Form 8283 Pdf

Form 8283 Pdf - Web updated for tax year 2022 • december 1, 2022 09:21 am overview if the combined value of all property you donate is more than $500, you must prepare irs. Aattach one or more forms 8283 to your tax return if. A partnership or s corporation. Instructions for form 8283 (rev. Choose the correct version of the editable pdf form. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. 8283a, claim for family coverage death benefits (sgli) if you are filing directly as. Ad access irs tax forms. Attach one or more forms 8283 to your tax return if.

Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. 8283, claim for death benefits (sgli/vgli) the form is in pdf format, readable with the adobe reader. Aattach one or more forms 8283 to your tax return if. Web find and fill out the correct form 8283 tax form. Choose the correct version of the editable pdf form. Web if you're filing your claim directly, , download this version: November 2019) department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Web if a casualty officer is helping you file your claim, download this version: Use this form to request an advance insurance payment for a servicemember or.

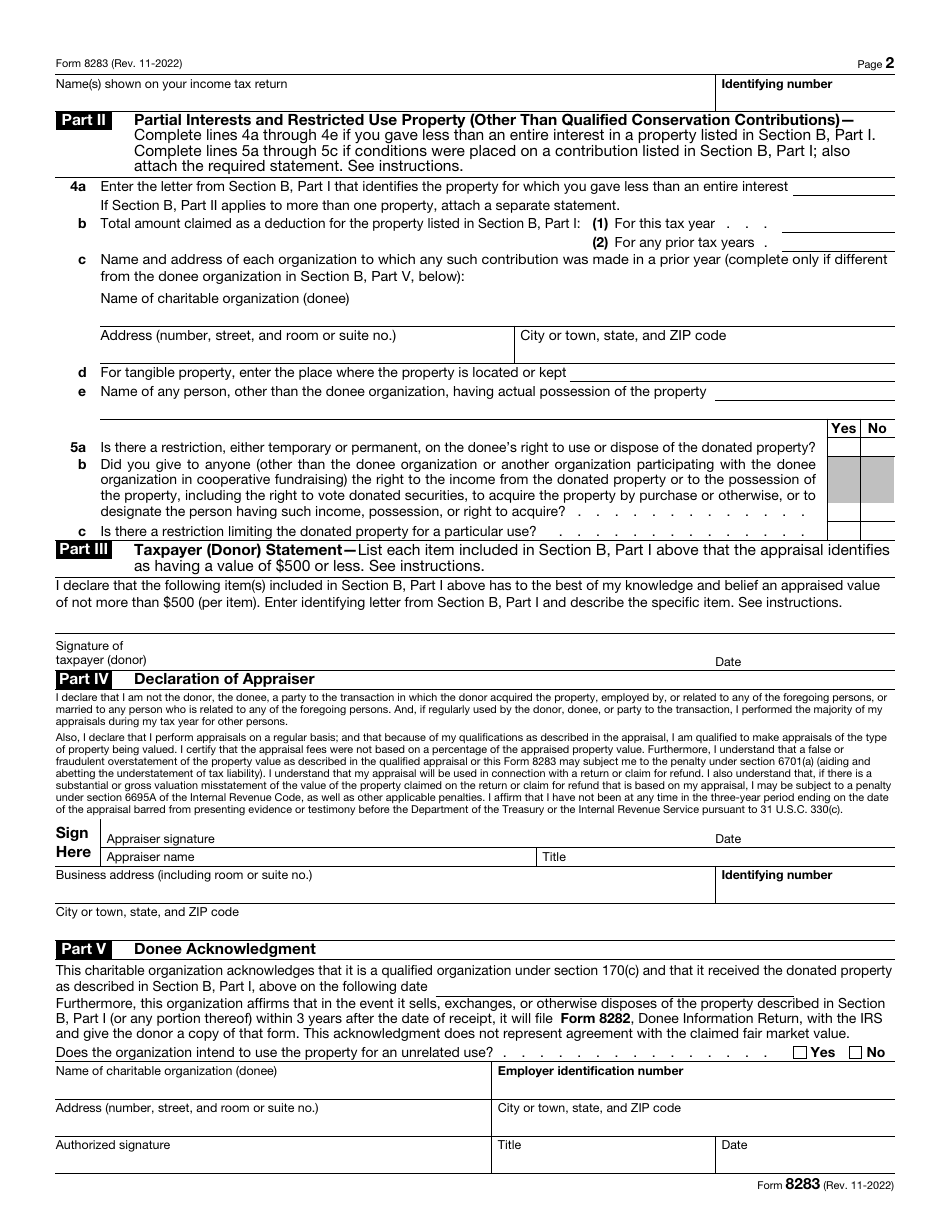

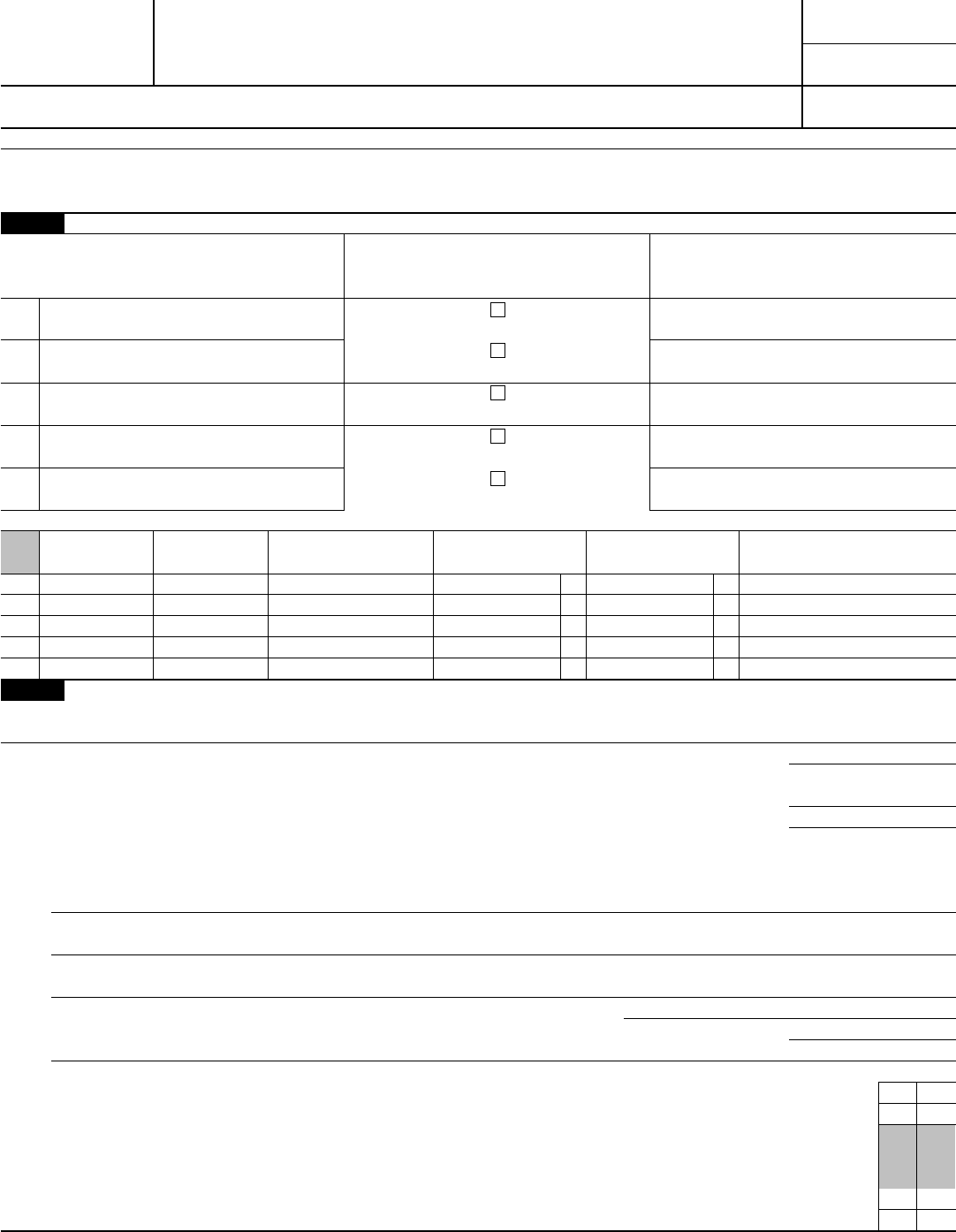

Use this form to request an advance insurance payment for a servicemember or. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web file form 8283 only if the amount claimed as a deduction is more than $5,000 per item or group of similar items. Web find and fill out the correct form 8283 tax form. Figure the amount of your contribution deduction before completing this form. Web fraudulent overstatement of the property value as described in the qualified appraisal or this form 8283 may subject me to the penalty under section 6701(a) (aiding and abetting the. Donated property of $5,000 or less and. 8283a, claim for family coverage death benefits (sgli) if you are filing directly as. Ad access irs tax forms.

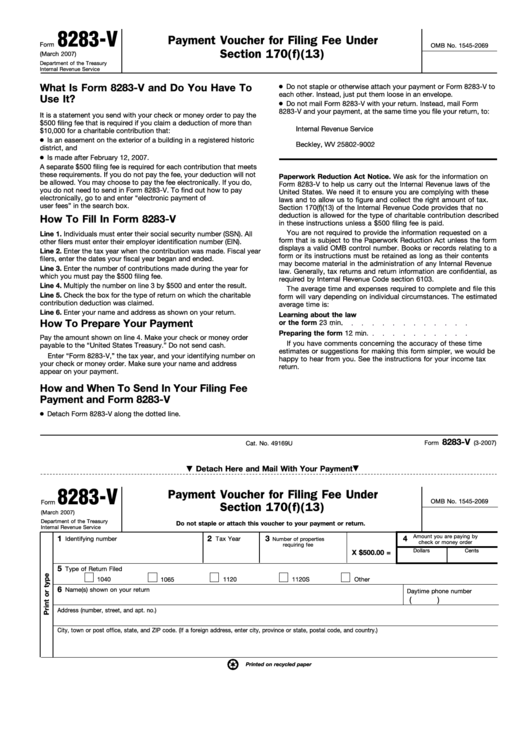

Fill Free fillable Form 8283V Payment Voucher for Filing Fee PDF form

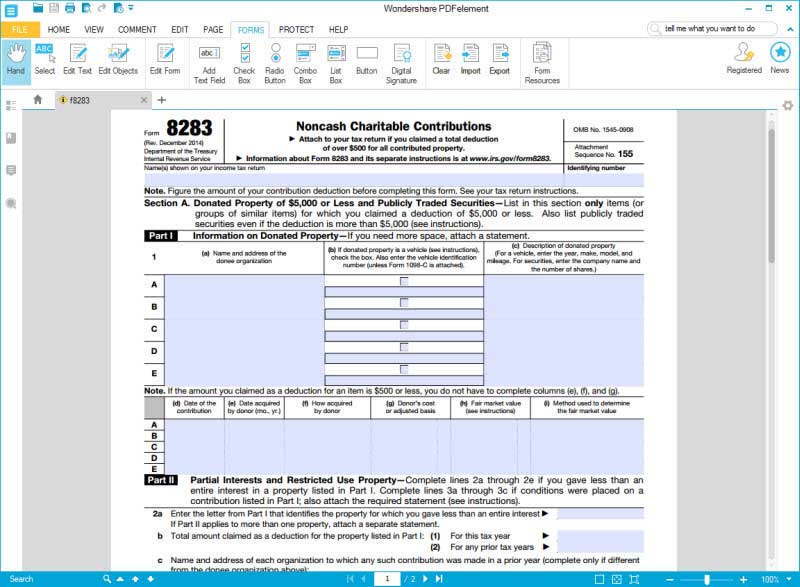

Web recommended by irs form 8283, noncash charitable contributions 2014 form 8283 form 8283 for 2014. December 2020) noncash charitable contributions. Web servicemember/veteran accelerated benefits option form. 8283a, claim for family coverage death benefits (sgli) if you are filing directly as. Use this form to request an advance insurance payment for a servicemember or.

IRS Form 8283 Download Fillable PDF or Fill Online Noncash Charitable

Ad access irs tax forms. Web find and fill out the correct form 8283 tax form. See your tax return instructions. Web if you're filing your claim directly, , download this version: Instructions for form 8283 (rev.

Instructions for How to Fill in IRS Form 8283

Ad access irs tax forms. November 2019) department of the treasury internal revenue service. Use this form to request an advance insurance payment for a servicemember or. Form 8283 is used to claim a deduction for. See your tax return instructions.

Example of form 8283 filled out Fill out & sign online DocHub

Web updated for tax year 2022 • december 1, 2022 09:21 am overview if the combined value of all property you donate is more than $500, you must prepare irs. Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. 2013 form 8283 form 8283 for 2013. Web recommended by irs.

Fillable Form 8283V Payment Voucher For Filing Fee Under Section 170

Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Choose the correct version of the editable pdf form. Web updated for tax year 2022 • december 1, 2022 09:21 am overview if the combined value of all property you donate is more than $500, you must prepare irs. Ad access.

Form 8283 Edit, Fill, Sign Online Handypdf

Web servicemember/veteran accelerated benefits option form. Choose the correct version of the editable pdf form. Web updated for tax year 2022 • december 1, 2022 09:21 am overview if the combined value of all property you donate is more than $500, you must prepare irs. Web recommended by irs form 8283, noncash charitable contributions 2014 form 8283 form 8283 for.

IRS Form 8283 Sharpe Group blog

Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Complete, edit or print tax forms instantly. Form 8283 is used to claim a deduction for. Form 8283 is required as an xml document, unless one of the following apply. Instructions for form 8283 (rev.

Irs form 8283 instructions

December 2014) department of the treasury internal revenue service noncash charitable contributions a attach to your tax return if you claimed a total. Donated property of $5,000 or less and. Use this form to request an advance insurance payment for a servicemember or. Figure the amount of your contribution deduction before completing this form. Web find and fill out the.

Download IRS Form 8283 Noncash Charitable Contributions Printable

Ad access irs tax forms. Web servicemember/veteran accelerated benefits option form. Web recommended by irs form 8283, noncash charitable contributions 2014 form 8283 form 8283 for 2014. Web updated for tax year 2022 • december 1, 2022 09:21 am overview if the combined value of all property you donate is more than $500, you must prepare irs. 8283a, claim for.

2022 form 8283 Fill Online, Printable, Fillable Blank

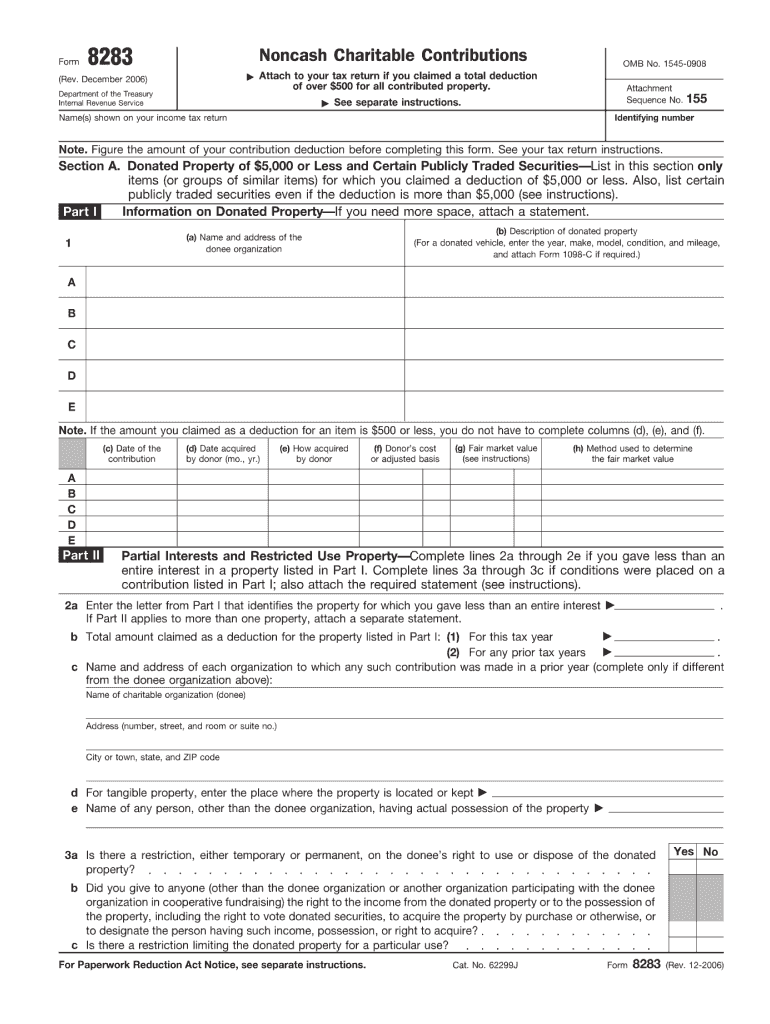

Web file form 8283 only if the amount claimed as a deduction is more than $5,000 per item or group of similar items. Web use form 8283 to report information about noncash charitable contributions. Donated property of $5,000 or less and. Web fraudulent overstatement of the property value as described in the qualified appraisal or this form 8283 may subject.

Instructions For Form 8283 (Rev.

8283, claim for death benefits (sgli/vgli) the form is in pdf format, readable with the adobe reader. Form 8283 is required as an xml document, unless one of the following apply. Web fraudulent overstatement of the property value as described in the qualified appraisal or this form 8283 may subject me to the penalty under section 6701(a) (aiding and abetting the. Web file form 8283 only if the amount claimed as a deduction is more than $5,000 per item or group of similar items.

8283A, Claim For Family Coverage Death Benefits (Sgli) If You Are Filing Directly As.

Donated property of $5,000 or less and. December 2020) noncash charitable contributions. Form 8283 is used to claim a deduction for. Web instructions for form 8283 (rev.

2013 Form 8283 Form 8283 For 2013.

Web updated for tax year 2022 • december 1, 2022 09:21 am overview if the combined value of all property you donate is more than $500, you must prepare irs. Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Web use form 8283 to report information about noncash charitable contributions. Figure the amount of your contribution deduction before completing this form.

Ad Access Irs Tax Forms.

Aattach one or more forms 8283 to your tax return if. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Choose the correct version of the editable pdf form.