Form Dr 405 Instructions

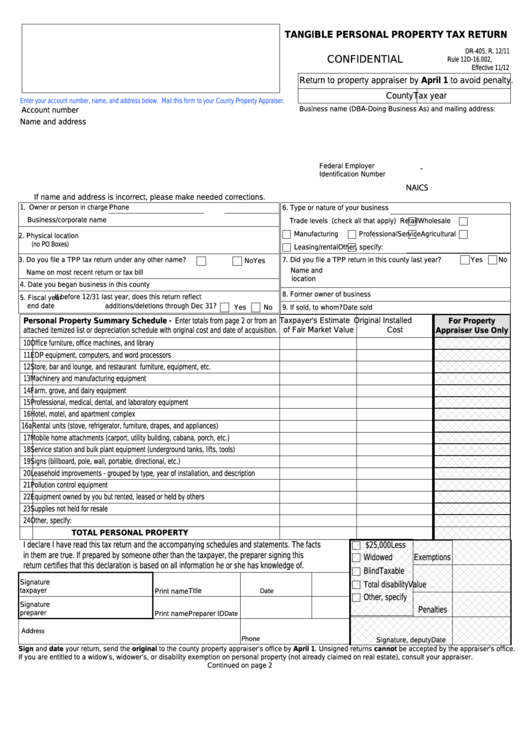

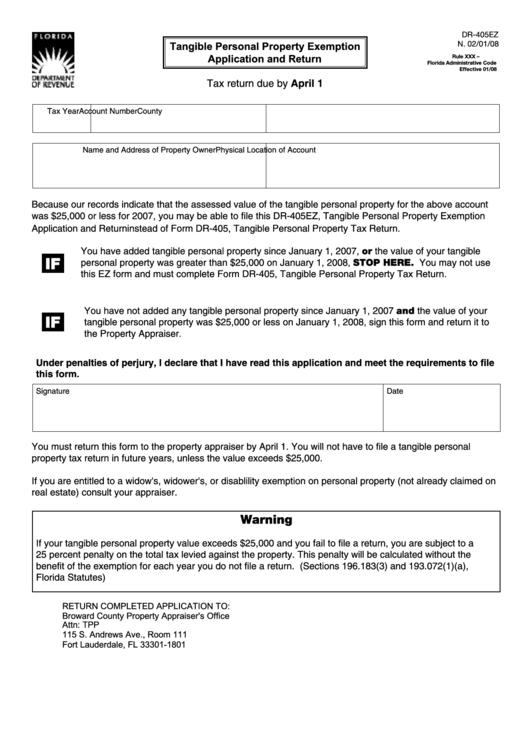

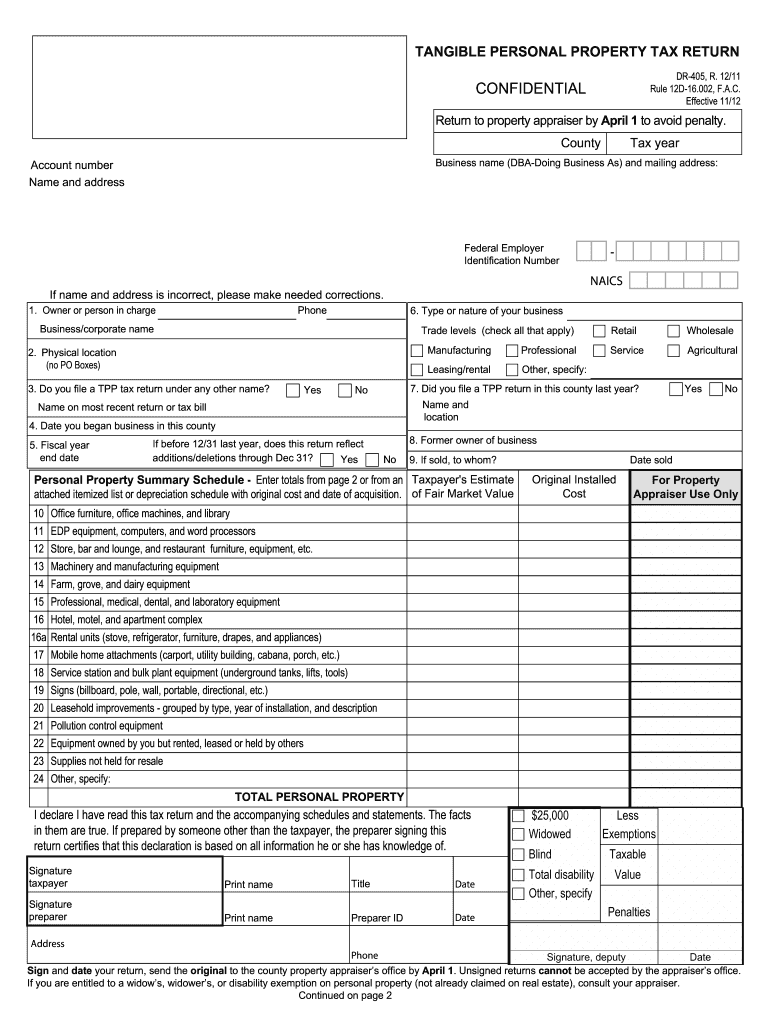

Form Dr 405 Instructions - Report all property located in the county on january 1. Tangible personal property tax return, r. Web ,16758&7,216 '5 5 sdjh :+$7 72 5(3257,qfoxgh rq \rxu uhwxuq 7dqjleoh 3huvrqdo 3urshuw\ *rrgv fkdwwhov dqg rwkhu duwlfohv ri ydoxh h[fhsw fhuwdlq yhklfohv wkdw Web tangible personal property tax return enter your account number, name, and address below. If you were required to file a return in the previous year but did not, you may have to pay a. Web ,16758&7,216 '5 5 sdjh :+$7 72 5(3257,qfoxgh rq \rxu uhwxuq 7dqjleoh 3huvrqdo 3urshuw\ *rrgv fkdwwhov dqg rwkhu duwlfohv ri ydoxh h[fhsw fhuwdlq yhklfohv wkdw Notice to taxpayer whose personal property return was waived in the previous year:. In fact, at least one county requires the form to be filed online from the county's web site. Goods, chattels, and other articles of value (except. Mail this form to your county property appraiser.

Web tangible personal property tax return enter your account number, name, and address below. 01/18, page 3 what to report include on your return: Tpp business address status change form; Mail this form to your county property appraiser. Goods, chattels, and other articles of value (except. In fact, at least one county requires the form to be filed online from the county's web site. Application for refund of tax. Tangible personal property tax return, r. Web all businesses are required to file a tangible personal property tax return ( form dr 405) annually by april 1st (florida statutes 193.062), unless the value of your tangible. If you were required to file a return in the previous year but did not, you may have to pay a.

01/18, page 3 what to report include on your return: Web tangible personal property tax return enter your account number, name, and address below. If you were required to file a return in the previous year but did not, you may have to pay a. Tpp business address status change form; Mail this form to your county property appraiser. Web tpp tax return & instructions: Report all property located in the county on january 1. Notice to taxpayer whose personal property return was waived in the previous year:. Tangible personal property tax return, r. Web all businesses are required to file a tangible personal property tax return ( form dr 405) annually by april 1st (florida statutes 193.062), unless the value of your tangible.

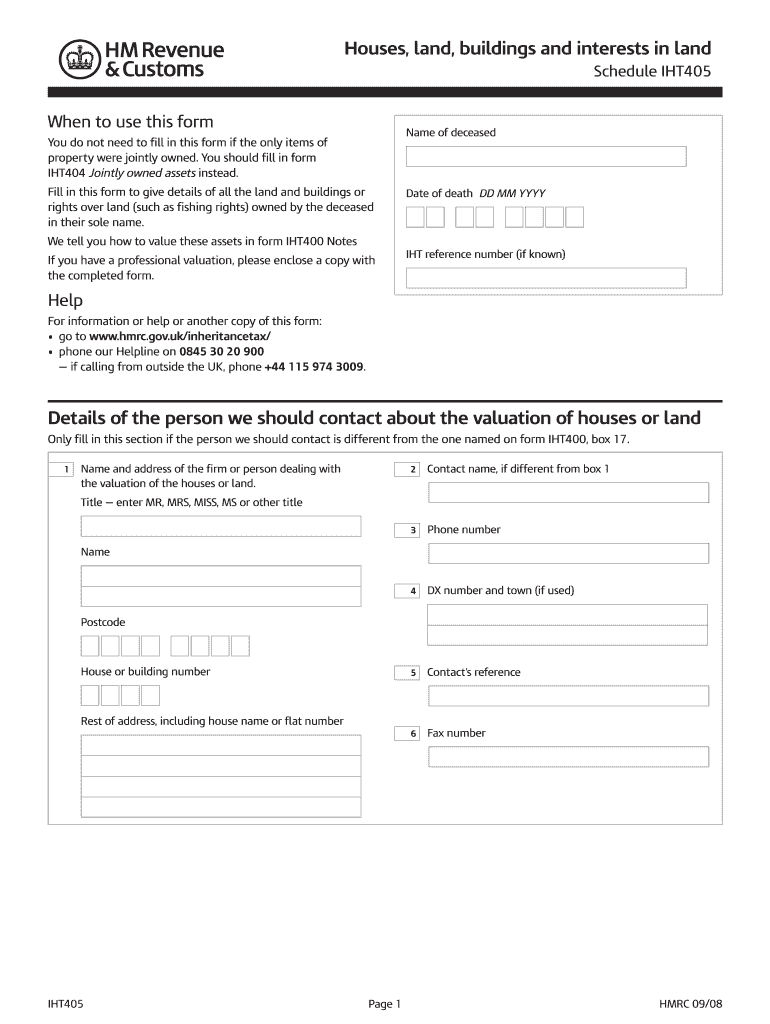

Iht405 Fill Out and Sign Printable PDF Template signNow

Goods, chattels, and other articles of value (except. Web ,16758&7,216 '5 5 sdjh :+$7 72 5(3257,qfoxgh rq \rxu uhwxuq 7dqjleoh 3huvrqdo 3urshuw\ *rrgv fkdwwhov dqg rwkhu duwlfohv ri ydoxh h[fhsw fhuwdlq yhklfohv wkdw 01/18, page 3 what to report include on your return: Web tpp tax return & instructions: Web all businesses are required to file a tangible personal property.

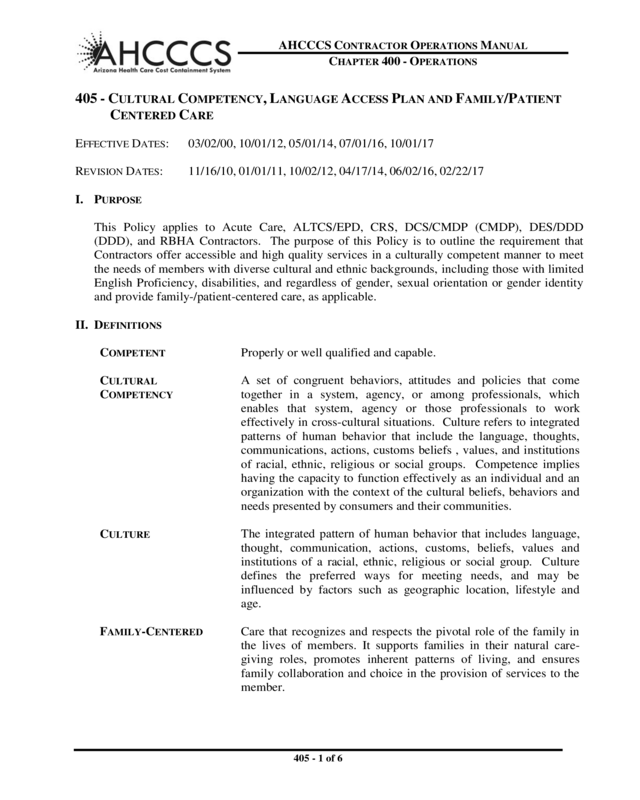

Quitclaim Deed RPI Form 405

If you were required to file a return in the previous year but did not, you may have to pay a. Web tangible personal property tax return enter your account number, name, and address below. Application for refund of tax. Web tpp tax return & instructions: Tpp business address status change form;

Florida Tangible Personal Property Tax Tondreault CPA

Goods, chattels, and other articles of value (except. Web all businesses are required to file a tangible personal property tax return ( form dr 405) annually by april 1st (florida statutes 193.062), unless the value of your tangible. Web tangible personal property tax return enter your account number, name, and address below. Web ,16758&7,216 '5 5 sdjh :+$7 72 5(3257,qfoxgh.

Form 405 Edit, Fill, Sign Online Handypdf

01/18, page 3 what to report include on your return: Web ,16758&7,216 '5 5 sdjh :+$7 72 5(3257,qfoxgh rq \rxu uhwxuq 7dqjleoh 3huvrqdo 3urshuw\ *rrgv fkdwwhov dqg rwkhu duwlfohv ri ydoxh h[fhsw fhuwdlq yhklfohv wkdw Web tangible personal property tax return enter your account number, name, and address below. Notice to taxpayer whose personal property return was waived in the.

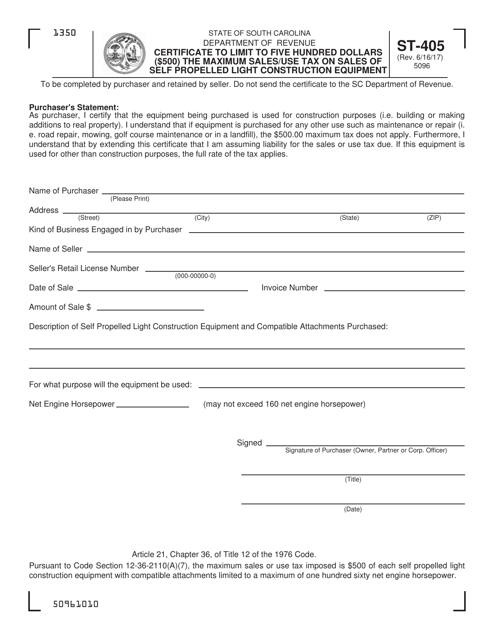

Form ST405 Download Printable PDF or Fill Online Certificate to Limit

01/18, page 3 what to report include on your return: Application for refund of tax. Web ,16758&7,216 '5 5 sdjh :+$7 72 5(3257,qfoxgh rq \rxu uhwxuq 7dqjleoh 3huvrqdo 3urshuw\ *rrgv fkdwwhov dqg rwkhu duwlfohv ri ydoxh h[fhsw fhuwdlq yhklfohv wkdw Notice to taxpayer whose personal property return was waived in the previous year:. Mail this form to your county property.

Fillable Form Dr405 Tangible Personal Property Tax Return printable

Mail this form to your county property appraiser. Report all property located in the county on january 1. If you were required to file a return in the previous year but did not, you may have to pay a. Tangible personal property tax return, r. 01/18, page 3 what to report include on your return:

Form Dr405ez Tangible Personal Property Exemption Application And

Web all businesses are required to file a tangible personal property tax return ( form dr 405) annually by april 1st (florida statutes 193.062), unless the value of your tangible. Web ,16758&7,216 '5 5 sdjh :+$7 72 5(3257,qfoxgh rq \rxu uhwxuq 7dqjleoh 3huvrqdo 3urshuw\ *rrgv fkdwwhov dqg rwkhu duwlfohv ri ydoxh h[fhsw fhuwdlq yhklfohv wkdw Mail this form to your.

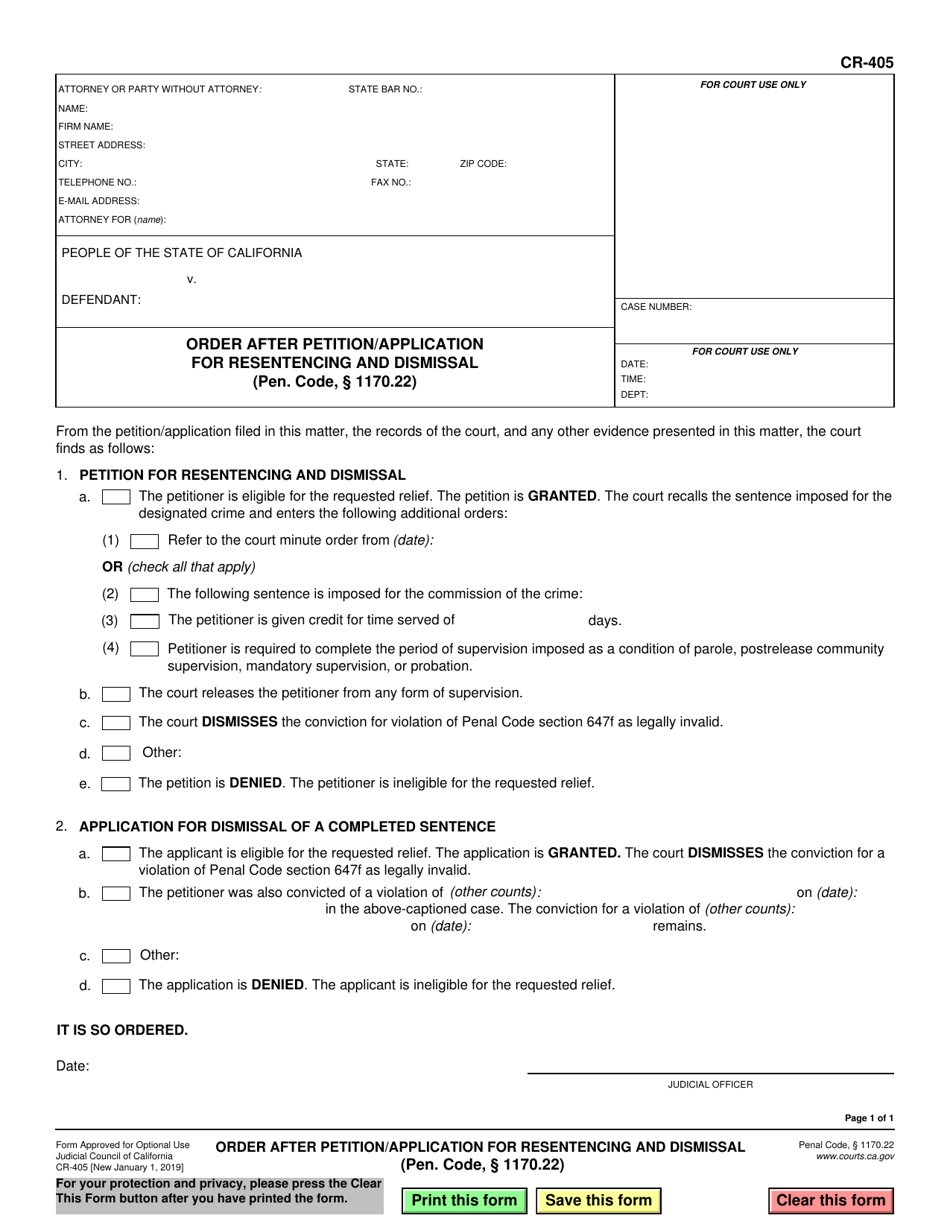

Form CR405 Download Fillable PDF or Fill Online Order After Petition

Web all businesses are required to file a tangible personal property tax return ( form dr 405) annually by april 1st (florida statutes 193.062), unless the value of your tangible. Web ,16758&7,216 '5 5 sdjh :+$7 72 5(3257,qfoxgh rq \rxu uhwxuq 7dqjleoh 3huvrqdo 3urshuw\ *rrgv fkdwwhov dqg rwkhu duwlfohv ri ydoxh h[fhsw fhuwdlq yhklfohv wkdw Web tangible personal property tax.

Dr 405 instructions Fill Out and Sign Printable PDF Template signNow

Web all businesses are required to file a tangible personal property tax return ( form dr 405) annually by april 1st (florida statutes 193.062), unless the value of your tangible. Mail this form to your county property appraiser. Notice to taxpayer whose personal property return was waived in the previous year:. Tangible personal property tax return, r. Application for refund.

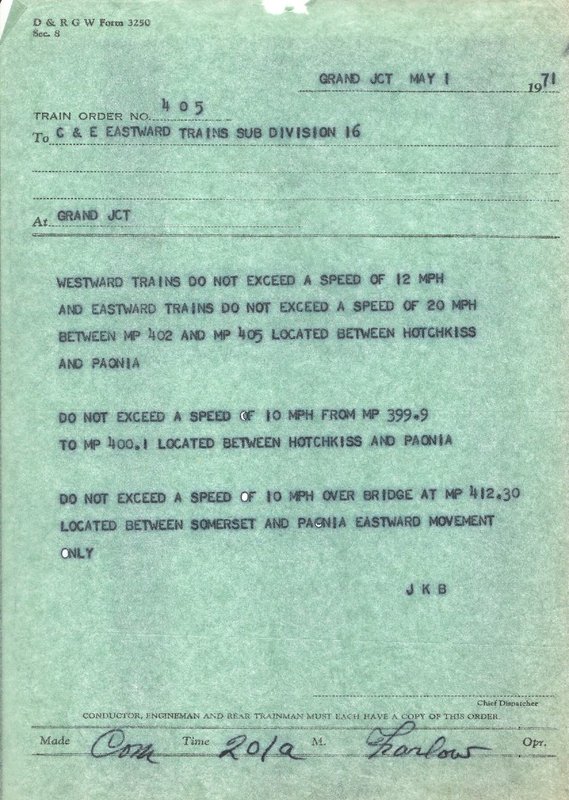

drgw_form3250_1_may_1971_405_840x1180.jpg

Application for refund of tax. Web ,16758&7,216 '5 5 sdjh :+$7 72 5(3257,qfoxgh rq \rxu uhwxuq 7dqjleoh 3huvrqdo 3urshuw\ *rrgv fkdwwhov dqg rwkhu duwlfohv ri ydoxh h[fhsw fhuwdlq yhklfohv wkdw Web tangible personal property tax return enter your account number, name, and address below. In fact, at least one county requires the form to be filed online from the county's.

Report All Property Located In The County On January 1.

Web tangible personal property tax return enter your account number, name, and address below. In fact, at least one county requires the form to be filed online from the county's web site. Web ,16758&7,216 '5 5 sdjh :+$7 72 5(3257,qfoxgh rq \rxu uhwxuq 7dqjleoh 3huvrqdo 3urshuw\ *rrgv fkdwwhov dqg rwkhu duwlfohv ri ydoxh h[fhsw fhuwdlq yhklfohv wkdw If you were required to file a return in the previous year but did not, you may have to pay a.

Application For Refund Of Tax.

Tangible personal property tax return, r. Web ,16758&7,216 '5 5 sdjh :+$7 72 5(3257,qfoxgh rq \rxu uhwxuq 7dqjleoh 3huvrqdo 3urshuw\ *rrgv fkdwwhov dqg rwkhu duwlfohv ri ydoxh h[fhsw fhuwdlq yhklfohv wkdw Goods, chattels, and other articles of value (except. Notice to taxpayer whose personal property return was waived in the previous year:.

Mail This Form To Your County Property Appraiser.

01/18, page 3 what to report include on your return: Web tpp tax return & instructions: Tpp business address status change form; Web all businesses are required to file a tangible personal property tax return ( form dr 405) annually by april 1st (florida statutes 193.062), unless the value of your tangible.