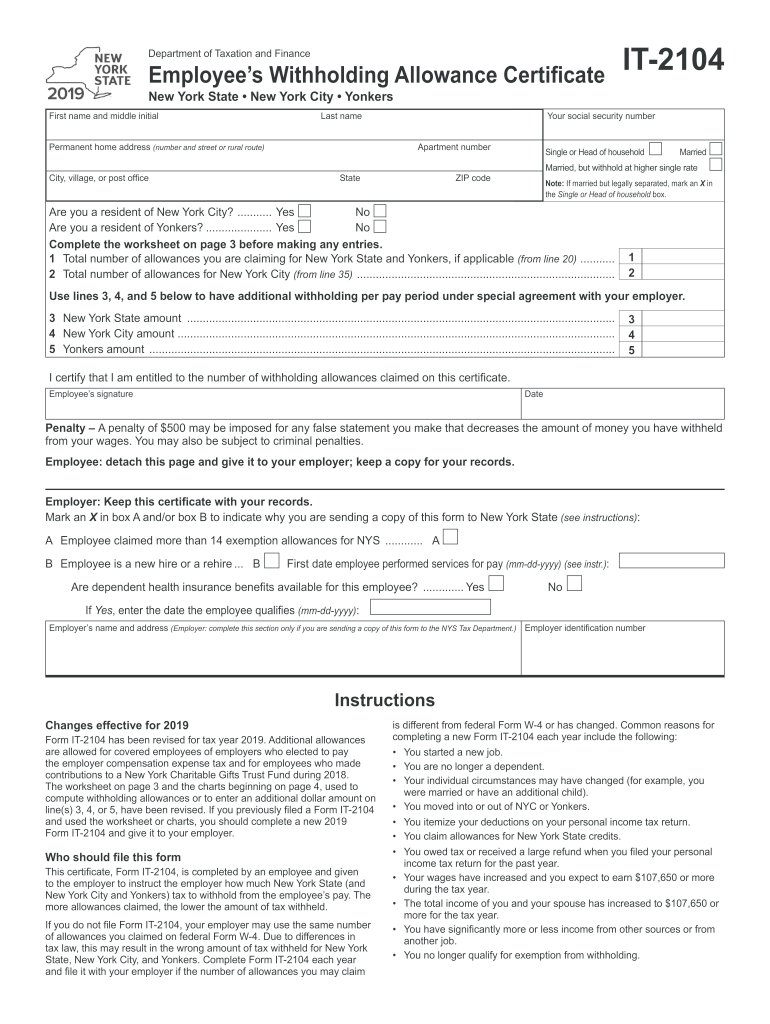

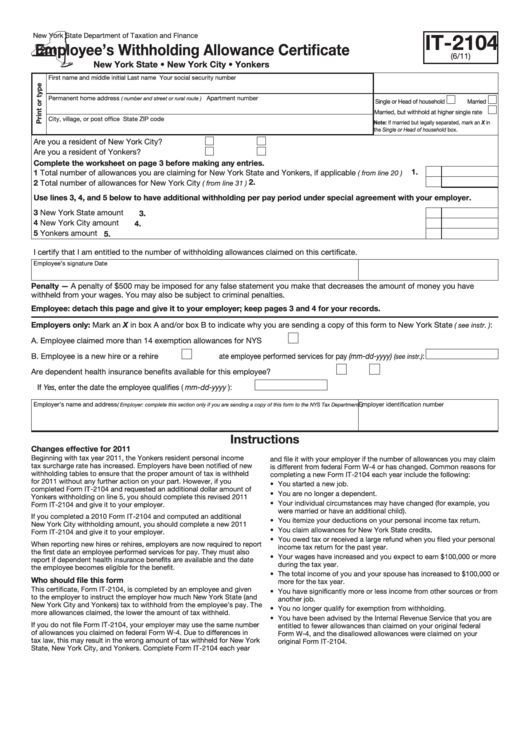

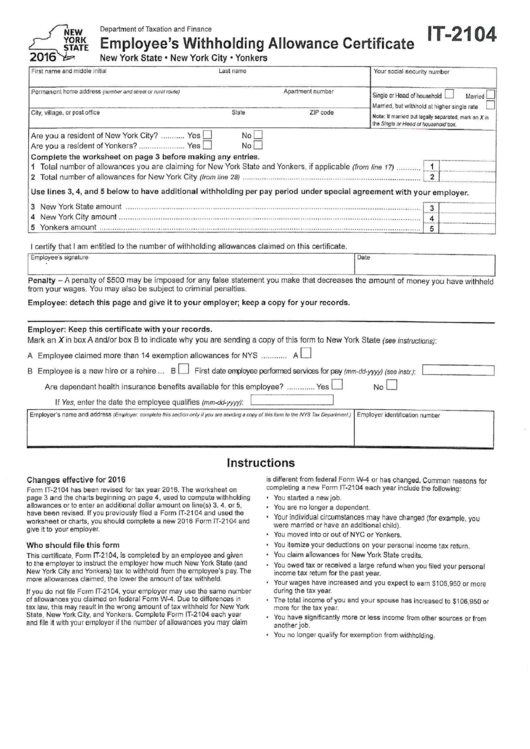

Form It 2104 Instructions

Form It 2104 Instructions - Use signnow to design and send it 2104 form for collecting signatures. Web income to exceed $3,100), you must file form it‑2104, employee’s withholding allowance certificate, with your employer. Follow the instructions on form it‑2104 to determine. Every employee must complete two withholding forms: Web if you want more tax withheld, you may claim fewer allowances. • you are a covered employee of an employer that has elected to participate in the employer compensation expense program. Web 12 rows employee's withholding allowance certificate. Every employee must pay federal and state taxes, unless you’re in a state that. • you are a covered employee of an employer that has elected to participate in the employer compensation expense program. Web 8 rows employee's withholding allowance certificate.

Use signnow to design and send it 2104 form for collecting signatures. Every employee must complete two withholding forms: Web 8 rows employee's withholding allowance certificate. • you are a covered employee of an employer that has elected to participate in the employer compensation expense program. Follow the instructions on form it‑2104 to determine. Web income to exceed $3,100), you must file form it‑2104, employee’s withholding allowance certificate, with your employer. Every employee must pay federal and state taxes, unless you’re in a state that. • you are a covered employee of an employer that has elected to participate in the employer compensation expense program. Signnow helps you fill in and. If you do not, your default.

Web 8 rows employee's withholding allowance certificate. Web income to exceed $3,100), you must file form it‑2104, employee’s withholding allowance certificate, with your employer. • you are a covered employee of an employer that has elected to participate in the employer compensation expense program. Every employee must pay federal and state taxes, unless you’re in a state that. • you are a covered employee of an employer that has elected to participate in the employer compensation expense program. Web 12 rows employee's withholding allowance certificate. Signnow helps you fill in and. Use signnow to design and send it 2104 form for collecting signatures. Follow the instructions on form it‑2104 to determine. If you do not, your default.

RANM FORM 2104 YouTube

• you are a covered employee of an employer that has elected to participate in the employer compensation expense program. Web 8 rows employee's withholding allowance certificate. Web income to exceed $3,100), you must file form it‑2104, employee’s withholding allowance certificate, with your employer. Follow the instructions on form it‑2104 to determine. If you do not, your default.

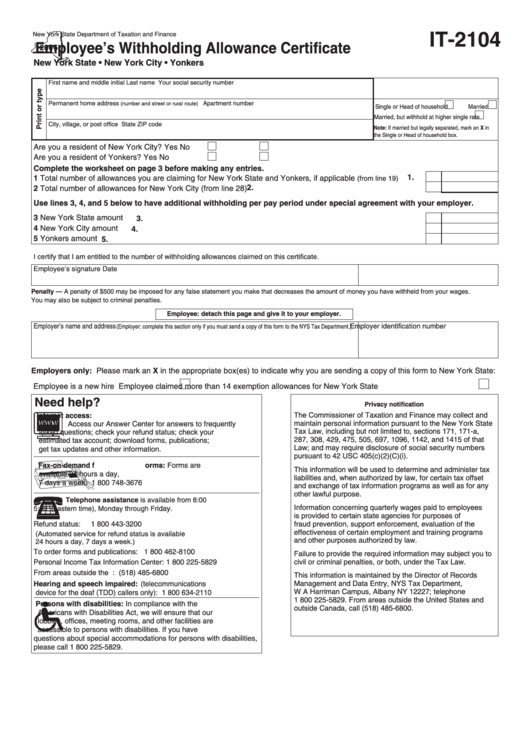

Fillable Online Ny Form It2104 Instructions Fax Email Print pdfFiller

Follow the instructions on form it‑2104 to determine. Web income to exceed $3,100), you must file form it‑2104, employee’s withholding allowance certificate, with your employer. • you are a covered employee of an employer that has elected to participate in the employer compensation expense program. • you are a covered employee of an employer that has elected to participate in.

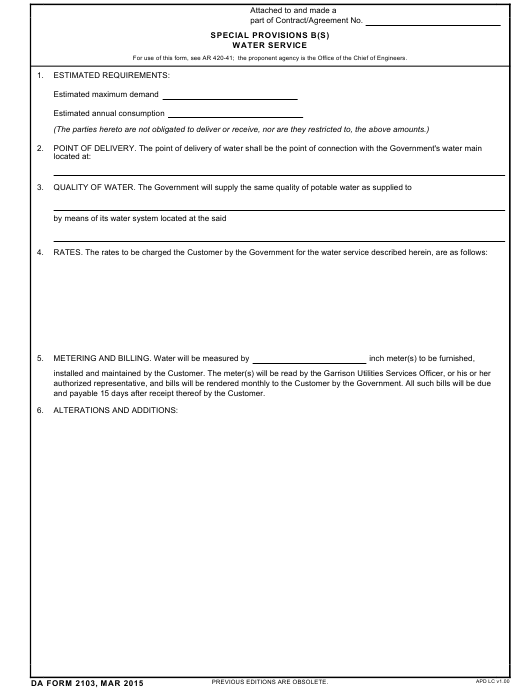

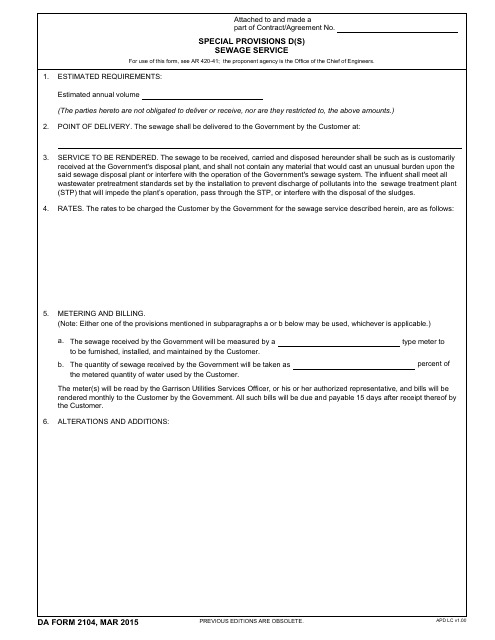

Download Fillable da Form 2103

Signnow helps you fill in and. If you do not, your default. • you are a covered employee of an employer that has elected to participate in the employer compensation expense program. Web income to exceed $3,100), you must file form it‑2104, employee’s withholding allowance certificate, with your employer. Every employee must complete two withholding forms:

It 2104 Fill Out and Sign Printable PDF Template signNow

Follow the instructions on form it‑2104 to determine. Web 12 rows employee's withholding allowance certificate. If you do not, your default. Web 8 rows employee's withholding allowance certificate. Every employee must pay federal and state taxes, unless you’re in a state that.

Fillable Form It2104 Employee'S Withholding Allowance Certificate

Every employee must complete two withholding forms: Use signnow to design and send it 2104 form for collecting signatures. • you are a covered employee of an employer that has elected to participate in the employer compensation expense program. Signnow helps you fill in and. Every employee must pay federal and state taxes, unless you’re in a state that.

Form It2104 Employee'S Withholding Allowance Certificate 2016

Every employee must pay federal and state taxes, unless you’re in a state that. • you are a covered employee of an employer that has elected to participate in the employer compensation expense program. Signnow helps you fill in and. Web 12 rows employee's withholding allowance certificate. Web if you want more tax withheld, you may claim fewer allowances.

DA Form 2104 Download Fillable PDF or Fill Online Special Provisions D

Every employee must complete two withholding forms: • you are a covered employee of an employer that has elected to participate in the employer compensation expense program. If you do not, your default. Web if you want more tax withheld, you may claim fewer allowances. • you are a covered employee of an employer that has elected to participate in.

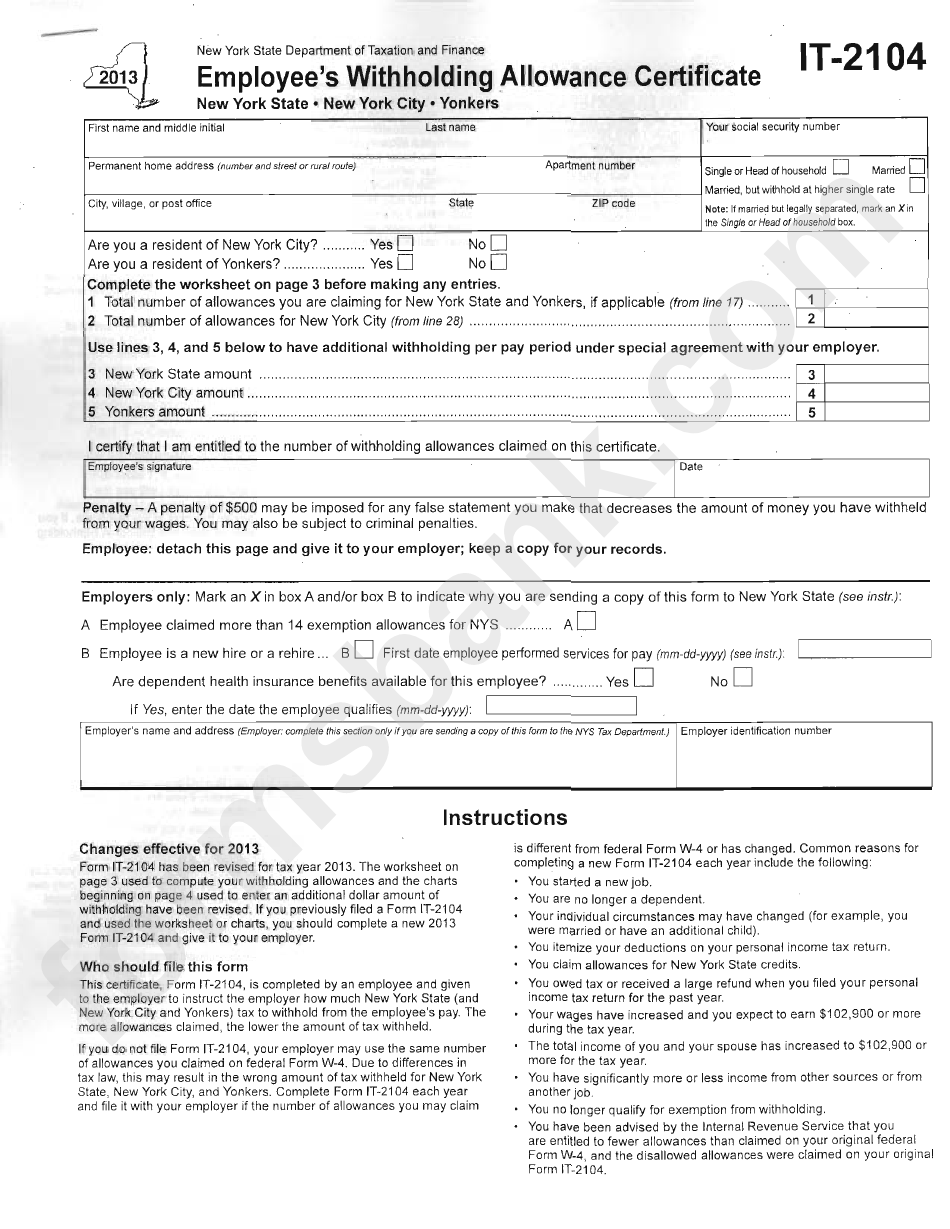

NEW HOW TO FILL FORM IT2104 Form

Use signnow to design and send it 2104 form for collecting signatures. Follow the instructions on form it‑2104 to determine. Web income to exceed $3,100), you must file form it‑2104, employee’s withholding allowance certificate, with your employer. Web 8 rows employee's withholding allowance certificate. • you are a covered employee of an employer that has elected to participate in the.

Fillable Form It2104 Employee'S Withholding Allowance Certificate

Web 8 rows employee's withholding allowance certificate. • you are a covered employee of an employer that has elected to participate in the employer compensation expense program. Use signnow to design and send it 2104 form for collecting signatures. • you are a covered employee of an employer that has elected to participate in the employer compensation expense program. Signnow.

Form It2104 Employee'S Withholding Allowance Certificate 2013

Web 8 rows employee's withholding allowance certificate. Use signnow to design and send it 2104 form for collecting signatures. Web income to exceed $3,100), you must file form it‑2104, employee’s withholding allowance certificate, with your employer. • you are a covered employee of an employer that has elected to participate in the employer compensation expense program. If you do not,.

Use Signnow To Design And Send It 2104 Form For Collecting Signatures.

Web if you want more tax withheld, you may claim fewer allowances. Every employee must pay federal and state taxes, unless you’re in a state that. Web income to exceed $3,100), you must file form it‑2104, employee’s withholding allowance certificate, with your employer. Every employee must complete two withholding forms:

Web 8 Rows Employee's Withholding Allowance Certificate.

• you are a covered employee of an employer that has elected to participate in the employer compensation expense program. Follow the instructions on form it‑2104 to determine. If you do not, your default. Web 12 rows employee's withholding allowance certificate.

• You Are A Covered Employee Of An Employer That Has Elected To Participate In The Employer Compensation Expense Program.

Signnow helps you fill in and.