Form 80 205

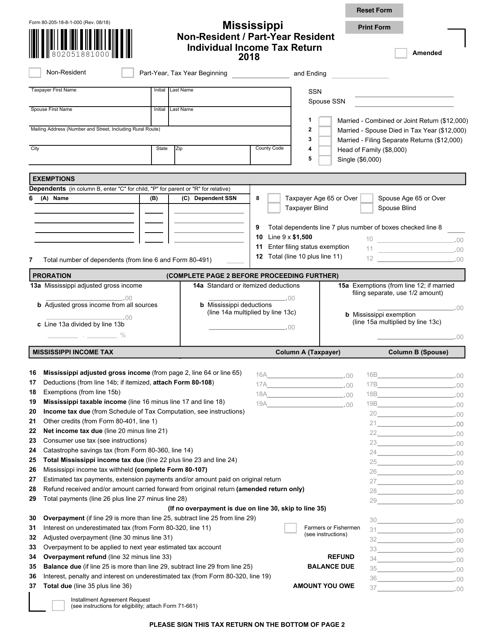

Form 80 205 - 08/20) in the event you filed using the standard deduction on your federal return and wish to itemize for mississippi purposes, use federal form 1040. You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions and. You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions and. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Use get form or simply click on the template preview to open it in the editor. Web complete 80 205 form online with us legal forms. Web check the amended box to indicate an amended tax return. You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions and exemptions.

Provide a military spouse id card; Provide a copy of the service member's. Web complete 80 205 form online with us legal forms. Start completing the fillable fields. You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions and. 8/15) 26 estimated tax payments, extension payments. Save or instantly send your ready documents. Web check the amended box to indicate an amended tax return. You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions and. Easily fill out pdf blank, edit, and sign them.

Web 17 deductions (from line 14b; Web complete 80 205 form online with us legal forms. You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions and exemptions. Use get form or simply click on the template preview to open it in the editor. Start completing the fillable fields. Easily fill out pdf blank, edit, and sign them. You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions and exemptions. Sign it in a few clicks draw your signature, type it,. 8/15) 26 estimated tax payments, extension payments. Easily fill out pdf blank, edit, and sign them.

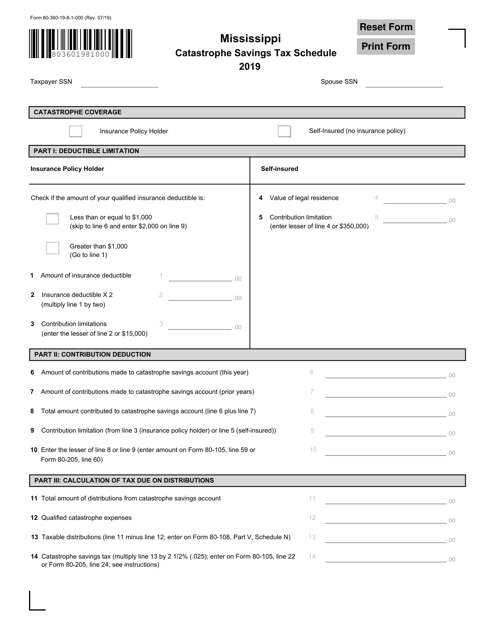

Form 80360 Download Fillable PDF or Fill Online Mississippi

You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions and exemptions. Web complete 80 205 form online with us legal forms. 08/20) in the event you filed using the standard deduction on your federal return and wish to itemize for mississippi purposes, use federal form 1040. Provide a military spouse.

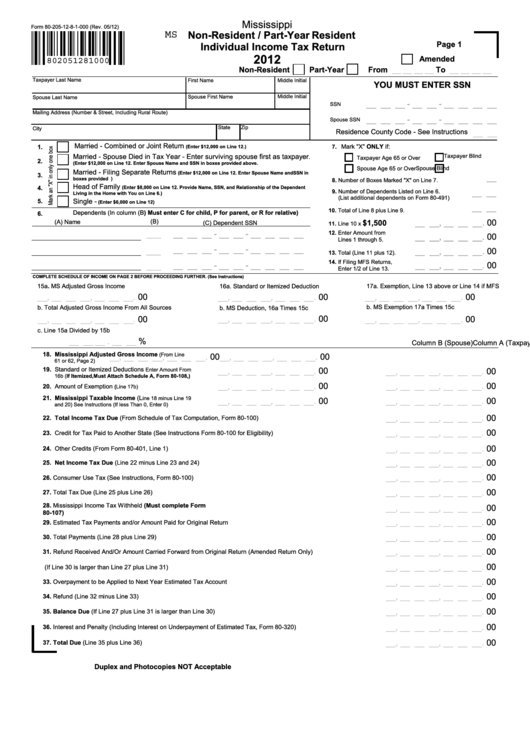

Form 802051281000 NonResident / PartYear Resident Individual

Web 17 deductions (from line 14b; Use get form or simply click on the template preview to open it in the editor. Web complete 80 205 form online with us legal forms. 08/20) in the event you filed using the standard deduction on your federal return and wish to itemize for mississippi purposes, use federal form 1040. You will be.

form 205fillable Hope for the warriors Frequncy list

Web check the amended box to indicate an amended tax return. Provide a military spouse id card; You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions and exemptions. 08/20) in the event you filed using the standard deduction on your federal return and wish to itemize for mississippi purposes, use.

Form 80205 Download Fillable PDF or Fill Online Nonresident/PartYear

This form is for income earned in tax year 2022, with tax returns due in april. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions and exemptions. Use get form or simply click on.

New editable form 80

Provide a military spouse id card; Save or instantly send your ready documents. Web complete 80 205 form online with us legal forms. Save or instantly send your ready documents. This form is for income earned in tax year 2022, with tax returns due in april.

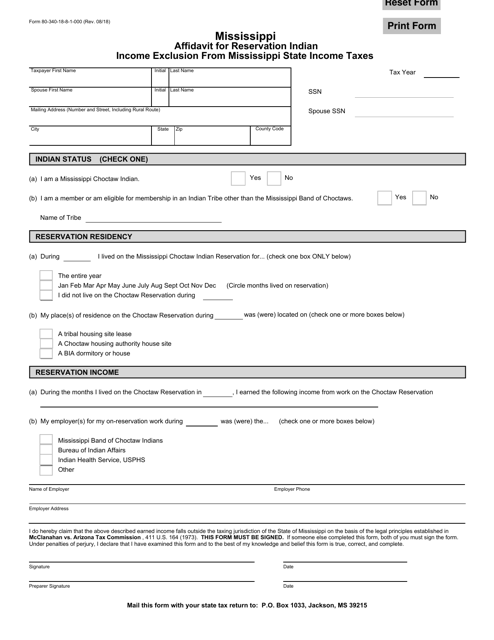

Form 80340 Download Fillable PDF or Fill Online Affidavit for

You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions and exemptions. You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions and. You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions.

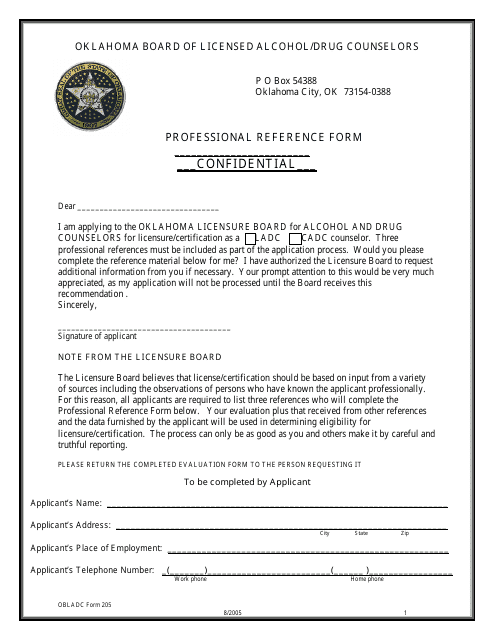

Form 205 Download Printable PDF or Fill Online Professional Reference

This form is for income earned in tax year 2022, with tax returns due in april. Provide a copy of the service member's. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Save or instantly send your ready documents.

Imprinter Form Sales Form (80Col / 2Copy / Carbonless) Case of

Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Use get form or simply click on the template preview to open it in the editor. Save or instantly send your ready documents. You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions and. Provide.

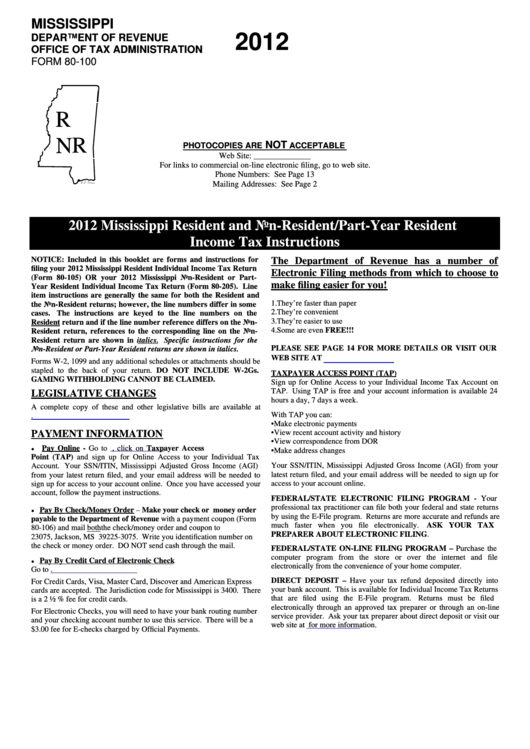

Instructions For Form 80100 Mississippi Resident And NonResident

Provide a copy of the service member's. 08/20) in the event you filed using the standard deduction on your federal return and wish to itemize for mississippi purposes, use federal form 1040. Save or instantly send your ready documents. Start completing the fillable fields. You will be taxed only on income earned while a resident of mississippi and you will.

Fill Free fillable Form 80205198 80205198 80205198.pdf (Mississippi

You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions and. Easily fill out pdf blank, edit, and sign them. Provide a copy of the service member's. 08/20) in the event you filed using the standard deduction on your federal return and wish to itemize for mississippi purposes, use federal form.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions and. You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions and exemptions. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions and.

Provide A Military Spouse Id Card;

Sign it in a few clicks draw your signature, type it,. Start completing the fillable fields. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents.

Web Check The Amended Box To Indicate An Amended Tax Return.

Web complete 80 205 form online with us legal forms. You will be taxed only on income earned while a resident of mississippi and you will prorate your deductions and exemptions. Save or instantly send your ready documents. Use get form or simply click on the template preview to open it in the editor.

Provide A Copy Of The Service Member's.

08/20) in the event you filed using the standard deduction on your federal return and wish to itemize for mississippi purposes, use federal form 1040. Web 17 deductions (from line 14b; Easily fill out pdf blank, edit, and sign them. 8/15) 26 estimated tax payments, extension payments.