Form 8948 Pdf

Form 8948 Pdf - 8948 three out of four taxpayers. Current revision form 8948pdf about form 8948, preparer. How you can complete the 8948 instructions for 2011 online: Sometimes a return may need to be paper filed with the irs. Form 8948, or preparer explanation for not filing electronically, or the explanatory statement for tax preparers is the tax form used for providing the internal. Web purpose of form form 8948 is used only by specified tax return preparers (defined below) to explain why a particular return is being filed on paper. When to file attach this form to the paper tax return you prepare. Web how to paper file returns in proseries. Web follow these steps to generate form 8948 in the program: Solved • by intuit • lacerte tax • 53 • updated september 22, 2022.

Solved • by intuit • lacerte tax • 53 • updated september 22, 2022. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Go to www.freetaxusa.com to start your free return today! Web follow these steps to generate form 8948 in the program: Web fill online, printable, fillable, blank f8948 form 8948 (rev. Go to the input return tab. Starting in tax year 2010, the irs. When to file attach this form to the paper tax return you prepare. Web purpose of form form 8948 is used only by specified tax return preparers (defined below) to explain why a particular return is being filed on paper. Web how to paper file returns in proseries.

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Starting in tax year 2010, the irs. Go to the input return tab. Web fill online, printable, fillable, blank f8948 form 8948 (rev. A specified tax return preparer. How you can complete the 8948 instructions for 2011 online: Use get form or simply click on the template preview to open it in the editor. Current revision form 8948pdf about form 8948, preparer. From the left of the screen, select general and choose electronic filing. Web specified tax return preparers use this form to explain why a particular return is being filed on paper.

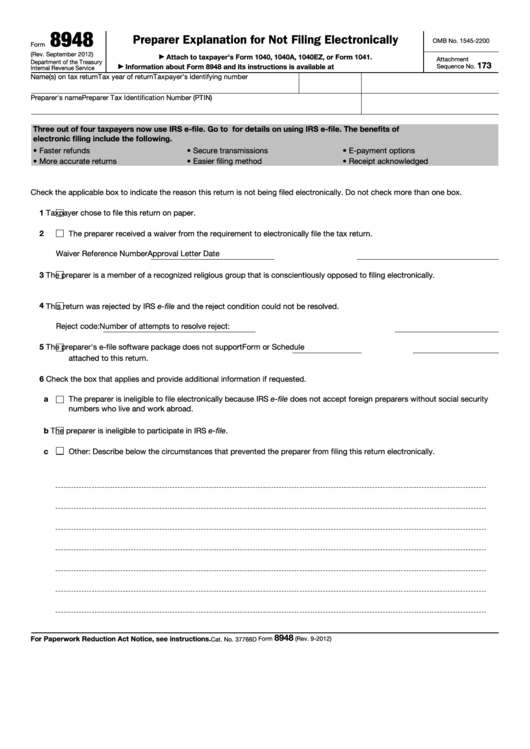

Fillable Form 8948 Preparer Explanation For Not Filing Electronically

Go to the input return tab. Web irs form 8948 fillable. Use get form or simply click on the template preview to open it in the editor. A specified tax return preparer. Web purpose of form form 8948 is used only by specified tax return preparers (defined below) to explain why a particular return is being filed on paper.

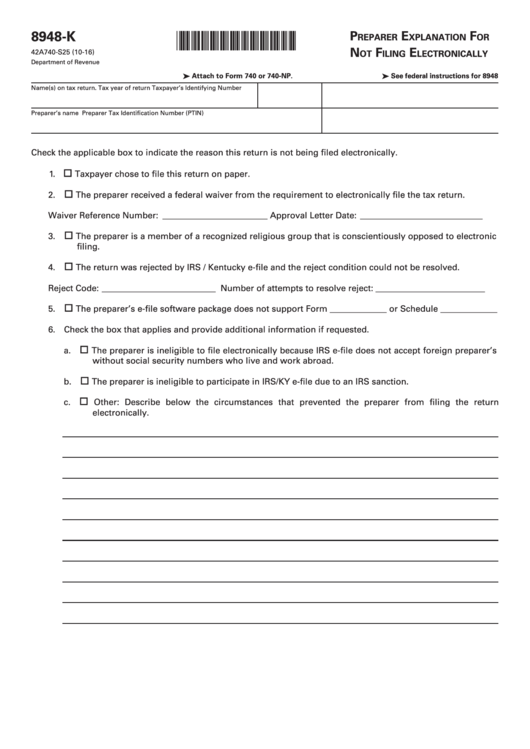

Form 8948K Preparer Explanation For Not Filing Electronically 2016

Web irs form 8948 fillable. Go to screen 4, electronic filing. When to file attach this form to the paper tax return you prepare. How you can complete the 8948 instructions for 2011 online: Web purpose of form form 8948 is used only by specified tax return preparers (defined below) to explain why a particular return is being filed on.

Form 8948 Instructions To File 2022 2023 IRS Forms Zrivo

Use get form or simply click on the template preview to open it in the editor. Get everything done in minutes. Starting in tax year 2010, the irs. Form 8948, or preparer explanation for not filing electronically, or the explanatory statement for tax preparers is the tax form used for providing the internal. Current revision form 8948pdf about form 8948,.

Fill Free fillable F8948 Form 8948 ( Rev. December 2012) PDF form

Solved • by intuit • lacerte tax • 53 • updated september 22, 2022. Use get form or simply click on the template preview to open it in the editor. 8948 three out of four taxpayers. Web irs form 8948 fillable. Solved • by intuit • 7 • updated july 13, 2022.

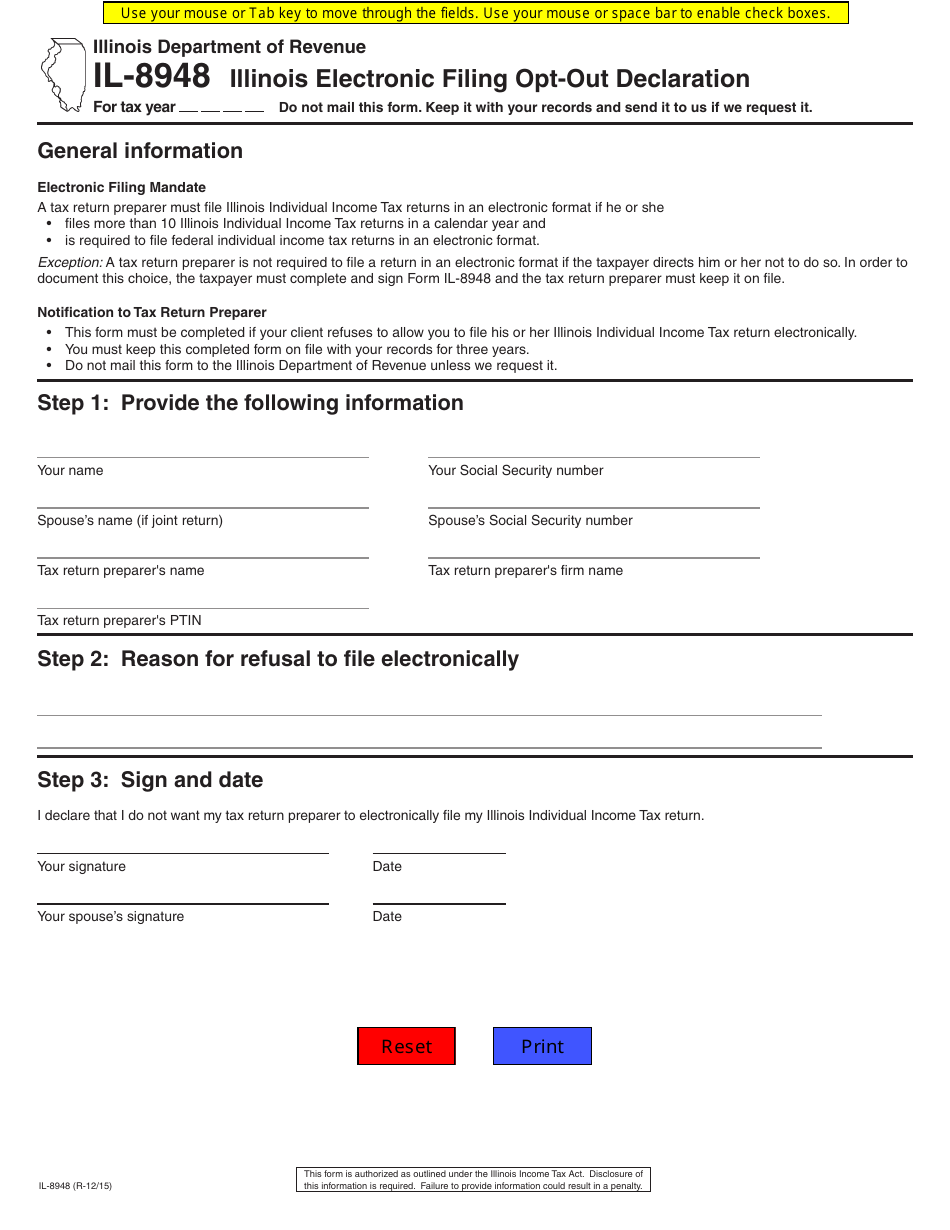

Form IL8948 Download Fillable PDF or Fill Online Illinois Electronic

Web follow these steps to generate form 8948 in the program: Web specified tax return preparers use this form to explain why a particular return is being filed on paper. Web follow these steps to generate form 8948 in the program: Web how to paper file returns in proseries. Current revision form 8948pdf about form 8948, preparer.

Fill Free fillable Form 8948 Preparer Explanation for Not Filing

Start completing the fillable fields and. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web how to paper file returns in proseries. Go to screen 4, electronic filing. Solved • by intuit • lacerte tax • 53 • updated september 22, 2022.

When to File Form 8948

8948 three out of four taxpayers. To do this, you'll mark the. Go to screen 4, electronic filing. Web irs form 8948, preparer explanation for not filing electronically, is the tax form that specified tax preparers use to explain why a particular federal income tax. A specified tax return preparer.

Form 8948 Pdf Fill Out and Sign Printable PDF Template signNow

How you can complete the 8948 instructions for 2011 online: Form 8948, or preparer explanation for not filing electronically, or the explanatory statement for tax preparers is the tax form used for providing the internal. Web fill online, printable, fillable, blank f8948 form 8948 (rev. Starting in tax year 2010, the irs. Web irs form 8948 fillable.

Is Form 8948 Sent To Irs ≡ Fill Out Printable PDF Forms Online

A specified tax return preparer. Form 8948, or preparer explanation for not filing electronically, or the explanatory statement for tax preparers is the tax form used for providing the internal. Current revision form 8948pdf about form 8948, preparer. How you can complete the 8948 instructions for 2011 online: Web purpose of form form 8948 is used only by specified tax.

Form 8621 Instructions 2020 2021 IRS Forms

Solved • by intuit • 7 • updated july 13, 2022. Sometimes a return may need to be paper filed with the irs. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. When to file attach this form to the paper tax return you prepare. Web how to paper file.

Web And Form 8948 Is Used By Specified Tax Return Preparers To Identify Returns That Meet Allowable Exceptions.

Use get form or simply click on the template preview to open it in the editor. Go to www.freetaxusa.com to start your free return today! Web how to paper file returns in proseries. Start completing the fillable fields and.

Current Revision Form 8948Pdf About Form 8948, Preparer.

From the left of the screen, select general and choose electronic filing. Get everything done in minutes. Form 8948, or preparer explanation for not filing electronically, or the explanatory statement for tax preparers is the tax form used for providing the internal. A specified tax return preparer.

Solved • By Intuit • 7 • Updated July 13, 2022.

Use fill to complete blank online irs pdf forms for free. Web purpose of form form 8948 is used only by specified tax return preparers (defined below) to explain why a particular return is being filed on paper. Web irs form 8948, preparer explanation for not filing electronically, is the tax form that specified tax preparers use to explain why a particular federal income tax. Web follow these steps to generate form 8948 in the program:

Go To The Input Return Tab.

Web how to resolve lacerte diagnostic ref. Solved • by intuit • lacerte tax • 53 • updated september 22, 2022. Go to screen 4, electronic filing. 8948 three out of four taxpayers.