Form 886-A Frozen Refund

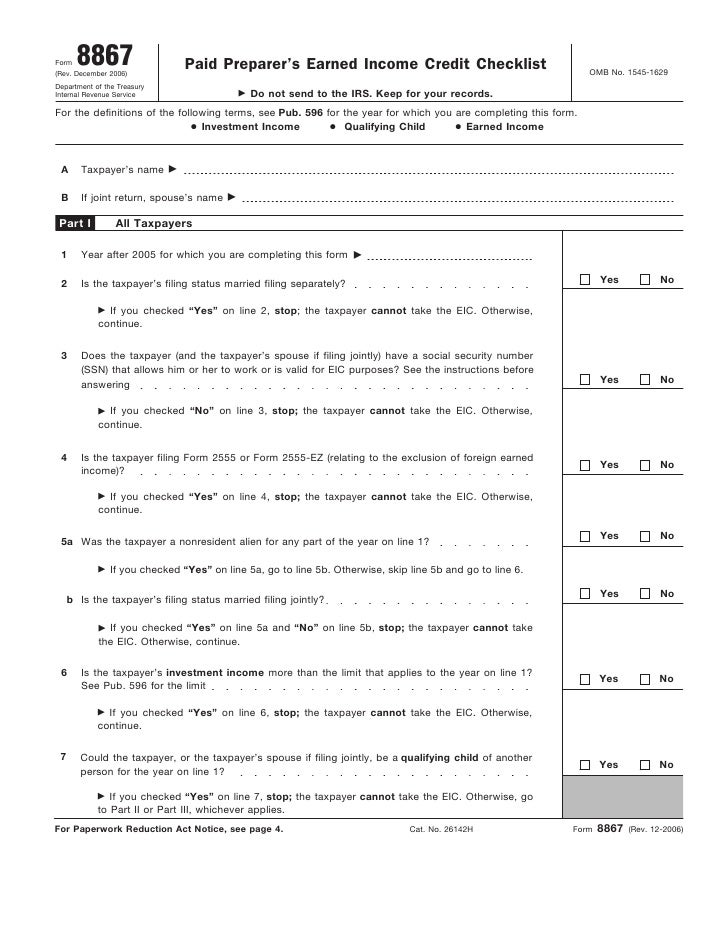

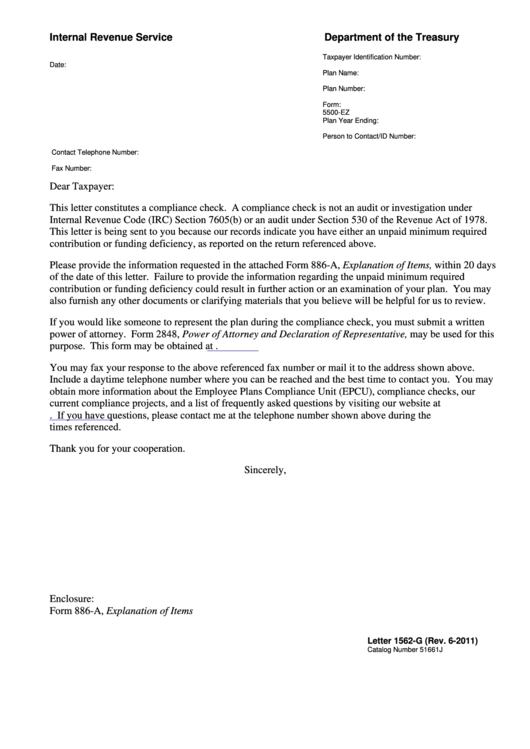

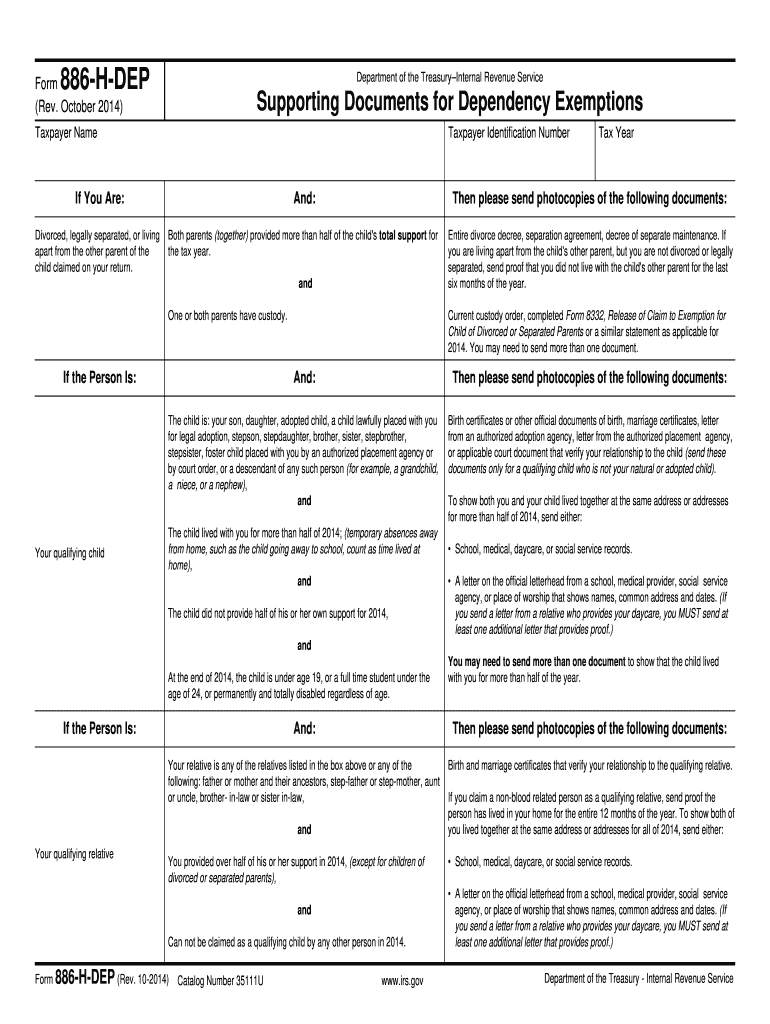

Form 886-A Frozen Refund - Over 30 days ago i received a letter of review and request for supporting documents. Web the title of irs form 886a is explanation of items. Web the form 3610 format discussed in paragraph (4)(a) can be shown on the tax computation schedule (form 5278, form 4549, etc). If the frozen refund is shown on. Web received a 4549 and 886 a notice from irs today, now what should i do. March 2011) begins on the next page. Web overview this letter is issued to inform the taxpayer of proposed changes stemming from an irs examination. Web for example, a penalty may be imposed when there is a “frozen refund,” a situation where a taxpayer has claimed a refund on an original return, but it has not yet been refunded. Web normally, you’ll receive irs letter cp88 indicating that your refund is frozen until the irs completes the audit. Since the purpose of form 886a is to explain something, the irs uses it for many various reasons.

Web the module is frozen from offset or refund until the freeze is released by the posting of the tc 150. If the frozen refund is shown on. Web normally, you’ll receive irs letter cp88 indicating that your refund is frozen until the irs completes the audit. Documents you need to send. Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. Web payments and credits from a filed return that are neither applied to a tax liability nor refunded to the taxpayer are called frozen refunds. Web the title of irs form 886a is explanation of items. Web for example, a penalty may be imposed when there is a “frozen refund,” a situation where a taxpayer has claimed a refund on an original return, but it has not yet been refunded. Web overview this letter is issued to inform the taxpayer of proposed changes stemming from an irs examination. The zip code for where to file separately an exact copy of the initial year filing of form 8886 has.

Web overview this letter is issued to inform the taxpayer of proposed changes stemming from an irs examination. The letter explains the changes to the tax return and requests payment. Instructions for form 8886 (rev. Documents you need to send. March 2011) begins on the next page. Web the form 3610 format discussed in paragraph (4)(a) can be shown on the tax computation schedule (form 5278, form 4549, etc). A statement from any government agency verifying the amount and type of benefits you and/or your dependent received for. January 1994) explanations of items schedule number or exhibit name of taxpayer tax identification number year/period ended n/a please check the. Web the title of irs form 886a is explanation of items. Most often, form 886a is.

Form 886 A Worksheet Worksheet List

Web normally, you’ll receive irs letter cp88 indicating that your refund is frozen until the irs completes the audit. Most often, form 886a is. Over 30 days ago i received a letter of review and request for supporting documents. Web the module is frozen from offset or refund until the freeze is released by the posting of the tc 150..

36 Irs Form 886 A Worksheet support worksheet

Web the module is frozen from offset or refund until the freeze is released by the posting of the tc 150. Most often, form 886a is. Web a statement of account from a child support agency. Web the form 3610 format discussed in paragraph (4)(a) can be shown on the tax computation schedule (form 5278, form 4549, etc). Web received.

Home Loan Joint Declaration Form Pdf

Over 30 days ago i received a letter of review and request for supporting documents. Web normally, you’ll receive irs letter cp88 indicating that your refund is frozen until the irs completes the audit. If the frozen refund is shown on. If you respond with the requested information by the. Web the module is frozen from offset or refund until.

36 Irs Form 886 A Worksheet support worksheet

March 2011) begins on the next page. Web normally, you’ll receive irs letter cp88 indicating that your refund is frozen until the irs completes the audit. Web for example, a penalty may be imposed when there is a “frozen refund,” a situation where a taxpayer has claimed a refund on an original return, but it has not yet been refunded..

Form 886A Explanation Of Items Department Of Treasury printable

January 1994) explanations of items schedule number or exhibit name of taxpayer tax identification number year/period ended n/a please check the. March 2011) begins on the next page. A statement from any government agency verifying the amount and type of benefits you and/or your dependent received for. Most often, form 886a is. Instructions for form 8886 (rev.

886 Form Fill Out and Sign Printable PDF Template signNow

If you participated in this reportable transaction through a partnership, s. A statement from any government agency verifying the amount and type of benefits you and/or your dependent received for. Web received a 4549 and 886 a notice from irs today, now what should i do. Web a statement of account from a child support agency. The zip code for.

886 Fill out & sign online DocHub

March 2011) begins on the next page. Instructions for form 8886 (rev. Web overview this letter is issued to inform the taxpayer of proposed changes stemming from an irs examination. Web the module is frozen from offset or refund until the freeze is released by the posting of the tc 150. The zip code for where to file separately an.

36 Irs Form 886 A Worksheet support worksheet

Web the module is frozen from offset or refund until the freeze is released by the posting of the tc 150. Web received a 4549 and 886 a notice from irs today, now what should i do. Web overview this letter is issued to inform the taxpayer of proposed changes stemming from an irs examination. January 1994) explanations of items.

Irs Form 886 A Worksheet Worksheet List

Web the title of irs form 886a is explanation of items. Most often, form 886a is. Web for example, a penalty may be imposed when there is a “frozen refund,” a situation where a taxpayer has claimed a refund on an original return, but it has not yet been refunded. Web payments and credits from a filed return that are.

36 Irs Form 886 A Worksheet support worksheet

Web enter the number of “same as or substantially similar” transactions reported on this form. Web normally, you’ll receive irs letter cp88 indicating that your refund is frozen until the irs completes the audit. Web overview this letter is issued to inform the taxpayer of proposed changes stemming from an irs examination. March 2011) begins on the next page. The.

Instructions For Form 8886 (Rev.

January 1994) explanations of items schedule number or exhibit name of taxpayer tax identification number year/period ended n/a please check the. Web payments and credits from a filed return that are neither applied to a tax liability nor refunded to the taxpayer are called frozen refunds. Over 30 days ago i received a letter of review and request for supporting documents. A statement from any government agency verifying the amount and type of benefits you and/or your dependent received for.

Most Often, Form 886A Is.

Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. If the frozen refund is shown on. Web the form 3610 format discussed in paragraph (4)(a) can be shown on the tax computation schedule (form 5278, form 4549, etc). Web the module is frozen from offset or refund until the freeze is released by the posting of the tc 150.

The Letter Explains The Changes To The Tax Return And Requests Payment.

Web overview this letter is issued to inform the taxpayer of proposed changes stemming from an irs examination. The zip code for where to file separately an exact copy of the initial year filing of form 8886 has. Web received a 4549 and 886 a notice from irs today, now what should i do. If you respond with the requested information by the.

Documents You Need To Send.

Web enter the number of “same as or substantially similar” transactions reported on this form. March 2011) begins on the next page. Web for example, a penalty may be imposed when there is a “frozen refund,” a situation where a taxpayer has claimed a refund on an original return, but it has not yet been refunded. Web normally, you’ll receive irs letter cp88 indicating that your refund is frozen until the irs completes the audit.