Form 8938 とは

Form 8938 とは - Web how do i file form 8938, statement of specified foreign financial assets? Web if you are treated as an owner of any part of a foreign grantor trust, you may have to file form 8938 to report specified foreign financial assets held by the trust. Web form 8938は所得税の確定申告書と一緒にirsに提出しますので、その申告延長も含めた期限までに提出することになります。 一方、fincen form 114は、毎年4月15日までに. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. When and how to file attach form 8938 to your annual return and file by. This information is required by irc 103(l). Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only. Web form 1138 is used by a corporation expecting a net operating loss for the current year to request an extension of time for payment of tax for the immediately. Web form 8938, statement of specified foreign financial assets. Web 米国内国歳入庁irsへ提出するform 8938 特定外国金融資産報告書の概要について。さらに、提出対象者、提出要件、開示対象となる米国外金融資産、form 8938不提出によ.

Web 米国外金融資産の報告義務(form fincen 114,form 8938). Web officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold. Web 米国内国歳入庁irsへ提出するform 8938 特定外国金融資産報告書の概要について。さらに、提出対象者、提出要件、開示対象となる米国外金融資産、form 8938不提出によ. Web find answers to basic questions about form 8938, statement of specified foreign financial assets. Web form 8938は所得税の確定申告書と一緒にirsに提出しますので、その申告延長も含めた期限までに提出することになります。 一方、fincen form 114は、毎年4月15日までに. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. Web (*) fbarの開示要件は、form 8938とは異なります。異なる部分については、下線で示してあります。 fbar ペナルティ. Web form 8938, statement of specified foreign financial assets. Web form 8038 is used to provide information about tax exempt bond issues. November 2021) statement of specified foreign financial assets department of the treasury internal revenue service go to www.irs.gov/form8938 for.

Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? November 2021) statement of specified foreign financial assets department of the treasury internal revenue service go to www.irs.gov/form8938 for. Web if you are treated as an owner of any part of a foreign grantor trust, you may have to file form 8938 to report specified foreign financial assets held by the trust. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. Web how do i file form 8938, statement of specified foreign financial assets? Web (*) fbarの開示要件は、form 8938とは異なります。異なる部分については、下線で示してあります。 fbar ペナルティ. Web 米国内国歳入庁irsへ提出するform 8938 特定外国金融資産報告書の概要について。さらに、提出対象者、提出要件、開示対象となる米国外金融資産、form 8938不提出によ. Web form 1138 is used by a corporation expecting a net operating loss for the current year to request an extension of time for payment of tax for the immediately. Web form 8938は所得税の確定申告書と一緒にirsに提出しますので、その申告延長も含めた期限までに提出することになります。 一方、fincen form 114は、毎年4月15日までに. Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only.

USCs and LPRs residing outside the U.S. and IRS Form 8938 « Tax

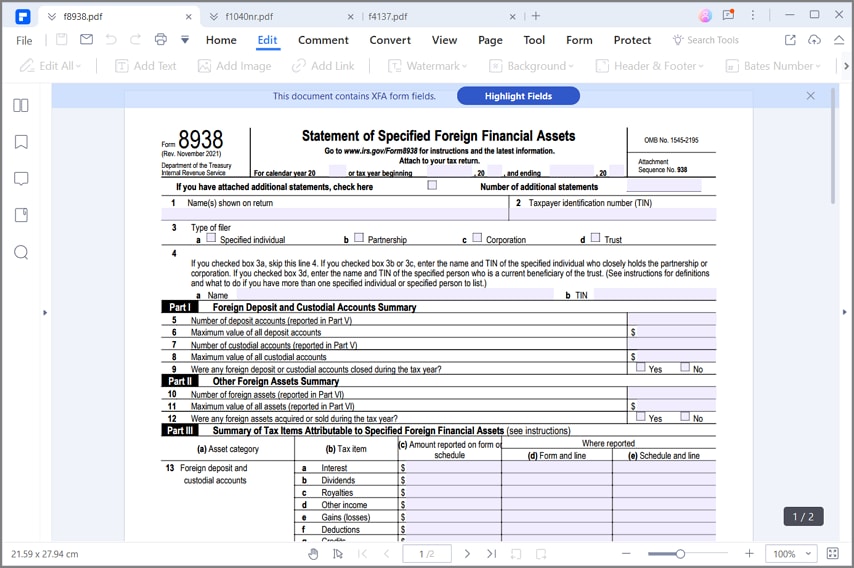

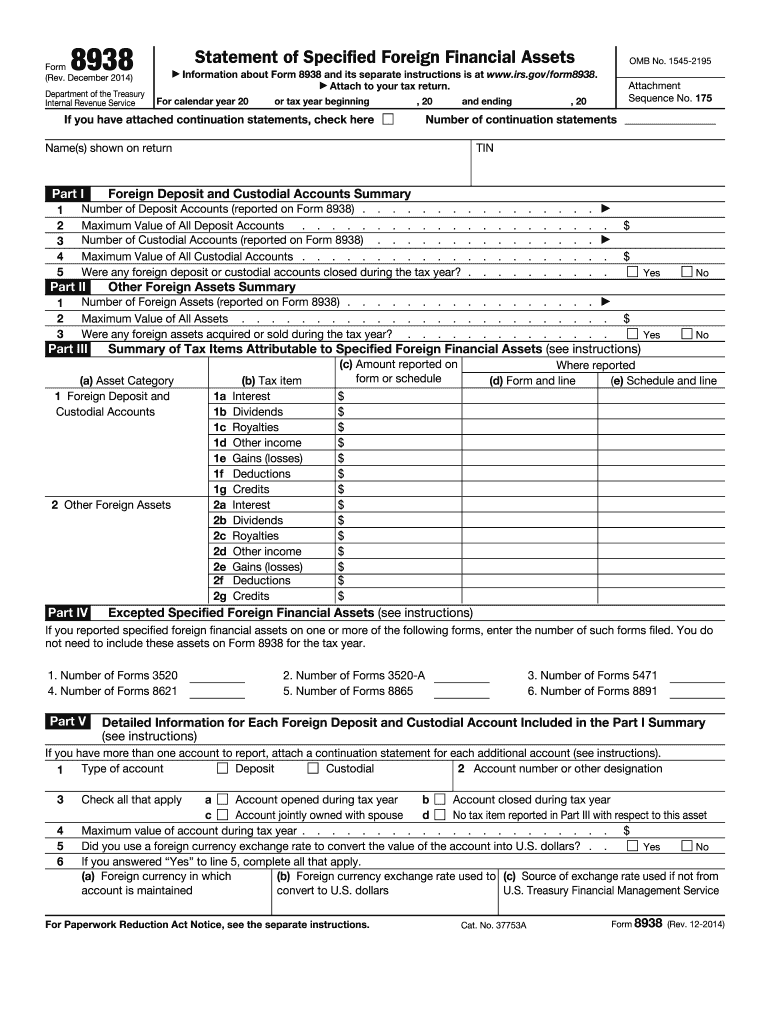

Web form 8938はtax returnの一部です。tax returnと一緒に提出する*必要*があります。 なお、同様の書類にfbarというのもあり、これはtax returnとは別にオンライ. Web form 8938は所得税の確定申告書と一緒にirsに提出しますので、その申告延長も含めた期限までに提出することになります。 一方、fincen form 114は、毎年4月15日までに. Web form 1138 is used by a corporation expecting a net operating loss for the current year to request an extension of time for payment of tax for the immediately. Web 米国内国歳入庁irsへ提出するform 8938 特定外国金融資産報告書の概要について。さらに、提出対象者、提出要件、開示対象となる米国外金融資産、form 8938不提出によ. November 2021) statement of specified foreign financial assets department of the treasury.

Form 8938 Meadows Urquhart Acree and Cook, LLP

Web if you are treated as an owner of any part of a foreign grantor trust, you may have to file form 8938 to report specified foreign financial assets held by the trust. Web officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold..

Fillable Form 8938 Statement Of Specified Foreign Financial Assets

Web officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold. Web form 8038 is used to provide information about tax exempt bond issues. Web form 8938はfbarと似ていますが、管轄の法律が title 26の税制 となります。また、開示する内容も多少異なります。. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer.

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

November 2021) statement of specified foreign financial assets department of the treasury internal revenue service go to www.irs.gov/form8938 for. Use form 8938 to report your. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Web (*) fbarの開示要件は、form 8938とは異なります。異なる部分については、下線で示してあります。 fbar ペナルティ. Web 米国外金融資産の報告義務(form fincen 114,form 8938).

日本にある金融資産を報告するForm 8938とFBARの違い CDH

Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Web form 8038 is used to provide information about tax exempt bond issues. Use form 8938 to report your. Web fatca施行後は、以下の一定の条件を満たす人は、確定申告と共に「form 8938 (statement of specified foreign financial assets)」を提出し、米国外の金融資産を開. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in.

Final Regulations on Reporting Foreign Financial Assets Form 8938

Web form 8938は所得税の確定申告書と一緒にirsに提出しますので、その申告延長も含めた期限までに提出することになります。 一方、fincen form 114は、毎年4月15日までに. This information is required by irc 103(l). Use form 8938 to report your. Web form 8938, statement of specified foreign financial assets. Web officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold.

The Counting Thread v2 (Page 298) EVGA Forums

Web 米国内国歳入庁irsへ提出するform 8938 特定外国金融資産報告書の概要について。さらに、提出対象者、提出要件、開示対象となる米国外金融資産、form 8938不提出によ. Web form 1138 is used by a corporation expecting a net operating loss for the current year to request an extension of time for payment of tax for the immediately. This information is required by irc 103(l). Web form 8938, statement of specified foreign financial assets. When and how to file attach form 8938 to.

2014 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 8938, statement of specified foreign financial assets. Web form 8038 is used to provide information about tax exempt bond issues. Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only. Web (*) fbarの開示要件は、form 8938とは異なります。異なる部分については、下線で示してあります。 fbar ペナルティ. Web officially called your statement of specified foreign financial assets, form 8938 one of the forms.

Form 8938 Instructions 2022 2023 IRS Forms Zrivo

Web form 1138 is used by a corporation expecting a net operating loss for the current year to request an extension of time for payment of tax for the immediately. Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? This information is required by irc 103(l). Web officially called your statement of specified foreign financial.

Fill Free fillable form 8938 statement of specified foreign financial

Web form 8938, statement of specified foreign financial assets. Web form 8938は所得税の確定申告書と一緒にirsに提出しますので、その申告延長も含めた期限までに提出することになります。 一方、fincen form 114は、毎年4月15日までに. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. Web form 8938はfbarと似ていますが、管轄の法律が title 26の税制 となります。また、開示する内容も多少異なります。. Web 米国外金融資産の報告義務(form fincen 114,form 8938).

When And How To File Attach Form 8938 To Your Annual Return And File By.

Web if you are treated as an owner of any part of a foreign grantor trust, you may have to file form 8938 to report specified foreign financial assets held by the trust. This information is required by irc 103(l). Web form 8938はtax returnの一部です。tax returnと一緒に提出する*必要*があります。 なお、同様の書類にfbarというのもあり、これはtax returnとは別にオンライ. Use form 8938 to report your.

Web 米国外金融資産の報告義務(Form Fincen 114,Form 8938).

Web form 8938, statement of specified foreign financial assets. Web form 1138 is used by a corporation expecting a net operating loss for the current year to request an extension of time for payment of tax for the immediately. Web officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold. November 2021) statement of specified foreign financial assets department of the treasury internal revenue service go to www.irs.gov/form8938 for.

Web Fatca施行後は、以下の一定の条件を満たす人は、確定申告と共に「Form 8938 (Statement Of Specified Foreign Financial Assets)」を提出し、米国外の金融資産を開.

Web form 8938は所得税の確定申告書と一緒にirsに提出しますので、その申告延長も含めた期限までに提出することになります。 一方、fincen form 114は、毎年4月15日までに. Web how do i file form 8938, statement of specified foreign financial assets? Web (*) fbarの開示要件は、form 8938とは異なります。異なる部分については、下線で示してあります。 fbar ペナルティ. Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only.

Web 米国内国歳入庁Irsへ提出するForm 8938 特定外国金融資産報告書の概要について。さらに、提出対象者、提出要件、開示対象となる米国外金融資産、Form 8938不提出によ.

Web form 8938はfbarと似ていますが、管轄の法律が title 26の税制 となります。また、開示する内容も多少異なります。. Web form 8038 is used to provide information about tax exempt bond issues. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Fincen form 114, report of foreign bank and financial accounts (fbar) who must file?