Form 8582 Cr

Form 8582 Cr - Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the. 1a b activities with net loss (enter. Figure the amount of any passive activity loss (pal) for. For more information on passive. Web form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. Noncorporate taxpayers use form 8582 to: A passive activity loss occurs when total losses (including. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. Worksheet 1—for form 8582, lines 1a,.

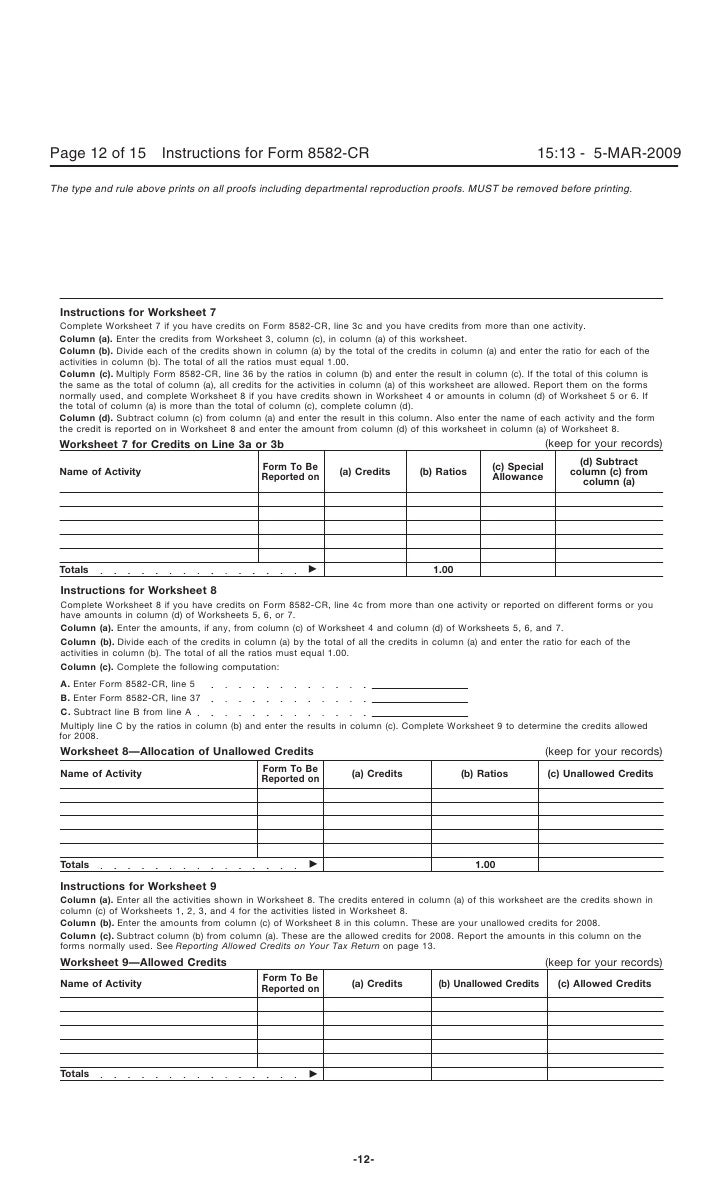

The worksheets must be filed with your tax return. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. Written comments should be received on or before. However, credits from (2)(a) and (2)(b) without taking into these activities may be subject to who must file. Web form 8283 contains more than one item, this exception applies only to those items that are clearly identified as having a value of $500 or less. Web special allowance for rental real estate activities in the instructions.) 1 a activities with net income (enter the amount from part iv, column (a)). Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. You can download or print. Keep a copy for your records. However, for purposes of the donor’s.

Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Written comments should be received on or before. 8582 (2018) form 8582 (2018) page. Web form 8283 contains more than one item, this exception applies only to those items that are clearly identified as having a value of $500 or less. Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the. 1a b activities with net loss (enter. Worksheet 1—for form 8582, lines 1a,. Keep a copy for your records. Web about form 8582, passive activity loss limitations. Figure the amount of any passive activity loss (pal) for.

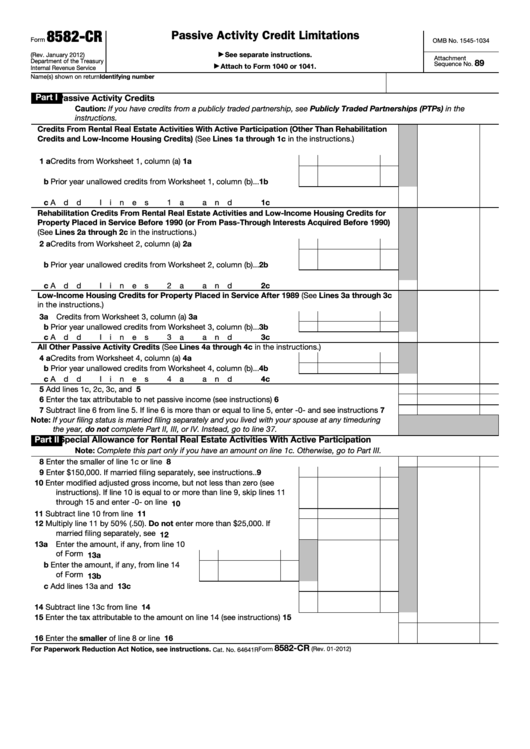

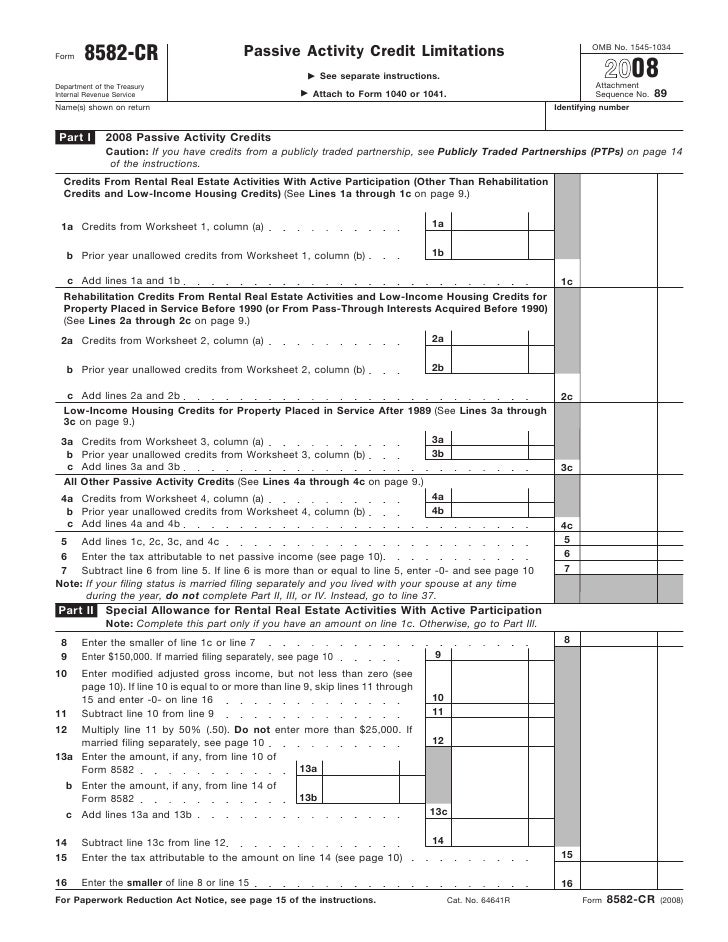

Fillable Form 8582Cr Passive Activity Credit Limitations printable

Web special allowance for rental real estate activities in the instructions.) 1 a activities with net income (enter the amount from part iv, column (a)). However, credits from (2)(a) and (2)(b) without taking into these activities may be subject to who must file. Web about form 8582, passive activity loss limitations. Noncorporate taxpayers use form 8582 to: Web loss and.

Form 8582CR Passive Activity Credit Limitations (2012) Free Download

The worksheets must be filed with your tax return. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Web loss and credit limitations. You can download or print. What is the form used for?

Instructions for Form 8582CR (01/2012) Internal Revenue Service

1a b activities with net loss (enter. Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the. What is the form used for? The worksheets must be filed with your tax return. 8582 (2018) form 8582 (2018) page.

Instructions for Form 8582CR, Passive Activity Credit Limitations

Figure the amount of any passive activity loss (pal) for. Web form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. However, credits from (2)(a) and (2)(b) without taking into these activities may be subject to who must file. Web special allowance for rental.

Form 8582CR Passive Activity Credit Limitations

Figure the amount of any passive activity credit (pac). Noncorporate taxpayers use form 8582 to: Web about form 8582, passive activity loss limitations. Keep a copy for your records. Web special allowance for rental real estate activities in the instructions.) 1 a activities with net income (enter the amount from part iv, column (a)).

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. However, for purposes of the donor’s. Web form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. Written comments should be received on or before. Web special allowance for rental real estate activities in the instructions.) 1 a activities with net income (enter the amount.

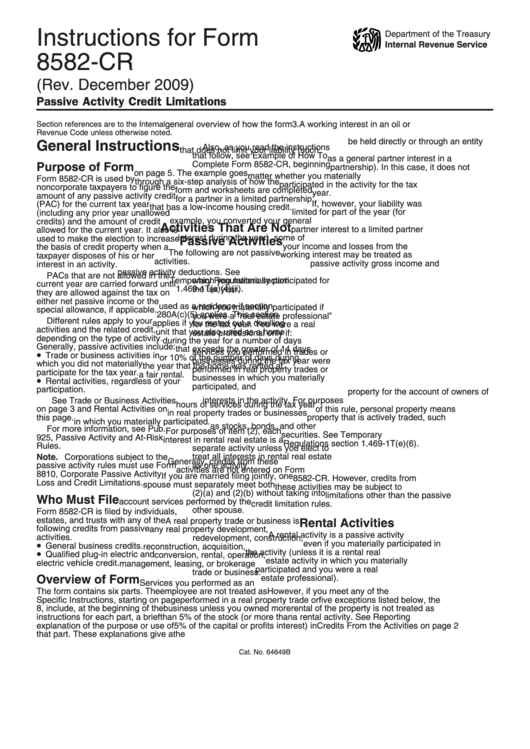

Instructions For Form 8582Cr (Rev. December 2009) printable pdf download

For more information on passive. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. 8582 (2018) form 8582 (2018) page. Figure the amount of any passive activity loss (pal) for. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss.

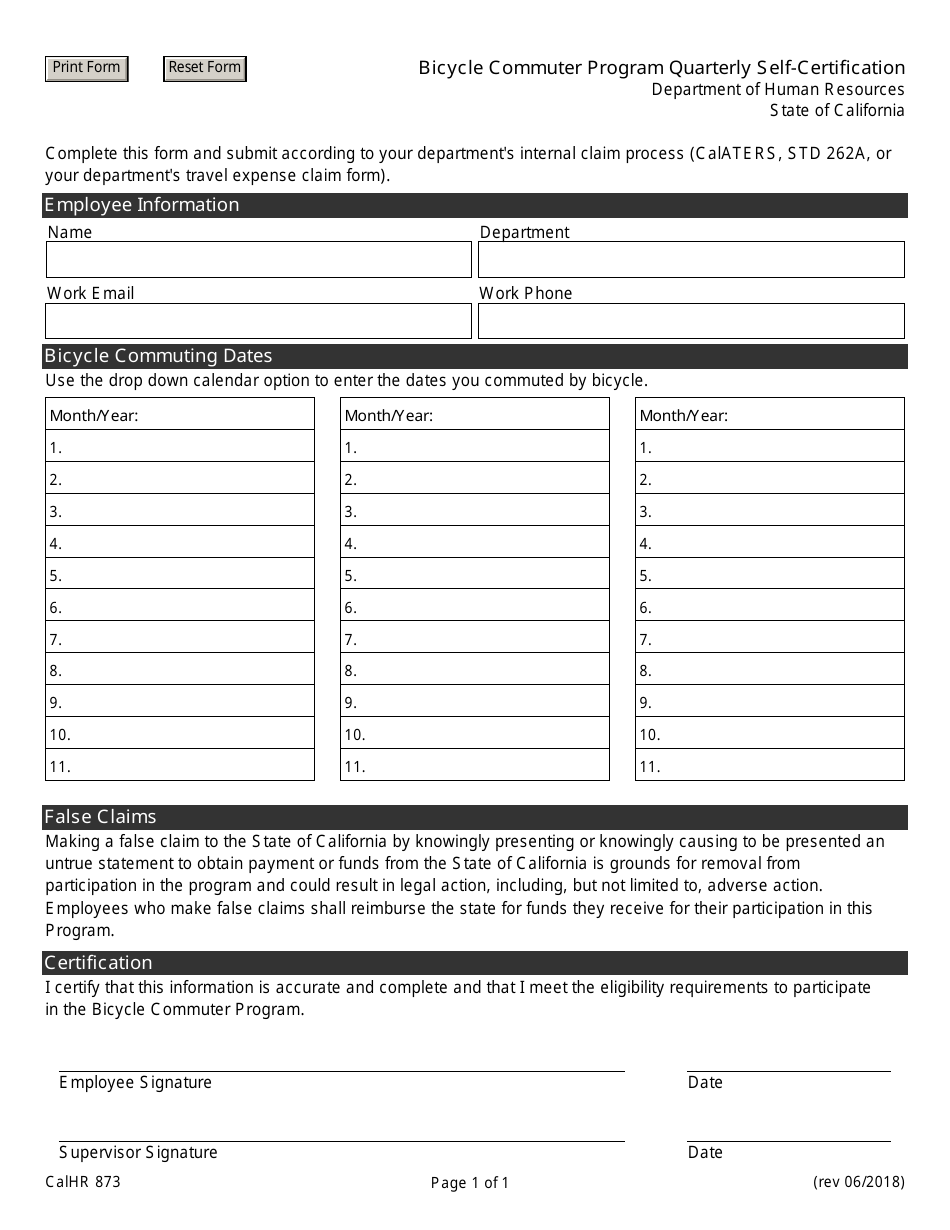

Form CALHR873 Download Fillable PDF or Fill Online Bicycle Commuter

1a b activities with net loss (enter. However, for purposes of the donor’s. Web about form 8582, passive activity loss limitations. What is the form used for? Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year.

Web Form 8582, Passive Activity Loss Limitations Is Used To Calculate The Amount Of Any Passive Activity Loss That A Taxpayer Can Take In A Given Year.

However, credits from (2)(a) and (2)(b) without taking into these activities may be subject to who must file. Web special allowance for rental real estate activities in the instructions.) 1 a activities with net income (enter the amount from part iv, column (a)). Web form 8283 contains more than one item, this exception applies only to those items that are clearly identified as having a value of $500 or less. Noncorporate taxpayers use form 8582 to:

A Passive Activity Loss Occurs When Total Losses (Including.

What is the form used for? Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Worksheet 1—for form 8582, lines 1a,. 1a b activities with net loss (enter.

Web Loss And Credit Limitations.

Web about form 8582, passive activity loss limitations. Written comments should be received on or before. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. Keep a copy for your records.

Figure The Amount Of Any Passive Activity Loss (Pal) For.

Figure the amount of any passive activity credit (pac). However, for purposes of the donor’s. The worksheets must be filed with your tax return. For more information on passive.