Form 941 Or 944

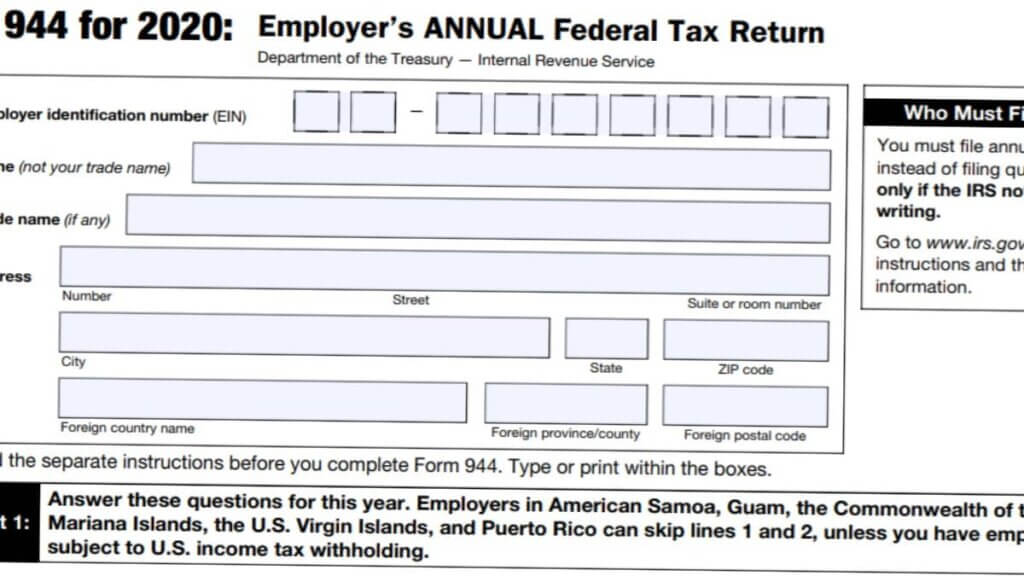

Form 941 Or 944 - But, only qualifying small employers can use form 944. Web generally, employers are required to file forms 941 quarterly. Generally, employers must report wages, tips and other compensation paid to an employee by filing the required forms to the irs. Form 944 is for smaller employers, whose annual tax liability is less than $1,000 for social security,. Some small employers are eligible to file an annual form 944 pdf. Web form 944 is designed so the smallest employers (those whose annual liability for social security, medicare, and withheld federal income taxes is $1,000 or less) will file and pay. In contrast to this, form 941. Go to www.irs.gov/form944 for instructions and the latest information. Web that’s a lot of time, especially when it’s not always clear whether an employer should use form 941 or 944 to report their payroll taxes. Form 941 is even more similar to form 944, and easier to confuse.

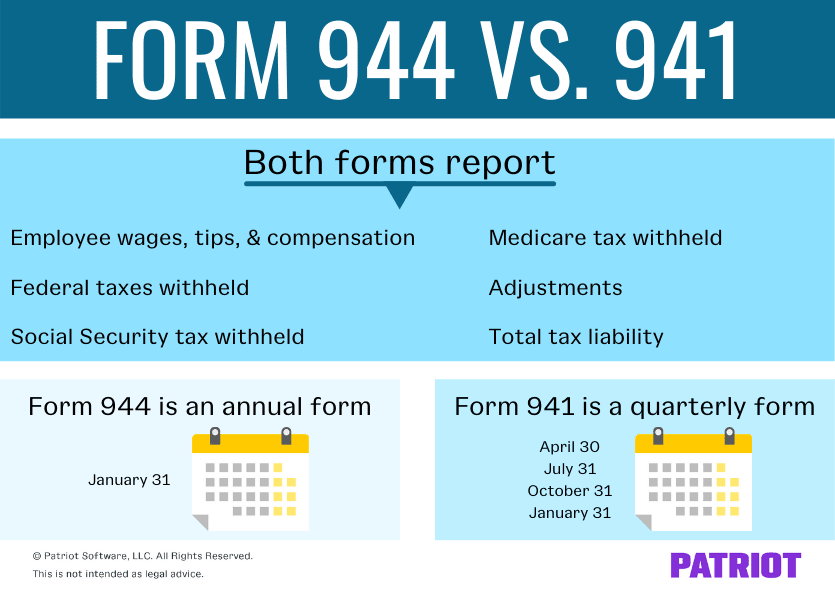

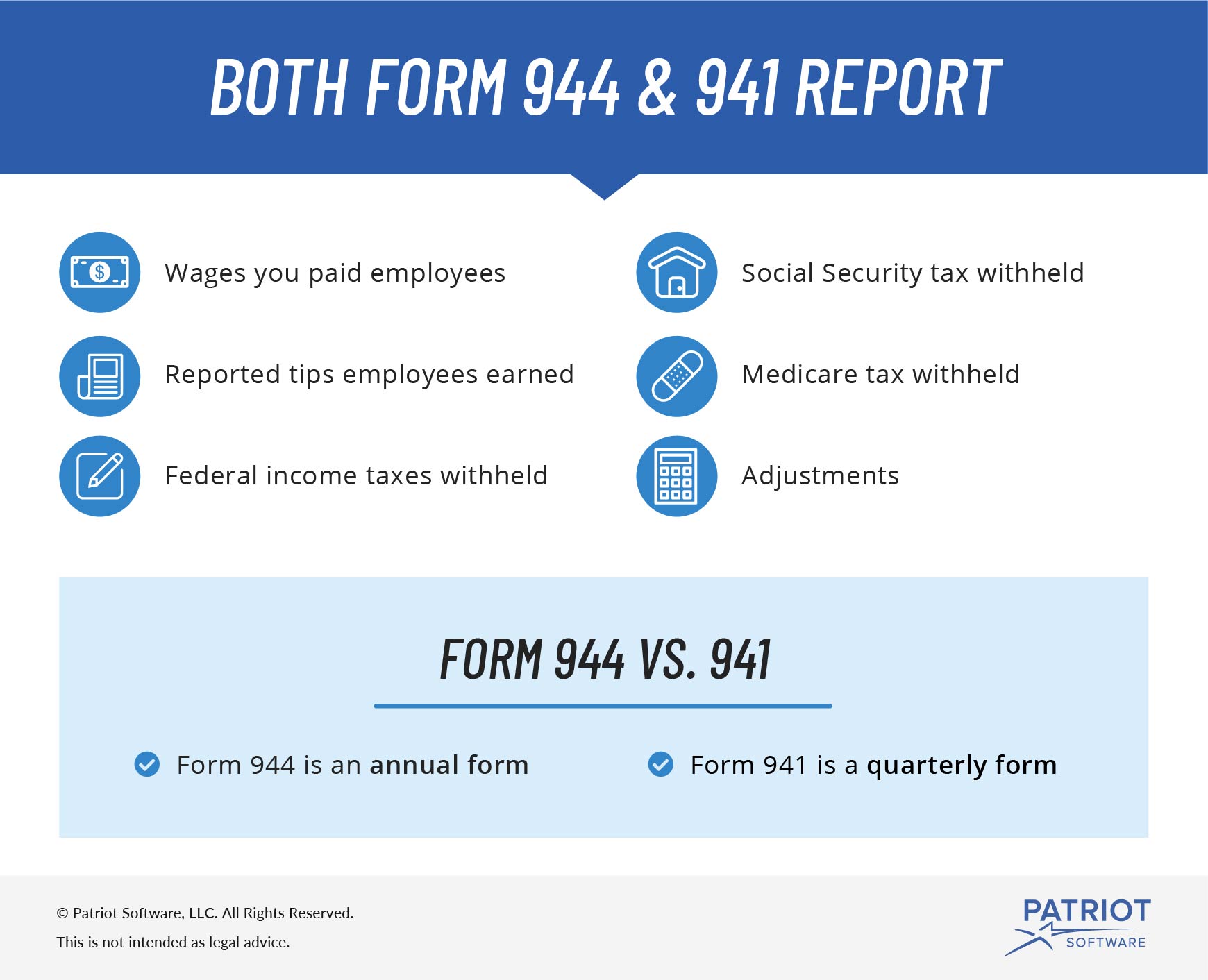

Form 941 is even more similar to form 944, and easier to confuse. Web how is form 944 different from form 941? Go to www.irs.gov/form944 for instructions and the latest information. All employers need to report to the irs the tax withheld from employees as well as their own tax liabilities. Web a quarterly (941 form) or annual (944 form) employer’s tax return must by filed by the extension council. Web unlike irs form 941, which reports much of the same information, but must be filed quarterly, form 944 is an annual tax return. 941/944 employer’s federal tax returns council has two filing. Some small employers are eligible to file an annual form 944 pdf. However, some small employers (those whose annual liability for social security, medicare, and. Web what’s the difference between form 941 and form 944?

All employers need to report to the irs the tax withheld from employees as well as their own tax liabilities. But, only qualifying small employers can use form 944. 941/944 employer’s federal tax returns council has two filing. Web that’s a lot of time, especially when it’s not always clear whether an employer should use form 941 or 944 to report their payroll taxes. Web form 944 is used by smaller employers instead of irs form 941, the employer's quarterly employment tax return. Web the main distinction between irs forms 941 and 944 involves how often wages and taxes are reported. Web generally, employers are required to file forms 941 quarterly. Go to www.irs.gov/form944 for instructions and the latest information. Web the 944 form is a replacement for the quarterly form 941. Form 944 is for smaller employers, whose annual tax liability is less than $1,000 for social security,.

Form 944 vs. Form 941 Should You File the Annual or Quarterly Form?

Go to www.irs.gov/form944 for instructions and the latest information. Both of these forms are used to report fica and income tax. Keep reading to learn the. In contrast to this, form 941. Web unlike irs form 941, which reports much of the same information, but must be filed quarterly, form 944 is an annual tax return.

How to Complete Form 941 in 5 Simple Steps

Web form 944 is used by smaller employers instead of irs form 941, the employer's quarterly employment tax return. However, some small employers (those whose annual liability for social security, medicare, and. Go to www.irs.gov/form944 for instructions and the latest information. Generally, employers must report wages, tips and other compensation paid to an employee by filing the required forms to.

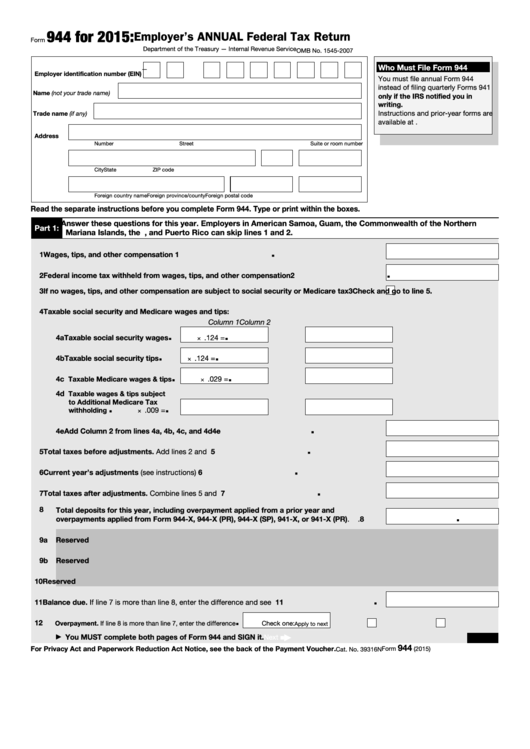

Form 944 Employer's Annual Federal Tax Return (2015) Free Download

You can only file form 944 if the irs. Web form 944 is used by smaller employers instead of irs form 941, the employer's quarterly employment tax return. You must also report taxes you. Keep reading to learn the. All employers need to report to the irs the tax withheld from employees as well as their own tax liabilities.

What Is The Difference Between Form 941 and Form 944? Blog TaxBandits

Web the main distinction between irs forms 941 and 944 involves how often wages and taxes are reported. You must also report taxes you. Web unlike irs form 941, which reports much of the same information, but must be filed quarterly, form 944 is an annual tax return. Web a quarterly (941 form) or annual (944 form) employer’s tax return.

Want To File Form 941 Instead of 944? This Is How Blog TaxBandits

Web the 944 form is a replacement for the quarterly form 941. Web unlike irs form 941, which reports much of the same information, but must be filed quarterly, form 944 is an annual tax return. You may qualify to use form 944 instead. Web as an employer, you're generally required to deposit the employment taxes reported on forms 941,.

Form 944 Demonstration

Web a quarterly (941 form) or annual (944 form) employer’s tax return must by filed by the extension council. Web form 944 is designed so the smallest employers (those whose annual liability for social security, medicare, and withheld federal income taxes is $1,000 or less) will file and pay. You can only file form 944 if the irs. You may.

Form 944 vs. Form 941 Should You File the Annual or Quarterly Form?

Some small employers are eligible to file an annual form 944 pdf. Web how is form 944 different from form 941? Web what is the difference between a 941 and a 944 form? You can only file form 944 if the irs. Both of these forms are used to report fica and income tax.

Fillable Form 944 Employer'S Annual Federal Tax Return 2017

Web the main distinction between form 940 and 941 is that form 940 documents futa tax, which is paid exclusively by the employer. Some small employers are eligible to file an annual form 944 pdf. You may qualify to use form 944 instead. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification.

Form 944 vs. 941 Should You File the Annual or Quarterly Form?

Web the main distinction between irs forms 941 and 944 involves how often wages and taxes are reported. Web what’s the difference between form 941 and form 944? Both of these forms are used to report fica and income tax. In contrast to this, form 941. Go to www.irs.gov/form944 for instructions and the latest information.

944 Form 2021 2022 IRS Forms Zrivo

Web what’s the difference between form 941 and form 944? Form 941 is even more similar to form 944, and easier to confuse. Form 941 is officially known as the employer’s quarterly federal tax. You can only file form 944 if the irs. Web you must file annual form 944 instead of filing quarterly forms 941 only if the irs.

Web Form 944 Is Used By Smaller Employers Instead Of Irs Form 941, The Employer's Quarterly Employment Tax Return.

But, only qualifying small employers can use form 944. Web how is form 944 different from form 941? Form 941 is officially known as the employer’s quarterly federal tax. Keep reading to learn the.

Web A Quarterly (941 Form) Or Annual (944 Form) Employer’s Tax Return Must By Filed By The Extension Council.

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Web that’s a lot of time, especially when it’s not always clear whether an employer should use form 941 or 944 to report their payroll taxes. Go to www.irs.gov/form944 for instructions and the latest information. You may qualify to use form 944 instead.

All Employers Need To Report To The Irs The Tax Withheld From Employees As Well As Their Own Tax Liabilities.

You must also report taxes you. Web generally, employers are required to file forms 941 quarterly. Web you must file annual form 944 instead of filing quarterly forms 941 only if the irs notified you in writing. Web the main distinction between irs forms 941 and 944 involves how often wages and taxes are reported.

Web What’s The Difference Between Form 941 And Form 944?

However, some small employers (those whose annual liability for social security, medicare, and. Web unlike irs form 941, which reports much of the same information, but must be filed quarterly, form 944 is an annual tax return. Form 941 is even more similar to form 944, and easier to confuse. Web form 944 is designed so the smallest employers (those whose annual liability for social security, medicare, and withheld federal income taxes is $1,000 or less) will file and pay.