Form 990 Due

Form 990 Due - Try it for free now! The form is due the 15th day of the fifth month after the. Web nonprofit tax returns due date finder. Complete, edit or print tax forms instantly. If your organization filed an 8868. It depends on the end of your organization’s taxable year; That may seem complicated, but for organizations whose tax. See where can i find my fiscal year end? The form is usually due the 15th of the fifth month after the organization’s taxable year. 2 the month your tax year ends december 31 (calendar) other than december 31 (fiscal).

If your organization filed an 8868. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. If you need assistance with. 2 the month your tax year ends december 31 (calendar) other than december 31 (fiscal). That may seem complicated, but for organizations whose tax. Web it depends on the end of your organization’s taxable year; Web nonprofit tax returns due date finder. Web the form 990 deadline is the 15th day of the 5th month after the end of an organization’s tax period. Complete, edit or print tax forms instantly. Web irs form 990 is due by the 15th day of the 5th month after the accounting period ends.

Web the form 990 tax return is due by the 15th day of the 5th month following your chapter's fiscal year end. Web form 990 due date calculator 1 choose your appropriate form to find the due date. See where can i find my fiscal year end? Web irs form 990 is due by the 15th day of the 5th month after the accounting period ends. If your organization filed an 8868. 2 the month your tax year ends december 31 (calendar) other than december 31 (fiscal). Web annual exempt organization return: The 15th day of the. Web the form 990 deadline is the 15th day of the 5th month after the end of an organization’s tax period. To use the table, you must know.

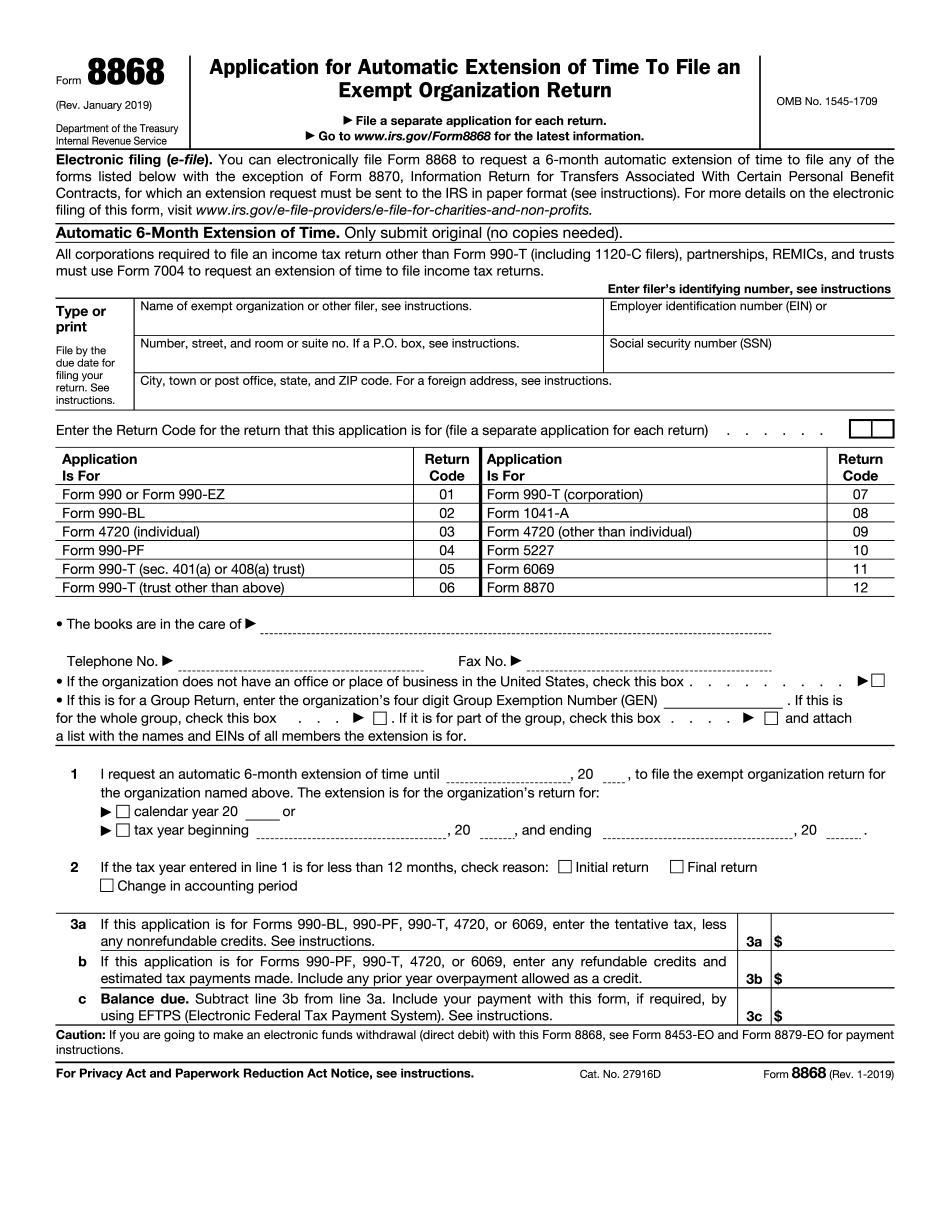

form 990 due date 2018 extension Fill Online, Printable, Fillable

The 15th day of the. Web it depends on the end of your organization’s taxable year; If you need assistance with. The form is usually due the 15th of the fifth month after the organization’s taxable year. Web monday, april 25, 2022 by justin d.

How Do I Complete The Form 990EZ?

Web nonprofit tax returns due date finder. To use the table, you must know. If your organization filed an 8868. 2 the month your tax year ends december 31 (calendar) other than december 31 (fiscal). Web the form 990 tax return is due by the 15th day of the 5th month following your chapter's fiscal year end.

Form 990 Due Date for Exempt Organizations YouTube

If your organization filed an 8868. 2 the month your tax year ends december 31 (calendar) other than december 31 (fiscal). Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. The form is usually due the 15th.

what is the extended due date for form 990 Fill Online, Printable

The form is due the 15th day of the fifth month after the. The 15th day of the. Web it depends on the end of your organization’s taxable year; The form is usually due the 15th of the fifth month after the organization’s taxable year. 2 the month your tax year ends december 31 (calendar) other than december 31 (fiscal).

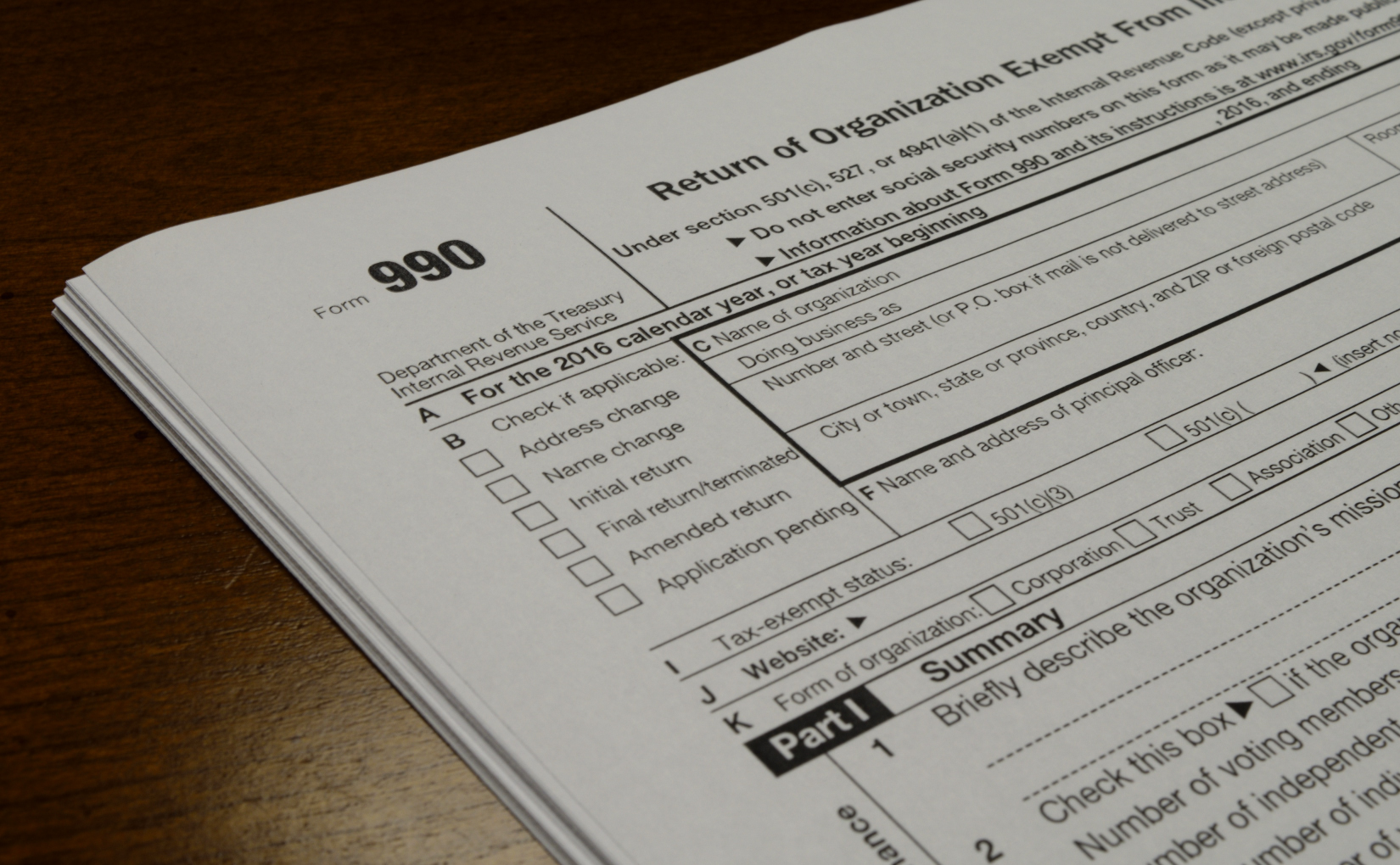

2016 Form 990 Due This Monday for Land Trusts Filing on Calendar Year

The form is usually due the 15th of the fifth month after the organization’s taxable year. If the due date falls on a saturday, sunday, or. If your organization filed an 8868. To use the table, you must know. The 15th day of the.

What You Need To Meet the Form 990 Due Date 2019 Blog TaxBandits

Complete, edit or print tax forms instantly. If your organization filed an 8868. Web so, when is form 990 due exactly? See where can i find my fiscal year end? Try it for free now!

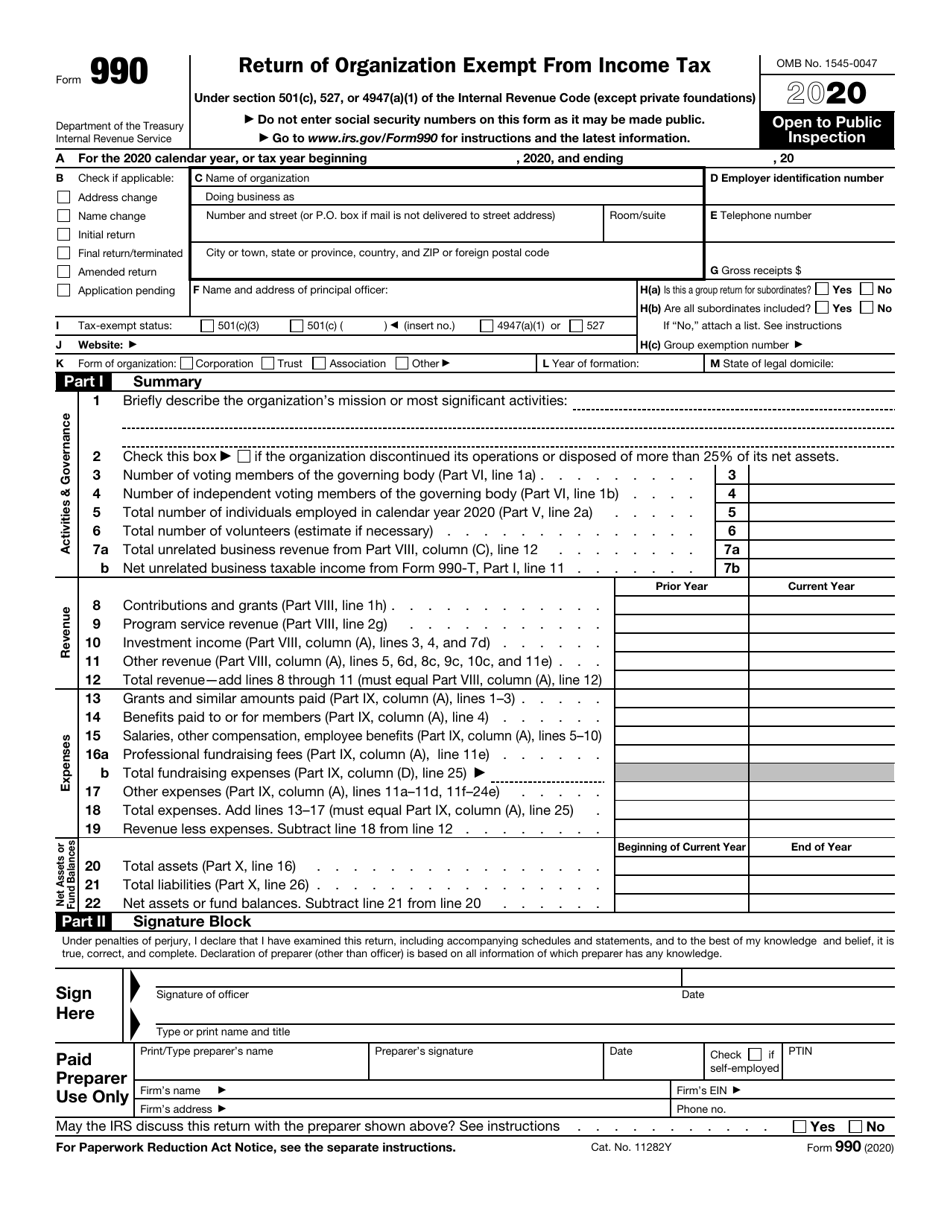

IRS Form 990 Download Fillable PDF or Fill Online Return of

2 the month your tax year ends december 31 (calendar) other than december 31 (fiscal). If you need assistance with. Web so, when is form 990 due exactly? The form is usually due the 15th of the fifth month after the organization’s taxable year. Upload, modify or create forms.

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

The form is usually due the 15th of the fifth month after the organization’s taxable year. The 15th day of the. Complete, edit or print tax forms instantly. The form is due the 15th day of the fifth month after the. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of.

Form 990 Due Today! Nonprofit Law Blog

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. See where can i find my fiscal year end? That may seem complicated, but for organizations whose tax. To use the table, you must know.

Calendar Year Tax Year? Your 990 Is Due Tony

Web for organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. Web the form 990 deadline is the 15th day of the 5th month after the end of an organization’s tax period. Web the form 990 tax return is due by the 15th day.

Web Annual Exempt Organization Return:

If your organization filed an 8868. To use the table, you must know. Upload, modify or create forms. Try it for free now!

That May Seem Complicated, But For Organizations Whose Tax.

The form is usually due the 15th of the fifth month after the organization’s taxable year. See where can i find my fiscal year end? Web nonprofit tax returns due date finder. Web for organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023.

Web It Depends On The End Of Your Organization’s Taxable Year;

It depends on the end of your organization’s taxable year; Web monday, april 25, 2022 by justin d. Complete, edit or print tax forms instantly. Web irs form 990 is due by the 15th day of the 5th month after the accounting period ends.

The Form Is Due The 15Th Day Of The Fifth Month After The.

Web the form 990 tax return is due by the 15th day of the 5th month following your chapter's fiscal year end. Complete, edit or print tax forms instantly. If the due date falls on a saturday, sunday, or. Web the form 990 deadline is the 15th day of the 5th month after the end of an organization’s tax period.