Form 8812 For 2021

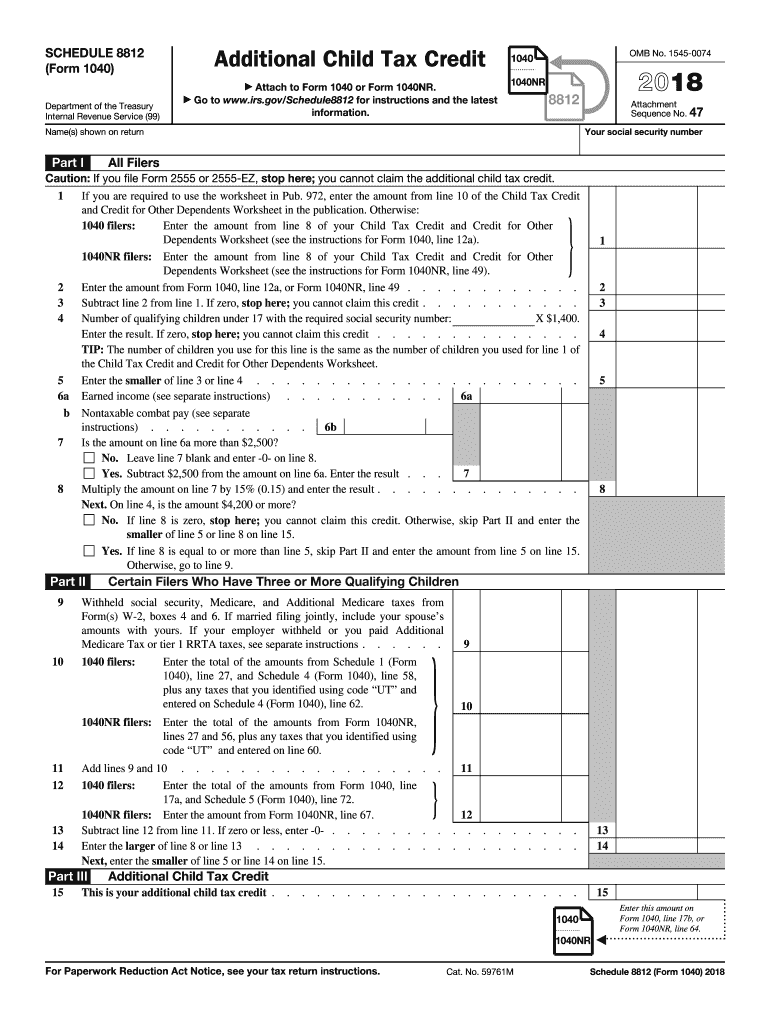

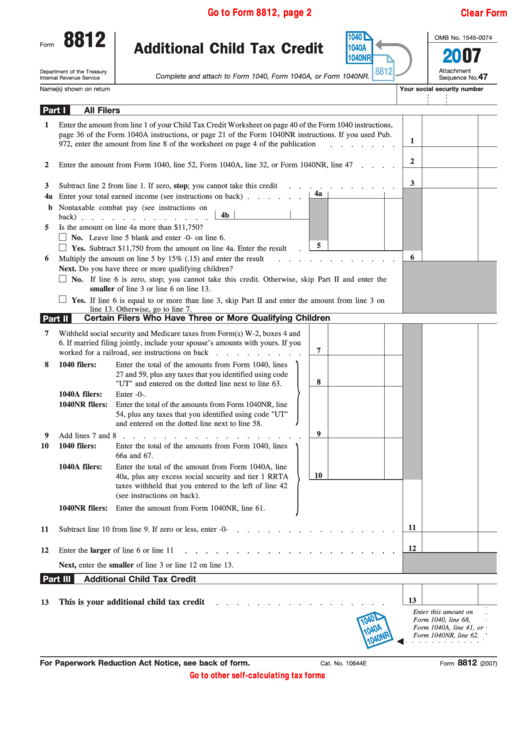

Form 8812 For 2021 - If you received advance payments of the child tax credit in 2021, you will need to report the payment amount on. Web printable form 1040 schedule 8812. This is for 2021 returns only. Go to www.irs.gov/schedule8812 for instructions and the latest information. Web advance child tax credit payment reconciliation form 8812. Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. Web 2020 instructions for schedule 8812 (rev. If you have children and a low tax bill, you may need irs form 8812 to claim all of your child tax credit. The ctc and odc are nonrefundable credits. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc).

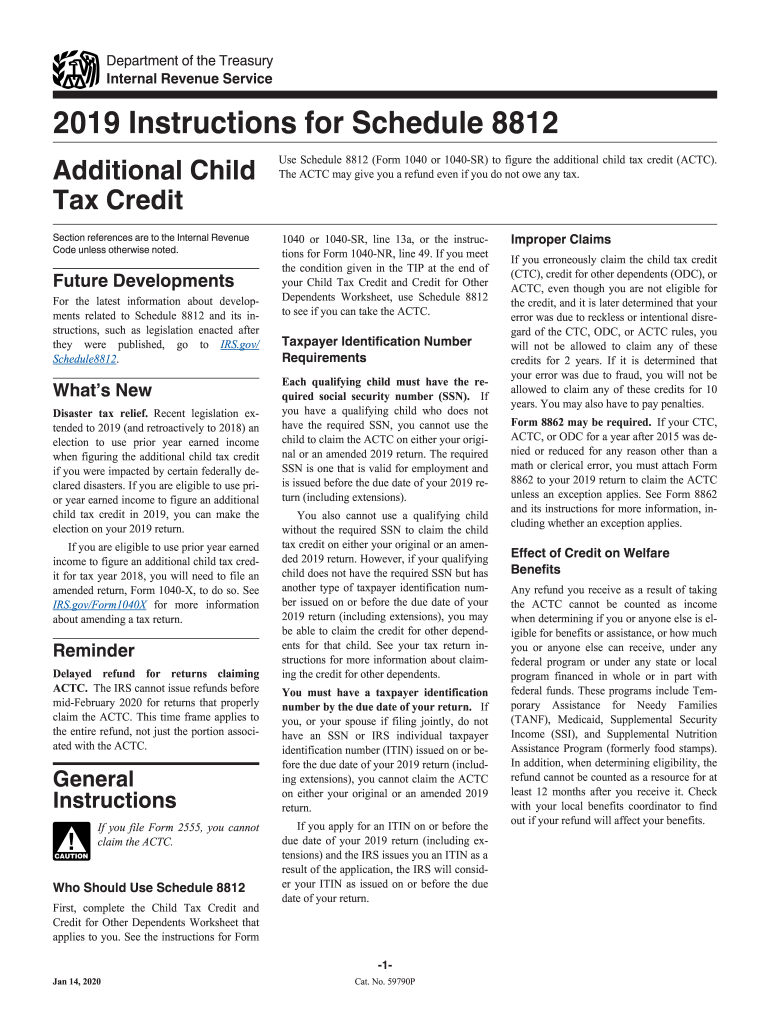

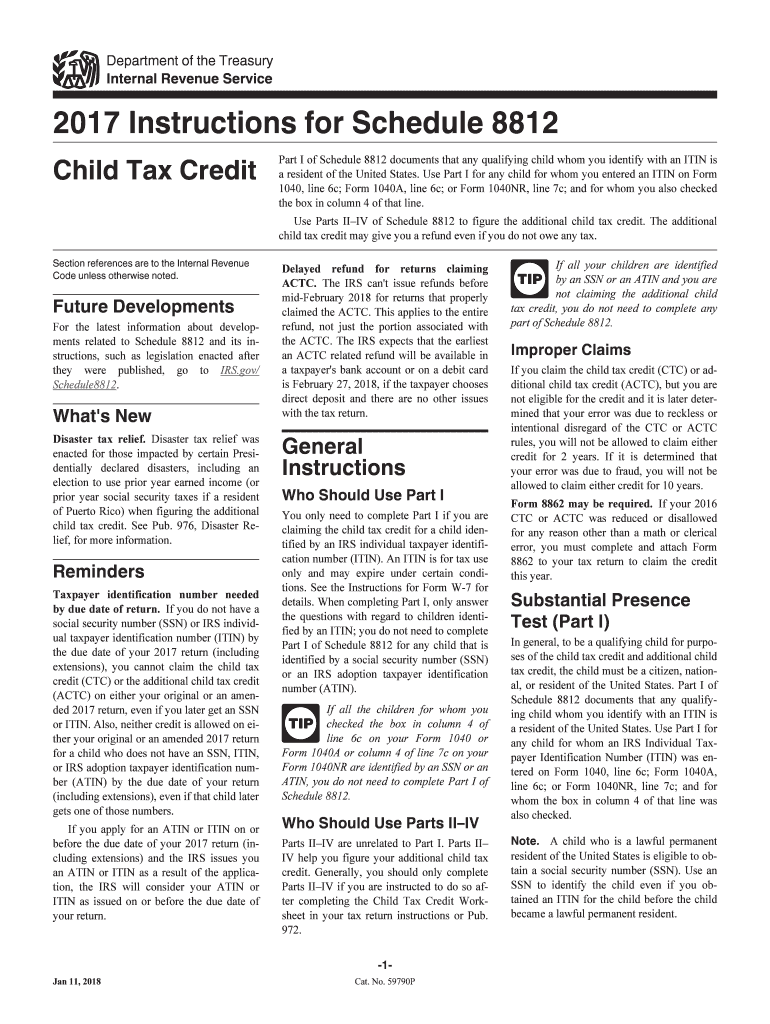

There are currently no advance payments for 2022. These free pdf files are unaltered and are sourced directly from the publisher. Go to www.irs.gov/schedule8812 for instructions and the latest information. Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). The ctc and odc are nonrefundable credits. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc). Web updated for tax year 2022 • february 9, 2023 01:46 pm. Section references are to the internal revenue code unless otherwise noted.

Click any of the irs schedule 8812 form links below to download, save, view, and print the file for the corresponding year. If you received advance payments of the child tax credit in 2021, you will need to report the payment amount on. The ctc and odc are nonrefundable credits. There are currently no advance payments for 2022. The ctc and odc are nonrefundable credits. Web printable form 1040 schedule 8812. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. Go to www.irs.gov/schedule8812 for instructions and the latest information. If you have children and a low tax bill, you may need irs form 8812 to claim all of your child tax credit. Section references are to the internal revenue code unless otherwise noted.

2015 form 8812 pdf Fill out & sign online DocHub

Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc). These.

Form 8812, Additional Child Tax Credit printable pdf download

If you received advance payments of the child tax credit in 2021, you will need to report the payment amount on. Web printable form 1040 schedule 8812. Web updated for tax year 2022 • february 9, 2023 01:46 pm. Go to www.irs.gov/schedule8812 for instructions and the latest information. There are currently no advance payments for 2022.

Top 8 Form 8812 Templates free to download in PDF format

Go to www.irs.gov/schedule8812 for instructions and the latest information. Web advance child tax credit payment reconciliation form 8812. The ctc and odc are nonrefundable credits. If you have children and a low tax bill, you may need irs form 8812 to claim all of your child tax credit. Web use schedule 8812 (form 1040) to figure your child tax credits,.

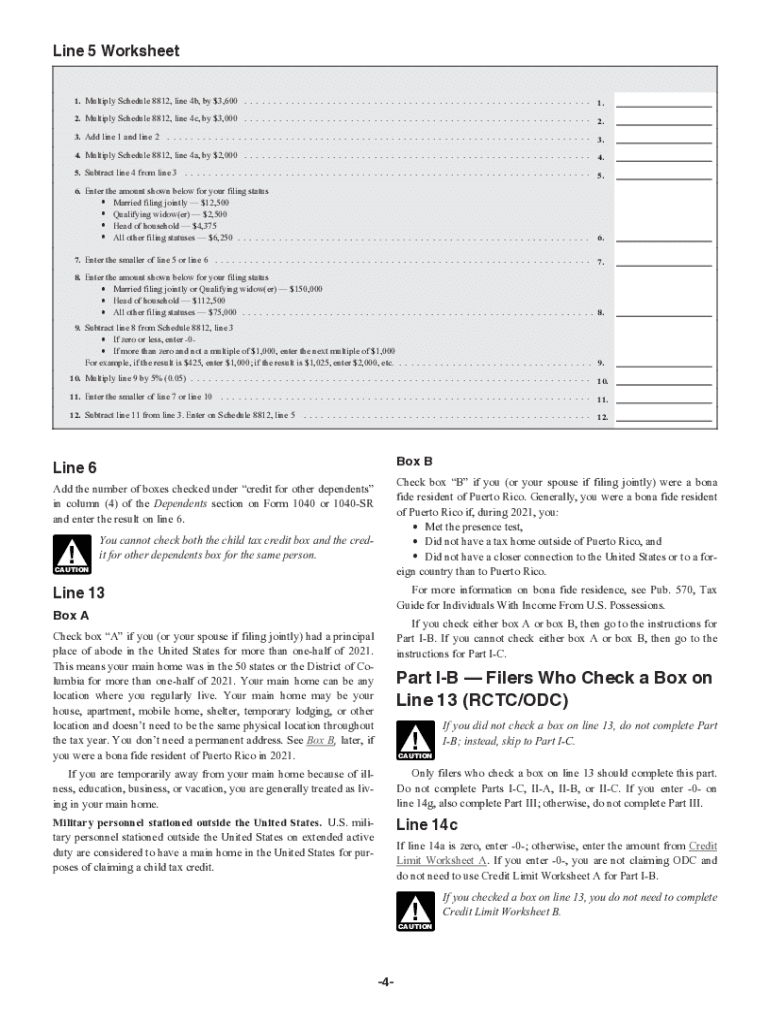

8812 Worksheet

If you received advance payments of the child tax credit in 2021, you will need to report the payment amount on. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments.

What Is The Credit Limit Worksheet A For Form 8812

Go to www.irs.gov/schedule8812 for instructions and the latest information. If you received advance payments of the child tax credit in 2021, you will need to report the payment amount on. The actc may give you a refund even if you do not owe any tax. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child.

Schedule 8812 Instructions Fill Out and Sign Printable PDF Template

Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). If you have children and a low tax bill, you may need irs form 8812 to claim all of your child tax credit. Web use schedule 8812 (form 1040) to figure your child tax credits, to.

Irs Instructions Form 8812 Fill Out and Sign Printable PDF Template

Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Section references are to the internal revenue code unless otherwise noted. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc). The actc may give you a refund.

8812 Instructions Tax Form Fill Out and Sign Printable PDF Template

Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. Web printable form 1040 schedule 8812. Web advance child tax credit payment reconciliation form 8812. The actc may give you a refund even if you do not owe any tax. Web updated for tax year 2022 • february 9, 2023 01:46 pm.

Schedule 8812 What is IRS Form Schedule 8812 & Filing Instructions

This is for 2021 returns only. Click any of the irs schedule 8812 form links below to download, save, view, and print the file for the corresponding year. Web updated for tax year 2022 • february 9, 2023 01:46 pm. If you have children and a low tax bill, you may need irs form 8812 to claim all of your.

Credit Limit Worksheets A Form

Click any of the irs schedule 8812 form links below to download, save, view, and print the file for the corresponding year. These free pdf files are unaltered and are sourced directly from the publisher. The actc is a refundable credit. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and.

Section References Are To The Internal Revenue Code Unless Otherwise Noted.

Web updated for tax year 2022 • february 9, 2023 01:46 pm. If you received advance payments of the child tax credit in 2021, you will need to report the payment amount on. Go to www.irs.gov/schedule8812 for instructions and the latest information. There are currently no advance payments for 2022.

The Actc May Give You A Refund Even If You Do Not Owe Any Tax.

The ctc and odc are nonrefundable credits. Web 2020 instructions for schedule 8812 (rev. The ctc and odc are nonrefundable credits. Click any of the irs schedule 8812 form links below to download, save, view, and print the file for the corresponding year.

Web Advance Child Tax Credit Payment Reconciliation Form 8812.

Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. Go to www.irs.gov/schedule8812 for instructions and the latest information. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc).

This Is For 2021 Returns Only.

These free pdf files are unaltered and are sourced directly from the publisher. If you have children and a low tax bill, you may need irs form 8812 to claim all of your child tax credit. Web printable form 1040 schedule 8812. The actc is a refundable credit.