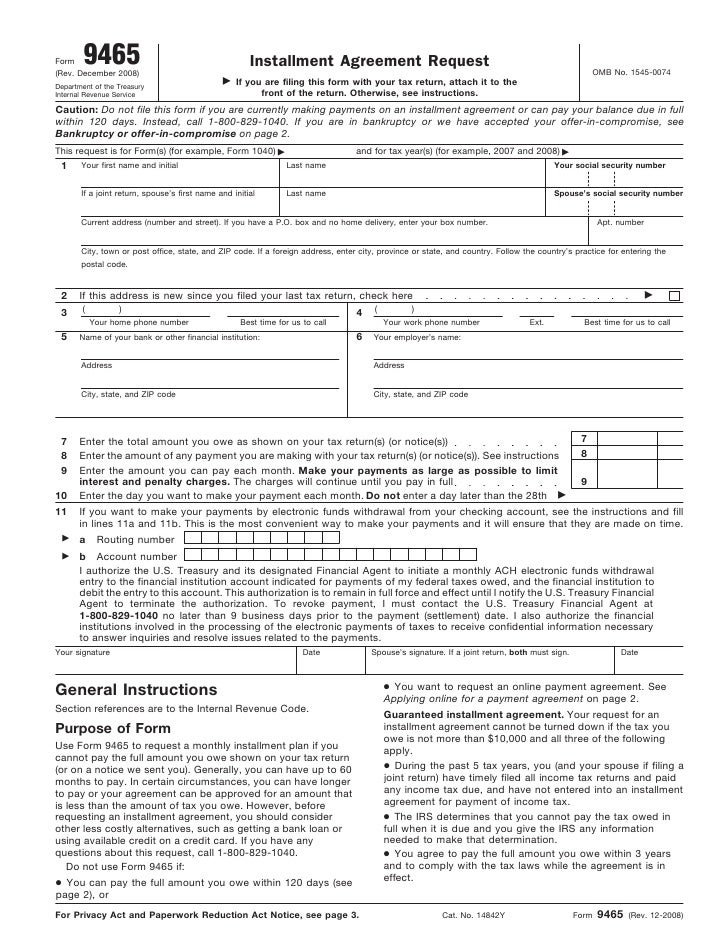

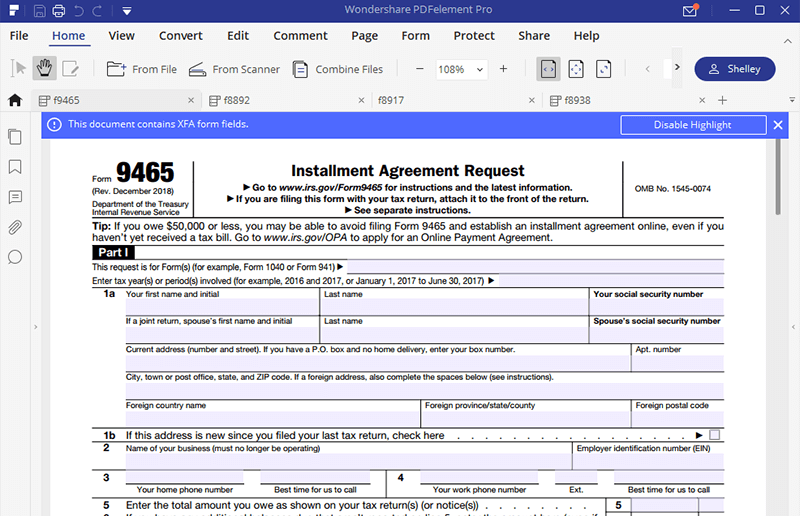

Form 9465 Installment

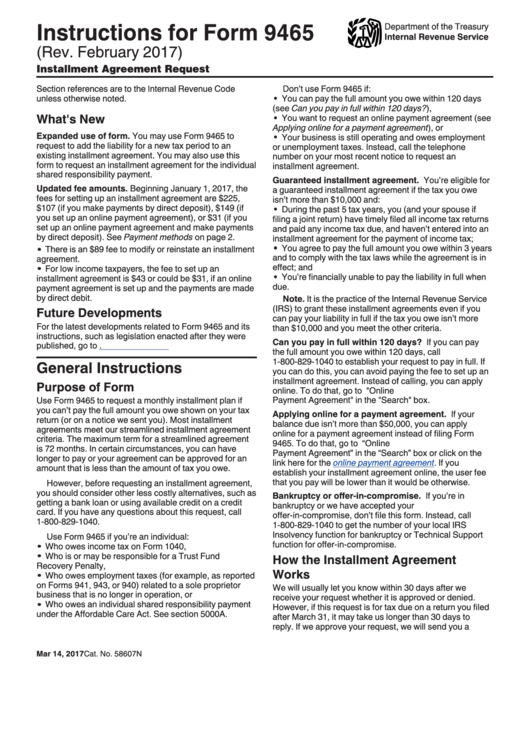

Form 9465 Installment - If you are filing form 9465 separate from your return, refer to the tables below to determine the correct filing address. Web if you are filing form 9465 with your return, attach it to the front of your return when you file. Most installment agreements meet our streamlined installment agreement criteria. Your request for an installment agreement cannot be turned down if the tax you owe is not more than $10,000 and all three of the following apply. All tax forms check my refund status register a new business refunds audits and collections tax rules and policies Web purpose of form use form 9465 to request a monthly installment plan if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Is your tax bill too much for you to handle? This helps taxpayers who cannot come up with a lump. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Purpose of form use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you).

Most installment agreements meet our streamlined installment agreement criteria. If you are filing form 9465 separate from your return, refer to the tables below to determine the correct filing address. All tax forms check my refund status register a new business refunds audits and collections tax rules and policies Is your tax bill too much for you to handle? You may qualify to pay the irs in installments. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Web watch this video to learn about the form 9465 installment agreement. Purpose of form use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Your request for an installment agreement cannot be turned down if the tax you owe is not more than $10,000 and all three of the following apply. The maximum term for a streamlined agreement is 72 months.

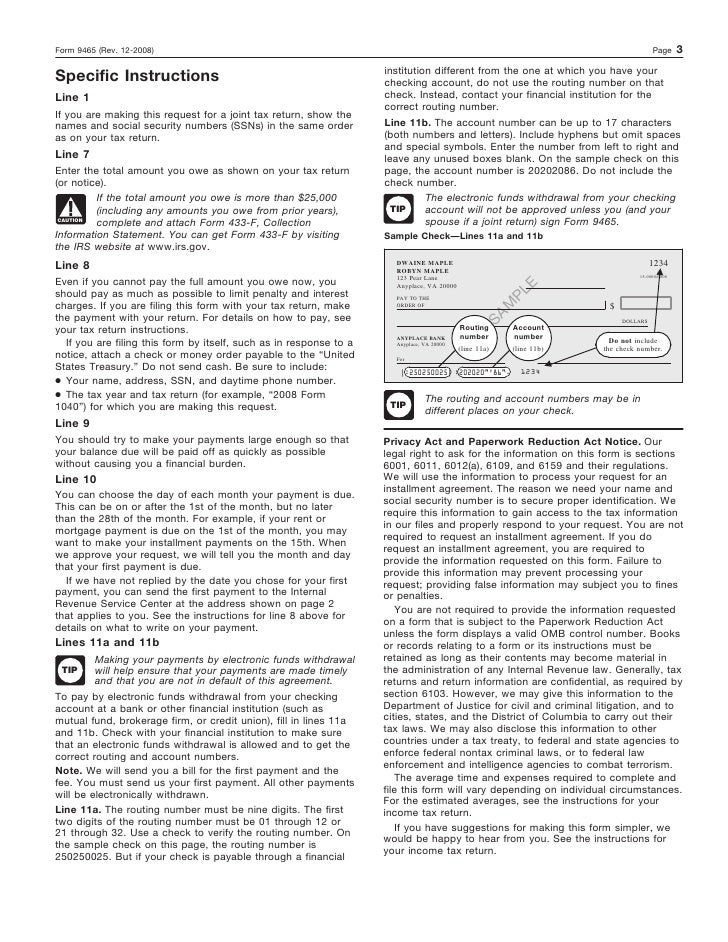

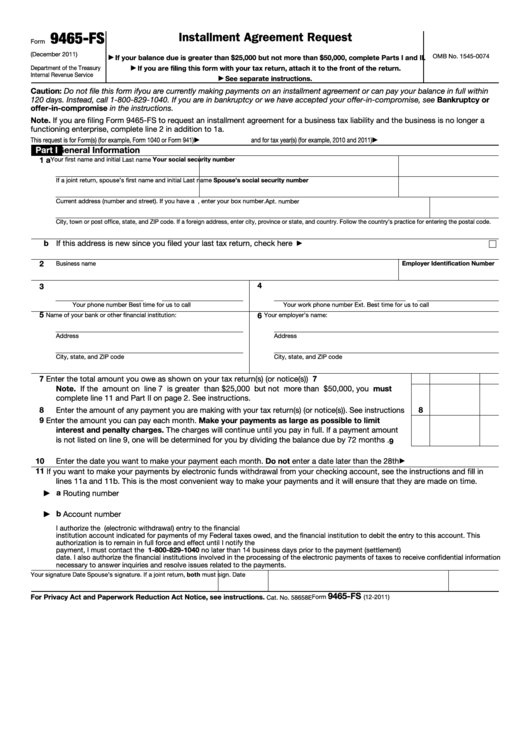

This request is for form(s) (for example, form 1040 or form 941) and for tax year(s) (for example, 2010 and 2011) Web watch this video to learn about the form 9465 installment agreement. This helps taxpayers who cannot come up with a lump. The maximum term for a streamlined agreement is 72 months. The maximum term for a streamlined agreement is 72 months. Purpose of form use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web purpose of form use form 9465 to request a monthly installment plan if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file.

Video Tips for Filling Out Form 9465, Installment Agreement Request

Web watch this video to learn about the form 9465 installment agreement. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web if you are filing form 9465 with your return, attach it to the front.

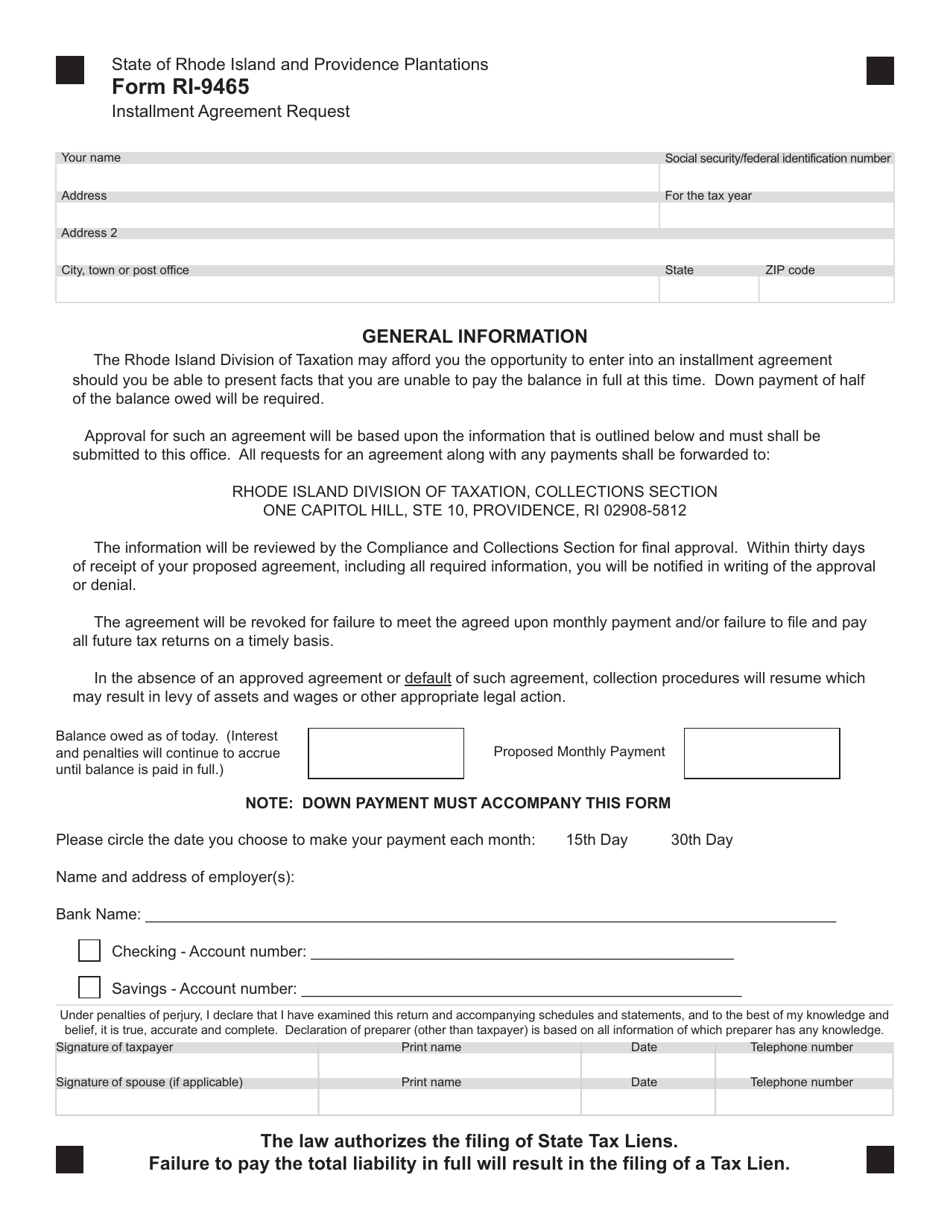

Form RI9465 Download Printable PDF or Fill Online Installment

Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. The maximum term for a streamlined agreement is 72 months. The maximum term for a streamlined agreement is 72 months. Web if you are filing form 9465 with your return, attach it to the front of your.

Fillable Form 9465Fs Installment Agreement Request printable pdf

You may qualify to pay the irs in installments. Most installment agreements meet our streamlined installment agreement criteria. The maximum term for a streamlined agreement is 72 months. Most installment agreements meet our streamlined installment agreement criteria. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe.

IRS Form 9465 Guide to Installment Agreement Request

If you are filing form 9465 separate from your return, refer to the tables below to determine the correct filing address. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web purpose of form use form.

IRS Form 9465 Instructions for How to Fill it Correctly File

Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Your request for an installment agreement cannot be.

Instructions For Form 9465 Installment Agreement Request printable

This request is for form(s) (for example, form 1040 or form 941) and for tax year(s) (for example, 2010 and 2011) Web taxpayers who owe taxes but can’t pay them all at once can file form 9465 to set up an installment plan if they meet certain conditions. Web if you are filing form 9465 with your return, attach it.

Interest Rates For Irs Installment Agreements Rating Walls

Purpose of form use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Web watch this video to learn about the form 9465 installment agreement. Web taxpayers who owe taxes but can’t pay them all at once can file form.

Form 9465Installment Agreement Request

Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). If you are filing form 9465 separate from your return, refer to the tables below to determine the correct filing address. Web if you are filing form.

Irs Installment Agreement Form 9465 Instructions Erin Anderson's Template

If you are filing form 9465 separate from your return, refer to the tables below to determine the correct filing address. This request is for form(s) (for example, form 1040 or form 941) and for tax year(s) (for example, 2010 and 2011) Most installment agreements meet our streamlined installment agreement criteria. All tax forms check my refund status register a.

Form 9465Installment Agreement Request

You may qualify to pay the irs in installments. All tax forms check my refund status register a new business refunds audits and collections tax rules and policies Most installment agreements meet our streamlined installment agreement criteria. Purpose of form use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on.

Purpose Of Form Use Form 9465 To Request A Monthly Installment Plan If You Cannot Pay The Full Amount You Owe Shown On Your Tax Return (Or On A Notice We Sent You).

This request is for form(s) (for example, form 1040 or form 941) and for tax year(s) (for example, 2010 and 2011) Web if you are filing form 9465 with your return, attach it to the front of your return when you file. Your request for an installment agreement cannot be turned down if the tax you owe is not more than $10,000 and all three of the following apply. Most installment agreements meet our streamlined installment agreement criteria.

Web Use Form 9465 To Request A Monthly Installment Agreement (Payment Plan) If You Can’t Pay The Full Amount You Owe Shown On Your Tax Return (Or On A Notice We Sent You).

Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). This helps taxpayers who cannot come up with a lump. Is your tax bill too much for you to handle? Most installment agreements meet our streamlined installment agreement criteria.

The Maximum Term For A Streamlined Agreement Is 72 Months.

Web taxpayers who owe taxes but can’t pay them all at once can file form 9465 to set up an installment plan if they meet certain conditions. The maximum term for a streamlined agreement is 72 months. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file.

Most Installment Agreements Meet Our Streamlined Installment Agreement Criteria.

You may qualify to pay the irs in installments. If you are filing form 9465 separate from your return, refer to the tables below to determine the correct filing address. Web purpose of form use form 9465 to request a monthly installment plan if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). All tax forms check my refund status register a new business refunds audits and collections tax rules and policies

/9465-InstallmentAgreementRequest-1-ad4522a907c94ba7a959e9bc7549e14d.png)