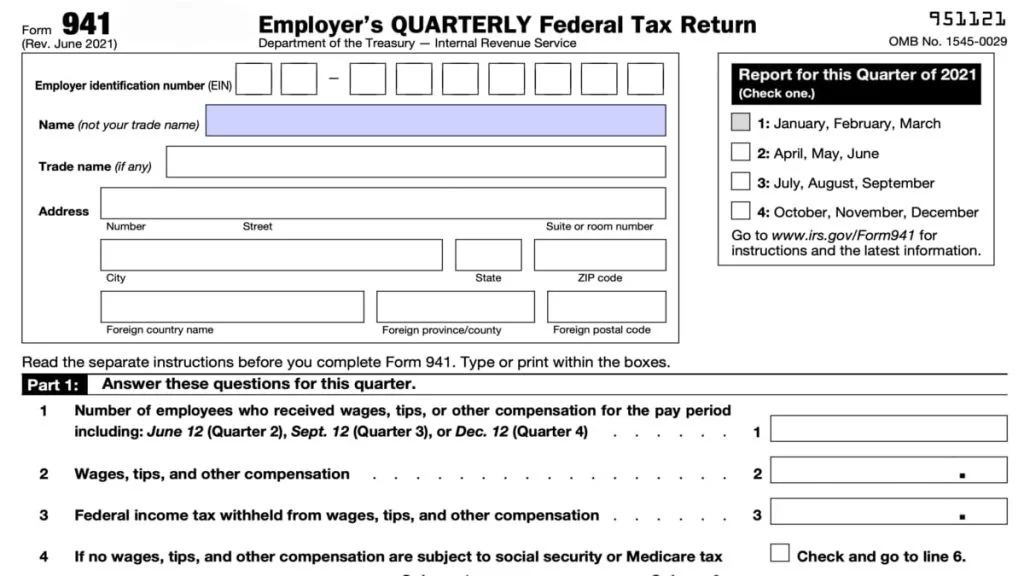

Form 941 March 2022

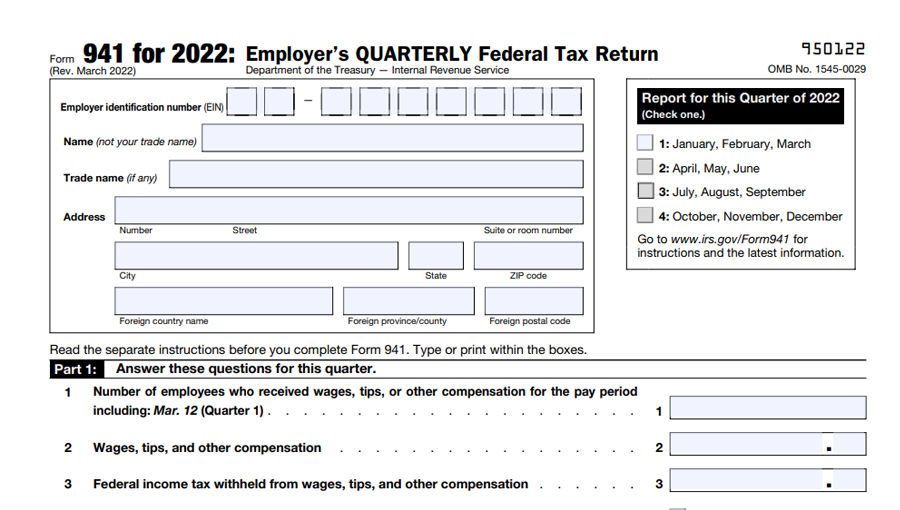

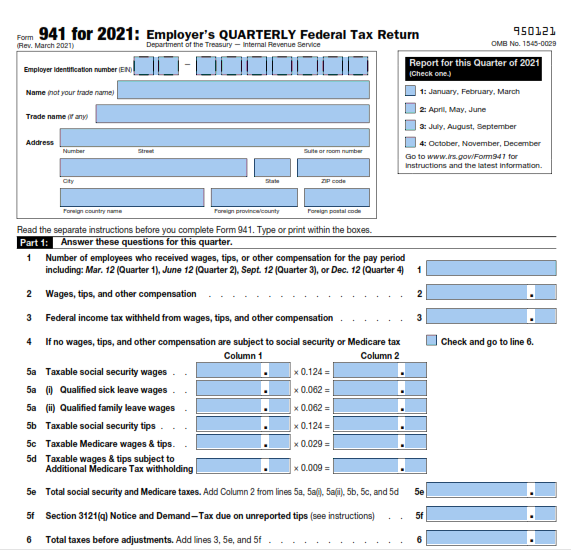

Form 941 March 2022 - The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in Web ployment tax returns for the first quarter of 2022. Web the inflation reduction act of 2022 (the ira) increases the election amount to $500,000 for tax years beginning after december 31, 2022. The last time form 941 was updated was in june 2021 for use in the second, third, and fourth quarters of 2021. April, may, june read the separate instructions before completing this form. For instructions and the latest information. Social security and medicare tax for 2022. June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code. Revised 2022 form 941 , employer’s quarterly federal tax return, and its instructions. You must complete all five pages.

26 by the internal revenue service. Web ployment tax returns for the first quarter of 2022. June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in Revised 2022 form 941 , employer’s quarterly federal tax return, and its instructions. Social security and medicare tax for 2022. The draft form 941 , which has a march 2022 revision date, contained several changes when compared with the version in effect for the second through fourth quarters of 2021. The last time form 941 was updated was in june 2021 for use in the second, third, and fourth quarters of 2021. Web the inflation reduction act of 2022 (the ira) increases the election amount to $500,000 for tax years beginning after december 31, 2022. Read the separate instructions before you complete form 941.

Web ployment tax returns for the first quarter of 2022. April, may, june read the separate instructions before completing this form. The payroll tax credit election must be made on or before the due date of the originally filed income tax return (including extensions). Type or print within the boxes. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Web report for this quarter of 2022 (check one.) 1: Social security and medicare tax for 2022. See the march 2022 revision of the instructions for form 941 or the 2022 instructions for form 944 for more information. 26 by the internal revenue service. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan.

Fillable 941 Quarterly Form 2022 Printable Form, Templates and Letter

The payroll tax credit election must be made on or before the due date of the originally filed income tax return (including extensions). Web report for this quarter of 2022 (check one.) 1: Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed.

941 Form 2023

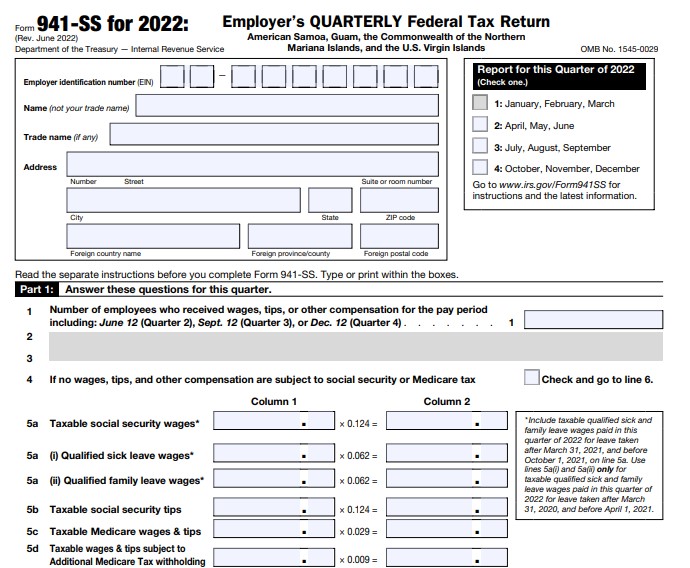

Type or print within the boxes. June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code. The rate of social security tax.

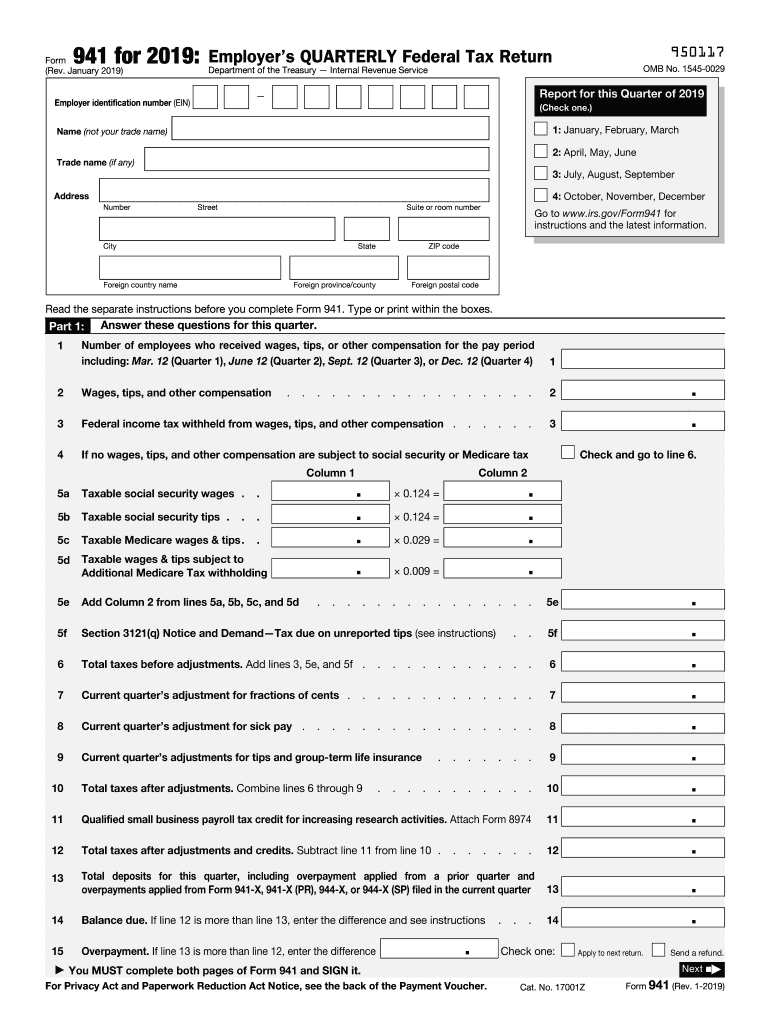

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES

Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web a draft version of the 2022 form 941, employer’s quarterly.

IRS Form 941 SS Online for 2022 Efile 941SS for 4.95

Revised 2022 form 941 , employer’s quarterly federal tax return, and its instructions. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Type or print within the boxes. Web report for this quarter of 2022 (check one.) 1: 26 by the internal revenue service.

Form 941 Fill Out and Sign Printable PDF Template signNow

For instructions and the latest information. June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code. Web information about form 941, employer's.

File Form 941 Online for 2023 Efile 941 at Just 5.95

For instructions and the latest information. April, may, june read the separate instructions before completing this form. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. The payroll tax credit election must be made on or before the due date of the originally filed income tax return (including.

Top10 US Tax Forms in 2022 Explained PDF.co

The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip.

Update Form 941 Changes Regulatory Compliance

Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in April, may, june read the separate instructions before completing this form. 26 by the internal revenue service. Web ployment tax returns for.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in The instructions were updated with requirements for claiming the remaining credits in 2022. Type or print within the boxes. Web form 941, which has a revision date of march 2022, must be used only for the first quarter of.

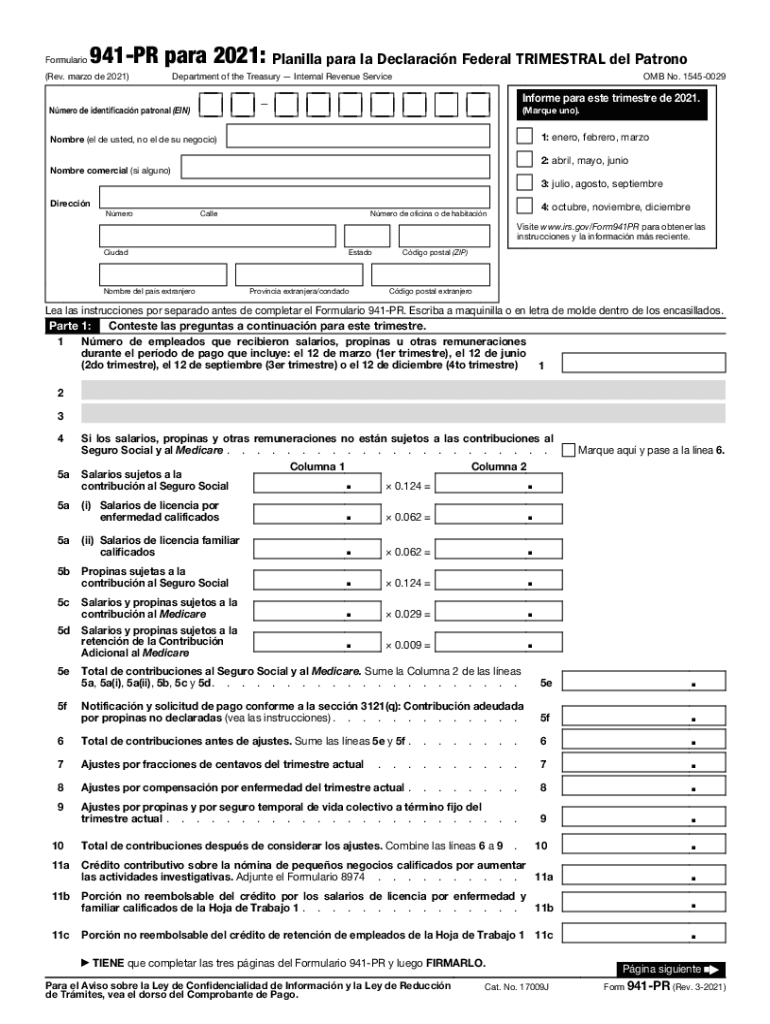

941 Pr 2021 Form Fill Out and Sign Printable PDF Template signNow

The last time form 941 was updated was in june 2021 for use in the second, third, and fourth quarters of 2021. Social security and medicare tax for 2022. Web ployment tax returns for the first quarter of 2022. Type or print within the boxes. 26 by the internal revenue service.

Revised 2022 Form 941 , Employer’s Quarterly Federal Tax Return, And Its Instructions.

Web ployment tax returns for the first quarter of 2022. 26 by the internal revenue service. Social security and medicare tax for 2022. The draft form 941 , which has a march 2022 revision date, contained several changes when compared with the version in effect for the second through fourth quarters of 2021.

The Last Time Form 941 Was Updated Was In June 2021 For Use In The Second, Third, And Fourth Quarters Of 2021.

Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out. Web report for this quarter of 2022 (check one.) 1: June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax.

Web Information About Form 941, Employer's Quarterly Federal Tax Return, Including Recent Updates, Related Forms, And Instructions On How To File.

Web the inflation reduction act of 2022 (the ira) increases the election amount to $500,000 for tax years beginning after december 31, 2022. Type or print within the boxes. Read the separate instructions before you complete form 941. Type or print within the boxes.

See The March 2022 Revision Of The Instructions For Form 941 Or The 2022 Instructions For Form 944 For More Information.

Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. April, may, june read the separate instructions before completing this form. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in For instructions and the latest information.