Form 8996 Instructions 2021

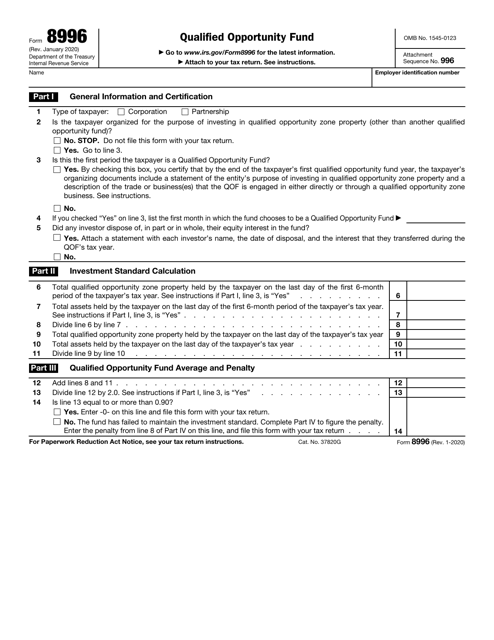

Form 8996 Instructions 2021 - Web turbotax does not support forms 8996 or 8997 at this time. Web form 8996 to certify that it is organized to invest in qoz property. However, if the qoz property was undergoing substantial improvement during the period of april 1, 2020, through march. Web november 8, 2021 draft as of form 8996 (rev. Web form 8996 (december 2018) department of the treasury internal revenue service. January 2021) department of the treasury internal revenue service. Web helping to build strong, vibrant communities. Form 8996 is filed annually @rubble2. Irc 6621 (a) (2) and (c) (1) underpayment rates. December 2021) department of the treasury internal revenue service qualified opportunity fund go to.

However, if the qoz property was undergoing substantial improvement during the period of april 1, 2020, through march. Form 8996 is filed annually @rubble2. Web draft form 8996, qualified opportunity fund, and instructions released november 2 to reflect penalty relief and voluntary decertification. Under the opportunity zones (oz) incentive, taxpayers can defer taxes by reinvesting. Web form 8996 to certify that it is organized to invest in qoz property. Web how to fill out irs form 8997 (for oz investors), with ashley tison. December 2021) department of the treasury internal revenue service qualified opportunity fund go to. Web general instructions future developments for the latest information about developments related to form 8996 and its instructions, such as legislation enacted. Irc 6621 (a) (2) and (c) (1) underpayment rates. No one at turbotax knows what forms will be supported in 2027.

However, if the qoz property was undergoing substantial improvement during the period of april 1, 2020, through march. December 2021) department of the treasury internal revenue service qualified opportunity fund go to. Web table of interest rates. A corporation or partnership that is organized and operated as a qof. Form 8996 is filed annually @rubble2. Instructions for form 8995, qualified business income deduction. Web how to fill out irs form 8997 (for oz investors), with ashley tison. Irc 6621 (a) (2) and (c) (1) underpayment rates. Web turbotax does not support forms 8996 or 8997 at this time. Web form 8996 to certify that it is organized to invest in qoz property.

Elementor 8996 ICIFE

January 2021) department of the treasury internal revenue service. Web november 8, 2021 draft as of form 8996 (rev. Web how to fill out irs form 8997 (for oz investors), with ashley tison. Web form 8996, qualified opportunity fund, and accompanying instructions released february 17 with changes made to reflect that the penalty for not meeting the. Under the opportunity.

Fill Free fillable Form 8996 Qualified Opportunity Fund (IRS) PDF form

Web how to fill out irs form 8997 (for oz investors), with ashley tison. Under the opportunity zones (oz) incentive, taxpayers can defer taxes by reinvesting. Community & economic development ›. Web instructions for form 8995, qualified business income deduction simplified computation 2020 inst 8995: Web table of interest rates.

Form Instructions Fill Out and Sign Printable PDF Template signNow

Instructions for form 8995, qualified business income deduction. Web form 8996 (december 2018) department of the treasury internal revenue service. December 2021) department of the treasury internal revenue service qualified opportunity fund go to. Web turbotax does not support forms 8996 or 8997 at this time. Irs form 8996 information and.

IRS Form 8996 Download Fillable PDF or Fill Online Qualified

Web turbotax does not support forms 8996 or 8997 at this time. Community & economic development ›. Web form 8996 to certify that it is organized to invest in qoz property. No one at turbotax knows what forms will be supported in 2027. In addition, a corporation or partnership files form 8996 annually to report that the qof meets the.

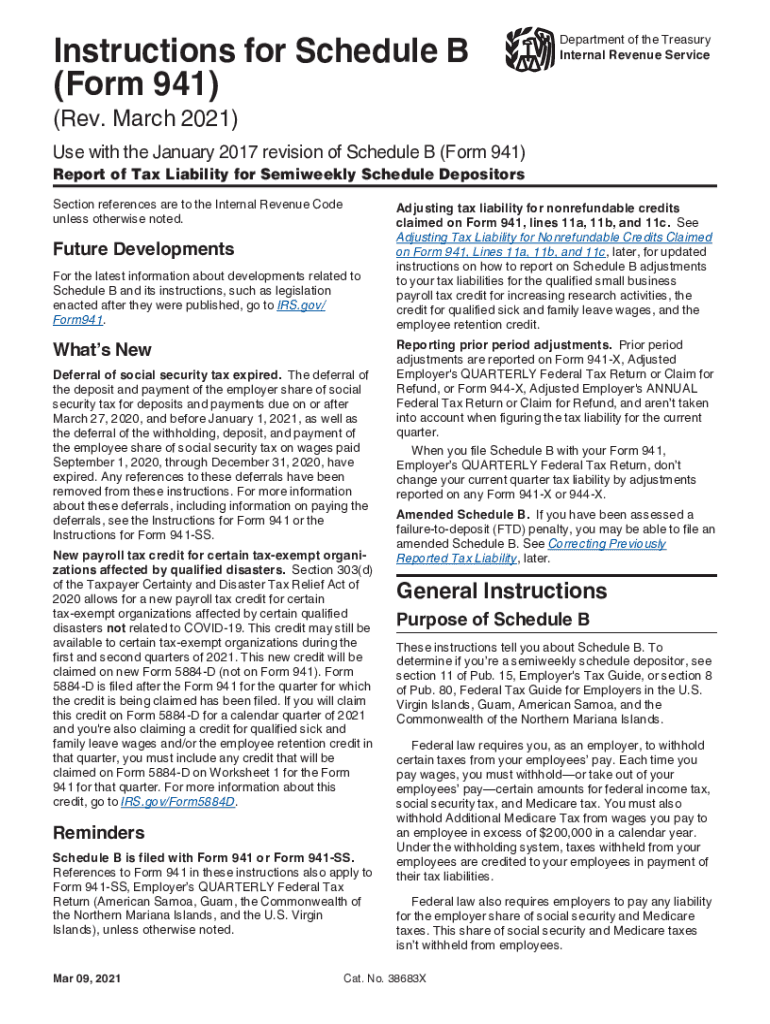

IRS Instructions 941 Schedule B 20212022 Fill and Sign Printable

Irc 6621 (a) (2) and (c) (1) underpayment rates. Form 8996 is filed annually @rubble2. A corporation or partnership that is organized and operated as a qof. Web general instructions future developments for the latest information about developments related to form 8996 and its instructions, such as legislation enacted. Web form 8996, qualified opportunity fund, and accompanying instructions released february.

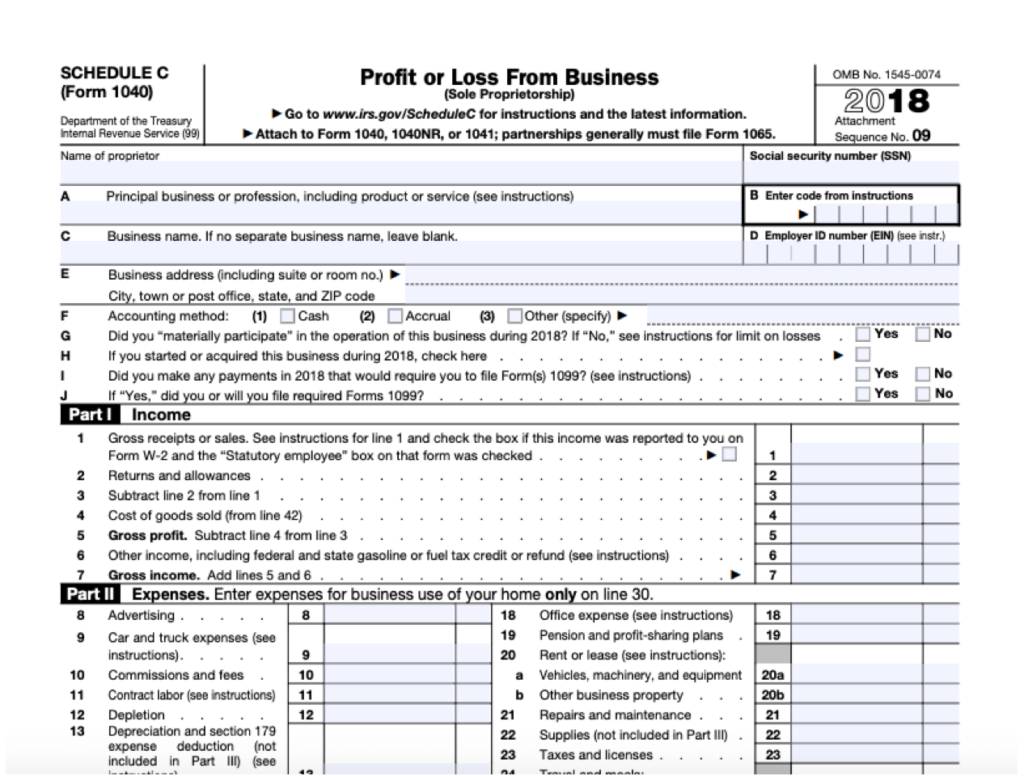

Schedule C Instructions With FAQs 2021 Tax Forms 1040 Printable

A corporation or partnership that is organized and operated as a qof. However, if the qoz property was undergoing substantial improvement during the period of april 1, 2020, through march. Irc 6621 (a) (2) and (c) (1) underpayment rates. Under the opportunity zones (oz) incentive, taxpayers can defer taxes by reinvesting. Web form 8996 to certify that it is organized.

IRS Form 8996 Qualified Opportunity Fund Lies on Flat Lay Office Table

Web november 8, 2021 draft as of form 8996 (rev. Web how to fill out irs form 8997 (for oz investors), with ashley tison. Community & economic development ›. A corporation or partnership that is organized and operated as a qof. Irc 6621 (a) (2) and (c) (1) underpayment rates.

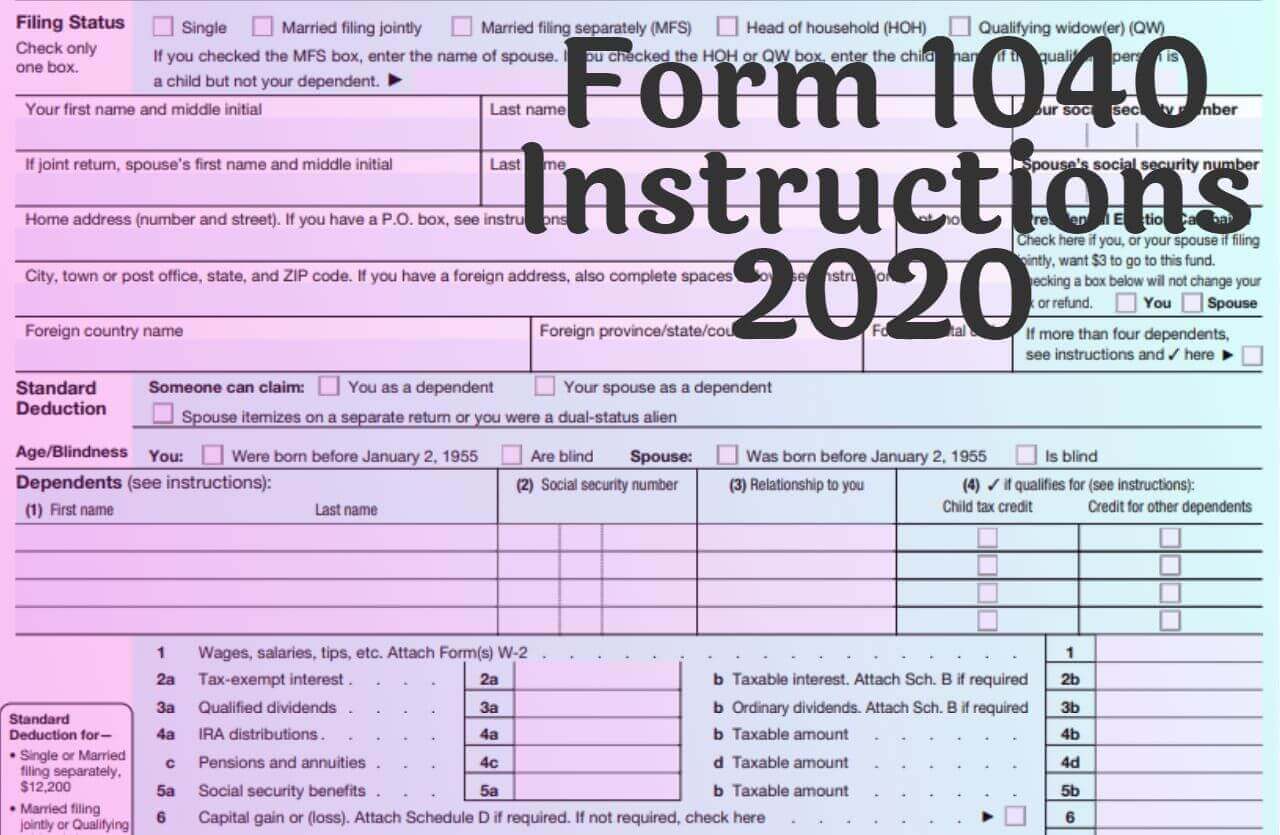

Form 1040 Instructions 2020

Form 8996 is filed annually @rubble2. Web table of interest rates. Instructions for form 8995, qualified business income deduction. Web general instructions future developments for the latest information about developments related to form 8996 and its instructions, such as legislation enacted. January 2021) department of the treasury internal revenue service.

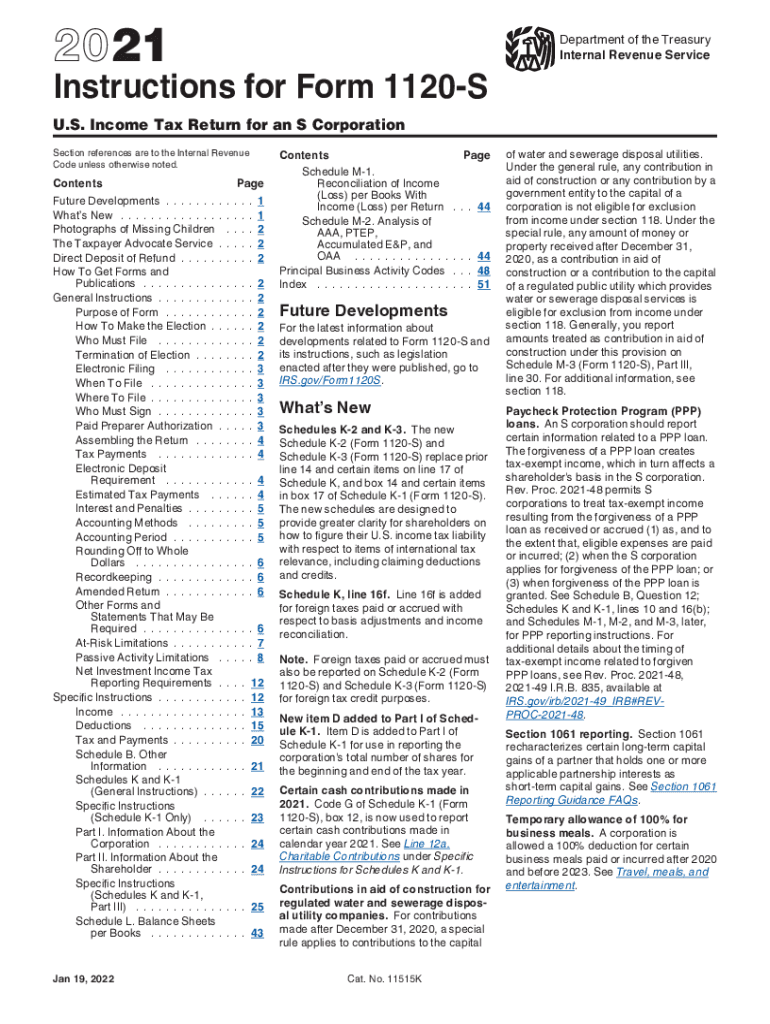

2021 Form IRS Instructions 1120S Fill Online, Printable, Fillable

Web how to fill out irs form 8997 (for oz investors), with ashley tison. Community & economic development ›. Web form 8996 to certify that it is organized to invest in qoz property. Web form 8996 (december 2018) department of the treasury internal revenue service. Web instructions for form 8995, qualified business income deduction simplified computation 2020 inst 8995:

1041 Fill Out and Sign Printable PDF Template signNow

Irc 6621 (a) (2) and (c) (1) underpayment rates. Under the opportunity zones (oz) incentive, taxpayers can defer taxes by reinvesting. December 2021) department of the treasury internal revenue service qualified opportunity fund go to. In addition, a corporation or partnership files form 8996 annually to report that the qof meets the 90%. Web turbotax does not support forms 8996.

Under The Opportunity Zones (Oz) Incentive, Taxpayers Can Defer Taxes By Reinvesting.

Web form 8996, qualified opportunity fund, and accompanying instructions released february 17 with changes made to reflect that the penalty for not meeting the. Web table of interest rates. A corporation or partnership that is organized and operated as a qof. No one at turbotax knows what forms will be supported in 2027.

Web Per Irs Form 8996 Instructions, This Form Is To Be Filed By A Corporation Or Partnership:

Web turbotax does not support forms 8996 or 8997 at this time. However, if the qoz property was undergoing substantial improvement during the period of april 1, 2020, through march. Irs form 8996 information and. Web form 8996 to certify that it is organized to invest in qoz property.

Web Draft Form 8996, Qualified Opportunity Fund, And Instructions Released November 2 To Reflect Penalty Relief And Voluntary Decertification.

Instructions for form 8995, qualified business income deduction. Form 8996 is filed annually @rubble2. In addition, a corporation or partnership files form 8996 annually to report that the qof meets the 90%. Irc 6621 (a) (2) and (c) (1) underpayment rates.

Web Instructions For Form 8995, Qualified Business Income Deduction Simplified Computation 2020 Inst 8995:

Web november 8, 2021 draft as of form 8996 (rev. Community & economic development ›. Web helping to build strong, vibrant communities. December 2021) department of the treasury internal revenue service qualified opportunity fund go to.