Form 8867 Instructions

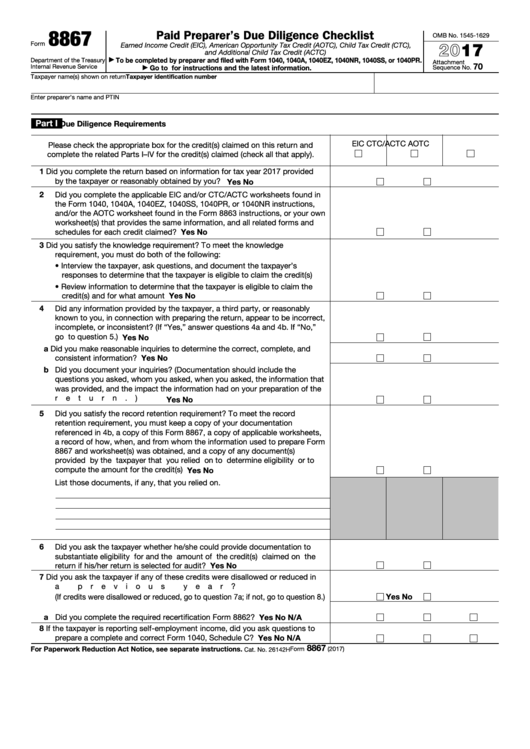

Form 8867 Instructions - Keep all five of the following records for 3 years from the latest of the dates specified later in document retention. Web parts of form 8867 compute the credits and complete all applicable credit worksheets, forms and schedules interview the client, make a record of your questions and the client’s responses, and review information to determine. November 2022) department of the treasury internal revenue service. For any information that appeared incorrect, inconsistent or incomplete,. Interviewing the taxpayer, asking adequate questions, contemporaneously documenting the questions and the taxpayer’s responses on the return or in your. Submit form 8867 in the manner required. Keep a copy of the five records listed above; Web form 8867, paid preparer’s due diligence checklist, must be filed with the tax return for any taxpayer claiming eic, the ctc/actc, and/or the aotc. Web enter preparer’s name and ptin for paperwork reduction act notice, see separate instructions. As part of exercising due diligence, the preparer must interview the client, ask adequate questions,

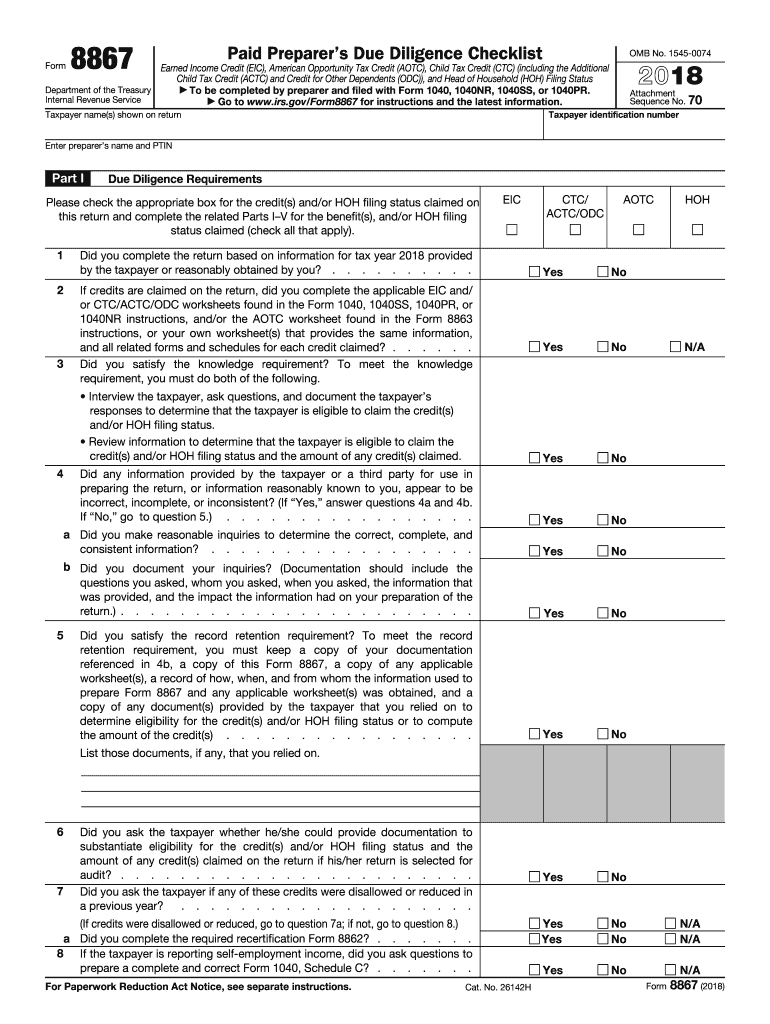

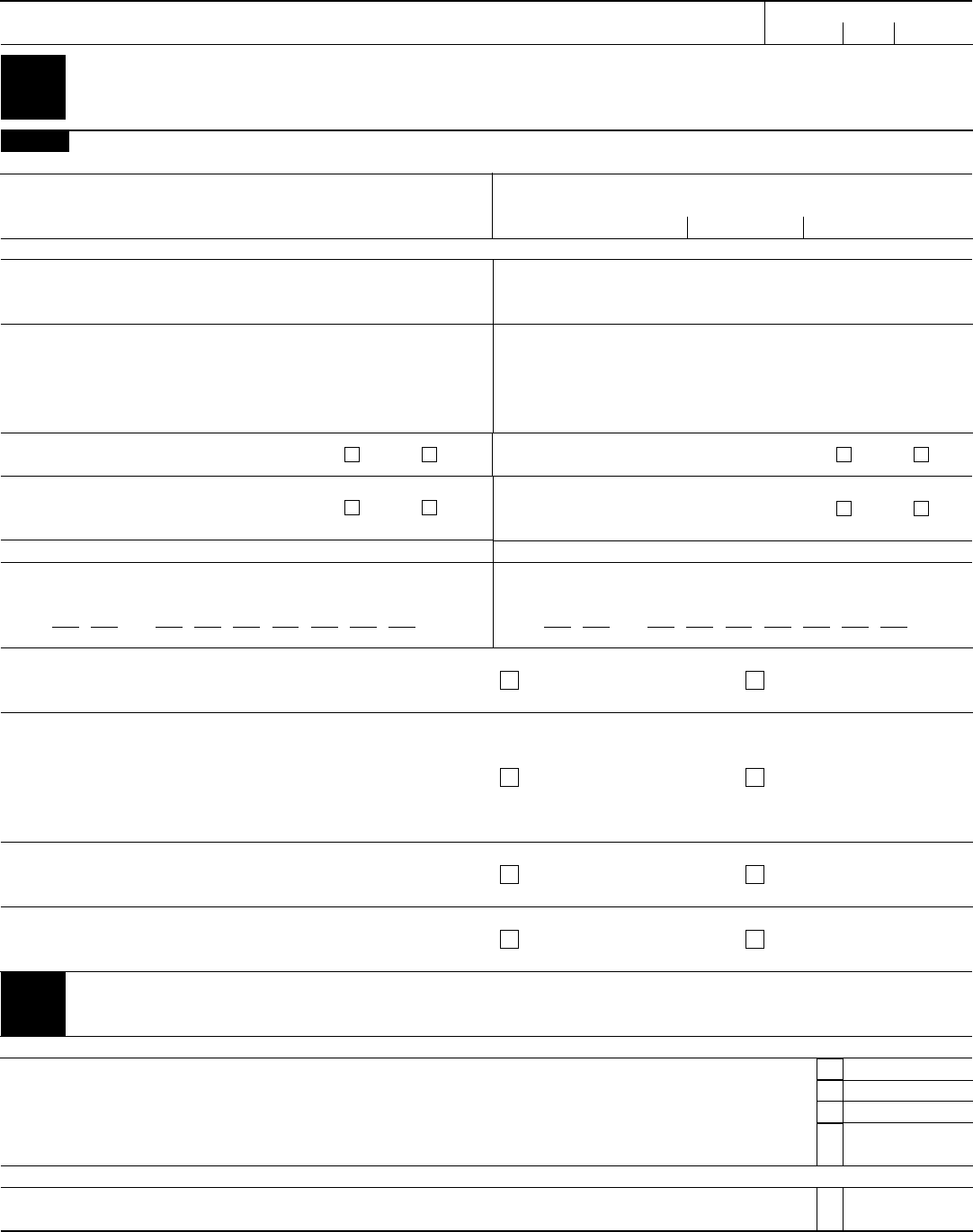

Keep a copy of the five records listed above; Submit form 8867 in the manner required. Future developments for the latest information about developments related to form 8867 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8867. Interviewing the taxpayer, asking adequate questions, contemporaneously documenting the questions and the taxpayer’s responses on the return or in your. Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared, such as the earned income tax credit (eitc), child tax credit (ctc), additional child tax credit (actc), credit for other dependents (odc), american opportunity credit (aotc) and/or the h. 26142hform 8867 (2018) form 8867 (2018) page 2 part iii due diligence questions for returns claiming ctc/actc/odc (if the return does not claim ctc, actc, or odc, go to part iv.) Complete form 8867 truthfully and accurately and complete the actions described on form 8867 for any applicable credit(s) claimed and hoh filing status, if claimed. Meet the knowledge requirement by. As part of exercising due diligence, the preparer must interview the client, ask adequate questions, Web enter preparer’s name and ptin for paperwork reduction act notice, see separate instructions.

November 2022) department of the treasury internal revenue service. Keep all five of the following records for 3 years from the latest of the dates specified later in document retention. For any information that appeared incorrect, inconsistent or incomplete,. Web enter preparer’s name and ptin for paperwork reduction act notice, see separate instructions. As part of exercising due diligence, the preparer must interview the client, ask adequate questions, Complete form 8867 truthfully and accurately and complete the actions described on form 8867 for any applicable credit(s) claimed and hoh filing status, if claimed. Keep a copy of the five records listed above; Web form 8867, paid preparer’s due diligence checklist, must be filed with the tax return for any taxpayer claiming eic, the ctc/actc, and/or the aotc. Future developments for the latest information about developments related to form 8867 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8867. Meet the knowledge requirement by.

Form 8867 Fill Out and Sign Printable PDF Template signNow

Keep a copy of the five records listed above; Complete form 8867 truthfully and accurately and complete the actions described on form 8867 for any applicable credit(s) claimed and hoh filing status, if claimed. Web enter preparer’s name and ptin for paperwork reduction act notice, see separate instructions. Submit form 8867 in the manner required. November 2022) department of the.

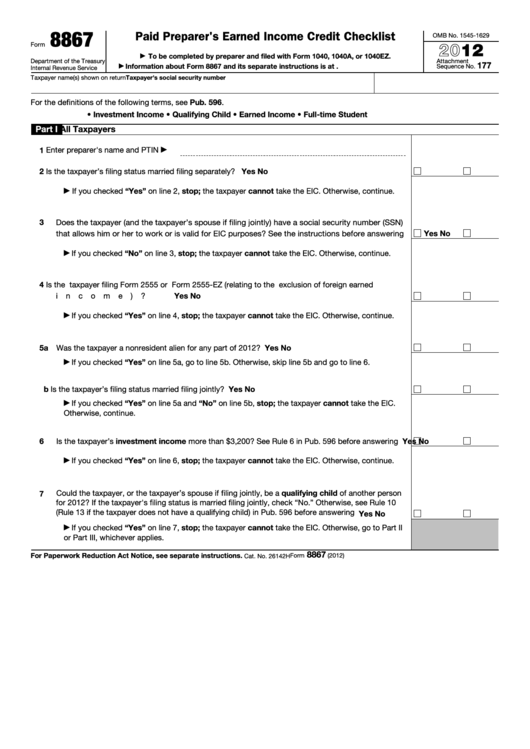

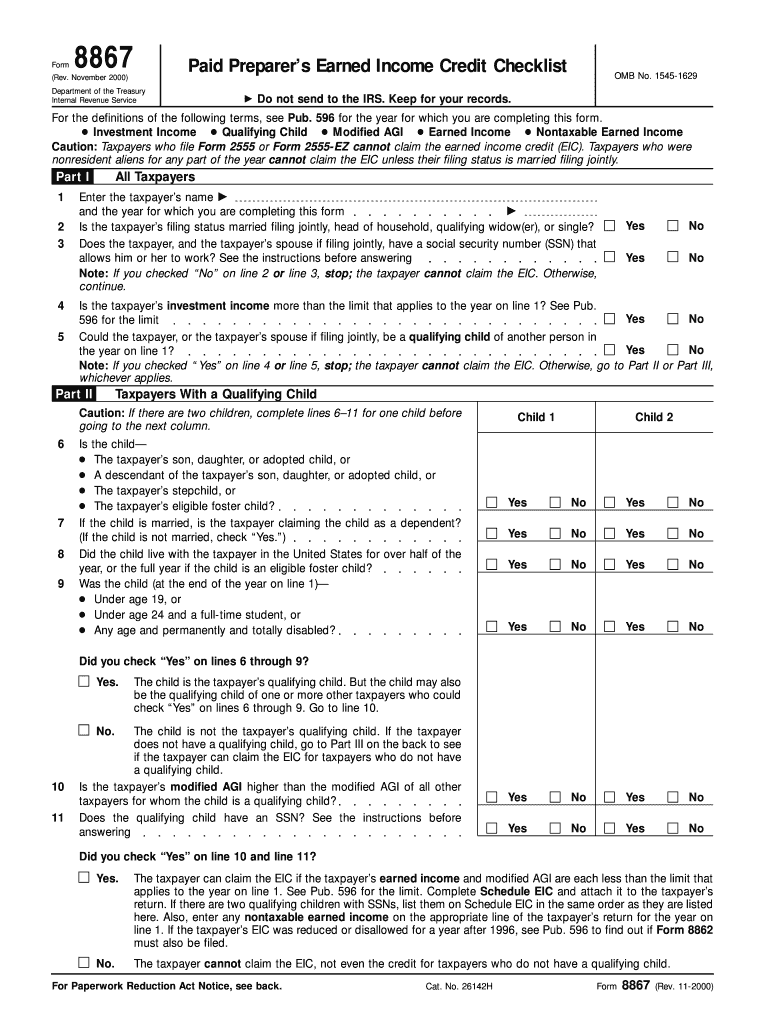

Fillable Form 8867 Paid Preparer'S Earned Credit Checklist

Interviewing the taxpayer, asking adequate questions, contemporaneously documenting the questions and the taxpayer’s responses on the return or in your. Web form 8867, paid preparer’s due diligence checklist, must be filed with the tax return for any taxpayer claiming eic, the ctc/actc, and/or the aotc. Future developments for the latest information about developments related to form 8867 and its instructions,.

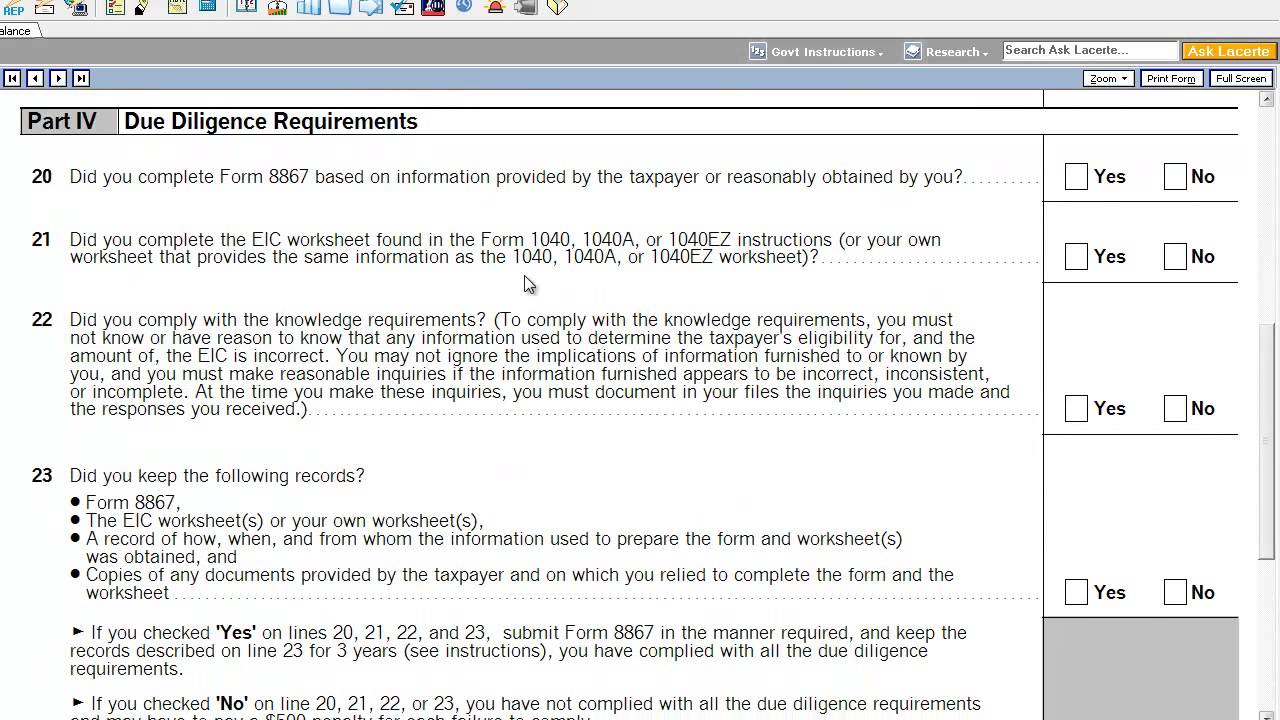

Form 8867, Paid Preparer's Earned Credit Checklist YouTube

As part of exercising due diligence, the preparer must interview the client, ask adequate questions, Web form 8867, paid preparer’s due diligence checklist, must be filed with the tax return for any taxpayer claiming eic, the ctc/actc, and/or the aotc. Future developments for the latest information about developments related to form 8867 and its instructions, such as legislation enacted after.

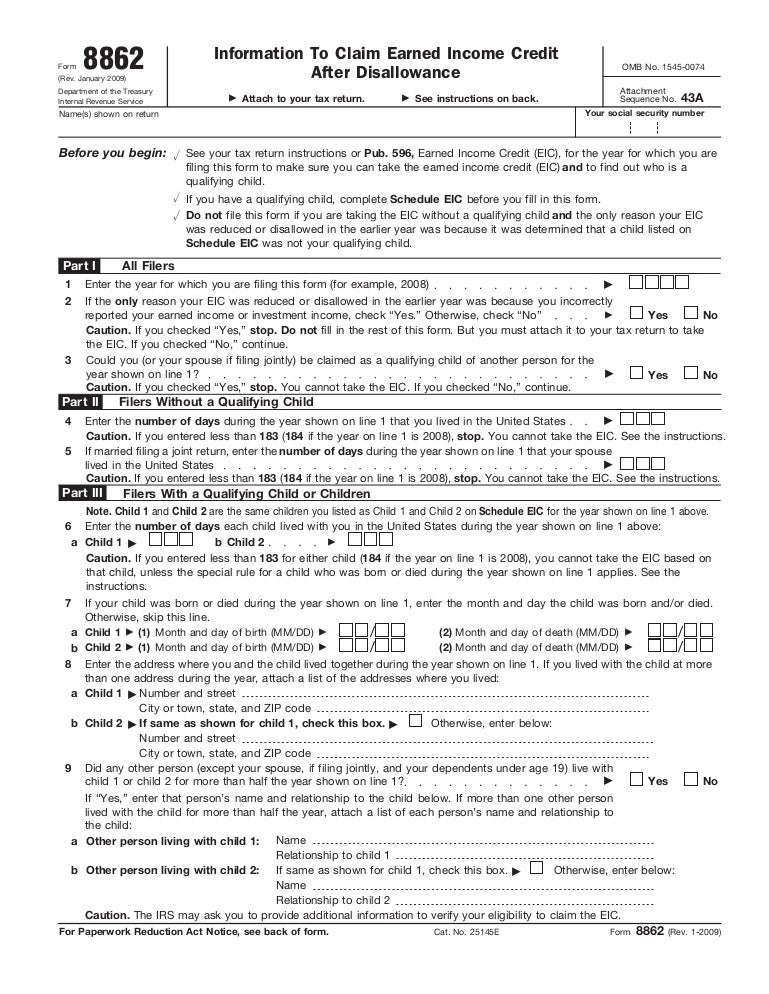

Form 8862Information to Claim Earned Credit for Disallowance

As part of exercising due diligence, the preparer must interview the client, ask adequate questions, Web enter preparer’s name and ptin for paperwork reduction act notice, see separate instructions. November 2022) department of the treasury internal revenue service. Complete form 8867 truthfully and accurately and complete the actions described on form 8867 for any applicable credit(s) claimed and hoh filing.

Form 8867 Fill Out and Sign Printable PDF Template signNow

November 2022) department of the treasury internal revenue service. Future developments for the latest information about developments related to form 8867 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8867. Submit form 8867 in the manner required. Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria.

Fillable Form 8867 Paid Preparer'S Earned Credit Checklist

Future developments for the latest information about developments related to form 8867 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8867. Complete form 8867 truthfully and accurately and complete the actions described on form 8867 for any applicable credit(s) claimed and hoh filing status, if claimed. November 2022) department of the treasury internal revenue service..

Form 8863 Instructions & Information on the Education Credit Form

Web parts of form 8867 compute the credits and complete all applicable credit worksheets, forms and schedules interview the client, make a record of your questions and the client’s responses, and review information to determine. Future developments for the latest information about developments related to form 8867 and its instructions, such as legislation enacted after they were published, go to.

Form 8867 Fill out & sign online DocHub

26142hform 8867 (2018) form 8867 (2018) page 2 part iii due diligence questions for returns claiming ctc/actc/odc (if the return does not claim ctc, actc, or odc, go to part iv.) Web form 8867, paid preparer’s due diligence checklist, must be filed with the tax return for any taxpayer claiming eic, the ctc/actc, and/or the aotc. Keep a copy of.

Form 8865 (Schedule O) Transfer of Property to a Foreign Partnership

Interviewing the taxpayer, asking adequate questions, contemporaneously documenting the questions and the taxpayer’s responses on the return or in your. Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared, such as the earned income tax credit (eitc), child tax credit (ctc), additional child.

Form 8863 Edit, Fill, Sign Online Handypdf

Web enter preparer’s name and ptin for paperwork reduction act notice, see separate instructions. November 2022) department of the treasury internal revenue service. As part of exercising due diligence, the preparer must interview the client, ask adequate questions, Keep a copy of the five records listed above; For any information that appeared incorrect, inconsistent or incomplete,.

Web The Purpose Of The Form Is To Ensure That The Practitioner Has Considered All Applicable Eligibility Criteria For Certain Tax Credits For Each Return Prepared, Such As The Earned Income Tax Credit (Eitc), Child Tax Credit (Ctc), Additional Child Tax Credit (Actc), Credit For Other Dependents (Odc), American Opportunity Credit (Aotc) And/Or The H.

Web parts of form 8867 compute the credits and complete all applicable credit worksheets, forms and schedules interview the client, make a record of your questions and the client’s responses, and review information to determine. Meet the knowledge requirement by. Interviewing the taxpayer, asking adequate questions, contemporaneously documenting the questions and the taxpayer’s responses on the return or in your. For any information that appeared incorrect, inconsistent or incomplete,.

November 2022) Department Of The Treasury Internal Revenue Service.

Web enter preparer’s name and ptin for paperwork reduction act notice, see separate instructions. Submit form 8867 in the manner required. Future developments for the latest information about developments related to form 8867 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8867. Web form 8867, paid preparer’s due diligence checklist, must be filed with the tax return for any taxpayer claiming eic, the ctc/actc, and/or the aotc.

26142Hform 8867 (2018) Form 8867 (2018) Page 2 Part Iii Due Diligence Questions For Returns Claiming Ctc/Actc/Odc (If The Return Does Not Claim Ctc, Actc, Or Odc, Go To Part Iv.)

Keep a copy of the five records listed above; Keep all five of the following records for 3 years from the latest of the dates specified later in document retention. Complete form 8867 truthfully and accurately and complete the actions described on form 8867 for any applicable credit(s) claimed and hoh filing status, if claimed. As part of exercising due diligence, the preparer must interview the client, ask adequate questions,