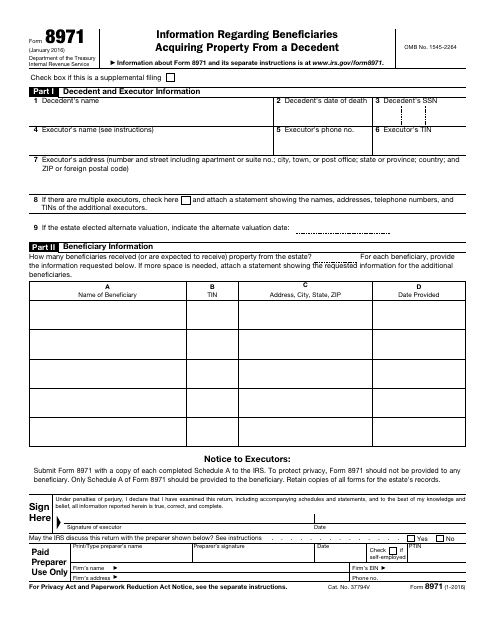

Form 8971 Instructions 2022

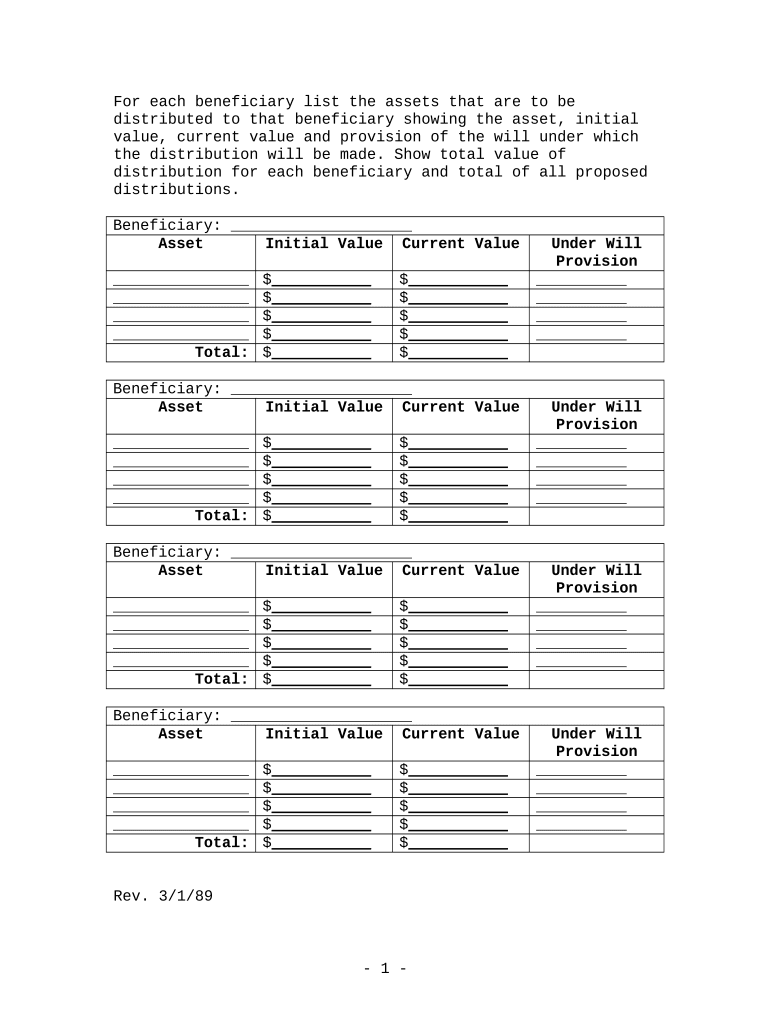

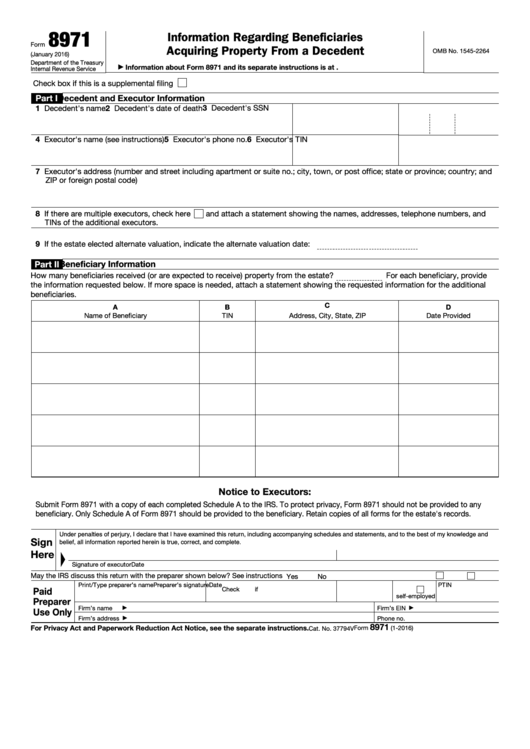

Form 8971 Instructions 2022 - Web form 8971, along with a copy of every schedule a, is used to report values to the irs. Retain copies of all forms for the estate's records. This item is used to. It is not clear that form 8971 is required under these circumstances. This information return reports the values from the decedent’s gross estate to both the irs and to each beneficiary receiving property from the estate. Form 8971 and attached schedule(s) a must be filed with the irs, separate from. Download this form print this form Web form 8971 (including all attached schedule(s) a) must be filed with the irs and only the schedule a is to be provided to the beneficiary listed on that schedule a, no later than the earlier of: Schedule a, attached to form 8971, is used to provide each beneficiary with information that must be reported under the new statute. Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax value of property of that estate.

Web form 8971 (including all attached schedule(s) a) must be filed with the irs and only the schedule a is to be provided to the beneficiary listed on that schedule a, no later than the earlier of: Web form 8971, along with a copy of every schedule a, is used to report values to the irs. This information return reports the values from the decedent’s gross estate to both the irs and to each beneficiary receiving property from the estate. One schedule a is provided to each beneficiary receiving property from an estate. Only schedule a of form 8971 should be provided to the beneficiary. Web form 8971 is required for any estate that files a 706 after july, 2015, regardless of the decedent’s date of death. Download this form print this form Retain copies of all forms for the estate's records. To protect privacy, form 8971 should not be provided to any beneficiary. This item is used to.

To protect privacy, form 8971 should not be provided to any beneficiary. Web about form 8971, information regarding beneficiaries acquiring property from a decedent. Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax value of property of that estate. Submit form 8971 with a copy of each completed schedule a to the irs. Web the new form 8971, information regarding beneficiaries acquiring property from a decedent, will be used by executors to report the required information to the irs. Web form 8971 (including all attached schedule(s) a) must be filed with the irs and only the schedule a is to be provided to the beneficiary listed on that schedule a, no later than the earlier of: Schedule a, attached to form 8971, is used to provide each beneficiary with information that must be reported under the new statute. Web date provided notice to executors: Web form 8971 is required for any estate that files a 706 after july, 2015, regardless of the decedent’s date of death. Only schedule a of form 8971 should be provided to the beneficiary.

Form 8938 Instructions 2022 2023 IRS Forms Zrivo

This item is used to. Only schedule a of form 8971 should be provided to the beneficiary. To protect privacy, form 8971 should not be provided to any beneficiary. Web form 8971 is required for any estate that files a 706 after july, 2015, regardless of the decedent’s date of death. Web form 8971 (including all attached schedule(s) a) must.

IRS Form 8971 Instructions Reporting a Decedent's Property

Executors file this form to report the final estate tax value of property distributed or to be distributed from the estate, if the estate tax return is filed after july 2015. Download this form print this form Web the new form 8971, information regarding beneficiaries acquiring property from a decedent, will be used by executors to report the required information.

IRS Form 8971 Instructions Reporting a Decedent's Property

Web about form 8971, information regarding beneficiaries acquiring property from a decedent. Web date provided notice to executors: Retain copies of all forms for the estate's records. Form 8971 and attached schedule(s) a must be filed with the irs, separate from. This item is used to.

IRS Form 8971 Download Fillable PDF or Fill Online Information

Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax value of property of that estate. Web federal information regarding beneficiaries acquiring property from a decedent form 8971 pdf form content report error it appears you don't have a pdf plugin for this browser. Submit form 8971 with.

IRS Form 8971 A Guide to Reporting Property From A Decedent

Only schedule a of form 8971 should be provided to the beneficiary. Executors file this form to report the final estate tax value of property distributed or to be distributed from the estate, if the estate tax return is filed after july 2015. Retain copies of all forms for the estate's records. Web date provided notice to executors: One schedule.

Form 8962 Fill Out and Sign Printable PDF Template signNow

Web form 8971 (including all attached schedule(s) a) must be filed with the irs and only the schedule a is to be provided to the beneficiary listed on that schedule a, no later than the earlier of: Only schedule a of form 8971 should be provided to the beneficiary. Submit form 8971 with a copy of each completed schedule a.

New IRS Form 8971 Rules to Report Beneficiary Cost Basis Fill Out and

Web form 8971 (including all attached schedule(s) a) must be filed with the irs and only the schedule a is to be provided to the beneficiary listed on that schedule a, no later than the earlier of: Do you have to file form 8971 for an estate that files its original 706 prior to july, 2015, but files a supplemental.

IRS Form 8971 Instructions Reporting a Decedent's Property

Download this form print this form One schedule a is provided to each beneficiary receiving property from an estate. Do you have to file form 8971 for an estate that files its original 706 prior to july, 2015, but files a supplemental 706 after july, 2015? Only schedule a of form 8971 should be provided to the beneficiary. Schedule a,.

New Basis Reporting Requirements for Estates Meeting Form 8971

Executors file this form to report the final estate tax value of property distributed or to be distributed from the estate, if the estate tax return is filed after july 2015. Web form 8971, along with a copy of every schedule a, is used to report values to the irs. Do you have to file form 8971 for an estate.

Fillable Form 8971 Information Regarding Beneficiaries Acquiring

Web the new form 8971, information regarding beneficiaries acquiring property from a decedent, will be used by executors to report the required information to the irs. Executors file this form to report the final estate tax value of property distributed or to be distributed from the estate, if the estate tax return is filed after july 2015. Web about form.

Web Form 8971 (Including All Attached Schedule(S) A) Must Be Filed With The Irs And Only The Schedule A Is To Be Provided To The Beneficiary Listed On That Schedule A, No Later Than The Earlier Of:

Web form 8971 (including all attached schedule(s) a) must be filed with the irs and only the schedule a is to be provided to the beneficiary listed on that schedule a, no later than the earlier of: Do you have to file form 8971 for an estate that files its original 706 prior to july, 2015, but files a supplemental 706 after july, 2015? Web date provided notice to executors: Web the new form 8971, information regarding beneficiaries acquiring property from a decedent, will be used by executors to report the required information to the irs.

One Schedule A Is Provided To Each Beneficiary Receiving Property From An Estate.

Download this form print this form Web form 8971 is required for any estate that files a 706 after july, 2015, regardless of the decedent’s date of death. This information return reports the values from the decedent’s gross estate to both the irs and to each beneficiary receiving property from the estate. Web federal information regarding beneficiaries acquiring property from a decedent form 8971 pdf form content report error it appears you don't have a pdf plugin for this browser.

Only Schedule A Of Form 8971 Should Be Provided To The Beneficiary.

It is not clear that form 8971 is required under these circumstances. Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax value of property of that estate. Web form 8971, along with a copy of every schedule a, is used to report values to the irs. Retain copies of all forms for the estate's records.

Submit Form 8971 With A Copy Of Each Completed Schedule A To The Irs.

Web about form 8971, information regarding beneficiaries acquiring property from a decedent. Form 8971 and attached schedule(s) a must be filed with the irs, separate from. Schedule a, attached to form 8971, is used to provide each beneficiary with information that must be reported under the new statute. To protect privacy, form 8971 should not be provided to any beneficiary.