Form 944 Due Date

Form 944 Due Date - Web up to $32 cash back the deadline to file your 2022 form 944 return is january 31, 2023. The purpose of form 944 is to reduce burden on small employers by allowing them to file one return per. However, if you made deposits on time in full payment of the. Web date items due; Web when is the due date for form 944? Web when is form 944 due? For 2022, you have to file form 944 by january 31, 2023. Web for the latest information about developments related to form 944 and its instructions, such as legislation enacted after they were published, go to irs.gov/form944. If you pay wages subject to federal income tax withholdings, medicare and social security taxes and expect to. In those cases, it is due on the following normal business day.

However, if you made deposits on time in full payment of the taxes due for the year, you can file the return by february 10, 2022. Web specifically we talked about due dates for tax deposits and penalties, how to determine if you are a monthly or semiweekly depositor, and making deposits electronically. Web where to get form 944 form 944 is available on the irs website. The irs encourages businesses to. Web the 2021 form 944 is due on january 31, 2022. It's a version of form. Web when is form 944 due? Web when is the due date to file 944 tax form? However, if you paid all your taxes owed for the year with. In those cases, it is due on the following normal business day.

Web where to get form 944 form 944 is available on the irs website. Quarterly returns for q4 payroll and income taxes from the prior. Web when is form 944 due? Web for the latest information about developments related to form 944 and its instructions, such as legislation enacted after they were published, go to irs.gov/form944. However, if you made deposits on time in full payment of the taxes due for the year, you can file the return by february 10, 2022. Web form 944 is due by january 31 each year. Web regardless of the filing method, form 944 is due by january 31st each year (paper or electronic filing). The purpose of form 944 is to reduce burden on small employers by allowing them to file one return per. Web date items due; Web specifically we talked about due dates for tax deposits and penalties, how to determine if you are a monthly or semiweekly depositor, and making deposits electronically.

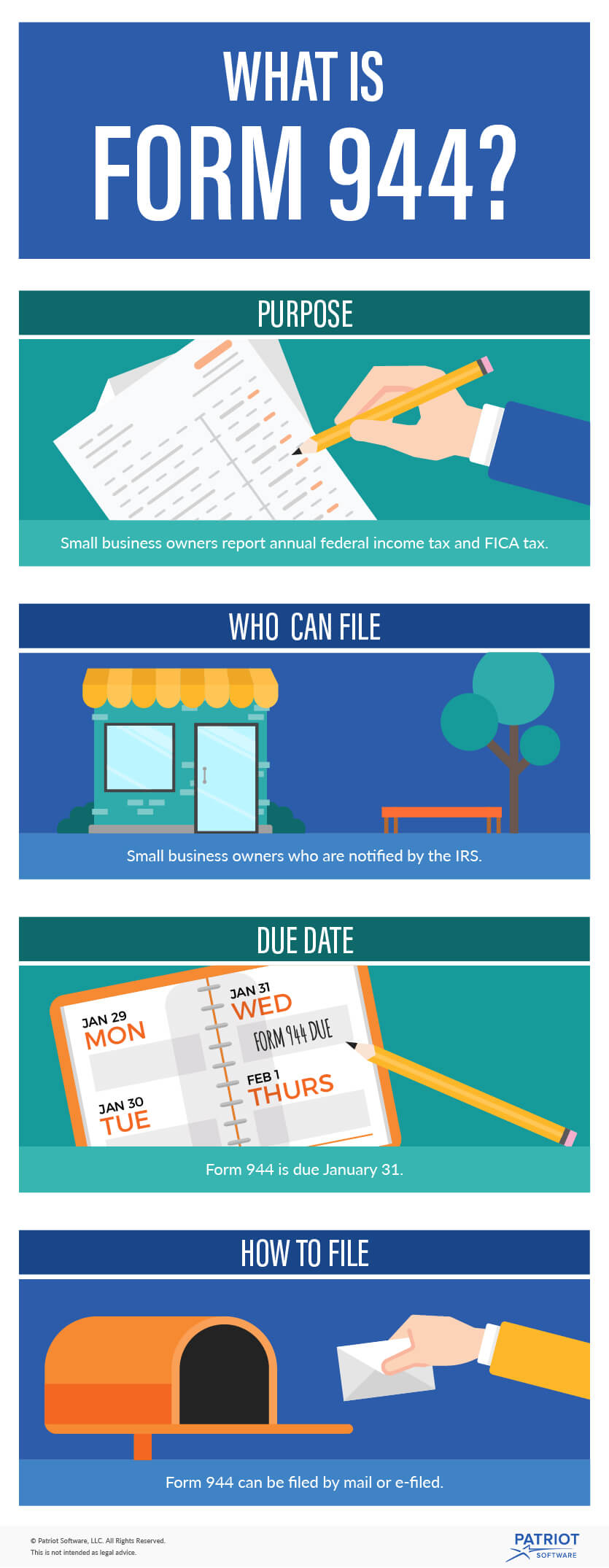

Form 944 Edit, Fill, Sign Online Handypdf

Web up to $32 cash back the deadline to file your 2022 form 944 return is january 31, 2023. If you pay wages subject to federal income tax withholdings, medicare and social security taxes and expect to. Web when is form 944 due? The irs encourages businesses to. Monthly deposit of payroll and income taxes.

2016 Form IRS 944 Fill Online, Printable, Fillable, Blank pdfFiller

The irs encourages businesses to. Web form 944 is due by january 31 each year. However, if you made deposits on time in full payment of the. However, if you made deposits on time in full payment of the. Web date items due;

Form 944 Employer's Annual Federal Tax Return (2015) Free Download

However, if you paid all your taxes owed for the year with. Web for 2022, the due date for filing form 944 is january 31, 2023. Web form 944 generally is due on january 31 of the following year. You can complete it online, download a copy, or you can print out a copy from the website. Web when is.

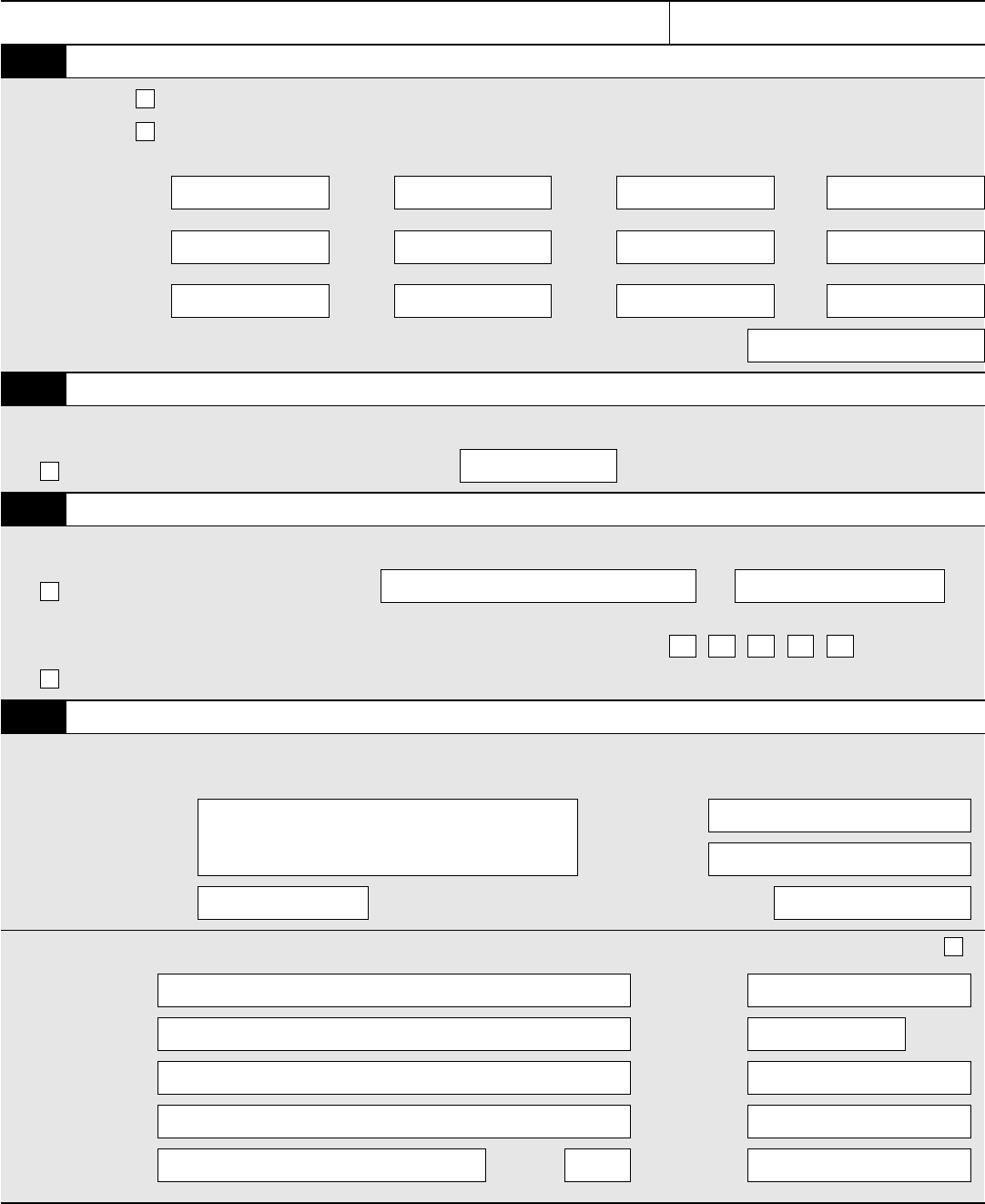

What Is Form 944 What Is Federal Form 944 For Employers How To

Web form 944 is due by january 31st every year, regardless of the filing method (paper or electronic filing). Web form 944 generally is due on january 31 of the following year. You can complete it online, download a copy, or you can print out a copy from the website. Web form 944, employer’s annual federal tax return: However, if.

What is Form 944? Reporting Federal & FICA Taxes

Web advertiser disclosure irs form 944: Web date items due; The irs encourages businesses to. Web where to get form 944 form 944 is available on the irs website. You can complete it online, download a copy, or you can print out a copy from the website.

944 Form 2021 2022 IRS Forms Zrivo

However, if you made deposits on time in full payment of the. Unlike those filing a 941, small business owners have the option to pay taxes when. Web up to $32 cash back the deadline to file your 2022 form 944 return is january 31, 2023. Monthly deposit of payroll and income taxes. If you pay wages subject to federal.

Fillable Form 944 Employer'S Annual Federal Tax Return 2017

It's a version of form. If your quarterly fica tax withholding is $1,000 or less, you must file form 944 with the irs every year by january 31 of the. However, if you made deposits on time in full payment of the. Web for 2022, the due date for filing form 944 is january 31, 2023. Web when is the.

What Is Form 944? Plus Instructions

Web when is form 944 due? However, if you made deposits on time in full payment of the. However, if you made deposits on time in full payment of the. Unlike those filing a 941, small business owners have the option to pay taxes when. Web form 944, employer’s annual federal tax return:

The Sweet Beginning in USA Form I944 Declaration of SelfSufficiency

Web when is form 944 due? However, if you made deposits on time in full payment of the taxes due for the year, you can file the return by february 10, 2022. It's a version of form. Web form 944 is due by january 31 each year. For 2022, you have to file form 944 by january 31, 2023.

Who is Required to File Form I944 for a Green Card? CitizenPath

Web when is form 944 due? Web advertiser disclosure irs form 944: If your quarterly fica tax withholding is $1,000 or less, you must file form 944 with the irs every year by january 31 of the. Web when is the due date to file 944 tax form? You can complete it online, download a copy, or you can print.

Monthly Deposit Of Payroll And Income Taxes.

The irs encourages businesses to. If your quarterly fica tax withholding is $1,000 or less, you must file form 944 with the irs every year by january 31 of the. Web specifically we talked about due dates for tax deposits and penalties, how to determine if you are a monthly or semiweekly depositor, and making deposits electronically. The purpose of form 944 is to reduce burden on small employers by allowing them to file one return per.

Web Form 944, Employer’s Annual Federal Tax Return:

Unlike those filing a 941, small business owners have the option to pay taxes when. Web 1st quarter 2015 estimated tax payment due. If you pay wages subject to federal income tax withholdings, medicare and social security taxes and expect to. Web regardless of the filing method, form 944 is due by january 31st each year (paper or electronic filing).

Web Form 944 Generally Is Due On January 31 Of The Following Year.

However, if you paid all your taxes owed for the year with. If the deposits are made on time in full payment of the taxes, the return can be filed by february 10,. However, if you made deposits on time in full payment of the. For 2022, you have to file form 944 by january 31, 2023.

In Those Cases, It Is Due On The Following Normal Business Day.

However, if you made deposits on time in full payment of the taxes due for the year, you can file the return by february 10, 2022. Web when is the due date for form 944? Web form 944 is due by january 31st every year, regardless of the filing method (paper or electronic filing). Web date items due;