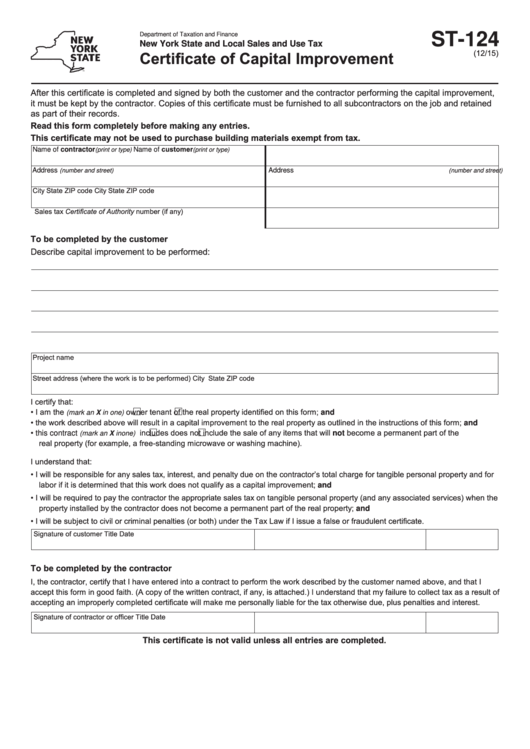

Form St 124

Form St 124 - This certificate is only for use by a purchaser who: Web for collecting sales tax on retail sales.) retailers can be businesses, individuals, or even. Purchase orders showing an exemption from the sales or use tax based on this certificate must contain the address of the Here you will find an alphabetical listing of sales and use tax forms administered by the massachusetts department of revenue (dor). (see publication 862 for additional information.) the term materials is defined as items that become a physical component part of real or personal property, such as lumber, bricks, or steel. You must give the contractor a properly completed form within 90 days after the service is rendered. That they sell, a product or related service. Web dor sales and use tax forms. Nonprofit organizations that sell, or make it known. This term also includes items such as doors, windows, sinks, and furnaces used in construction.

The contractor must use a separate form st‑120.1, contractor exempt purchase certificate, for each project. A certificate is accepted in good faith when a contractor has no knowledge that the certificate is false or is fraudulently given, Web for collecting sales tax on retail sales.) retailers can be businesses, individuals, or even. Here you will find an alphabetical listing of sales and use tax forms administered by the massachusetts department of revenue (dor). This term also includes items such as doors, windows, sinks, and furnaces used in construction. Purchase orders showing an exemption from the sales or use tax based on this certificate must contain the address of the (see publication 862 for additional information.) the term materials is defined as items that become a physical component part of real or personal property, such as lumber, bricks, or steel. That they sell, a product or related service. This certificate is only for use by a purchaser who: Web dor sales and use tax forms.

Nonprofit organizations that sell, or make it known. This term also includes items such as doors, windows, sinks, and furnaces used in construction. A certificate is accepted in good faith when a contractor has no knowledge that the certificate is false or is fraudulently given, Here you will find an alphabetical listing of sales and use tax forms administered by the massachusetts department of revenue (dor). The contractor must use a separate form st‑120.1, contractor exempt purchase certificate, for each project. This certificate is only for use by a purchaser who: Web for collecting sales tax on retail sales.) retailers can be businesses, individuals, or even. Purchase orders showing an exemption from the sales or use tax based on this certificate must contain the address of the Web dor sales and use tax forms. That they sell, a product or related service.

Getting A Home Improvement Loan Home Improvement Pennsylvania

Purchase orders showing an exemption from the sales or use tax based on this certificate must contain the address of the Nonprofit organizations that sell, or make it known. This term also includes items such as doors, windows, sinks, and furnaces used in construction. Web dor sales and use tax forms. That they sell, a product or related service.

Form ST 124 Tax Ny Gov New York State Fill Out and Sign Printable PDF

(see publication 862 for additional information.) the term materials is defined as items that become a physical component part of real or personal property, such as lumber, bricks, or steel. Web for collecting sales tax on retail sales.) retailers can be businesses, individuals, or even. This term also includes items such as doors, windows, sinks, and furnaces used in construction..

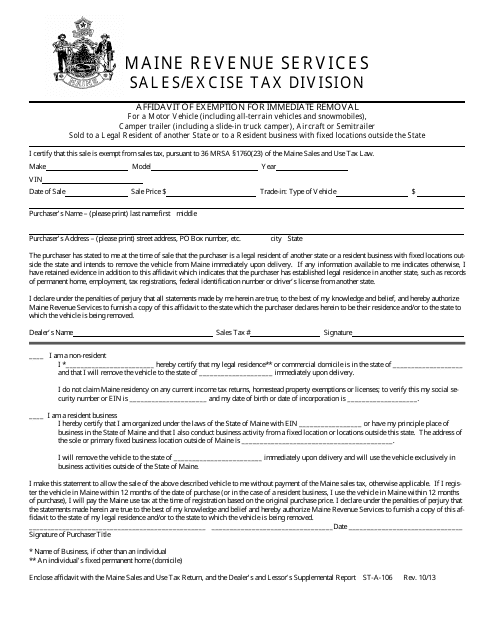

Form STA106 Download Printable PDF or Fill Online Affidavit of

This term also includes items such as doors, windows, sinks, and furnaces used in construction. (see publication 862 for additional information.) the term materials is defined as items that become a physical component part of real or personal property, such as lumber, bricks, or steel. You must give the contractor a properly completed form within 90 days after the service.

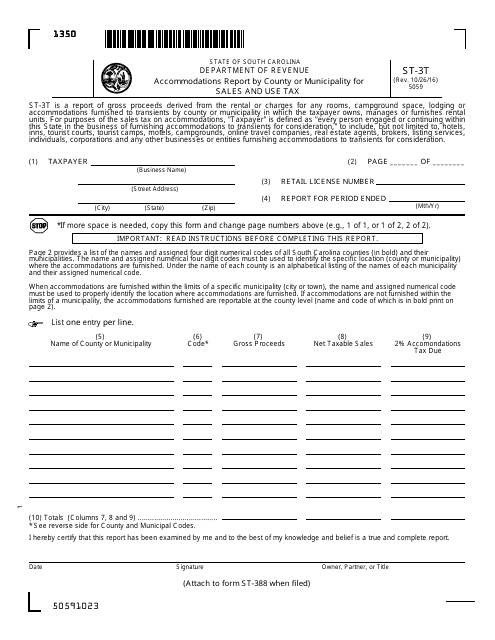

Form ST3t Download Printable PDF or Fill Online Report

You must give the contractor a properly completed form within 90 days after the service is rendered. A certificate is accepted in good faith when a contractor has no knowledge that the certificate is false or is fraudulently given, The contractor must use a separate form st‑120.1, contractor exempt purchase certificate, for each project. Web dor sales and use tax.

How To Fill Out St 120 Form

(see publication 862 for additional information.) the term materials is defined as items that become a physical component part of real or personal property, such as lumber, bricks, or steel. This certificate is only for use by a purchaser who: A certificate is accepted in good faith when a contractor has no knowledge that the certificate is false or is.

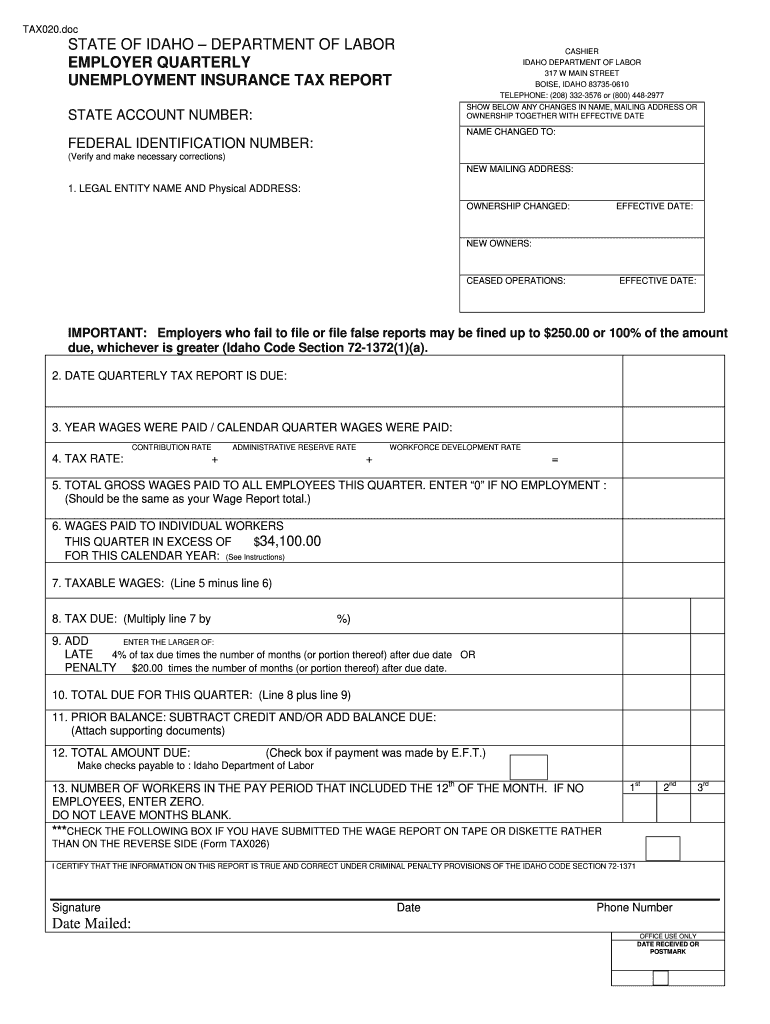

Tax020 form Fill out & sign online DocHub

Here you will find an alphabetical listing of sales and use tax forms administered by the massachusetts department of revenue (dor). Nonprofit organizations that sell, or make it known. A certificate is accepted in good faith when a contractor has no knowledge that the certificate is false or is fraudulently given, This certificate is only for use by a purchaser.

St12 form 2007 Fill out & sign online DocHub

Here you will find an alphabetical listing of sales and use tax forms administered by the massachusetts department of revenue (dor). Nonprofit organizations that sell, or make it known. You must give the contractor a properly completed form within 90 days after the service is rendered. (see publication 862 for additional information.) the term materials is defined as items that.

Fillable Form St124 Certificate Of Capital Improvement printable pdf

Web for collecting sales tax on retail sales.) retailers can be businesses, individuals, or even. You must give the contractor a properly completed form within 90 days after the service is rendered. Web dor sales and use tax forms. A certificate is accepted in good faith when a contractor has no knowledge that the certificate is false or is fraudulently.

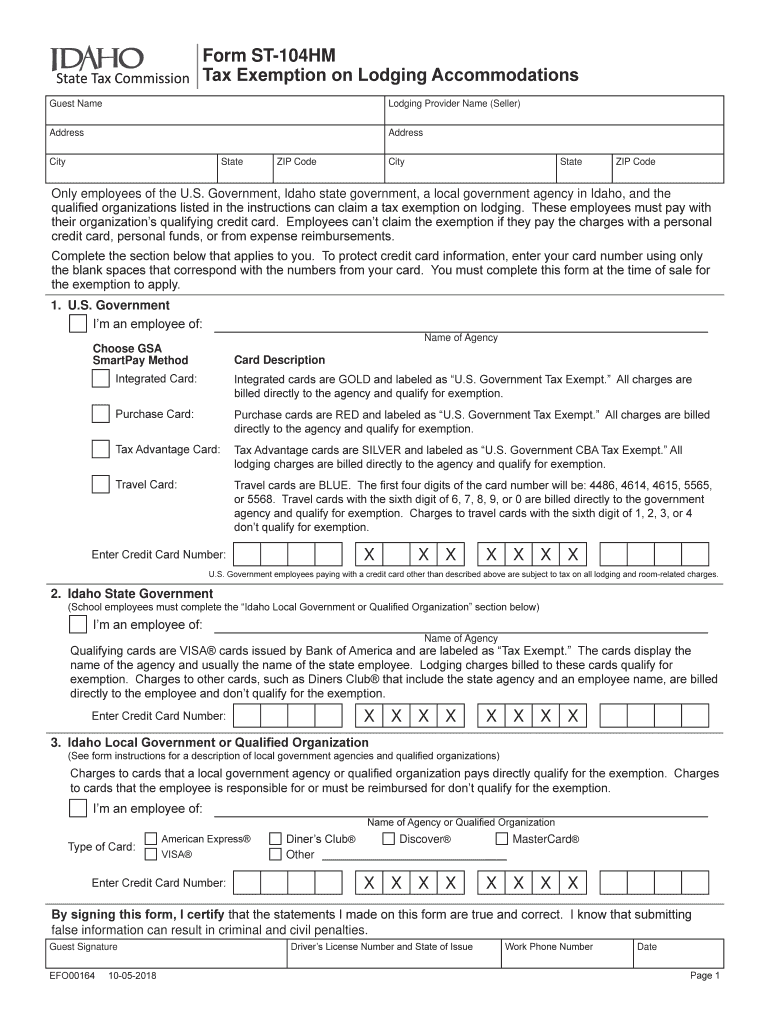

Idaho form st104 Fill out & sign online DocHub

Here you will find an alphabetical listing of sales and use tax forms administered by the massachusetts department of revenue (dor). (see publication 862 for additional information.) the term materials is defined as items that become a physical component part of real or personal property, such as lumber, bricks, or steel. Purchase orders showing an exemption from the sales or.

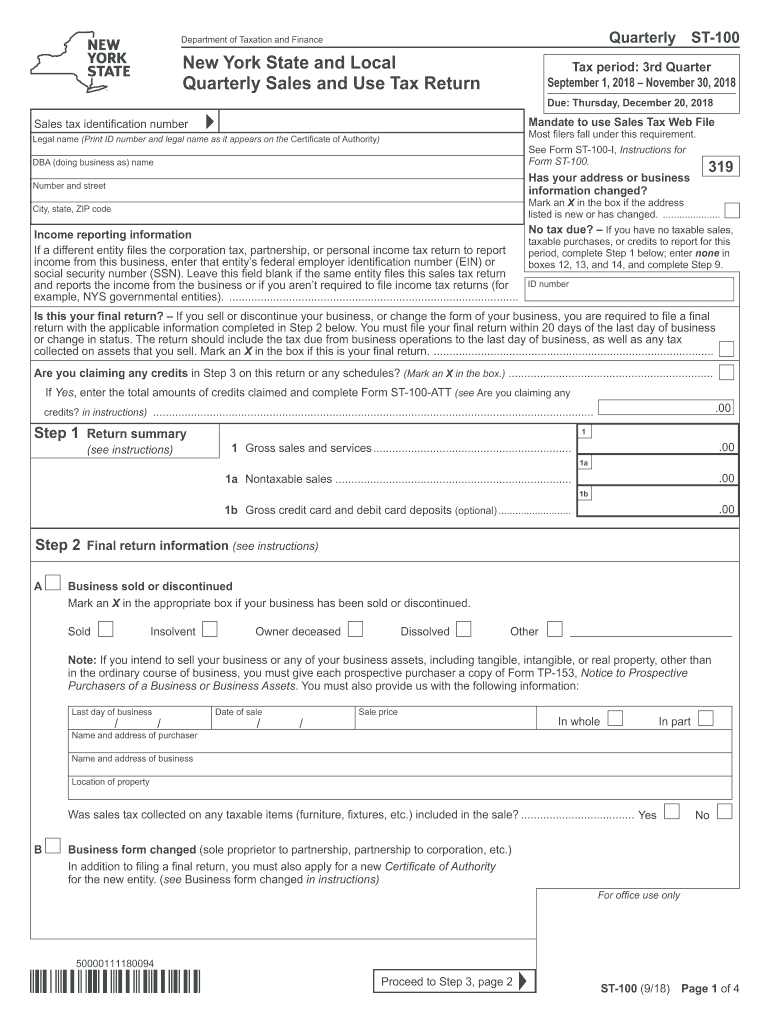

2018 Form NY DTF ST100 Fill Online, Printable, Fillable, Blank pdfFiller

Nonprofit organizations that sell, or make it known. A certificate is accepted in good faith when a contractor has no knowledge that the certificate is false or is fraudulently given, Web dor sales and use tax forms. (see publication 862 for additional information.) the term materials is defined as items that become a physical component part of real or personal.

You Must Give The Contractor A Properly Completed Form Within 90 Days After The Service Is Rendered.

Nonprofit organizations that sell, or make it known. That they sell, a product or related service. Here you will find an alphabetical listing of sales and use tax forms administered by the massachusetts department of revenue (dor). This certificate is only for use by a purchaser who:

(See Publication 862 For Additional Information.) The Term Materials Is Defined As Items That Become A Physical Component Part Of Real Or Personal Property, Such As Lumber, Bricks, Or Steel.

The contractor must use a separate form st‑120.1, contractor exempt purchase certificate, for each project. Purchase orders showing an exemption from the sales or use tax based on this certificate must contain the address of the Web for collecting sales tax on retail sales.) retailers can be businesses, individuals, or even. Web dor sales and use tax forms.

A Certificate Is Accepted In Good Faith When A Contractor Has No Knowledge That The Certificate Is False Or Is Fraudulently Given,

This term also includes items such as doors, windows, sinks, and furnaces used in construction.