Form 990 Deadline

Form 990 Deadline - Web when is the 990ez deadline? (not applicable to form 8868 filers) 4. The short answer is may 15th. The authentication process must be complete. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. The return must be verified and marked as complete in the 990 online system 2. The majority of nonprofits choose to operate on the calendar fiscal year, hence the short answer of may 15th for your tax form due dates. We must have received payment of the 990 online usage fee. Registered nonprofits must file their annual tax returns by the 15th day of the 5th month after their fiscal year ends. For organizations on a calendar year, the form 990 is due on may 15th of the following year.

The short answer is may 15th. The authentication process must be complete. (not applicable to form 8868 filers) 4. If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. For organizations on a calendar year, the form 990 is due on may 15th of the following year. Web 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due dates for 990 returns. Web upcoming form 990 deadline: Also, if you filed an 8868 extension on february 15, 2023, then your form 990 extended deadline is august 15, 2023. Web when is the 990ez deadline? We must have received payment of the 990 online usage fee.

Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. You can find information from the irs in publication 4163. For organizations with an accounting tax period starting on april 1,. For organizations on a calendar year, the form 990 is due on may 15th of the following year. If your organization’s accounting tax period starts on april 1, 2022, and ends on march 31, 2023, your form 990 is due by august 15, 2023. All deadlines are 11:59:59 pm local time. Form 990 due date | internal revenue service If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. The short answer is may 15th. Web upcoming form 990 deadline:

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

We must have received payment of the 990 online usage fee. Web 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due dates for 990 returns. All deadlines are 11:59:59 pm local time. You can find information from the irs in publication 4163. Form 990 due date | internal.

What Nonprofits Need to Know About the July 15, 2021 Form 990 Deadline

If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. For organizations with an accounting tax period starting on april 1,. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Registered nonprofits must file their annual tax returns by the.

Extend Your Form 990 Deadline with IRS Form 8868!

Form 990 due date | internal revenue service If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. The return must be verified and marked as complete in the 990 online system 2. Registered nonprofits must file their annual tax returns by the 15th day of the 5th month after their fiscal.

What To Do When You Miss The IRS Form 990 Deadline ExpressTaxExempt

Registered nonprofits must file their annual tax returns by the 15th day of the 5th month after their fiscal year ends. Web upcoming form 990 deadline: For organizations with an accounting tax period starting on april 1,. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. The return.

The Form 990 Deadline is Approaching! Avoid IRS Penalties

Form 990 due date | internal revenue service For organizations on a calendar year, the form 990 is due on may 15th of the following year. You can find information from the irs in publication 4163. Web 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due dates for.

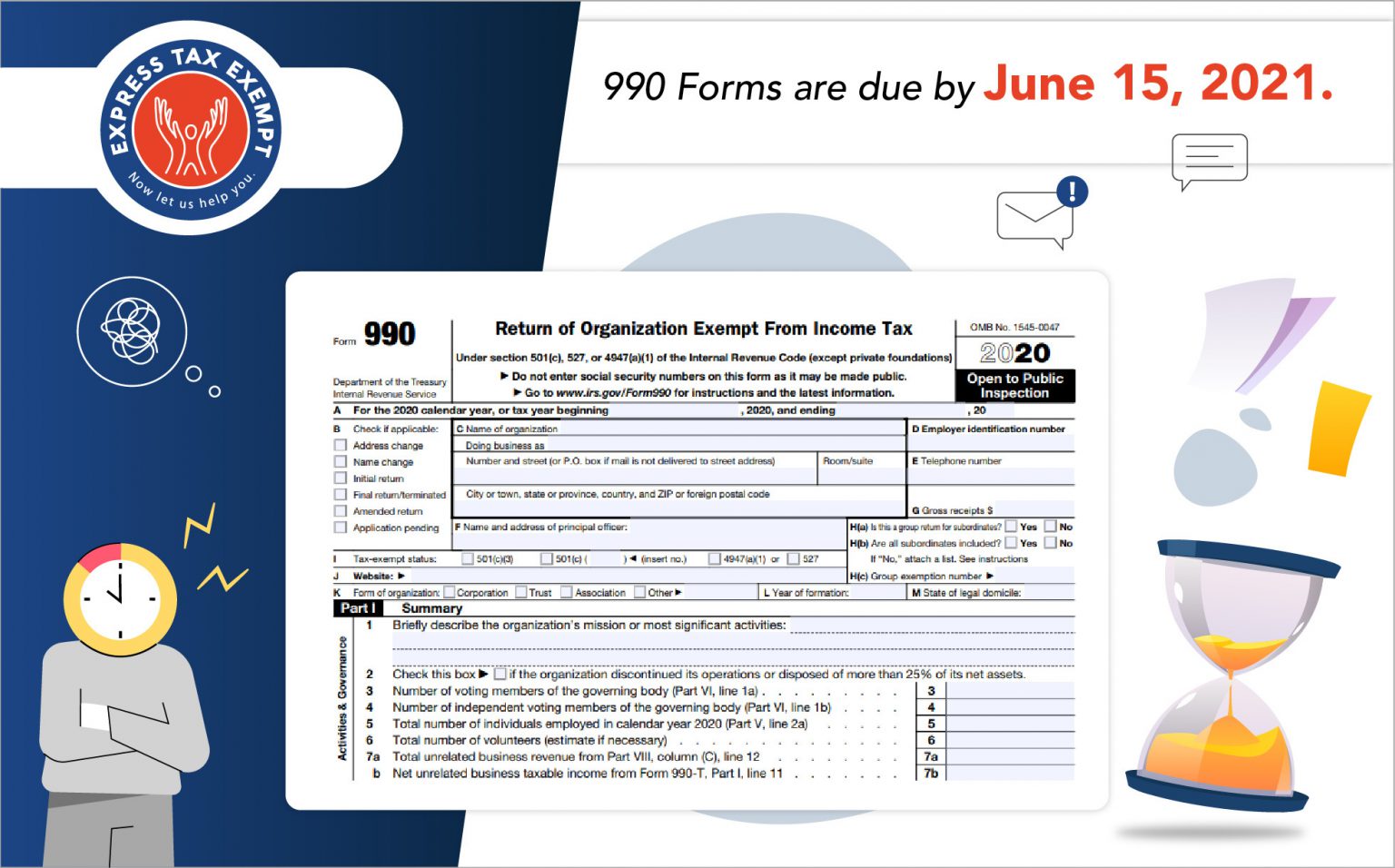

Is June 15, 2021 Your IRS Form 990 Deadline? What You Need to Know

All deadlines are 11:59:59 pm local time. The majority of nonprofits choose to operate on the calendar fiscal year, hence the short answer of may 15th for your tax form due dates. If your organization’s accounting tax period starts on april 1, 2022, and ends on march 31, 2023, your form 990 is due by august 15, 2023. Web upcoming.

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

The return must be verified and marked as complete in the 990 online system 2. The majority of nonprofits choose to operate on the calendar fiscal year, hence the short answer of may 15th for your tax form due dates. We must have received payment of the 990 online usage fee. For organizations with an accounting tax period starting on.

It's Time to Get Prepared For the Form 990 Deadline

For organizations on a calendar year, the form 990 is due on may 15th of the following year. The authentication process must be complete. Web 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due dates for 990 returns. (not applicable to form 8868 filers) 4. All deadlines are.

How to Meet Your August 17 Form 990 Deadline!

Web upcoming form 990 deadline: The short answer is may 15th. Web when is the 990ez deadline? (not applicable to form 8868 filers) 4. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year.

Today Is Your Last Chance to Meet the Form 990 Deadline!

The authentication process must be complete. The short answer is may 15th. All deadlines are 11:59:59 pm local time. The majority of nonprofits choose to operate on the calendar fiscal year, hence the short answer of may 15th for your tax form due dates. Form 990 due date | internal revenue service

Web Upcoming Form 990 Deadline:

The authentication process must be complete. If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. Web when is the 990ez deadline? Form 990 due date | internal revenue service

We Must Have Received Payment Of The 990 Online Usage Fee.

The majority of nonprofits choose to operate on the calendar fiscal year, hence the short answer of may 15th for your tax form due dates. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. All deadlines are 11:59:59 pm local time. For organizations with an accounting tax period starting on april 1,.

For Organizations On A Calendar Year, The Form 990 Is Due On May 15Th Of The Following Year.

The short answer is may 15th. You can find information from the irs in publication 4163. Web 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due dates for 990 returns. Web upcoming form 990 deadline:

If Your Organization’s Accounting Tax Period Starts On April 1, 2022, And Ends On March 31, 2023, Your Form 990 Is Due By August 15, 2023.

Also, if you filed an 8868 extension on february 15, 2023, then your form 990 extended deadline is august 15, 2023. Registered nonprofits must file their annual tax returns by the 15th day of the 5th month after their fiscal year ends. The return must be verified and marked as complete in the 990 online system 2. (not applicable to form 8868 filers) 4.