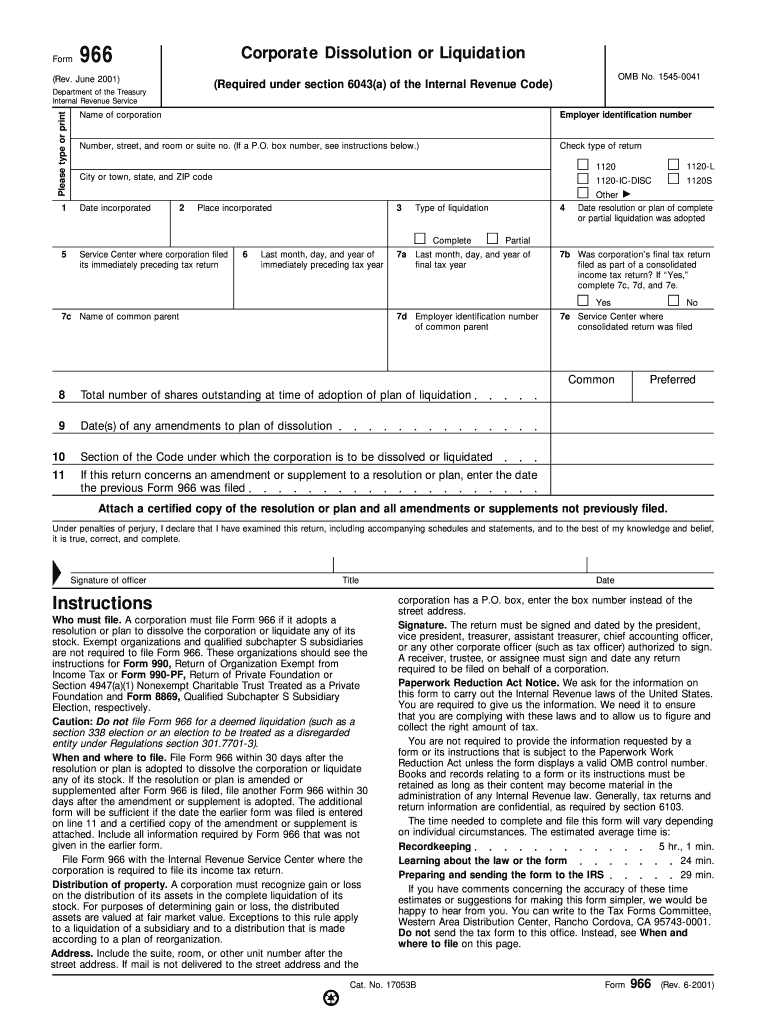

Form 966 Filing Requirements

Form 966 Filing Requirements - Beginning in 2018, the unique identifying number must be entered in the “identifier” box provided at. Web who must file corporations organized under wisconsin law and whose income is not exempt. Foreign corporations licensed to do business in wisconsin and whose income. Web [1] in accordance with this provision, the internal revenue service has adopted a regulation requiring a dissolving corporation to file a return on form 966 (corporate dissolution or. Web who must file a corporation (or a farmer’s cooperative) must file form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. In this situation, you are responsible for notifying all. Web common questions about form 966 corporate dissolution or liquidation for form 1120s. Web you must complete and file form 966 when dissolving an llc if you have elected to be a c corporation or a cooperative (coop) for tax purposes. Web an rdcffi must file form 8966 to report a u.s. Web with respect to the corporate distributor in a sec.

Web a corporation (or a farmer’s cooperative) must file form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. I already filed my final return. Web once a corporation adopts a plan of liquidation and files the proper state paperwork (if required), it must send form 966, corporate dissolution or liquidation,. Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock, the. Web am i required to send a 966 form to the irs? Foreign corporations licensed to do business in wisconsin and whose income. Form 966 corporate dissolution or liquidation can be generated by. Web common questions about form 966 corporate dissolution or liquidation for form 1120s. Web general instructions reminders identifying numbers for paper forms 8966.

Web [1] in accordance with this provision, the internal revenue service has adopted a regulation requiring a dissolving corporation to file a return on form 966 (corporate dissolution or. Web with respect to the corporate distributor in a sec. Beginning in 2018, the unique identifying number must be entered in the “identifier” box provided at. In this situation, you are responsible for notifying all. Web am i required to send a 966 form to the irs? Web the liquidating corporation must timely file form 966, “corporate dissolution or liquidation ,” (or its successor form) and its final federal corporate income tax return. I already filed my final return. Web who must file a corporation (or a farmer’s cooperative) must file form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. Web form 966 corporate dissolution or liquidation is the irs form that must be filled out when closing down an s corporation. Web they must file form 966, corporate dissolution or liquidation, if they adopt a resolution or plan to dissolve the corporation or liquidate any of its stock.

Form 966 (Rev PDF Tax Return (United States) S Corporation

Beginning in 2018, the unique identifying number must be entered in the “identifier” box provided at. Form 966 corporate dissolution or liquidation can be generated by. Go to screen 51, corp.dissolution/liquidation (966). In this situation, you are responsible for notifying all. Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution.

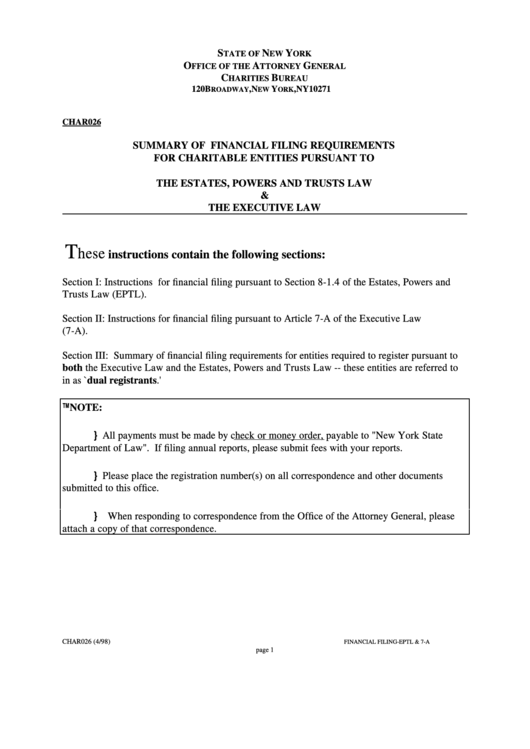

Form Char026 Summary Of Financial Filing Requirements Office Of The

Account for which it has reporting obligations as a condition of its applicable rdcffi status. Web who must file corporations organized under wisconsin law and whose income is not exempt. Web general instructions reminders identifying numbers for paper forms 8966. In this situation, you are responsible for notifying all. Web they must file form 966, corporate dissolution or liquidation, if.

Form 966 Fill Out and Sign Printable PDF Template signNow

Web the liquidating corporation must timely file form 966, “corporate dissolution or liquidation ,” (or its successor form) and its final federal corporate income tax return. Web you must complete and file form 966 when dissolving an llc if you have elected to be a c corporation or a cooperative (coop) for tax purposes. Check the box labeled print form.

Form 1099 Electronic Filing Requirements Universal Network

In this situation, you are responsible for notifying all. Web who must file a corporation (or a farmer’s cooperative) must file form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. Web with respect to the corporate distributor in a sec. Web form 966 must be filed within 30 days after.

How to Complete IRS Form 966 Bizfluent

Web they must file form 966, corporate dissolution or liquidation, if they adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. I already filed my final return. Web the liquidating corporation must timely file form 966, “corporate dissolution or liquidation ,” (or its successor form) and its final federal corporate income tax return. Web.

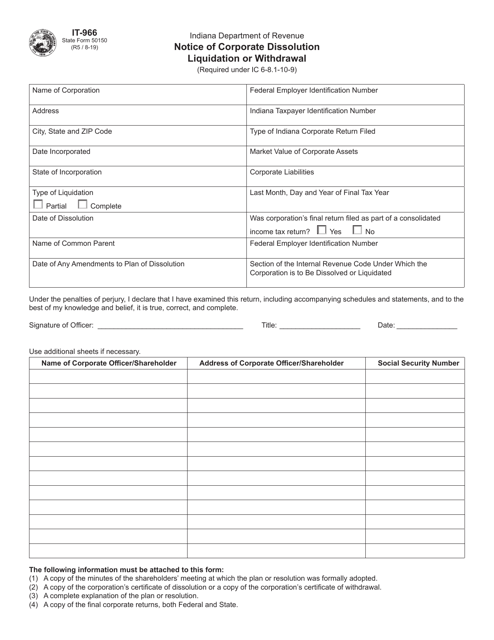

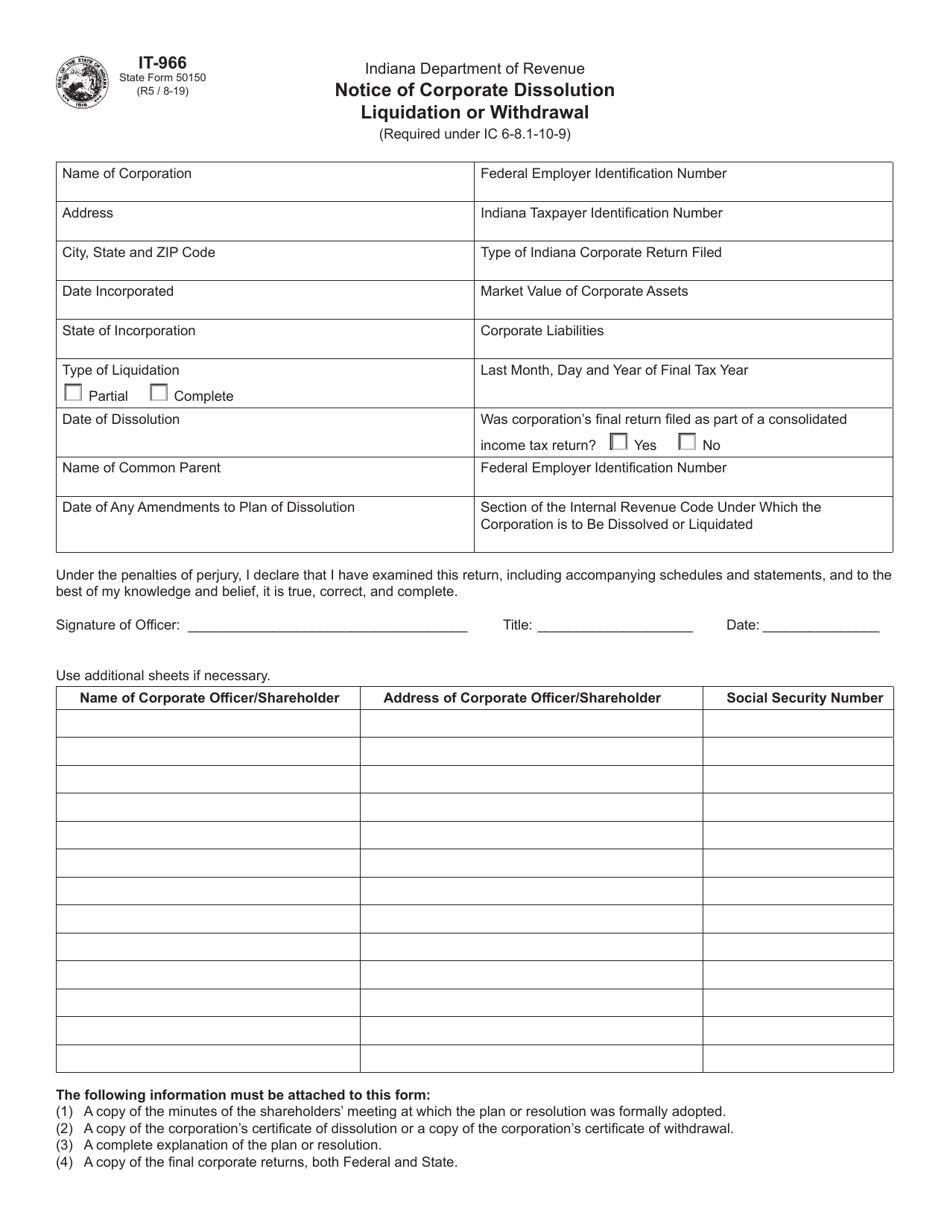

Form IT966 (State Form 50150) Download Fillable PDF or Fill Online

Web form 966 must be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Web [1] in accordance with this provision, the internal revenue service has adopted a regulation requiring a dissolving corporation to file a return on form 966 (corporate dissolution or. Account for which it has.

Fill Free fillable Corporate Dissolution or Liquidation Form 966 PDF form

Web once a corporation adopts a plan of liquidation and files the proper state paperwork (if required), it must send form 966, corporate dissolution or liquidation,. Web an rdcffi must file form 8966 to report a u.s. Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or.

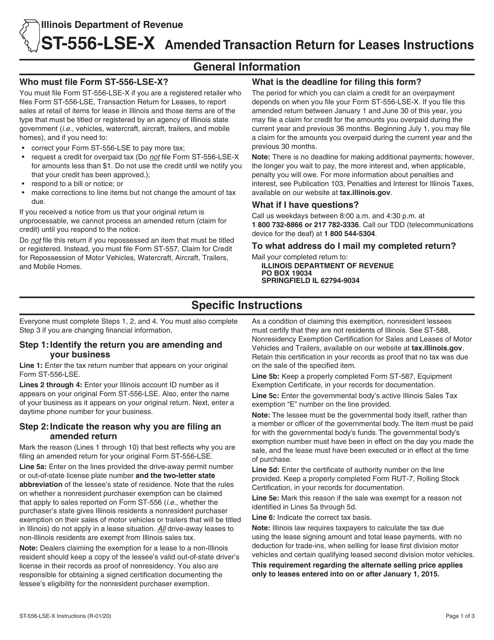

Download Instructions for Form ST556LSEX, 966 Amended Transaction

Web who must file a corporation (or a farmer’s cooperative) must file form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. Web a corporation (or a farmer’s cooperative) must file form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. I.

Form IT966 (State Form 50150) Download Fillable PDF or Fill Online

Web with respect to the corporate distributor in a sec. Web form 966 must be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Web who must file corporations organized under wisconsin law and whose income is not exempt. Leverage 1040 tax automation software to make tax preparation.

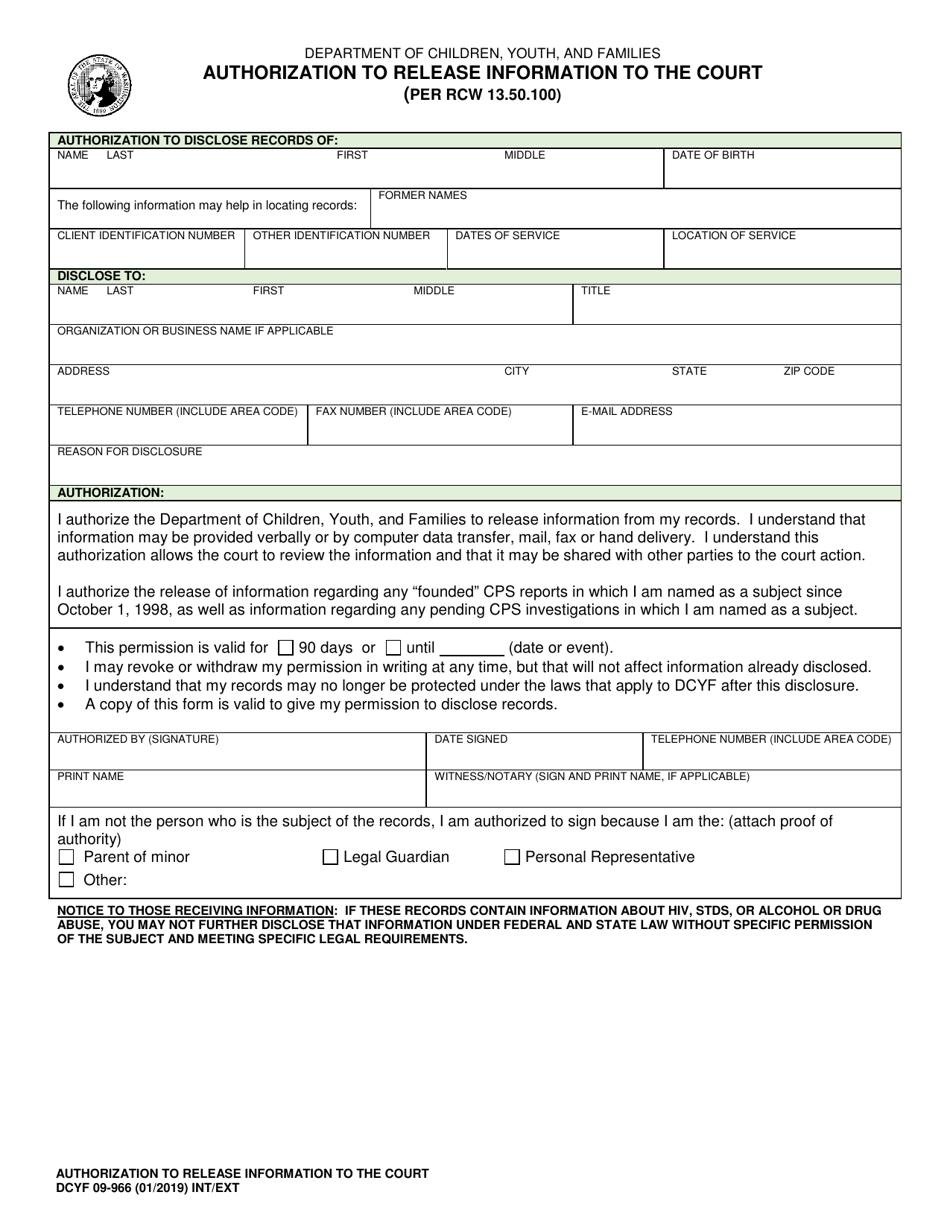

DCYF Form 09966 Download Fillable PDF or Fill Online Authorization to

Account for which it has reporting obligations as a condition of its applicable rdcffi status. Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Web an rdcffi must file form 8966 to report a u.s. Web they must file form 966, corporate dissolution or liquidation, if they adopt a resolution.

Form 966 Corporate Dissolution Or Liquidation Can Be Generated By.

Web form 966 corporate dissolution or liquidation is the irs form that must be filled out when closing down an s corporation. Leverage 1040 tax automation software to make tax preparation more profitable. Web an rdcffi must file form 8966 to report a u.s. Web the liquidating corporation must timely file form 966, “corporate dissolution or liquidation ,” (or its successor form) and its final federal corporate income tax return.

Web They Must File Form 966, Corporate Dissolution Or Liquidation, If They Adopt A Resolution Or Plan To Dissolve The Corporation Or Liquidate Any Of Its Stock.

Go to screen 51, corp.dissolution/liquidation (966). Account for which it has reporting obligations as a condition of its applicable rdcffi status. I already filed my final return. Web you must complete and file form 966 when dissolving an llc if you have elected to be a c corporation or a cooperative (coop) for tax purposes.

Beginning In 2018, The Unique Identifying Number Must Be Entered In The “Identifier” Box Provided At.

Web general instructions reminders identifying numbers for paper forms 8966. Web [1] in accordance with this provision, the internal revenue service has adopted a regulation requiring a dissolving corporation to file a return on form 966 (corporate dissolution or. In this situation, you are responsible for notifying all. Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock, the.

Web With Respect To The Corporate Distributor In A Sec.

Web a corporation (or a farmer’s cooperative) must file form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. Foreign corporations licensed to do business in wisconsin and whose income. Web common questions about form 966 corporate dissolution or liquidation for form 1120s. Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners.