Form Mo-Pte Instructions 2022

Form Mo-Pte Instructions 2022 - 2400) that, among other things: Web the missouri department of revenue jan. Web the individual income tax form includes: Return this form with check or money order payable to the missouri department of. Web the taxable year if your missouri estimated tax can reasonably be expected to be at least $250 (section 143.521.2, rsmo). Missouri miles total miles percent. Web by using this form, the pte acknowledges that it has made the election for the taxable year with its first payment (estimated form 510/511d, extension form 510/511e, or with. Web how to last modified: Mesas a member, supporter, volunteer of, or donor of financial or nonfinancial support to, any mo scholars receipt. Any taxpayer who donates cash or food to a food pantry, homeless shelter, or soup kitchen unless such food is donated.

Lives in a nursing home or residential care facility while the other spouse. Return this form with check or money order payable to the missouri department of. Mesas a member, supporter, volunteer of, or donor of financial or nonfinancial support to, any mo scholars receipt. Missouri miles total miles percent. Web how to last modified: Web by using this form, the pte acknowledges that it has made the election for the taxable year with its first payment (estimated form 510/511d, extension form 510/511e, or with. 2400) that, among other things: Web governor mike parson on june 30, 2022, signed into law a bill ( h.b. Web the new law known as the “missouri salt parity act,” is effective beginning with tax years ending on or after december 31, 2022. Web the taxable year if your missouri estimated tax can reasonably be expected to be at least $250 (section 143.521.2, rsmo).

Web the new law known as the “missouri salt parity act,” is effective beginning with tax years ending on or after december 31, 2022. Any taxpayer who donates cash or food to a food pantry, homeless shelter, or soup kitchen unless such food is donated. You can find printable forms and instructions on the missouri. Return this form with check or money order payable to the missouri department of. Web the taxable year if your missouri estimated tax can reasonably be expected to be at least $250 (section 143.521.2, rsmo). 03/23/2023 objectives prepare and populate missouri pass through entity income tax return and related forms. Web how to last modified: Web governor mike parson on june 30, 2022, signed into law a bill ( h.b. Lives in a nursing home or residential care facility while the other spouse. Missouri miles total miles percent.

I9 Form 2022 Instructions

Income tax to any corporation. 03/23/2023 objectives prepare and populate missouri pass through entity income tax return and related forms. Web governor mike parson on june 30, 2022, signed into law a bill ( h.b. Select this box if you have an approved. Return this form with check or money order payable to the missouri department of.

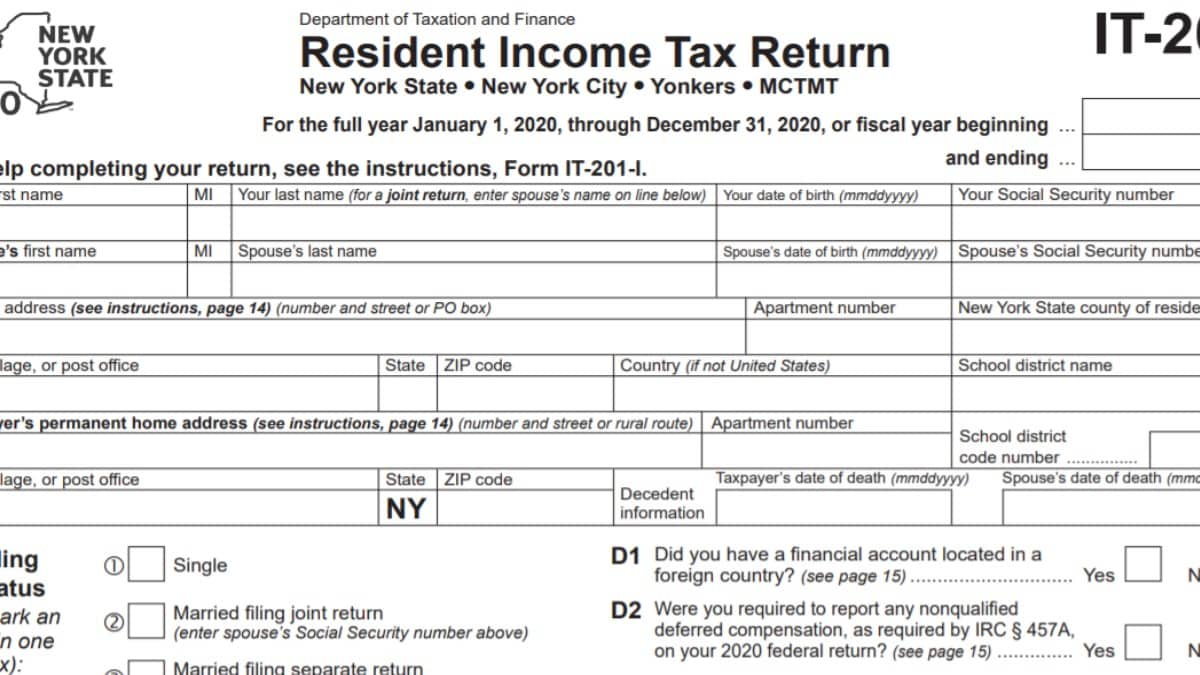

IT201 Instructions 2022 2023 State Taxes TaxUni

Any taxpayer who donates cash or food to a food pantry, homeless shelter, or soup kitchen unless such food is donated. Web how to last modified: Mesas a member, supporter, volunteer of, or donor of financial or nonfinancial support to, any mo scholars receipt. Income tax to any corporation. Return this form with check or money order payable to the.

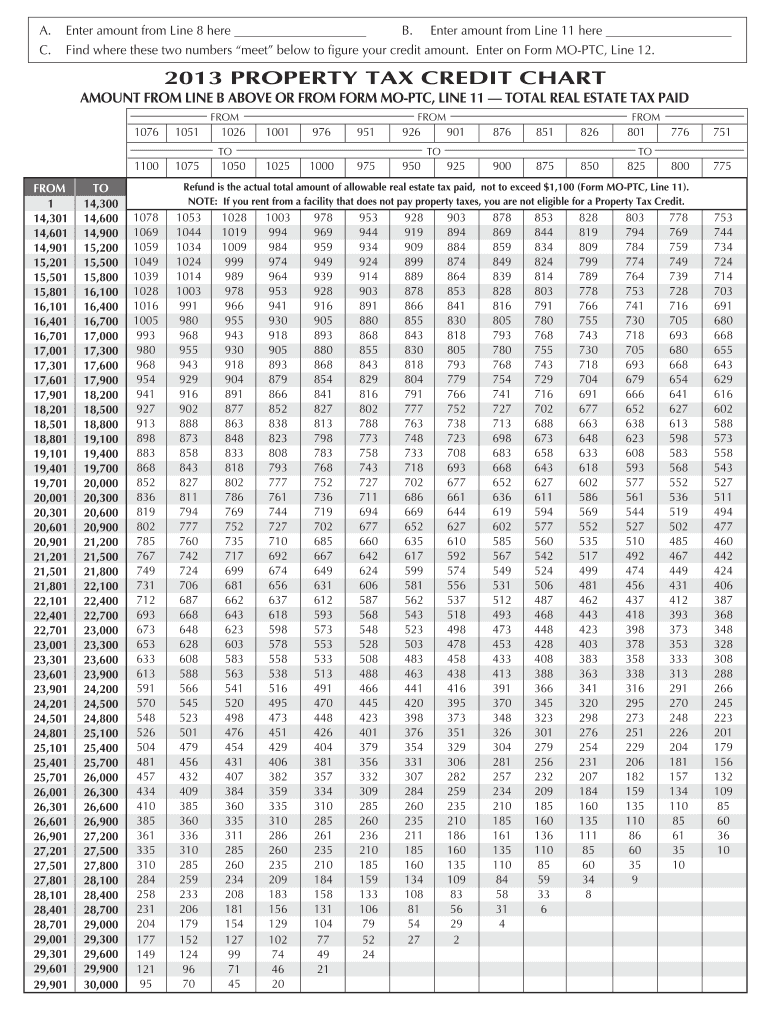

2013 Form MOPTC Property Tax Credit Claim dor mo Fill out & sign

Missouri miles total miles percent. You can find printable forms and instructions on the missouri. Any taxpayer who donates cash or food to a food pantry, homeless shelter, or soup kitchen unless such food is donated. Web by using this form, the pte acknowledges that it has made the election for the taxable year with its first payment (estimated form.

2022 Form MO DoR MOPTS Fill Online, Printable, Fillable, Blank pdfFiller

Web governor mike parson on june 30, 2022, signed into law a bill ( h.b. Web the taxable year if your missouri estimated tax can reasonably be expected to be at least $250 (section 143.521.2, rsmo). You can find printable forms and instructions on the missouri. 2400) that, among other things: Lives in a nursing home or residential care facility.

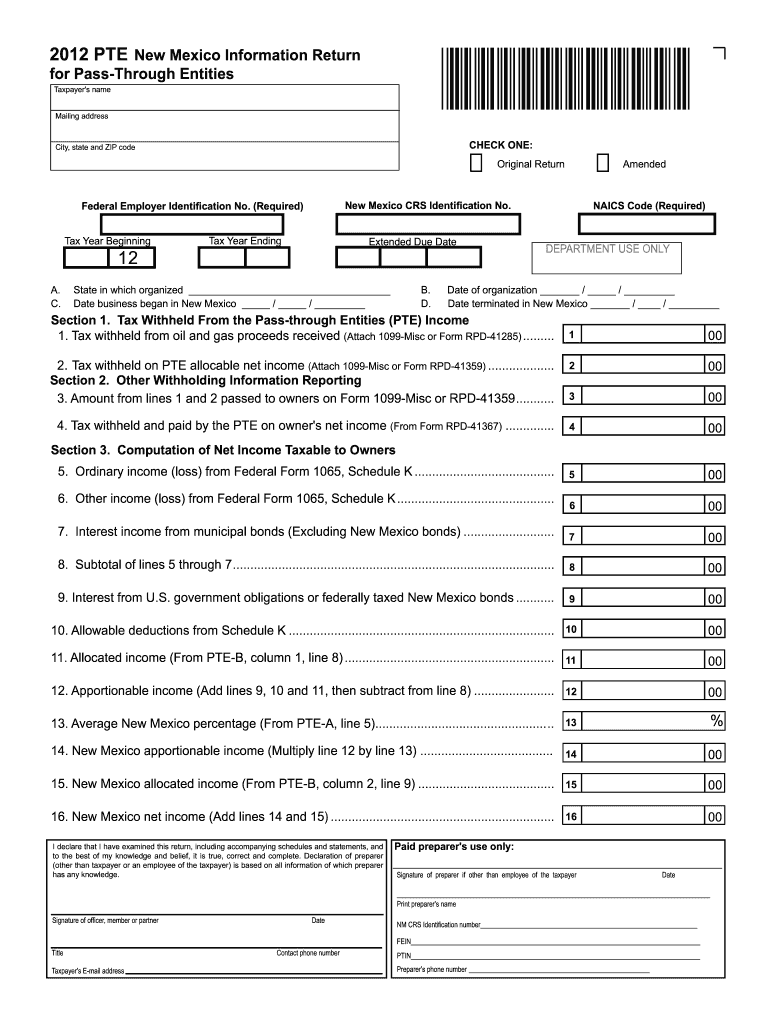

New Mexico Pte Instructions Fill Out and Sign Printable PDF Template

Missouri grants an automatic extension of time to file corporation. You can find printable forms and instructions on the missouri. Select this box if you have an approved. Income tax to any corporation. You can find printable forms and instructions on the missouri.

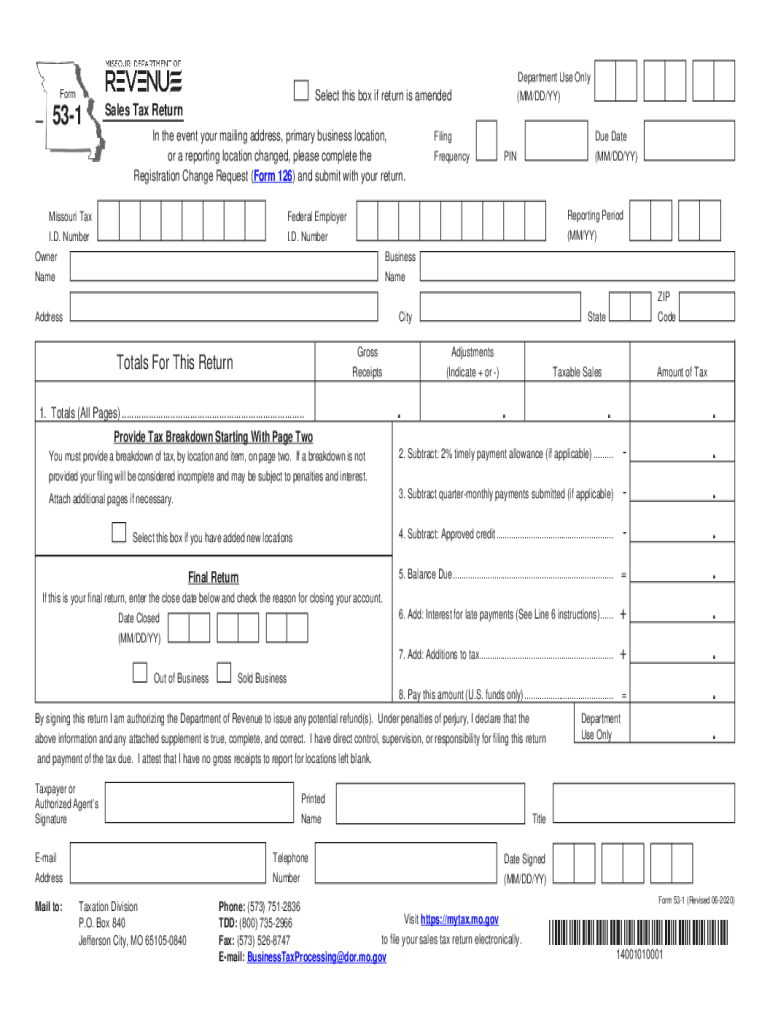

20202022 MO DoR Form 531 Fill Online, Printable, Fillable, Blank

Return this form with check or money order payable to the missouri department of. Mesas a member, supporter, volunteer of, or donor of financial or nonfinancial support to, any mo scholars receipt. Web the taxable year if your missouri estimated tax can reasonably be expected to be at least $250 (section 143.521.2, rsmo). Any taxpayer who donates cash or food.

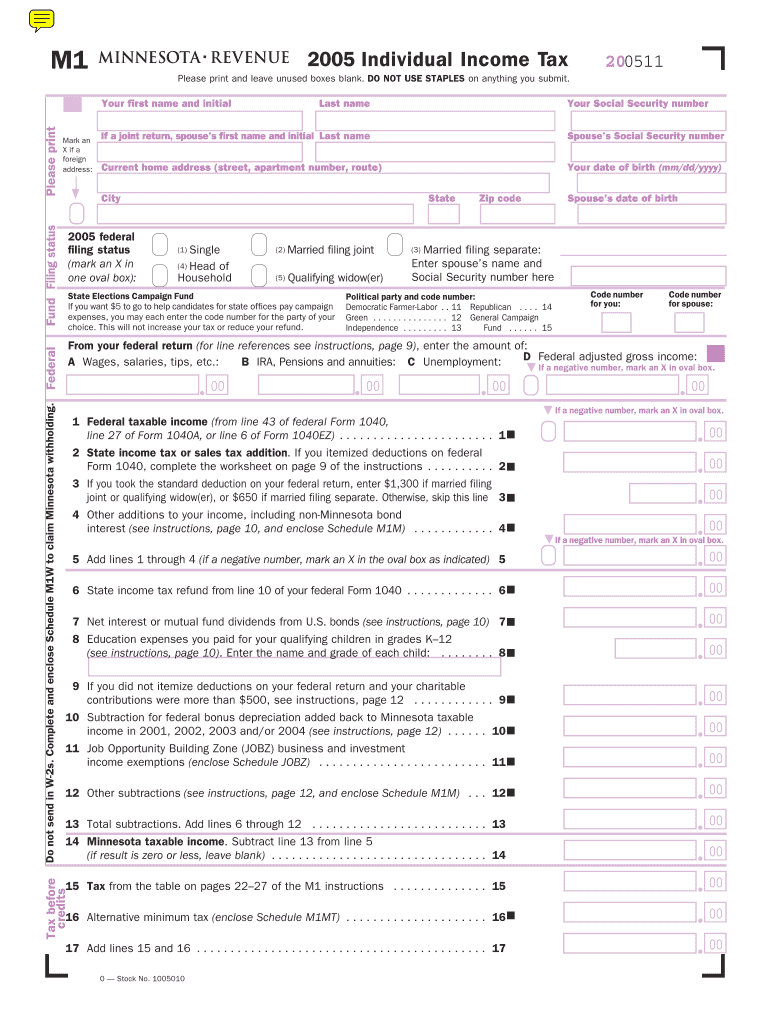

M1 Mn State Tax Form Fill Out and Sign Printable PDF Template signNow

Web the new law known as the “missouri salt parity act,” is effective beginning with tax years ending on or after december 31, 2022. Web by using this form, the pte acknowledges that it has made the election for the taxable year with its first payment (estimated form 510/511d, extension form 510/511e, or with. Web the missouri department of revenue.

2008 Form SC DoR SC1040 Fill Online, Printable, Fillable, Blank pdfFiller

Web how to last modified: Select this box if you have an approved. 03/23/2023 objectives prepare and populate missouri pass through entity income tax return and related forms. Web the individual income tax form includes: Web governor mike parson on june 30, 2022, signed into law a bill ( h.b.

Mo Ptc 2020 Fillable Form Fill and Sign Printable Template Online

Return this form with check or money order payable to the missouri department of. Lives in a nursing home or residential care facility while the other spouse. Web governor mike parson on june 30, 2022, signed into law a bill ( h.b. Select this box if you have an approved. Missouri miles total miles percent.

AKedOLQRbkAsciZ77iRbxaSvrkVErjsbJiY4N73hJqSc=s900ckc0x00ffffffnorj

Web the missouri department of revenue jan. Web how to last modified: Any taxpayer who donates cash or food to a food pantry, homeless shelter, or soup kitchen unless such food is donated. Lives in a nursing home or residential care facility while the other spouse. Mesas a member, supporter, volunteer of, or donor of financial or nonfinancial support to,.

You Can Find Printable Forms And Instructions On The Missouri.

Web the taxable year if your missouri estimated tax can reasonably be expected to be at least $250 (section 143.521.2, rsmo). Select this box if you have an approved. Any taxpayer who donates cash or food to a food pantry, homeless shelter, or soup kitchen unless such food is donated. Mesas a member, supporter, volunteer of, or donor of financial or nonfinancial support to, any mo scholars receipt.

Web The Missouri Department Of Revenue Jan.

You can find printable forms and instructions on the missouri. Box 118, jefferson city, mo. 2400) that, among other things: 03/23/2023 objectives prepare and populate missouri pass through entity income tax return and related forms.

Missouri Miles Total Miles Percent.

Return this form with check or money order payable to the missouri department of. Missouri grants an automatic extension of time to file corporation. Web the individual income tax form includes: Web governor mike parson on june 30, 2022, signed into law a bill ( h.b.

Lives In A Nursing Home Or Residential Care Facility While The Other Spouse.

Web the new law known as the “missouri salt parity act,” is effective beginning with tax years ending on or after december 31, 2022. Income tax to any corporation. Web how to last modified: Web by using this form, the pte acknowledges that it has made the election for the taxable year with its first payment (estimated form 510/511d, extension form 510/511e, or with.