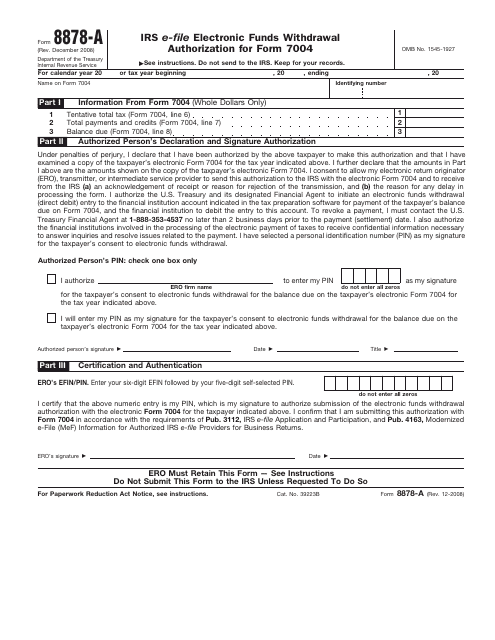

Form 8878 A

Form 8878 A - (0 / 5) 0 votes. Web purpose of form complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the electronic return originator (ero) to. These forms are similar to form 8879 and are. Web complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the electronic return originator (ero) to enter or generate. Web report error it appears you don't have a pdf plugin for this browser. Web form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification number (pin) on form 4868 or form 2350. Amount you are paying from form 4868, line 7. Web extension of time to file (form 4868 or form 2350). Miscellaneous application for extension (form 7004) / form 7004. Web form 8878 a is a form filed by u.s.

Amount you are paying from form 4868, line 7. These forms are similar to form 8879 and are. Taxpayers who have not or will not itemize their deductions and claim a standard deduction on their income tax return. Complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the. Web complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the electronic return originator (ero) to enter or generate. Web form 8878 a is a form filed by u.s. Web report error it appears you don't have a pdf plugin for this browser. Miscellaneous application for extension (form 7004) / form 7004. Web extension of time to file (form 4868 or form 2350). Easily fill out and sign forms.

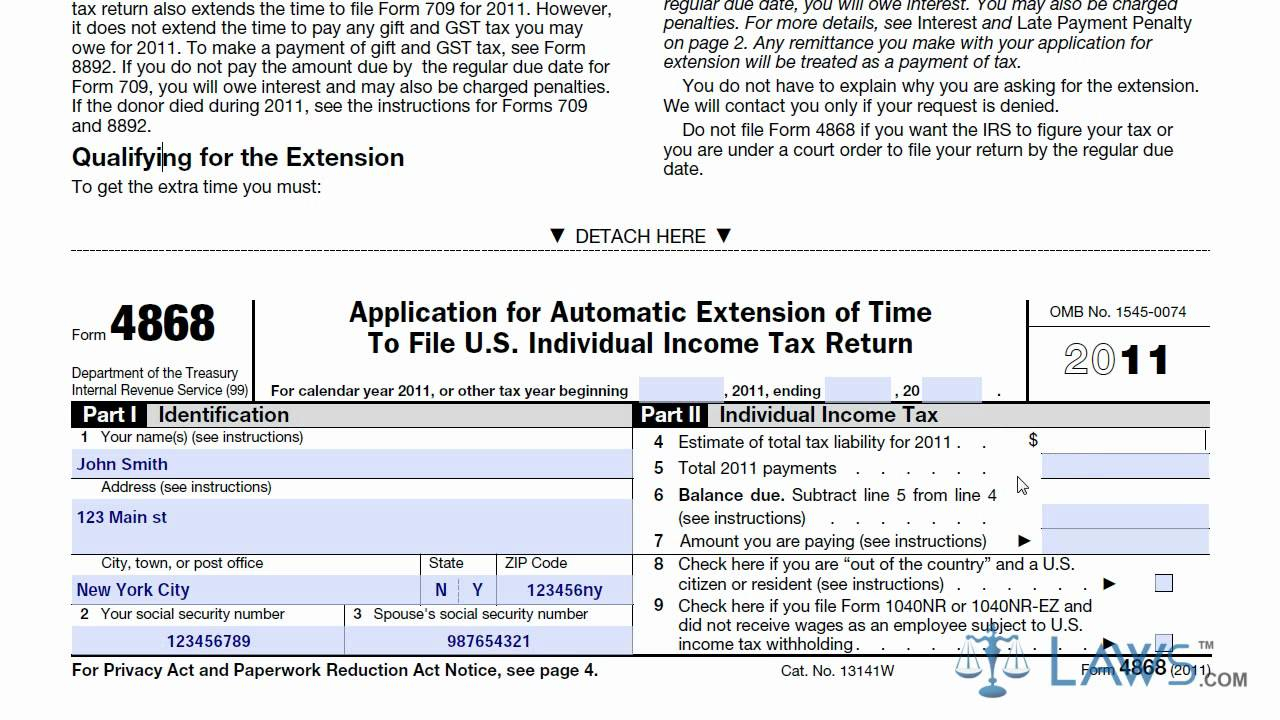

Complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the. Web extension of time to file (form 4868 or form 2350). (0 / 5) 0 votes. Web form 4868, application for automatic extension of time to file u.s. Web form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification number (pin) on form 4868 or form 2350. Miscellaneous application for extension (form 7004) / form 7004. These forms are similar to form 8879 and are. Easily fill out and sign forms. Web form 8878 a is a form filed by u.s. Amount you are paying from form 4868, line 7.

IRS Form 8878A Download Fillable PDF or Fill Online IRS EFile

Web report error it appears you don't have a pdf plugin for this browser. (0 / 5) 0 votes. Complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the. Easily fill out and sign forms. Taxpayers who have not or will not itemize their deductions and claim a standard.

Printable 4868 Tax Form Master of Documents

Taxpayers who have not or will not itemize their deductions and claim a standard deduction on their income tax return. These forms are similar to form 8879 and are. Miscellaneous application for extension (form 7004) / form 7004. Web form 8878 a is a form filed by u.s. Web report error it appears you don't have a pdf plugin for.

Financial Concept Meaning Form 8878a IRS Efile Electronic Funds

Web form 4868, application for automatic extension of time to file u.s. Taxpayers who have not or will not itemize their deductions and claim a standard deduction on their income tax return. (0 / 5) 0 votes. Web purpose of form complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer.

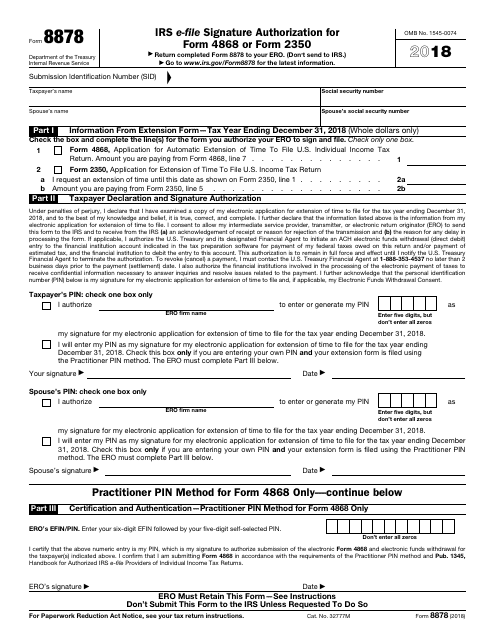

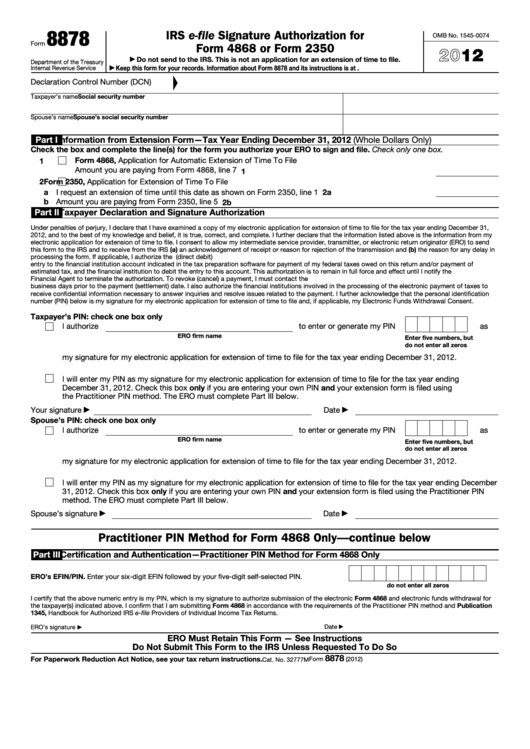

Fillable Form 8878 Irs EFile Signature Authorization For Form 4868

(0 / 5) 0 votes. Web form 8878 a is a form filed by u.s. Miscellaneous application for extension (form 7004) / form 7004. Complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the. Web extension of time to file (form 4868 or form 2350).

Fill Free fillable Form 8878A 2008 Electronic Funds Withdrawal

Web purpose of form complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the electronic return originator (ero) to. These forms are similar to form 8879 and are. Taxpayers who have not or will not itemize their deductions and claim a standard deduction on their income tax return. Web.

Print Irs Extension Form 4868 2021 Calendar Printables Free Blank

Easily fill out and sign forms. Web form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification number (pin) on form 4868 or form 2350. (0 / 5) 0 votes. Web extension of time to file (form 4868 or form 2350). Miscellaneous application for extension (form 7004) / form 7004.

Form 8879 Signature

Web complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the electronic return originator (ero) to enter or generate. (0 / 5) 0 votes. These forms are similar to form 8879 and are. Web form 4868, application for automatic extension of time to file u.s. Web form 8878 allows.

Form FA2656 Download Fillable PDF or Fill Online Electronic Funds

Taxpayers who have not or will not itemize their deductions and claim a standard deduction on their income tax return. Web purpose of form complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the electronic return originator (ero) to. These forms are similar to form 8879 and are. Complete.

Form 8879 Electronic Signature

Miscellaneous application for extension (form 7004) / form 7004. Complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the. Easily fill out and sign forms. Web complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the electronic return.

Fill Free fillable Form 8878 2019 Signature Authorization PDF form

Taxpayers who have not or will not itemize their deductions and claim a standard deduction on their income tax return. Web form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification number (pin) on form 4868 or form 2350. (0 / 5) 0 votes. Web extension of time to file (form.

Web Complete Form 8878 (A) When Form 4868 Is Filed Using The Practitioner Pin Method, Or (B) When The Taxpayer Authorizes The Electronic Return Originator (Ero) To Enter Or Generate.

Web purpose of form complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the electronic return originator (ero) to. Amount you are paying from form 4868, line 7. Web extension of time to file (form 4868 or form 2350). Web report error it appears you don't have a pdf plugin for this browser.

Web Form 8878 Allows The Taxpayer To Authorizes The Electronic Return Originator (Ero) To Enter Or Generate Their Personal Identification Number (Pin) On Form 4868 Or Form 2350.

(0 / 5) 0 votes. Easily fill out and sign forms. Miscellaneous application for extension (form 7004) / form 7004. Web form 8878 a is a form filed by u.s.

Taxpayers Who Have Not Or Will Not Itemize Their Deductions And Claim A Standard Deduction On Their Income Tax Return.

Web form 4868, application for automatic extension of time to file u.s. These forms are similar to form 8879 and are. Complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the.