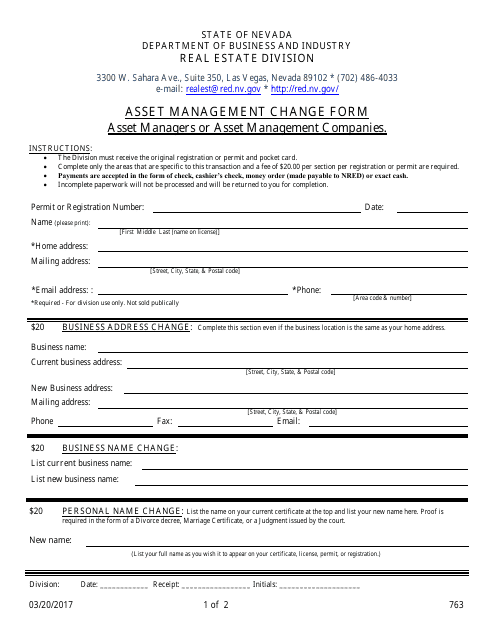

Form 763 Download Fillable PDF or Fill Online Asset Management Change

Web which form to file: Easily fill out pdf blank, edit, and sign them. This form is for income earned in tax year 2022, with tax returns due in april. Use this booklet to help you fill out and file your nonresident income tax form. Form 763 requires you to list multiple forms of income, such as wages, interest, or.

Fillable Form 763 Virginia Nonresident Tax Return 2016

Web virginia form 763 instructions what's new virginia's fixed date conformity with the internal revenue code: Web enter the amount of disability income reported as wages (or payments in lieu of wages) on your federal return for permanent and total disability. Get ready for tax season deadlines by completing any required tax forms today. Quickly access top tasks for frequently.

Form 763 Virginia Nonresident Tax Return 2011 printable pdf

Of taxation 2601045 763adj rev. Web file form 763, the nonresident return, to report the virginia source income received as a nonresident. Ad download or email va 763 & more fillable forms, register and subscribe now! Web which form to file: Web virginia form 763 instructions what's new virginia's fixed date conformity with the internal revenue code:

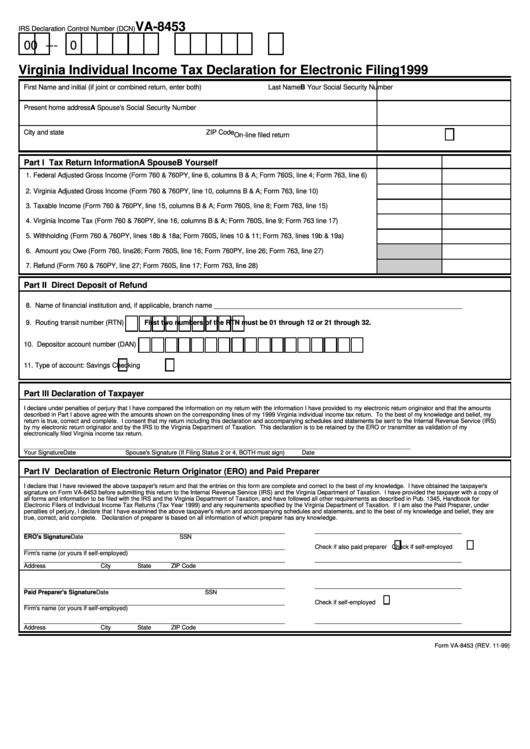

Form Va8453 Virginia Individual Tax Declaration For

06/20 additions to adjusted gross income 1. Web search for va forms by keyword, form name, or form number. Save or instantly send your ready documents. Web file form 763, the nonresident return, to report the virginia source income received as a nonresident. Virginia's date of conformity with the federal enhanced earned.

Form 763S Download Fillable PDF or Fill Online Special Nonresident

(a person is considered a resident if they have been living in virginia for more than 183 days in a calendar year). Web nonresidents of virginia need to file form 763 for their virginia income taxes. Web file form 763, the nonresident return, to report the virginia source income received as a nonresident. Based on the information you have provided,.

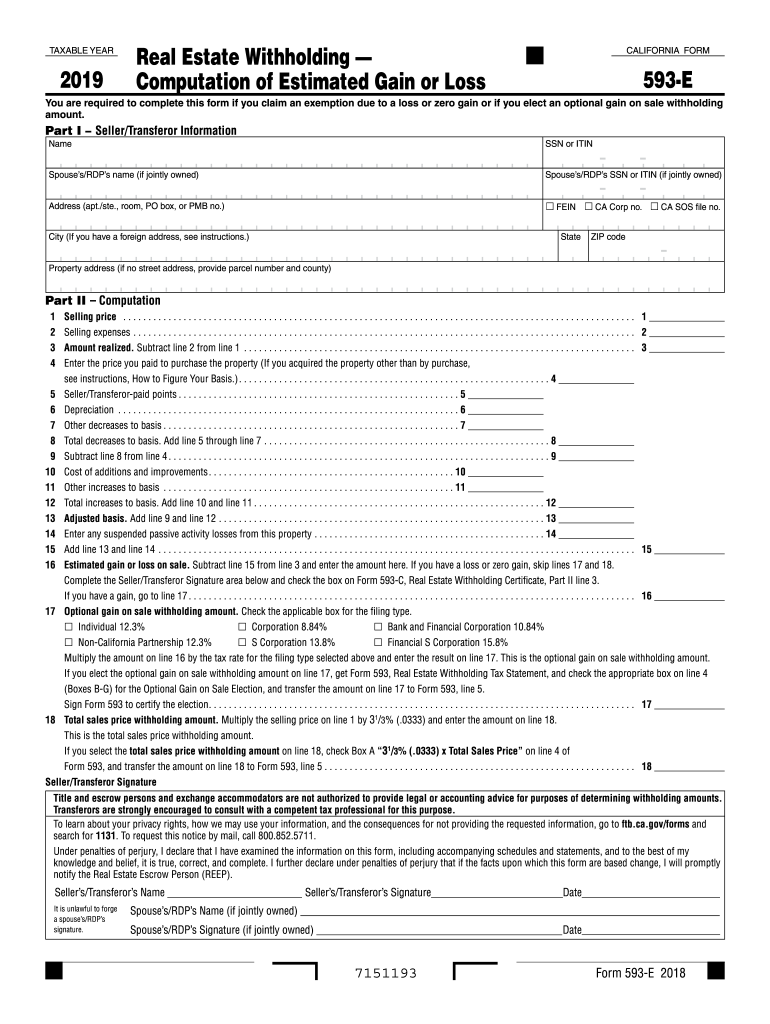

CA FTB 593E 20192022 Fill out Tax Template Online US Legal Forms

Ad download or email va 763 & more fillable forms, register and subscribe now! Of taxation 763s f 2601046 rev. Save or instantly send your ready documents. (a person is considered a resident if they have been living in virginia for more than 183 days in a calendar year). Web we last updated virginia form 763s in february 2023 from.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Web which form to file: Web what form should i file | 763s. Based on the information you have provided, it appears you should file form 763s claim for individual income tax withheld. 06/20 additions to adjusted gross income 1.

Of Taxation 2601045 763Adj Rev.

Web file form 763, the nonresident return, to report the virginia source income received as a nonresident. (a person is considered a resident if they have been living in virginia for more than 183 days in a calendar year). Virginia's date of conformity with the federal enhanced earned. Web search for va forms by keyword, form name, or form number.

Web 2022 Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld

Use this booklet to help you fill out and file your nonresident income tax form. Web we last updated virginia form 763 instructions in march 2023 from the virginia department of taxation. Web virginia form 763 instructions what's new virginia's fixed date conformity with the internal revenue code: 09/21 2021 virginia form 763 nonresident individual income tax instructions u please file electronically!

Web Nonresidents Of Virginia Need To File Form 763 For Their Virginia Income Taxes.

Get ready for tax season deadlines by completing any required tax forms today. Save or instantly send your ready documents. On joint returns, each spouse can. This form is for income earned in tax year 2022, with tax returns due in april.