Form 8832 Pdf

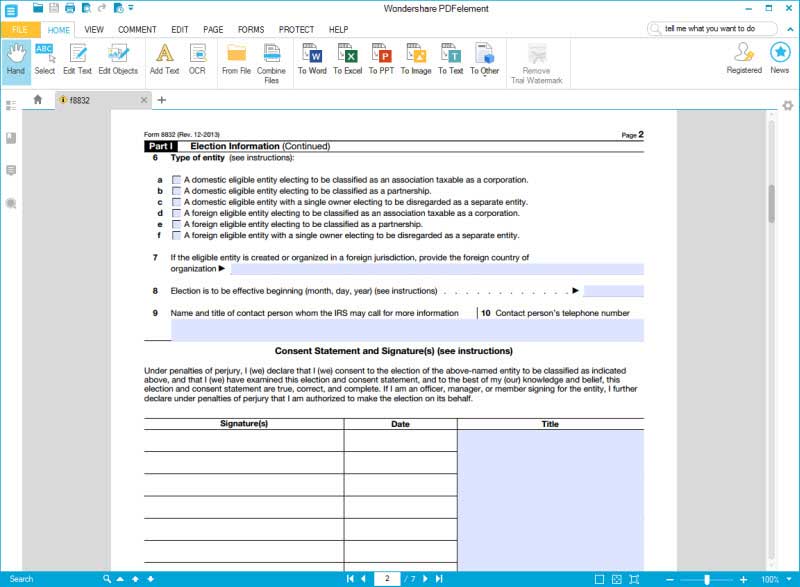

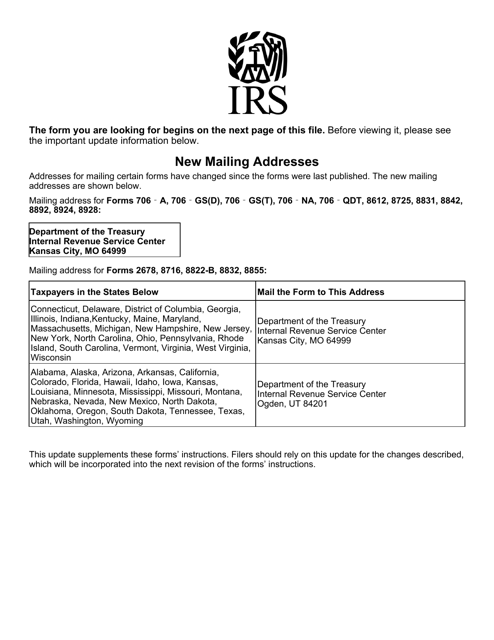

Form 8832 Pdf - Web in our simple guide, we'll walk you through form 8832 instructions so you can change how your organization will be classified for federal taxation purposes. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Number, street, and room or suite no. Web what is irs form 8832? Web form 8832 is the irs form a new limited liability company (llc) uses to elect how it wants to be taxed or an established llc uses to change its current tax classification. Web if the entity qualifies and files timely in accordance with rev. Here’s a quick overview of form 8832: Web to start your form 8832 submission, you can download the full form here as a pdf. Web purpose of form an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. Tax form 8832 is typically used by partnerships or limited liability companies (llcs) to choose or change their tax classification.

Information to have before filling out irs form 8832; Name of eligible entity making election. Below are more details on who is eligible to file it, how to complete, and how to send it to the irs. Tax form 8832 is typically used by partnerships or limited liability companies (llcs) to choose or change their tax classification. An eligible entity is classified for federal tax purposes under the default rules described below unless it files form 8832 or Web to start your form 8832 submission, you can download the full form here as a pdf. Web form 8832 is the irs form a new limited liability company (llc) uses to elect how it wants to be taxed or an established llc uses to change its current tax classification. Web if the entity qualifies and files timely in accordance with rev. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Number, street, and room or suite no.

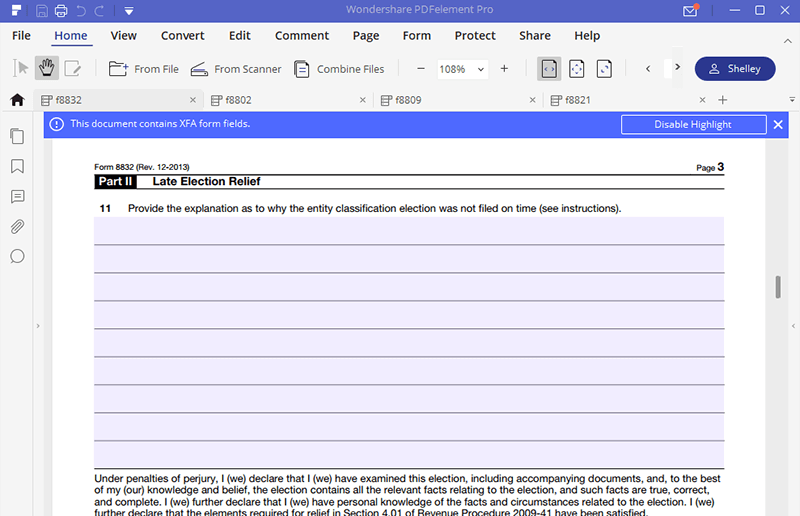

Below are more details on who is eligible to file it, how to complete, and how to send it to the irs. If the entity does not qualify under the provisions of the revenue procedure, its only recourse is to request a private letter ruling. An eligible entity is classified for federal tax purposes under the default rules described below unless it files form 8832 or Web to start your form 8832 submission, you can download the full form here as a pdf. Web at a glance. Web form 8832 is the irs form a new limited liability company (llc) uses to elect how it wants to be taxed or an established llc uses to change its current tax classification. Who should file form 8832? City or town, state, and zip code. Llcs are formed at the state level. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes.

(PDF) Form 8832 Shane Dorn Academia.edu

Information to have before filling out irs form 8832; If the entity does not qualify under the provisions of the revenue procedure, its only recourse is to request a private letter ruling. Who should file form 8832? Web to start your form 8832 submission, you can download the full form here as a pdf. Web if the entity qualifies and.

Fill Free fillable Form 8832 Entity Classification Election 2013 PDF form

Below are more details on who is eligible to file it, how to complete, and how to send it to the irs. Web what is irs form 8832? Web form 8832 is the irs form a new limited liability company (llc) uses to elect how it wants to be taxed or an established llc uses to change its current tax.

Irs Form 8832 Fillable Pdf Printable Forms Free Online

What happens if i don't file form 8832? Number, street, and room or suite no. Llcs are formed at the state level. If the entity does not qualify under the provisions of the revenue procedure, its only recourse is to request a private letter ruling. Form 8832 is used by eligible entities to choose how they are classified for federal.

IRS Form 8832 How to Fill it Right

City or town, state, and zip code. If the entity does not qualify under the provisions of the revenue procedure, its only recourse is to request a private letter ruling. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. An eligible entity is classified for federal tax purposes under the default rules.

Form 8832 Edit, Fill, Sign Online Handypdf

Who should file form 8832? City or town, state, and zip code. If the entity does not qualify under the provisions of the revenue procedure, its only recourse is to request a private letter ruling. Web in our simple guide, we'll walk you through form 8832 instructions so you can change how your organization will be classified for federal taxation.

IRS Form 8832 Instructions and FAQs for Business Owners

Llcs are formed at the state level. Tax form 8832 is typically used by partnerships or limited liability companies (llcs) to choose or change their tax classification. City or town, state, and zip code. Web what is irs form 8832? Web in our simple guide, we'll walk you through form 8832 instructions so you can change how your organization will.

IRS Form 8832 How to Fill it Right

Web in our simple guide, we'll walk you through form 8832 instructions so you can change how your organization will be classified for federal taxation purposes. Web if the entity qualifies and files timely in accordance with rev. What happens if i don't file form 8832? Number, street, and room or suite no. Web to start your form 8832 submission,.

Irs Form 8832 Fillable Pdf Printable Forms Free Online

Name of eligible entity making election. Web if the entity qualifies and files timely in accordance with rev. Web at a glance. Web in our simple guide, we'll walk you through form 8832 instructions so you can change how your organization will be classified for federal taxation purposes. Web what is irs form 8832?

Power Of Attorney Pdf Irs

An eligible entity is classified for federal tax purposes under the default rules described below unless it files form 8832 or Tax form 8832 is typically used by partnerships or limited liability companies (llcs) to choose or change their tax classification. What happens if i don't file form 8832? Web information about form 8832, entity classification election, including recent updates,.

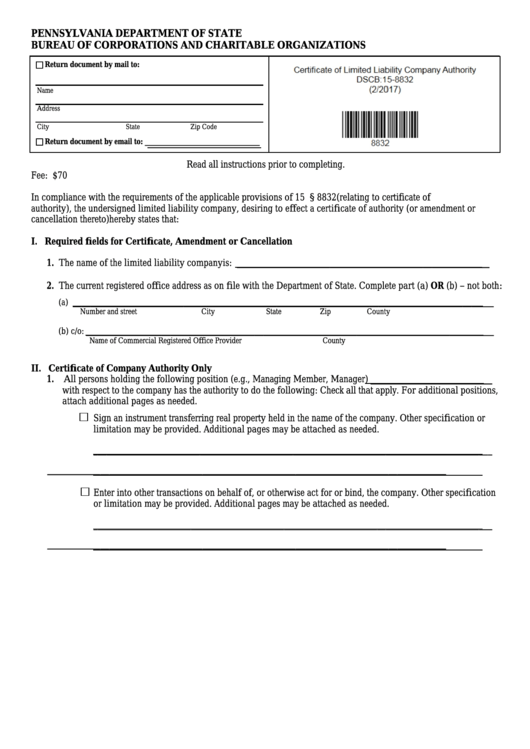

Fillable Form Dscb158832 Certificate Of Authority/amendment

Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Tax form 8832 is typically used by partnerships or limited liability companies (llcs) to choose or change their tax classification. Web at a glance. Web if the entity qualifies and files timely in accordance with rev. Information to have before filling out irs.

Web Information About Form 8832, Entity Classification Election, Including Recent Updates, Related Forms, And Instructions On How To File.

Here’s a quick overview of form 8832: Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. What happens if i don't file form 8832? Web if the entity qualifies and files timely in accordance with rev.

Web Purpose Of Form An Eligible Entity Uses Form 8832 To Elect How It Will Be Classified For Federal Tax Purposes, As A Corporation, A Partnership, Or An Entity Disregarded As Separate From Its Owner.

February 2010) department of the treasury internal revenue service. Web in our simple guide, we'll walk you through form 8832 instructions so you can change how your organization will be classified for federal taxation purposes. Information to have before filling out irs form 8832; Web form 8832 is the irs form a new limited liability company (llc) uses to elect how it wants to be taxed or an established llc uses to change its current tax classification.

Below Are More Details On Who Is Eligible To File It, How To Complete, And How To Send It To The Irs.

If the entity does not qualify under the provisions of the revenue procedure, its only recourse is to request a private letter ruling. Web to start your form 8832 submission, you can download the full form here as a pdf. Number, street, and room or suite no. City or town, state, and zip code.

Web At A Glance.

Who should file form 8832? An eligible entity is classified for federal tax purposes under the default rules described below unless it files form 8832 or Tax form 8832 is typically used by partnerships or limited liability companies (llcs) to choose or change their tax classification. Web what is irs form 8832?