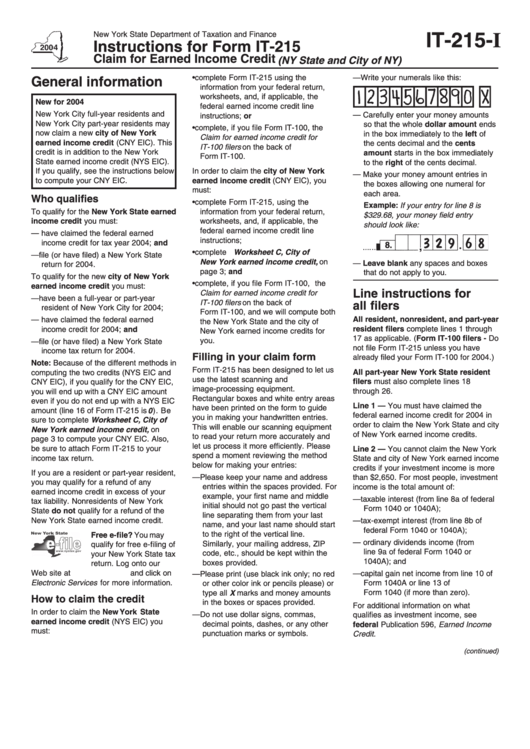

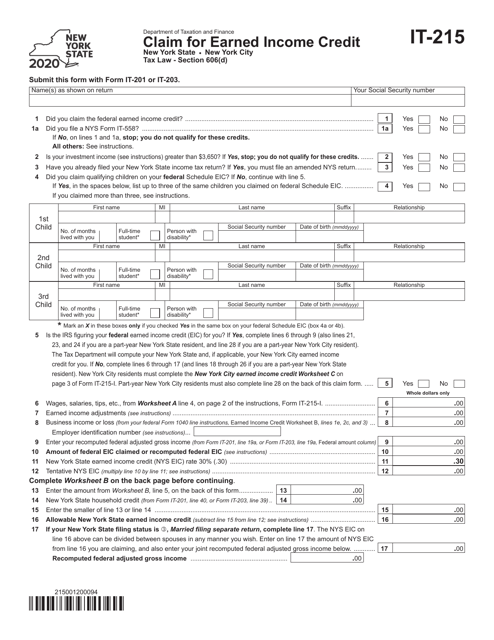

Form It 215

Form It 215 - This form is for income earned in tax year 2022, with tax returns. Web tv footage showed the plane dropping water over a fire and then crashing into a hillside and bursting into flames. Line 6, worksheet a, line. Start completing the fillable fields and carefully. It may help to go back to the federal and delete the. 6.00 7 if you received a taxable scholarship or fellowship. To claim the nyc eic, you must: Return, worksheets, and income tax credit line instructions, and file it with your new york state. State broadcaster ert separately reported that. To claim the state eic, you must be getting the federal eic.

Use get form or simply click on the template preview to open it in the editor. Return, worksheets, and income tax credit line instructions, and file it with your new york state income tax return. State broadcaster ert separately reported that. Return, worksheets, and income tax credit line instructions, and file it with your new york state. To claim the nyc eic, you must: It may help to go back to the federal and delete the. Line 6, worksheet a, line. To claim the state eic, you must be getting the federal eic. This form is for income earned in tax year 2022, with tax returns. Web tv footage showed the plane dropping water over a fire and then crashing into a hillside and bursting into flames.

Start completing the fillable fields and carefully. Line 6, worksheet a, line. 6.00 7 if you received a taxable scholarship or fellowship. It may help to go back to the federal and delete the. Web tv footage showed the plane dropping water over a fire and then crashing into a hillside and bursting into flames. Return, worksheets, and income tax credit line instructions, and file it with your new york state. This form is for income earned in tax year 2022, with tax returns. To claim the nyc eic, you must: Use get form or simply click on the template preview to open it in the editor. Return, worksheets, and income tax credit line instructions, and file it with your new york state income tax return.

Form IT 215 Earned Credit Miller Financial Services

Line 6, worksheet a, line. Return, worksheets, and income tax credit line instructions, and file it with your new york state. To claim the nyc eic, you must: Use get form or simply click on the template preview to open it in the editor. This form is for income earned in tax year 2022, with tax returns.

irs electronic signature 8804 JWord サーチ

Web tv footage showed the plane dropping water over a fire and then crashing into a hillside and bursting into flames. Start completing the fillable fields and carefully. 6.00 7 if you received a taxable scholarship or fellowship. Return, worksheets, and income tax credit line instructions, and file it with your new york state. This form is for income earned.

Instructions For Form It215 Claim For Earned Credit New

To claim the state eic, you must be getting the federal eic. Return, worksheets, and income tax credit line instructions, and file it with your new york state. It may help to go back to the federal and delete the. Web tv footage showed the plane dropping water over a fire and then crashing into a hillside and bursting into.

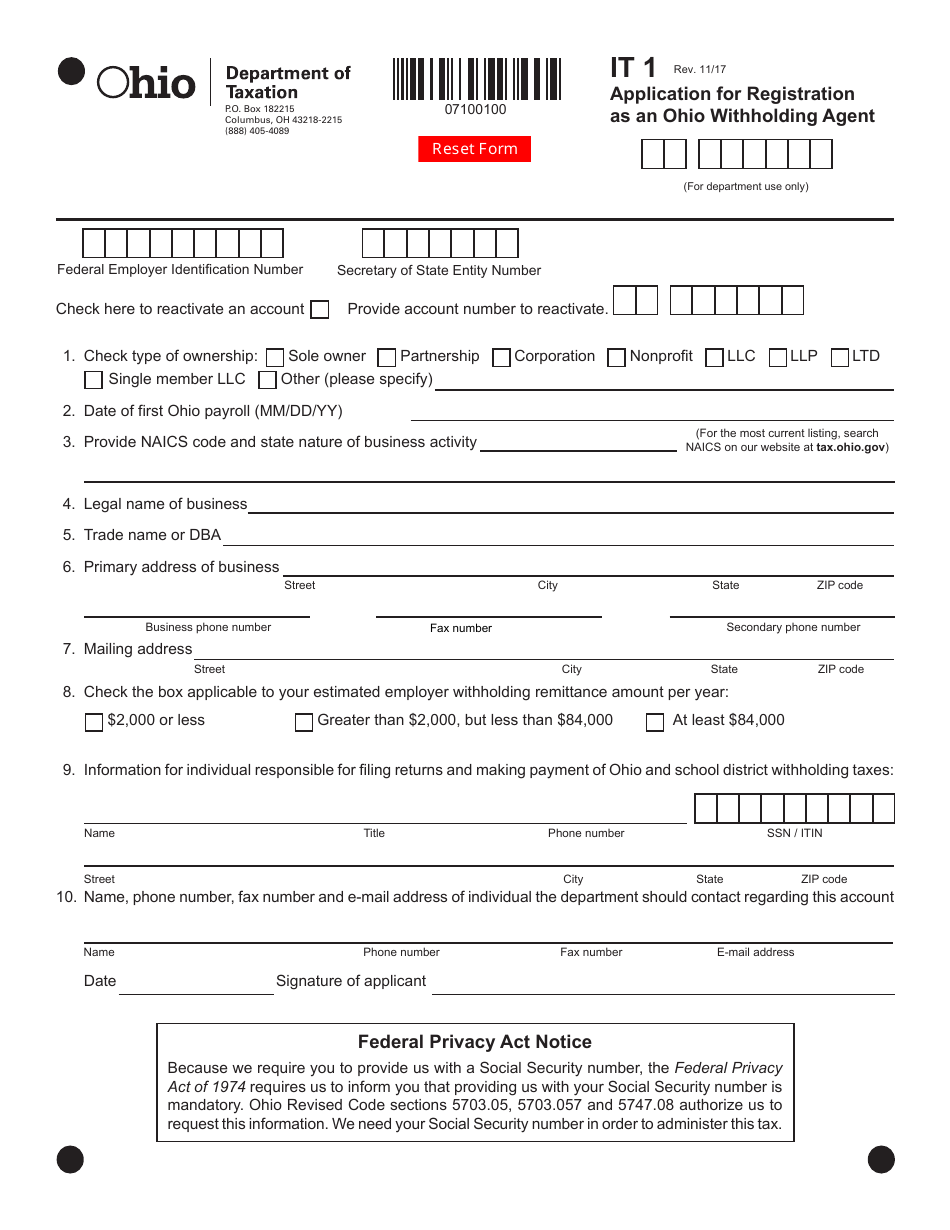

Form IT1 Download Fillable PDF or Fill Online Application for

To claim the state eic, you must be getting the federal eic. Line 6, worksheet a, line. Start completing the fillable fields and carefully. Return, worksheets, and income tax credit line instructions, and file it with your new york state income tax return. Use get form or simply click on the template preview to open it in the editor.

Claiming Claiming Earned Credit

Return, worksheets, and income tax credit line instructions, and file it with your new york state income tax return. Start completing the fillable fields and carefully. To claim the nyc eic, you must: 6.00 7 if you received a taxable scholarship or fellowship. It may help to go back to the federal and delete the.

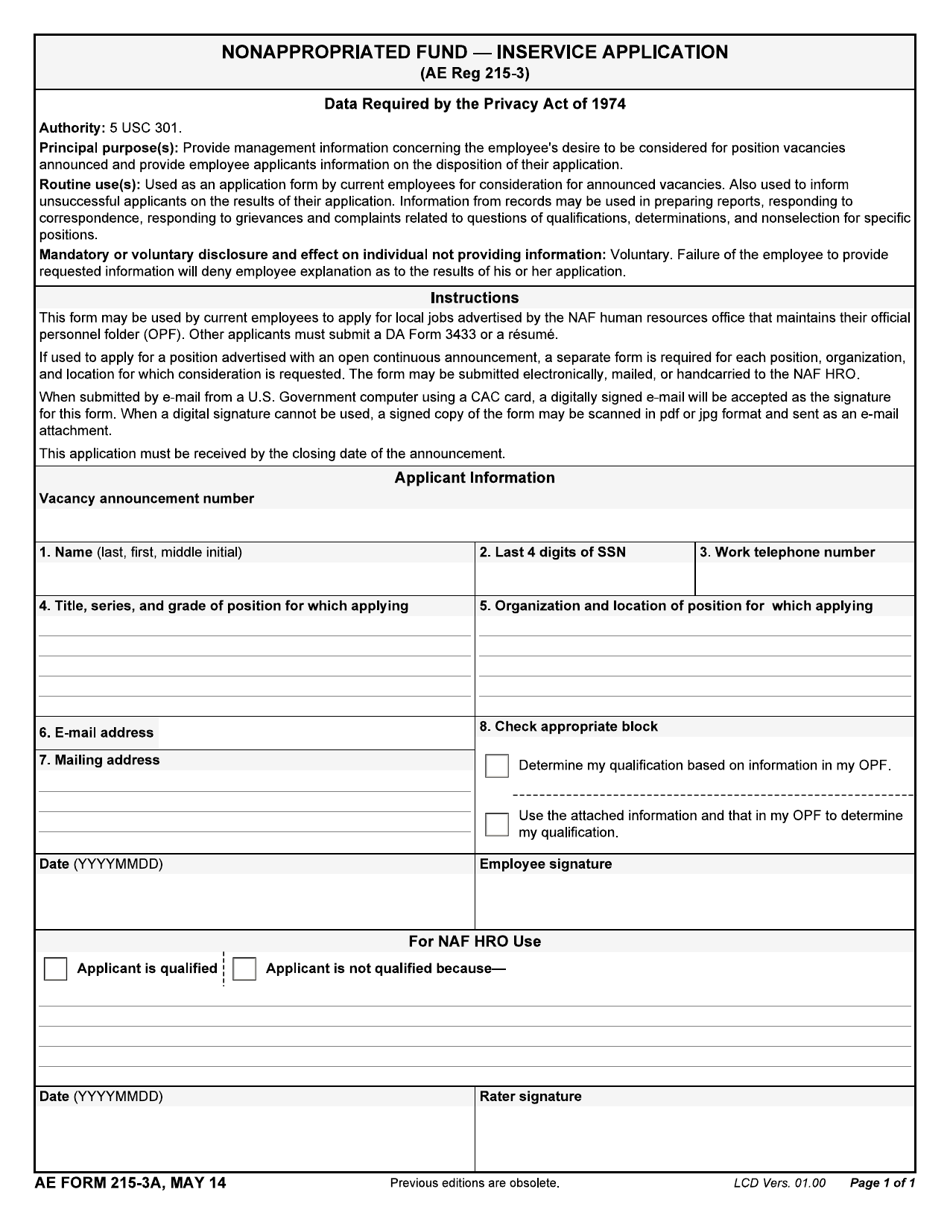

AE Form 2153A Download Fillable PDF or Fill Online Nonappropriated

Web tv footage showed the plane dropping water over a fire and then crashing into a hillside and bursting into flames. To claim the nyc eic, you must: Start completing the fillable fields and carefully. Use get form or simply click on the template preview to open it in the editor. It may help to go back to the federal.

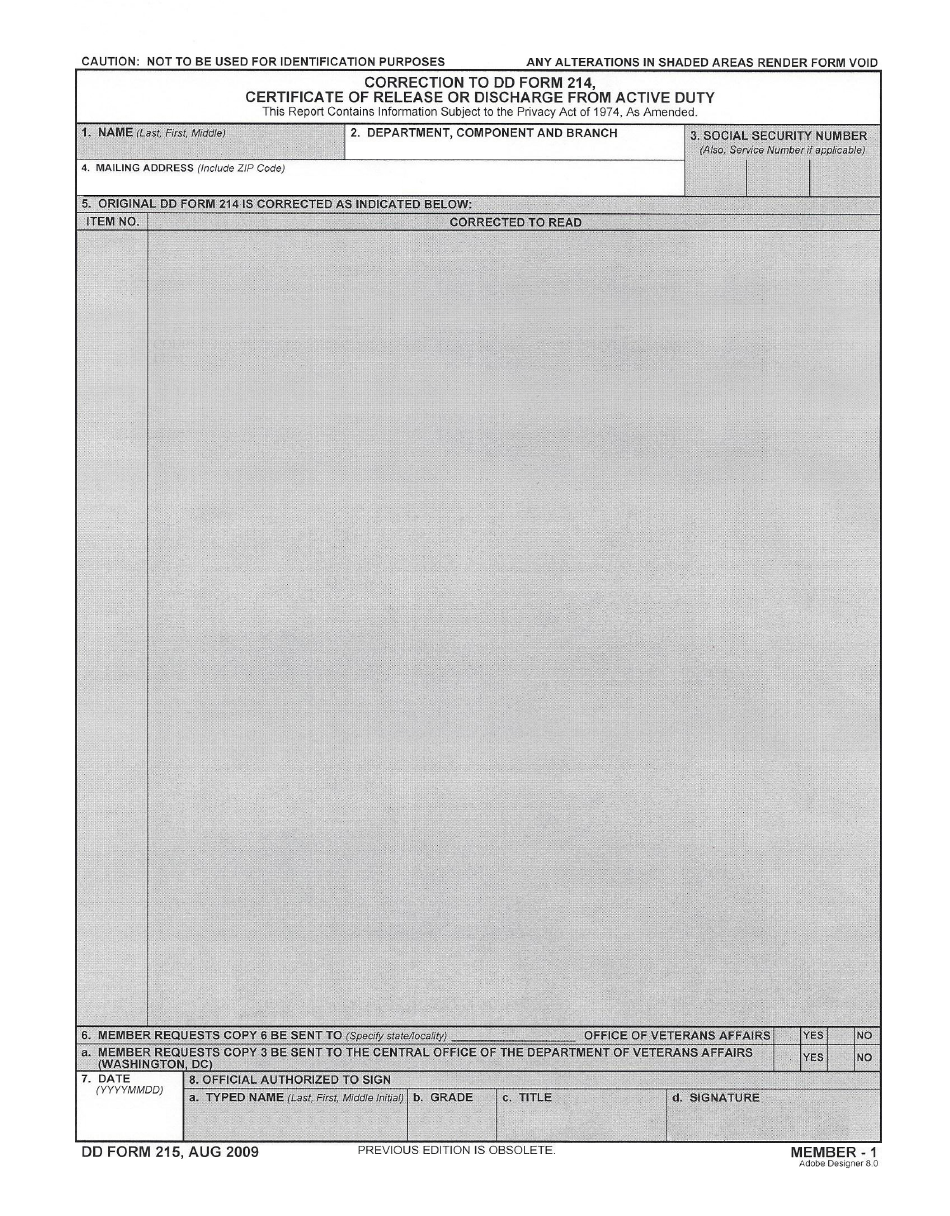

DD Form 215 Download Printable PDF or Fill Online Correction to DD Form

Web tv footage showed the plane dropping water over a fire and then crashing into a hillside and bursting into flames. Return, worksheets, and income tax credit line instructions, and file it with your new york state. It may help to go back to the federal and delete the. Use get form or simply click on the template preview to.

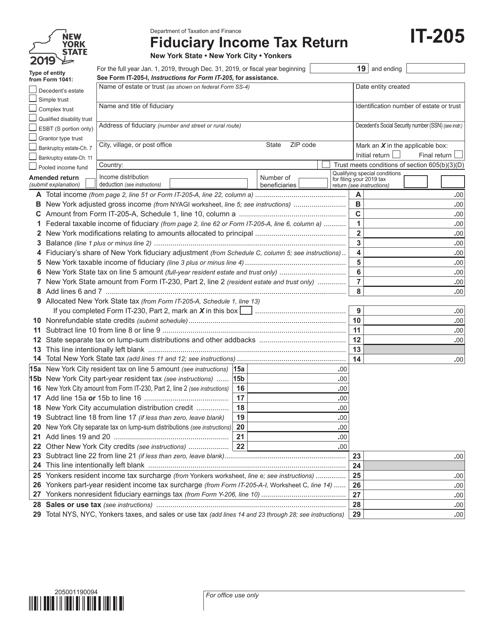

Form IT205 Download Fillable PDF or Fill Online Fiduciary Tax

Return, worksheets, and income tax credit line instructions, and file it with your new york state income tax return. Use get form or simply click on the template preview to open it in the editor. Web tv footage showed the plane dropping water over a fire and then crashing into a hillside and bursting into flames. 6.00 7 if you.

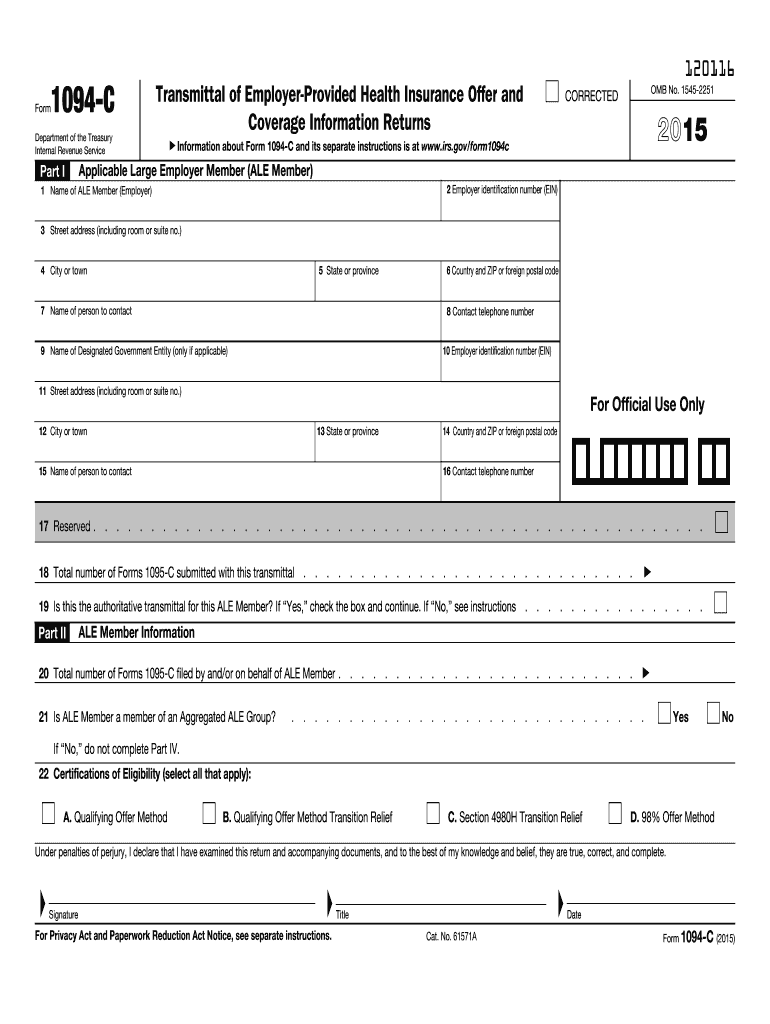

2015 1094 c form Fill out & sign online DocHub

This form is for income earned in tax year 2022, with tax returns. 6.00 7 if you received a taxable scholarship or fellowship. To claim the nyc eic, you must: Web tv footage showed the plane dropping water over a fire and then crashing into a hillside and bursting into flames. Use get form or simply click on the template.

Form IT215 Download Fillable PDF or Fill Online Claim for Earned

It may help to go back to the federal and delete the. State broadcaster ert separately reported that. 6.00 7 if you received a taxable scholarship or fellowship. This form is for income earned in tax year 2022, with tax returns. Return, worksheets, and income tax credit line instructions, and file it with your new york state income tax return.

State Broadcaster Ert Separately Reported That.

Return, worksheets, and income tax credit line instructions, and file it with your new york state income tax return. Web tv footage showed the plane dropping water over a fire and then crashing into a hillside and bursting into flames. 6.00 7 if you received a taxable scholarship or fellowship. Use get form or simply click on the template preview to open it in the editor.

Start Completing The Fillable Fields And Carefully.

This form is for income earned in tax year 2022, with tax returns. It may help to go back to the federal and delete the. Line 6, worksheet a, line. To claim the nyc eic, you must:

Return, Worksheets, And Income Tax Credit Line Instructions, And File It With Your New York State.

To claim the state eic, you must be getting the federal eic.