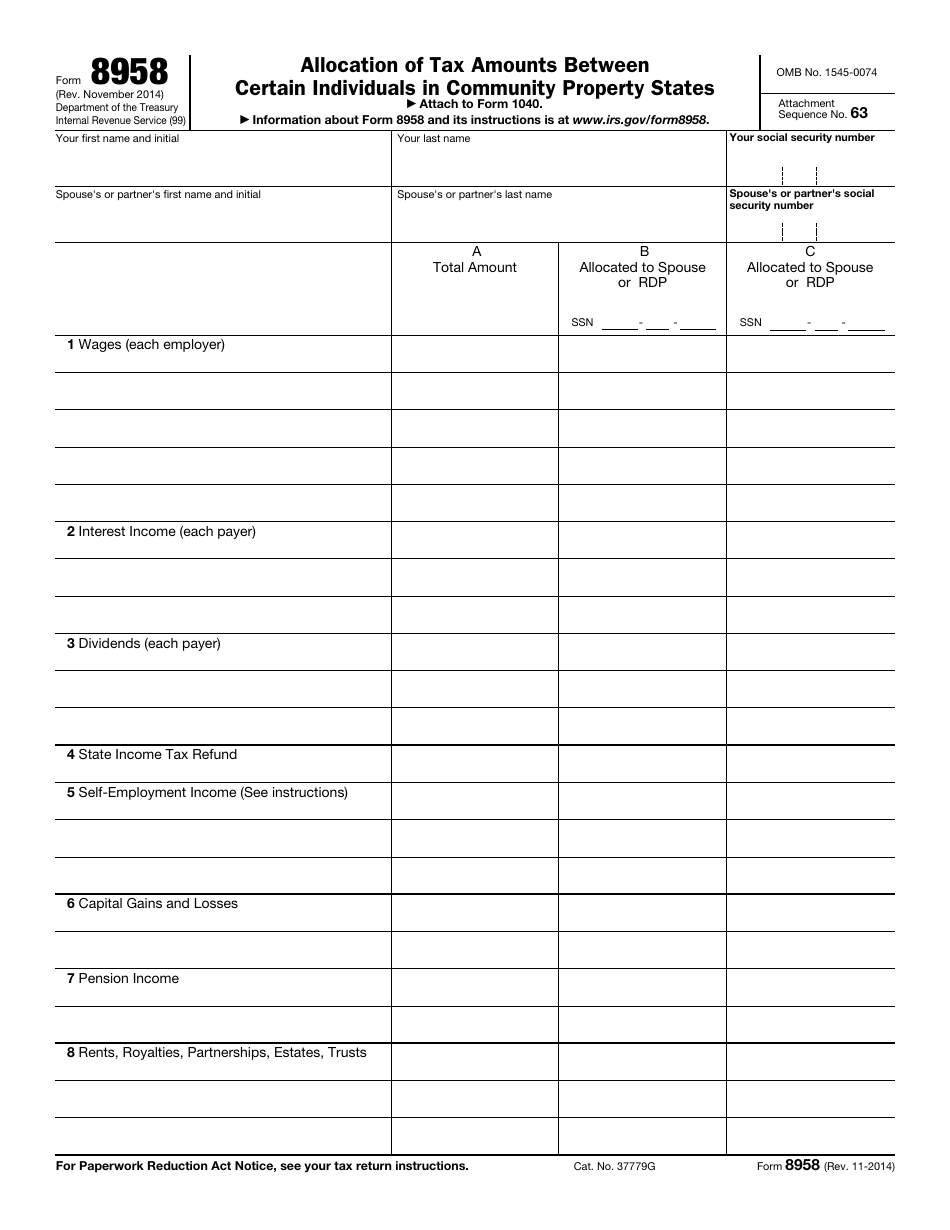

Form 8958 Example

Form 8958 Example - Web common questions about entering form 8958 income for community property allocation in lacerte. Web you calculate the tax on the community property, and pay that. Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so this is the latest version of form 8958, fully. Income allocation information is required when electronically filing a return with. Web what makes the example of completed form 8958 legally valid? Web level 1 how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Mary earns $15,000, and her husband john earns $25,000, for a total family income of $40,000. If mary and john elect to file separate mfs returns, then they will pay. If form 8958 is needed, a federal note is produced,. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property.

The form 8958 allows the irs to match the amounts on your tax return to the source documents. Web common questions about entering form 8958 income for community property allocation in lacerte. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. My wife and i are filing married, filing. My wife and i are married filing separately and live in a community. If form 8958 is needed, a federal note is produced,. Web what makes the example of completed form 8958 legally valid? Income allocation information is required when electronically filing a return with. Click yes to complete or modify the community property allocation. If mary and john elect to file separate mfs returns, then they will pay.

If form 8958 is needed, a federal note is produced,. Web level 1 how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Click yes to complete or modify the community property allocation. Web what makes the example of completed form 8958 legally valid? Web common questions about entering form 8958 income for community property allocation in lacerte. Mary earns $15,000, and her husband john earns $25,000, for a total family income of $40,000. I got married in nov 2021. The form 8958 allows the irs to match the amounts on your tax return to the source documents. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half.

Alcoholics Anonymous 12 Step Worksheets Universal Network

Click yes to complete or modify the community property allocation. I got married in nov 2021. My wife and i are filing married, filing. My wife and i are married filing separately and live in a community. The form 8958 allows the irs to match the amounts on your tax return to the source documents.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

If form 8958 is needed, a federal note is produced,. Web you calculate the tax on the community property, and pay that. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Web we last updated the allocation of tax amounts between certain individuals in community.

3.11.3 Individual Tax Returns Internal Revenue Service

Click yes to complete or modify the community property allocation. Web per irs publication 555 community property, starting on page 2, you would only complete form 8958 allocation of tax amounts between certain individuals in community. If form 8958 is needed, a federal note is produced,. My wife and i are married filing separately and live in a community. If.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web common questions about entering form 8958 income for community property allocation in lacerte. Click yes to complete or modify the community property allocation. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. The form 8958 allows the.

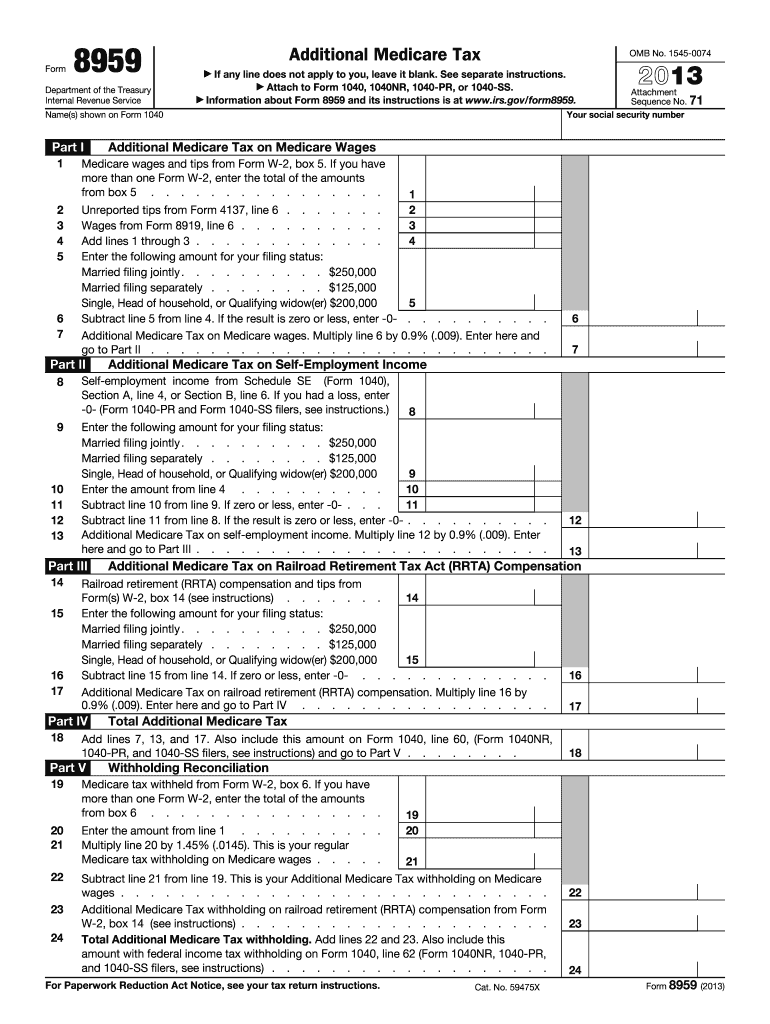

Form 8959 for year 2013 Fill out & sign online DocHub

Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web what makes the example of completed form 8958 legally valid? Click yes to complete or modify the community property allocation. The form 8958 allows the irs to match.

CCH® ProSystem fx® / Global fx Tax Splitting a MFJ Tax Return YouTube

Web what makes the example of completed form 8958 legally valid? If form 8958 is needed, a federal note is produced,. Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so this is the latest version of form 8958, fully. Click yes to complete or modify the community property allocation..

3.11.3 Individual Tax Returns Internal Revenue Service

Web what makes the example of completed form 8958 legally valid? The form 8958 allows the irs to match the amounts on your tax return to the source documents. My wife and i are filing married, filing. I got married in nov 2021. Click yes to complete or modify the community property allocation.

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

Click yes to complete or modify the community property allocation. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web what makes the example of completed form 8958 legally valid? The form 8958 allows the irs to match.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web what makes the example of completed form 8958 legally valid? Web per irs publication 555 community property, starting on page 2, you would only complete form 8958 allocation of tax amounts between certain individuals in community. Income allocation information is required when electronically filing a return with. Web you calculate the tax on the community property, and pay that..

3.11.3 Individual Tax Returns Internal Revenue Service

Web per irs publication 555 community property, starting on page 2, you would only complete form 8958 allocation of tax amounts between certain individuals in community. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. I got married in nov 2021. Income allocation information is required.

Web Common Questions About Entering Form 8958 Income For Community Property Allocation In Lacerte.

Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Income allocation information is required when electronically filing a return with. Mary earns $15,000, and her husband john earns $25,000, for a total family income of $40,000. Web what makes the example of completed form 8958 legally valid?

If Mary And John Elect To File Separate Mfs Returns, Then They Will Pay.

Web you calculate the tax on the community property, and pay that. The form 8958 allows the irs to match the amounts on your tax return to the source documents. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Click yes to complete or modify the community property allocation.

Web Level 1 How To Properly Fill Out Form 8958 I Moved To Nevada In Feb 2021 From North Carolina.

If form 8958 is needed, a federal note is produced,. My wife and i are married filing separately and live in a community. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. My wife and i are filing married, filing.

Web Click The Miscellaneous Topics Dropdown, Then Click Community Property Allocation Record (Form 8958).

Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so this is the latest version of form 8958, fully. I got married in nov 2021. Web per irs publication 555 community property, starting on page 2, you would only complete form 8958 allocation of tax amounts between certain individuals in community.