Form 944 Instructions 2022

Form 944 Instructions 2022 - Who must file form 944? This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return). Complete, edit or print tax forms instantly. Type or print within the boxes. “no” answers indicate possible errors in. Web the inflation reduction act of 2022 (the ira) makes changes to the qualified small business payroll tax credit for increasing research activities for tax years beginning after december. Enclose your check or money order made payable to “united states treasury.”. Complete, edit or print tax forms instantly. Draft instructions for the 2021 form 944, employer’s annual federal tax return, were issued. You must complete all five pages.

Before you begin to file, gather the payroll data. Draft instructions for the 2021 form 944, employer’s annual federal tax return, were issued. Web file form 944 online for 2022. Web irs form 944 is the employer's annual federal tax return. Web annual federal tax return. Web form 944 was intended to give small business employers a break when it came to filing and paying federal payroll taxes. Ad access irs tax forms. How should you complete form 944? You must complete all five pages. Complete, edit or print tax forms instantly.

Ad get ready for tax season deadlines by completing any required tax forms today. Be sure to enter your ein, “form 944,” and “2022” on your check or. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return). The irs released draft instructions for the 2022 form 944. Draft instructions for the 2021 form 944, employer’s annual federal tax return, were issued. 13.0 acceptable documents for verifying employment authorization and identity. Before you begin to file, gather the payroll data. Web file form 944 online for 2022.

944 Form 2021 2022 IRS Forms Zrivo

This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return). Web we last updated the employer's annual federal tax return in february 2023, so this is the latest version of form 944, fully updated for tax year 2022. Draft instructions for the 2021 form 944, employer’s annual federal tax return, were issued. Web.

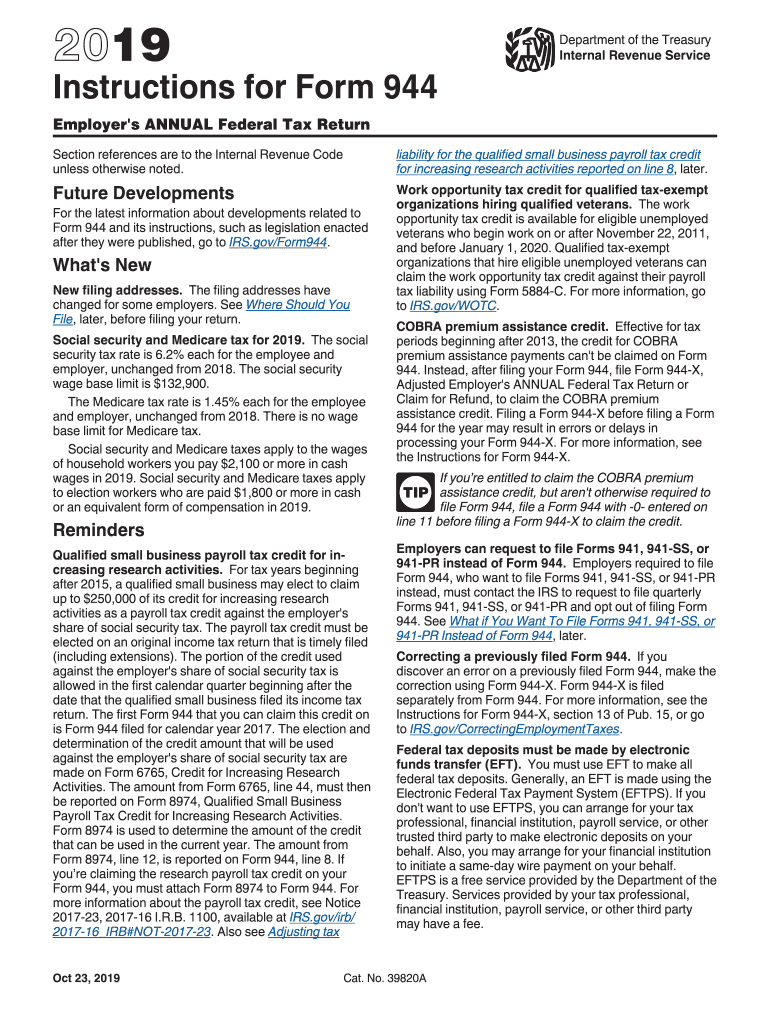

Form 944 2019 Fill Out and Sign Printable PDF Template signNow

Web irs form 944 is the employer's annual federal tax return. The draft changes the form’s worksheets. Web 12.0 instructions for agricultural recruiters and referrers for a fee. Web follow the simple instructions below: How to fill out form 944 for 2022?

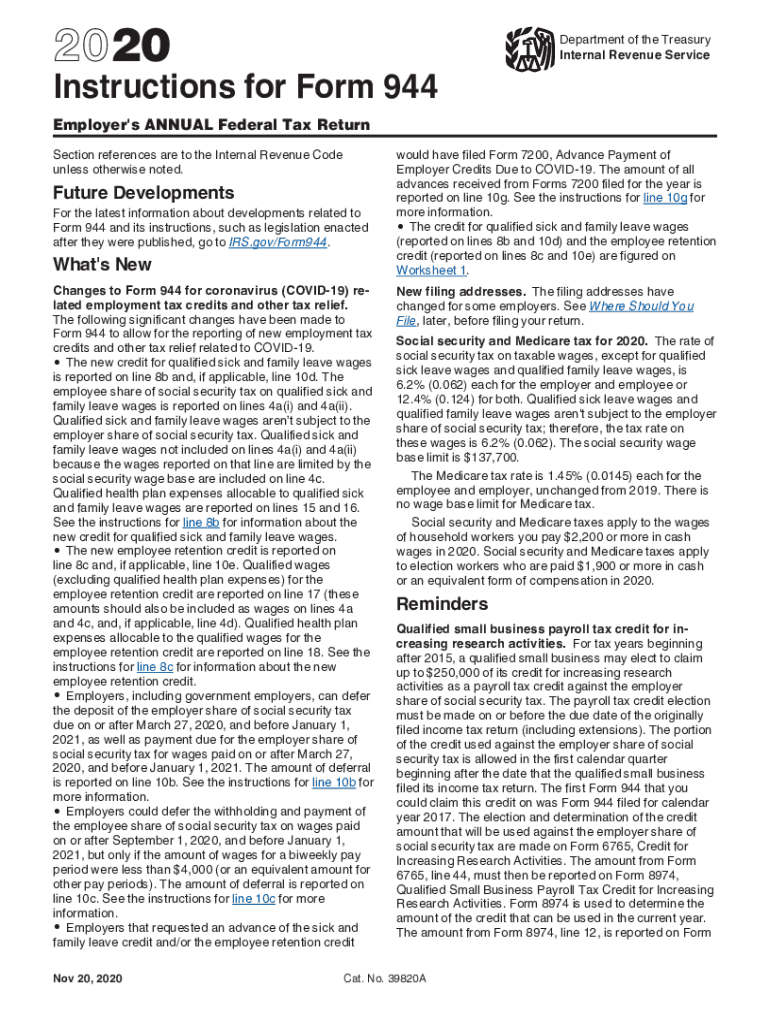

Form 944 2020 Fill Out and Sign Printable PDF Template signNow

Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your. Draft instructions for the 2022 form 944 were. Web form 944 was intended to give small business employers a break when it came to filing and paying federal payroll taxes. Web.

What Is Form 944? Plus Instructions

“no” answers indicate possible errors in. You must complete all five pages. Web in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a. Web home form 944 what is form 944? Web file form 944 online for 2022.

Form I944 StepByStep Instructions How To Fill Out [2021 Guide

Web home form 944 what is form 944? How should you complete form 944? When you aren?t connected to document managing and law operations, submitting irs documents can be extremely difficult. Type or print within the boxes. Complete, edit or print tax forms instantly.

IRS Form 944 Instructions and Who Needs to File It NerdWallet

Draft instructions for the 2022 form 944 were. Irs form 944 contains 5 parts in which certain information should be reported. Web in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a. Web irs form 944 is the employer's annual federal tax return. You can download or print.

IRS Form 944 LinebyLine Instructions 2022 Employer's Annual Federal

Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your. Who must file form 944? Web follow the simple instructions below: Ad get ready for tax season deadlines by completing any required tax forms today. Web in 2022 for leave taken.

The Sweet Beginning in USA Form I944 Declaration of SelfSufficiency

Ad get ready for tax season deadlines by completing any required tax forms today. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your. Type or print within the boxes. Get ready for tax season deadlines by completing any required tax.

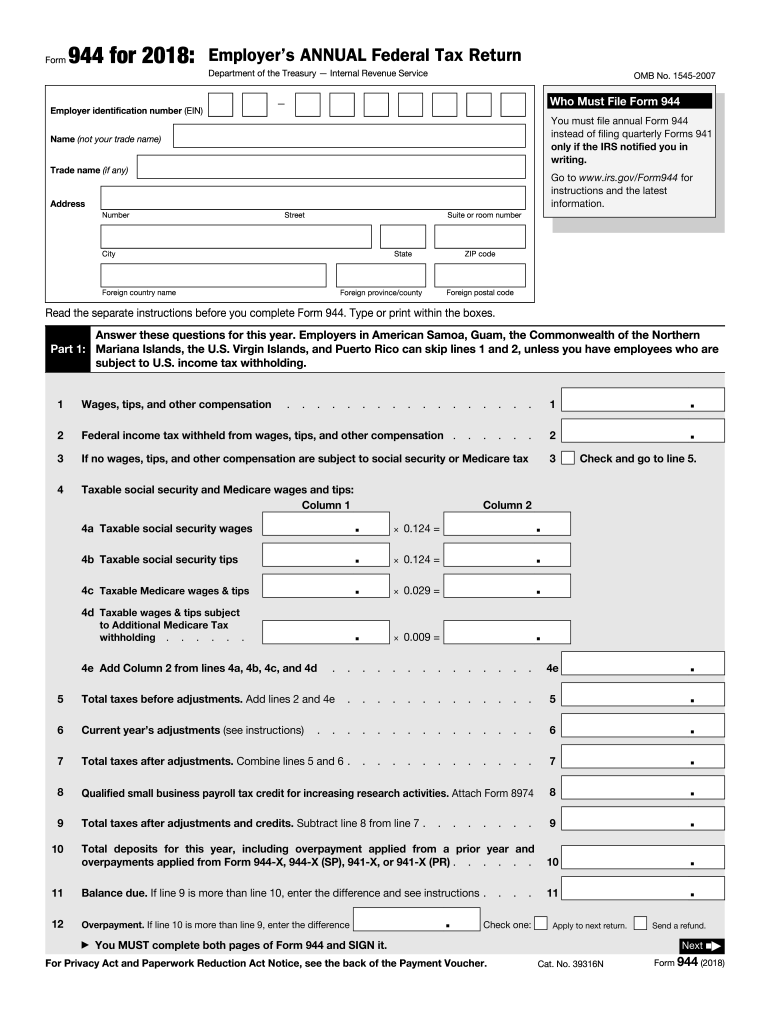

2018 Form IRS 944 Fill Online, Printable, Fillable, Blank PDFfiller

Web in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your. Enclose your check or money order made payable to “united states.

How To Fill Out Form I944 StepByStep Instructions [2021]

Get ready for tax season deadlines by completing any required tax forms today. Web irs form 944 is the employer's annual federal tax return. The irs released draft instructions for the 2022 form 944. Before you begin to file, gather the payroll data. Web form 944 was intended to give small business employers a break when it came to filing.

Web Form 944 Is An Irs Tax Form That Reports The Taxes — Including Federal Income Tax, Social Security Tax And Medicare Tax — That You’ve Withheld From Your.

Type or print within the boxes. Web the inflation reduction act of 2022 (the ira) makes changes to the qualified small business payroll tax credit for increasing research activities for tax years beginning after december. Irs form 944 contains 5 parts in which certain information should be reported. The irs released draft instructions for the 2022 form 944.

How To Fill Out Form 944 For 2022?

This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return). Web file form 944 online for 2022. Web form 944 for 2022: Get ready for tax season deadlines by completing any required tax forms today.

Who Must File Form 944?

Web we last updated the employer's annual federal tax return in february 2023, so this is the latest version of form 944, fully updated for tax year 2022. When you aren?t connected to document managing and law operations, submitting irs documents can be extremely difficult. The other reason for form 944 is to save the irs man. Web in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a.

Web Annual Federal Tax Return.

You can download or print. Draft instructions for the 2022 form 944 were. Complete, edit or print tax forms instantly. “no” answers indicate possible errors in.

![How To Fill Out Form I944 StepByStep Instructions [2021]](https://self-lawyer.com/wp-content/uploads/2020/05/I-944-2-1024x572.png)