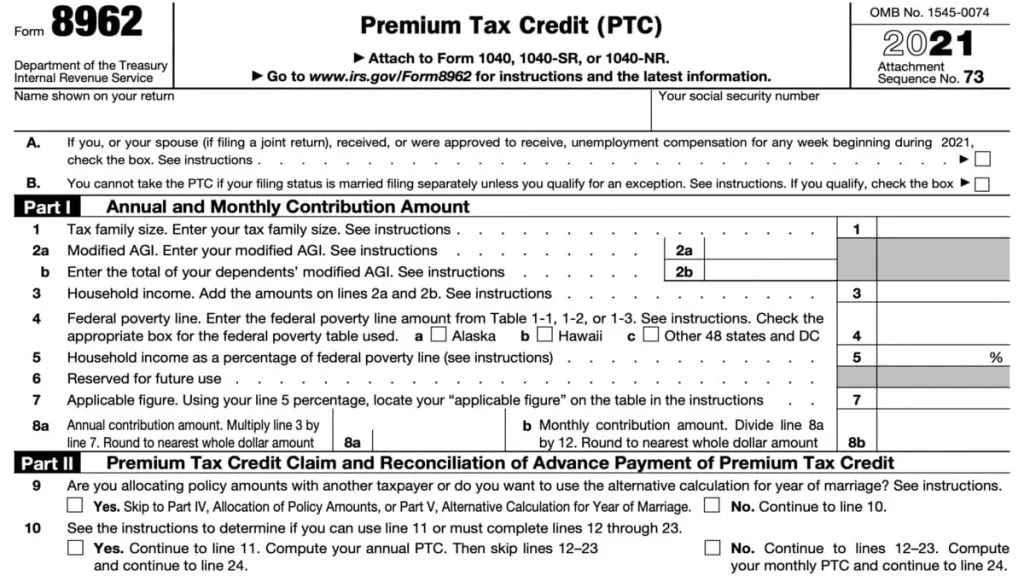

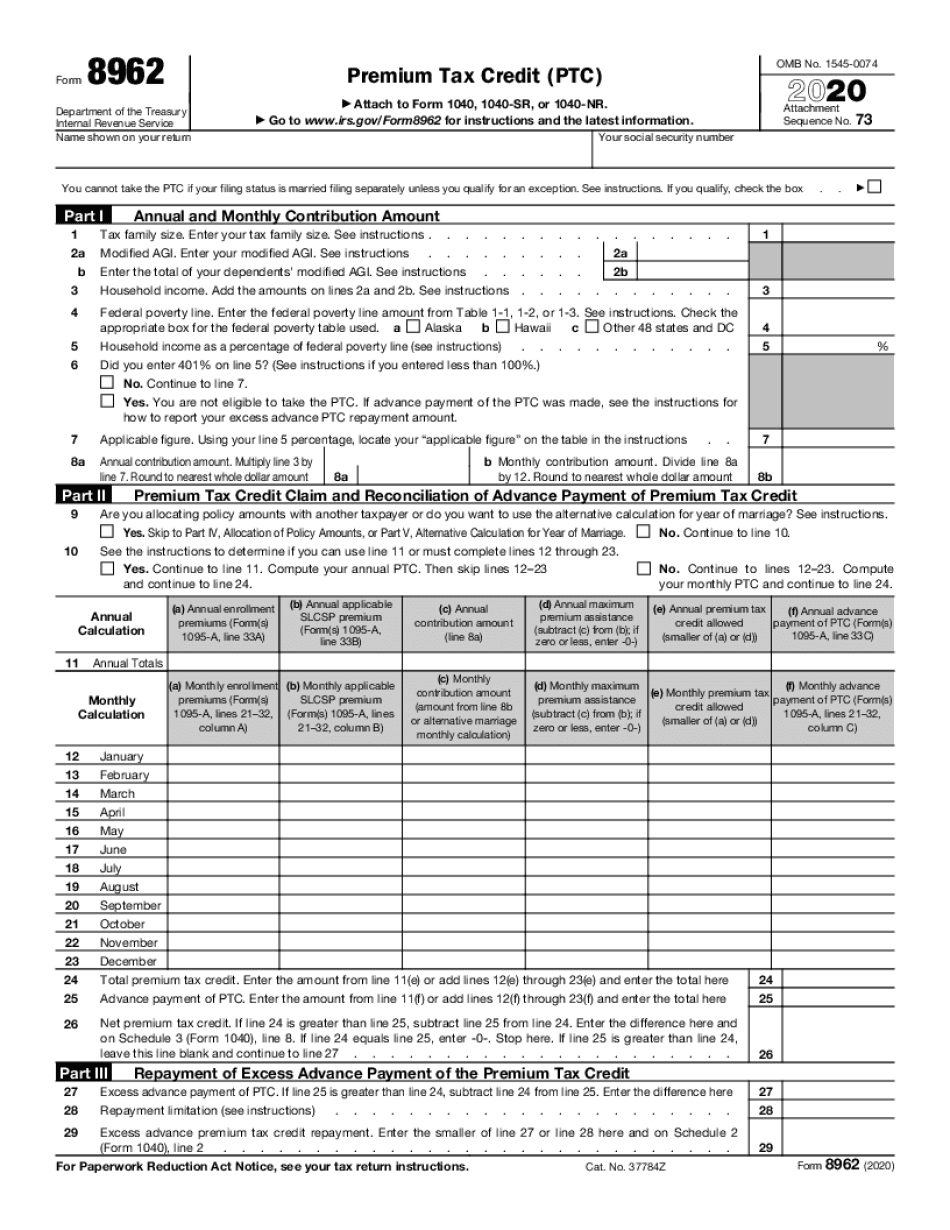

Form 8962 For 2021

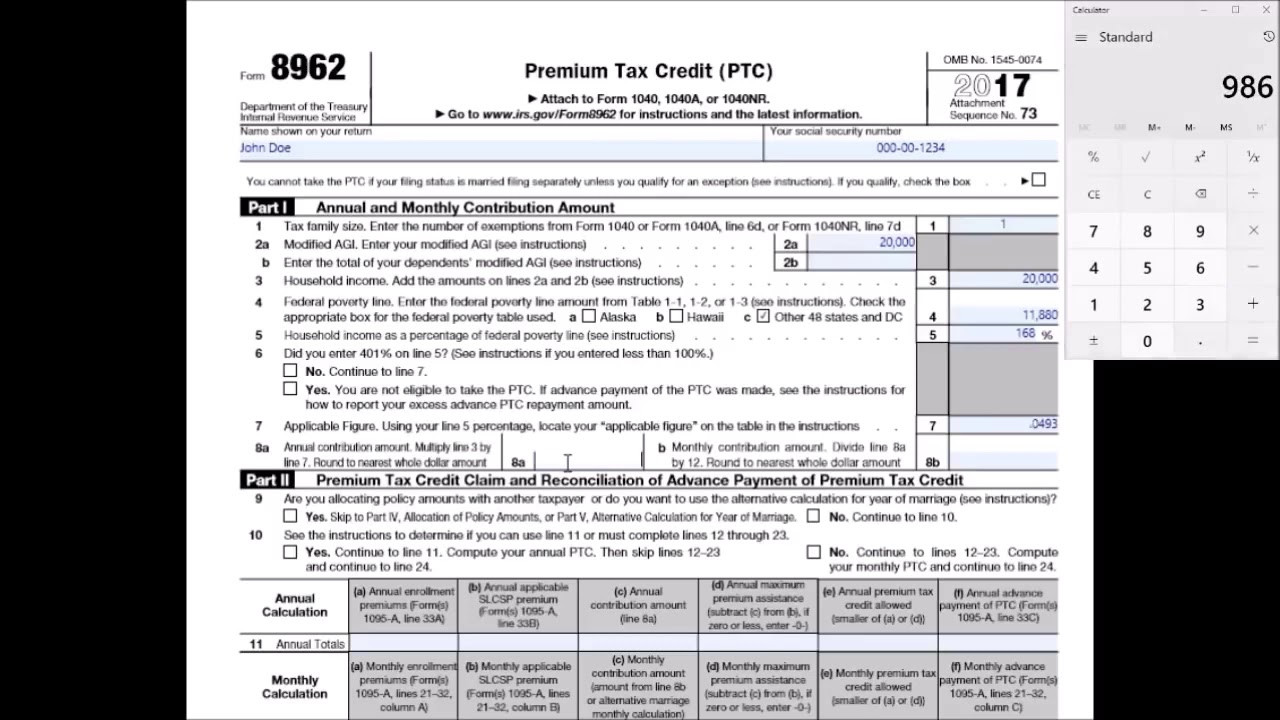

Form 8962 For 2021 - Web suspension of repayment of the excess aptc applied to tax year 2020 only and means that taxpayers must repay excess aptc in 2021 after reconciling the. The american rescue plan, signed into law on march 11, 2021, includes a provision that eliminates the requirement. You can download or print current or past. Web tax calculators & tips / tax tips guides & videos / aca / what is the premium tax credit (ptc) and what is tax form 8962? 4.8 satisfied (287 votes) irs 8962 2017. Upload, modify or create forms. Go to www.irs.gov/form8962 for instructions and the. If your client (or their spouse, if married filing jointly) received unemployment compensation for any week of 2021, their. Web to get this credit, you must meet certain requirements and file a tax return with form 8962, premium tax credit (ptc). Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022.

You'll find out if you qualify for a premium tax credit based on your final 2021 income. Upload, modify or create forms. If your client (or their spouse, if married filing jointly) received unemployment compensation for any week. Reminders applicable federal poverty line percentages. What is the premium tax. Ad get ready for tax season deadlines by completing any required tax forms today. Try it for free now! Web use form 8962 to “reconcile” your premium tax credit — compare the amount you used in 2021 to lower your monthly insurance payment with the actual premium tax credit you. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. 4.8 satisfied (287 votes) irs 8962 2017.

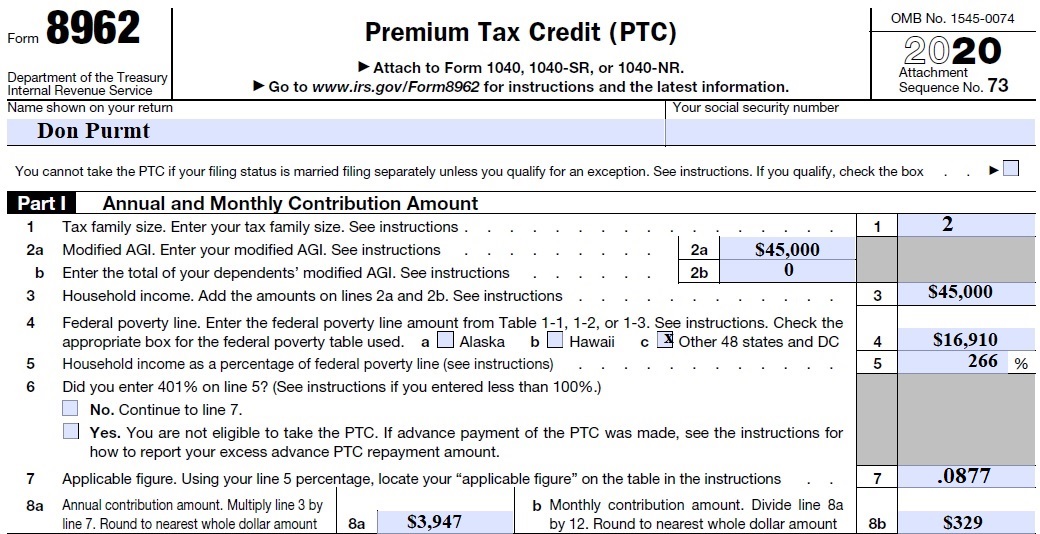

4.8 satisfied (287 votes) irs 8962 2017. Web we’re reviewing the tax provisions of the american rescue plan act of 2021, signed into law on march 11, 2021. Web suspension of repayment of the excess aptc applied to tax year 2020 only and means that taxpayers must repay excess aptc in 2021 after reconciling the. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. Upload, modify or create forms. Upload, modify or create forms. 4.7 satisfied (191 votes) irs 8962 2020. 4.7 satisfied (108 votes) irs 8962 2018. You'll find out if you qualify for a premium tax credit based on your final 2021 income. Web when the health insurance marketplace pays advance payments of the premium tax credit on your behalf, you must file form 8962 to reconcile the advance.

How To Fill Out Form 8962 Step By Step Premium Tax Credit Ptc Sample

Reminders applicable federal poverty line percentages. Web we’re reviewing the tax provisions of the american rescue plan act of 2021, signed into law on march 11, 2021. If your client (or their spouse, if married filing jointly) received unemployment compensation for any week of 2021, their. Web why is the tax year 2021 form 8962, line 5 showing 133%? You.

If You Received an Obamacare Subsidy, the 2021 Covid Relief Bill

2021 and 2022 ptc eligibility. The american rescue plan, signed into law on march 11, 2021, includes a provision that eliminates the requirement. Web dental coverage medicaid & chip how to apply & enroll picking a plan check if you can change plans report income/family changes new, lower costs available health care tax. Upload, modify or create forms. You have.

Health Insurance 1095A Subsidy Flow Through IRS Tax Return

The american rescue plan, signed into law on march 11, 2021, includes a provision that eliminates the requirement. Web dental coverage medicaid & chip how to apply & enroll picking a plan check if you can change plans report income/family changes new, lower costs available health care tax. Reminders applicable federal poverty line percentages. Web we’re reviewing the tax provisions.

8962 Form 2022 2023 Premium Tax Credit IRS Forms TaxUni

Web to get this credit, you must meet certain requirements and file a tax return with form 8962, premium tax credit (ptc). 4.7 satisfied (191 votes) irs 8962 2020. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. If your client (or their.

Instructions for Form 8962 for 2018 KasenhasLopez

On april 9, 2021, the irs released guidance on returns that were. Upload, modify or create forms. You'll find out if you qualify for a premium tax credit based on your final 2021 income. You have to include form 8962 with your tax return if: What is the premium tax.

8962 Form 2021 IRS Forms Zrivo

Try it for free now! You can download or print current or past. Web suspension of repayment of the excess aptc applied to tax year 2020 only and means that taxpayers must repay excess aptc in 2021 after reconciling the. Web we’re reviewing the tax provisions of the american rescue plan act of 2021, signed into law on march 11,.

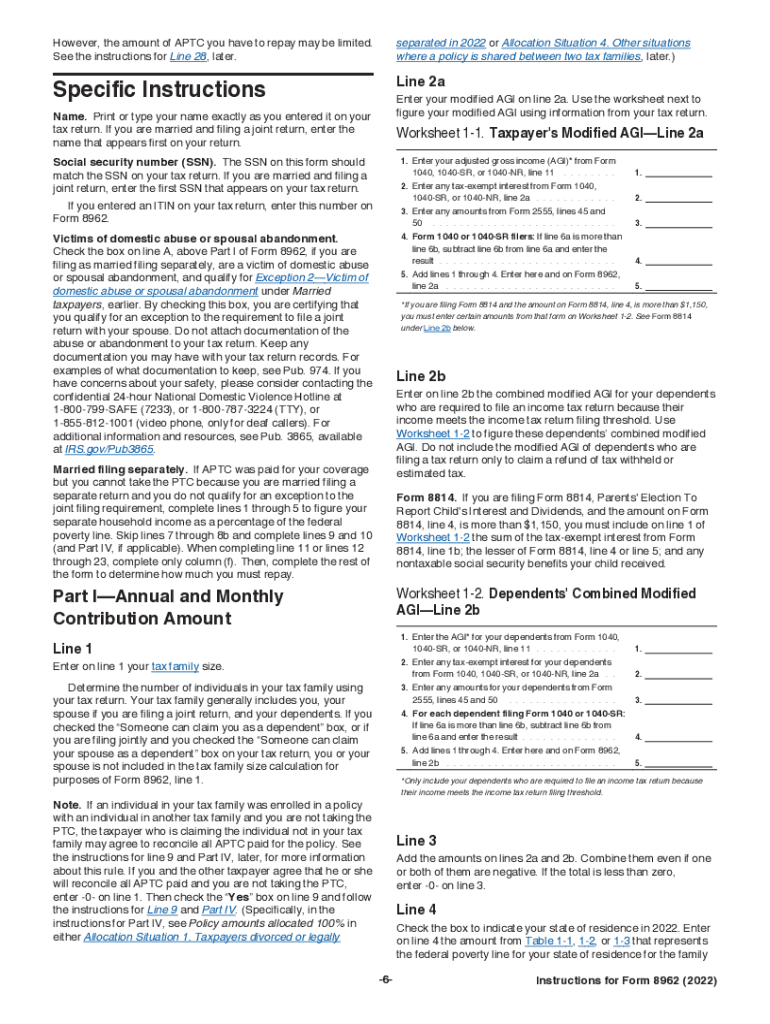

2022 Form IRS Instructions 8962 Fill Online, Printable, Fillable, Blank

Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. Web suspension of repayment of the excess aptc applied to tax year 2020 only and means that taxpayers must repay excess aptc in 2021 after reconciling the. Web tax calculators & tips / tax.

form 8962 2014 Diy Menu Cards, Menu Card Template, Wedding Menu

Ad get ready for tax season deadlines by completing any required tax forms today. You can download or print current or past. Web use this slcsp figure to fill out form 8962, premium tax credit (pdf, 110 kb). Web suspension of repayment of the excess aptc applied to tax year 2020 only and means that taxpayers must repay excess aptc.

form 8962 for 2020 2021 printable Fill Online, Printable, Fillable

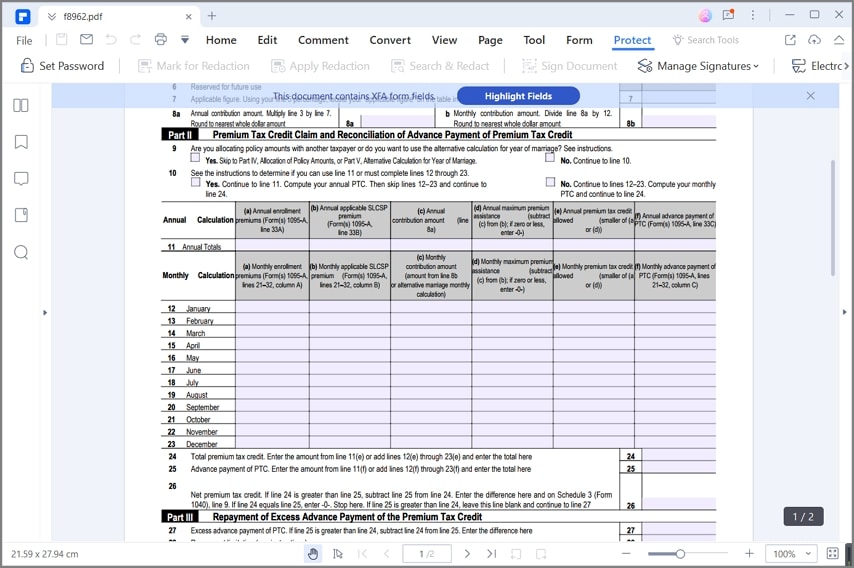

Try it for free now! Web video instructions and help with filling out and completing 8962 form 2021 printable. Watch this brief video to get answers on many questions you will have while completing the irs. Web use form 8962 to “reconcile” your premium tax credit — compare the amount you used in 2021 to lower your monthly insurance payment.

Online Advertising; Do Your 2020 Tax Return Right with IRS VITA

Upload, modify or create forms. 4.8 satisfied (287 votes) irs 8962 2017. Go to www.irs.gov/form8962 for instructions and the. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. Try it for free now!

Upload, Modify Or Create Forms.

Web use this slcsp figure to fill out form 8962, premium tax credit (pdf, 110 kb). Web when the health insurance marketplace pays advance payments of the premium tax credit on your behalf, you must file form 8962 to reconcile the advance. Ad get ready for tax season deadlines by completing any required tax forms today. Web why is the tax year 2021 form 8962, line 5 showing 133%?

You Can Download Or Print Current Or Past.

Web tax calculators & tips / tax tips guides & videos / aca / what is the premium tax credit (ptc) and what is tax form 8962? What is the premium tax. Try it for free now! Ad get ready for tax season deadlines by completing any required tax forms today.

Web Use Form 8962 To “Reconcile” Your Premium Tax Credit — Compare The Amount You Used In 2021 To Lower Your Monthly Insurance Payment With The Actual Premium Tax Credit You.

On april 9, 2021, the irs released guidance on returns that were. Web we’re reviewing the tax provisions of the american rescue plan act of 2021, signed into law on march 11, 2021. You'll find out if you qualify for a premium tax credit based on your final 2021 income. The american rescue plan, signed into law on march 11, 2021, includes a provision that eliminates the requirement.

Upload, Modify Or Create Forms.

2021 and 2022 ptc eligibility. Figure the amount of your premium tax credit. You have to include form 8962 with your tax return if: 4.7 satisfied (191 votes) irs 8962 2020.