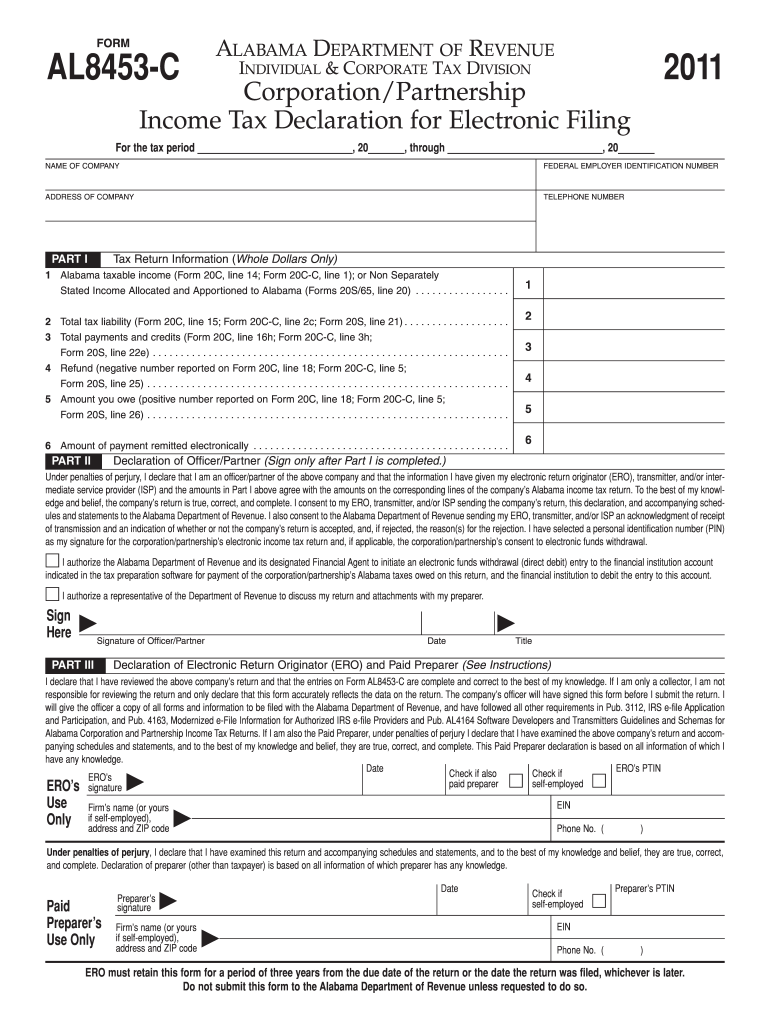

Form 8453 C

Form 8453 C - ( ) electronic return originator’s signature social security number or id number date telephone ( ) preparer’s signature social security number or id number date telephone part d declaration and signature of electronic return originator (ero) and paid preparer i declare that i have reviewed the above. Web part iv banking information (have you verified the corporation’s banking information?) authorize the corporate account to be settled as designated in part ii.ii if i check part ii,ll box 6, i declare that the bank account specified in part iv for the direct deposit refund agrees with the authorization stated on my return. By signing this form, the corporation, electronic return originator (ero), and paid preparer declare that the return is true, correct, and complete. By signing this form, the corporation, electronic return originator (ero), and paid preparer declare that the return is true, correct, and complete. If you are required to mail in any documentation Web this form is to be maintained by ero. • authenticate an electronic form 1120, u.s. Don’t attach any form or document that isn’t shown on form 8453 next to the checkboxes. • authorize the intermediate service provider (isp) to transmit via a thirdparty transmitter if you are filing online (not using an ero);

By signing this form, the corporation, electronic return originator (ero), and paid preparer declare that the return is true, correct, and complete. By signing this form, the corporation, electronic return originator (ero), and paid preparer declare that the return is true, correct, and complete. ( ) electronic return originator’s signature social security number or id number date telephone ( ) preparer’s signature social security number or id number date telephone part d declaration and signature of electronic return originator (ero) and paid preparer i declare that i have reviewed the above. If you are required to mail in any documentation • authenticate an electronic form 1120, u.s. Web part iv banking information (have you verified the corporation’s banking information?) authorize the corporate account to be settled as designated in part ii.ii if i check part ii,ll box 6, i declare that the bank account specified in part iv for the direct deposit refund agrees with the authorization stated on my return. Don’t attach any form or document that isn’t shown on form 8453 next to the checkboxes. • authorize the intermediate service provider (isp) to transmit via a thirdparty transmitter if you are filing online (not using an ero); Web this form is to be maintained by ero.

• authenticate an electronic form 1120, u.s. By signing this form, the corporation, electronic return originator (ero), and paid preparer declare that the return is true, correct, and complete. By signing this form, the corporation, electronic return originator (ero), and paid preparer declare that the return is true, correct, and complete. If you are required to mail in any documentation ( ) electronic return originator’s signature social security number or id number date telephone ( ) preparer’s signature social security number or id number date telephone part d declaration and signature of electronic return originator (ero) and paid preparer i declare that i have reviewed the above. Web part iv banking information (have you verified the corporation’s banking information?) authorize the corporate account to be settled as designated in part ii.ii if i check part ii,ll box 6, i declare that the bank account specified in part iv for the direct deposit refund agrees with the authorization stated on my return. Web this form is to be maintained by ero. Don’t attach any form or document that isn’t shown on form 8453 next to the checkboxes. • authorize the intermediate service provider (isp) to transmit via a thirdparty transmitter if you are filing online (not using an ero);

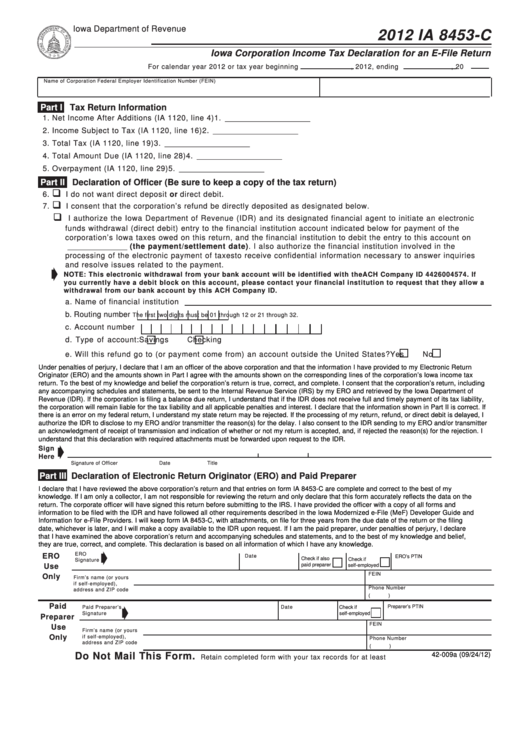

Form Ia 8453C Iowa Corporation Tax Declaration For An EFile

• authorize the intermediate service provider (isp) to transmit via a thirdparty transmitter if you are filing online (not using an ero); • authenticate an electronic form 1120, u.s. Web this form is to be maintained by ero. By signing this form, the corporation, electronic return originator (ero), and paid preparer declare that the return is true, correct, and complete..

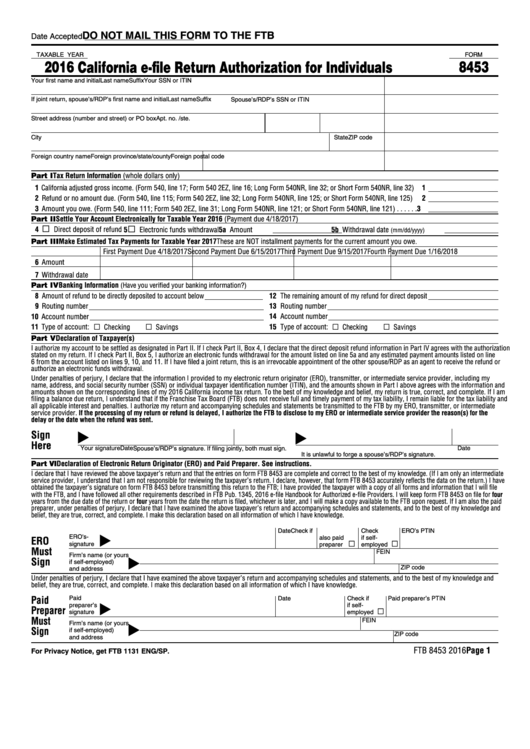

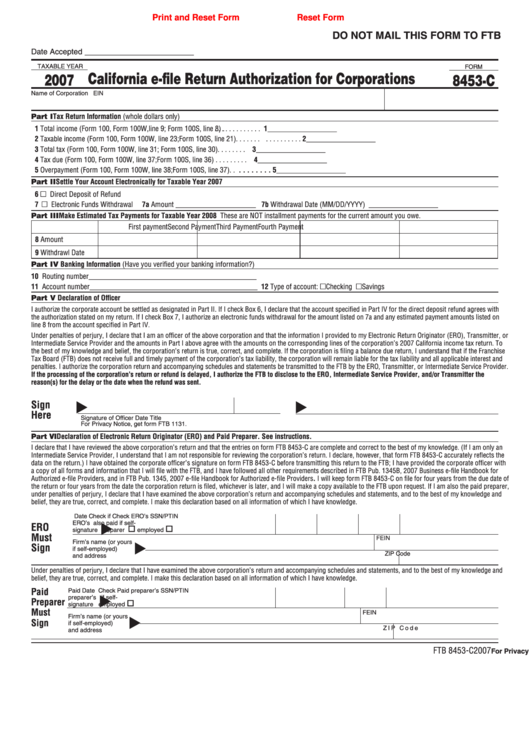

Form FTB8453 Download Fillable PDF or Fill Online California EFile

By signing this form, the corporation, electronic return originator (ero), and paid preparer declare that the return is true, correct, and complete. Don’t attach any form or document that isn’t shown on form 8453 next to the checkboxes. • authorize the intermediate service provider (isp) to transmit via a thirdparty transmitter if you are filing online (not using an ero);.

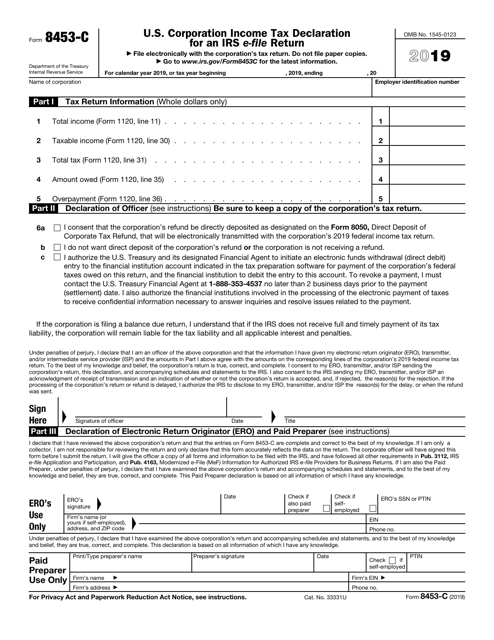

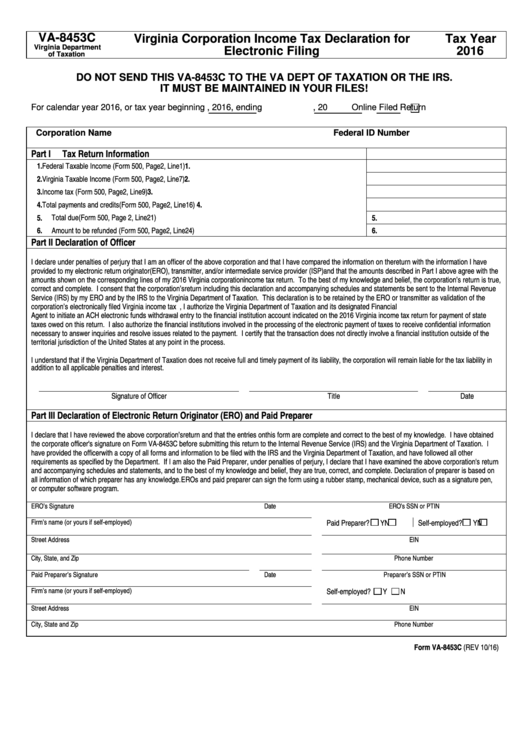

IRS Form 8453C Download Fillable PDF or Fill Online U.S. Corporation

( ) electronic return originator’s signature social security number or id number date telephone ( ) preparer’s signature social security number or id number date telephone part d declaration and signature of electronic return originator (ero) and paid preparer i declare that i have reviewed the above. By signing this form, the corporation, electronic return originator (ero), and paid preparer.

Form 8453 California EFile Return Authorization For Individuals

If you are required to mail in any documentation • authenticate an electronic form 1120, u.s. Don’t attach any form or document that isn’t shown on form 8453 next to the checkboxes. ( ) electronic return originator’s signature social security number or id number date telephone ( ) preparer’s signature social security number or id number date telephone part d.

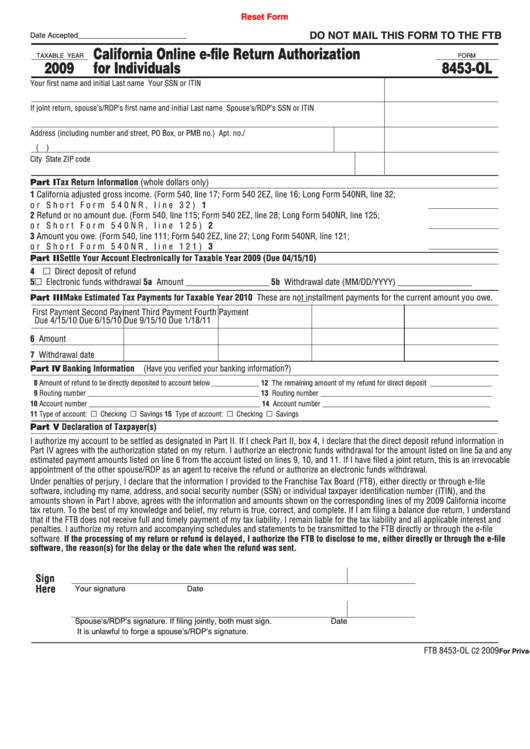

Fillable Form 8453Ol California Online EFile Return Authorization

( ) electronic return originator’s signature social security number or id number date telephone ( ) preparer’s signature social security number or id number date telephone part d declaration and signature of electronic return originator (ero) and paid preparer i declare that i have reviewed the above. Web part iv banking information (have you verified the corporation’s banking information?) authorize.

Form 8453 C Fill Out and Sign Printable PDF Template signNow

Web part iv banking information (have you verified the corporation’s banking information?) authorize the corporate account to be settled as designated in part ii.ii if i check part ii,ll box 6, i declare that the bank account specified in part iv for the direct deposit refund agrees with the authorization stated on my return. Web this form is to be.

Fillable Form 8453C California EFile Return Authorization For

Don’t attach any form or document that isn’t shown on form 8453 next to the checkboxes. • authenticate an electronic form 1120, u.s. If you are required to mail in any documentation By signing this form, the corporation, electronic return originator (ero), and paid preparer declare that the return is true, correct, and complete. ( ) electronic return originator’s signature.

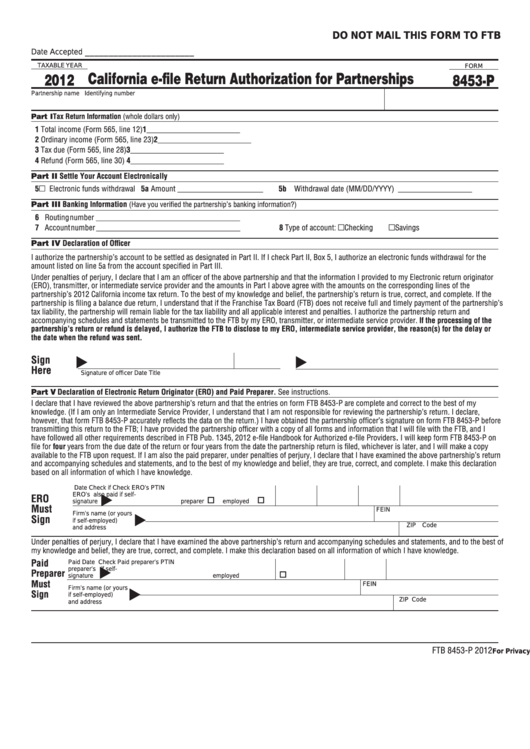

Fillable Form 8453P California EFile Return Authorization For

Web this form is to be maintained by ero. • authenticate an electronic form 1120, u.s. ( ) electronic return originator’s signature social security number or id number date telephone ( ) preparer’s signature social security number or id number date telephone part d declaration and signature of electronic return originator (ero) and paid preparer i declare that i have.

Form 8453C U.S. Corporation Tax Declaration for an IRS efile

If you are required to mail in any documentation ( ) electronic return originator’s signature social security number or id number date telephone ( ) preparer’s signature social security number or id number date telephone part d declaration and signature of electronic return originator (ero) and paid preparer i declare that i have reviewed the above. • authenticate an electronic.

Top 10 Form 8453c Templates free to download in PDF format

• authorize the intermediate service provider (isp) to transmit via a thirdparty transmitter if you are filing online (not using an ero); • authenticate an electronic form 1120, u.s. Web this form is to be maintained by ero. ( ) electronic return originator’s signature social security number or id number date telephone ( ) preparer’s signature social security number or.

By Signing This Form, The Corporation, Electronic Return Originator (Ero), And Paid Preparer Declare That The Return Is True, Correct, And Complete.

Web this form is to be maintained by ero. Web part iv banking information (have you verified the corporation’s banking information?) authorize the corporate account to be settled as designated in part ii.ii if i check part ii,ll box 6, i declare that the bank account specified in part iv for the direct deposit refund agrees with the authorization stated on my return. Don’t attach any form or document that isn’t shown on form 8453 next to the checkboxes. ( ) electronic return originator’s signature social security number or id number date telephone ( ) preparer’s signature social security number or id number date telephone part d declaration and signature of electronic return originator (ero) and paid preparer i declare that i have reviewed the above.

By Signing This Form, The Corporation, Electronic Return Originator (Ero), And Paid Preparer Declare That The Return Is True, Correct, And Complete.

• authorize the intermediate service provider (isp) to transmit via a thirdparty transmitter if you are filing online (not using an ero); • authenticate an electronic form 1120, u.s. If you are required to mail in any documentation