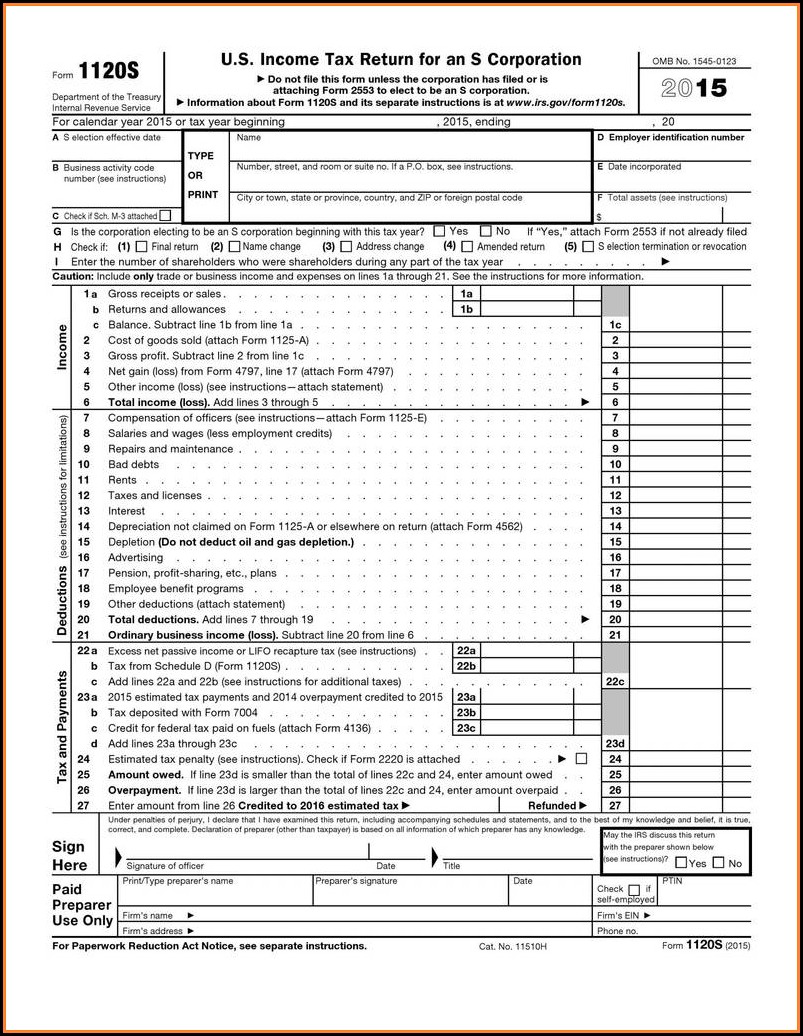

Form To Change Llc To S Corp

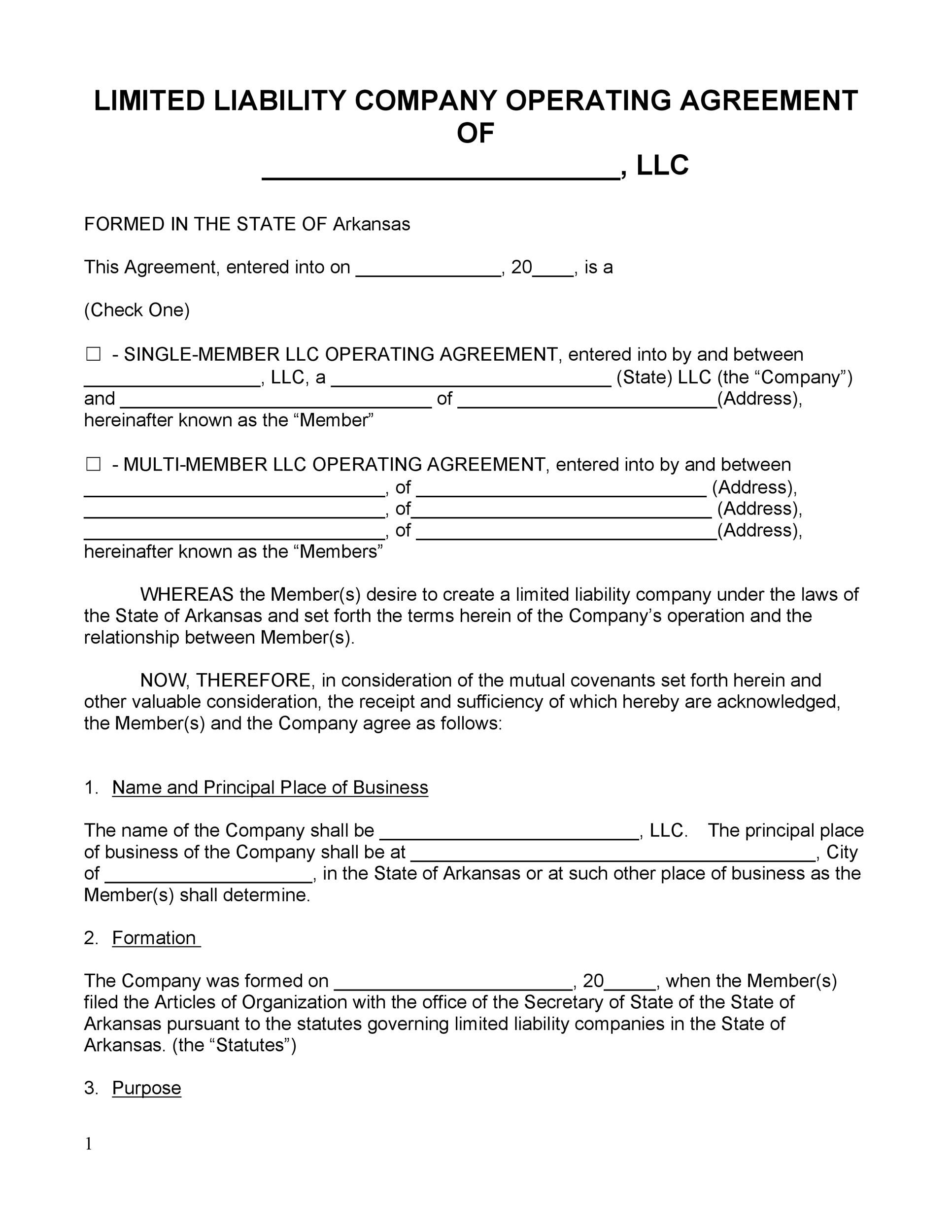

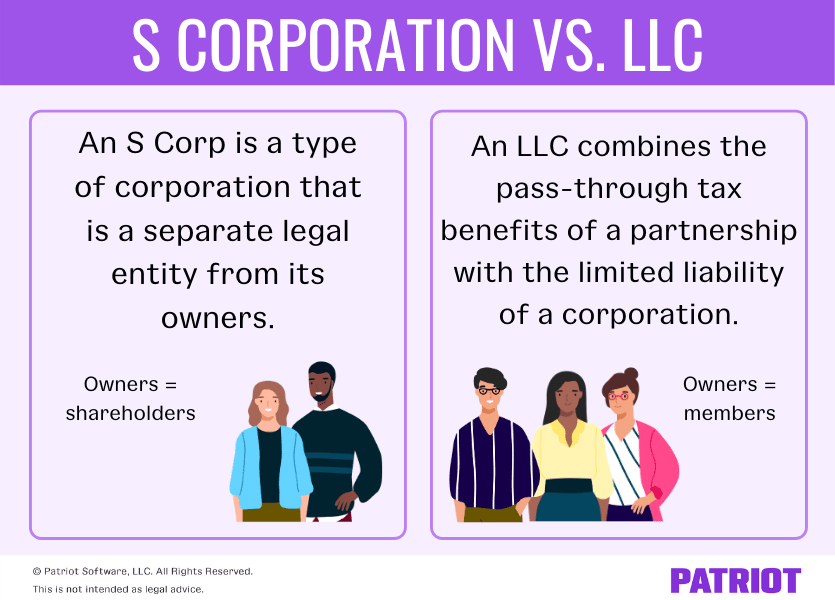

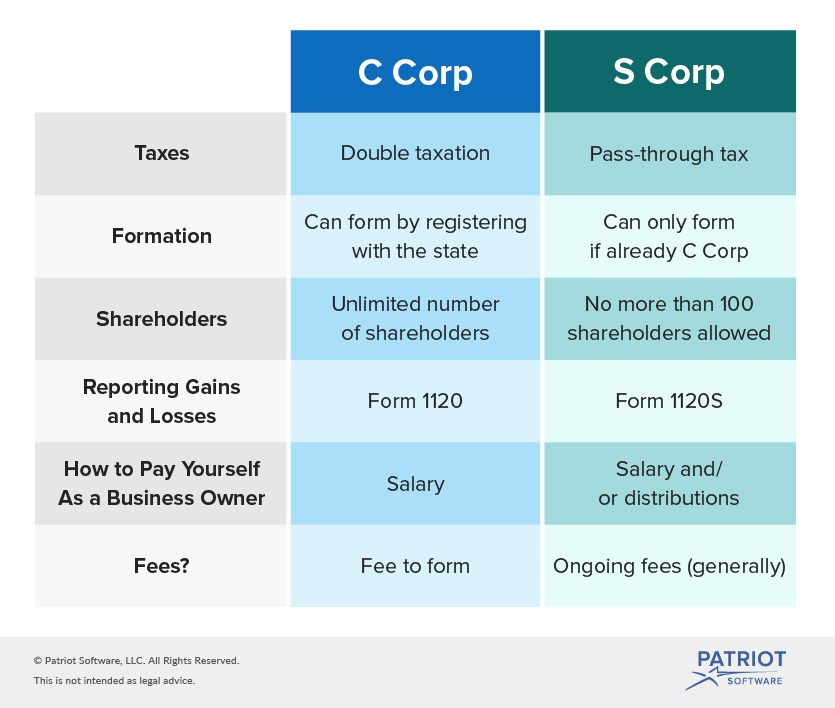

Form To Change Llc To S Corp - Cancel the llc while filing with the state for a new. To convert your llc to a west virginia corporation, you'll need to: A corporation receives a new charter from the secretary of state. Web dissolving a corporation to form an llc need a new llc? Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Web up to 25% cash back west virginia law currently only allows for statutory mergers. This transaction can be complicated. Our trusted & experienced business specialists provide personal customer support. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Ad 10 minute filing & fast turnaround time with swyft filings®.

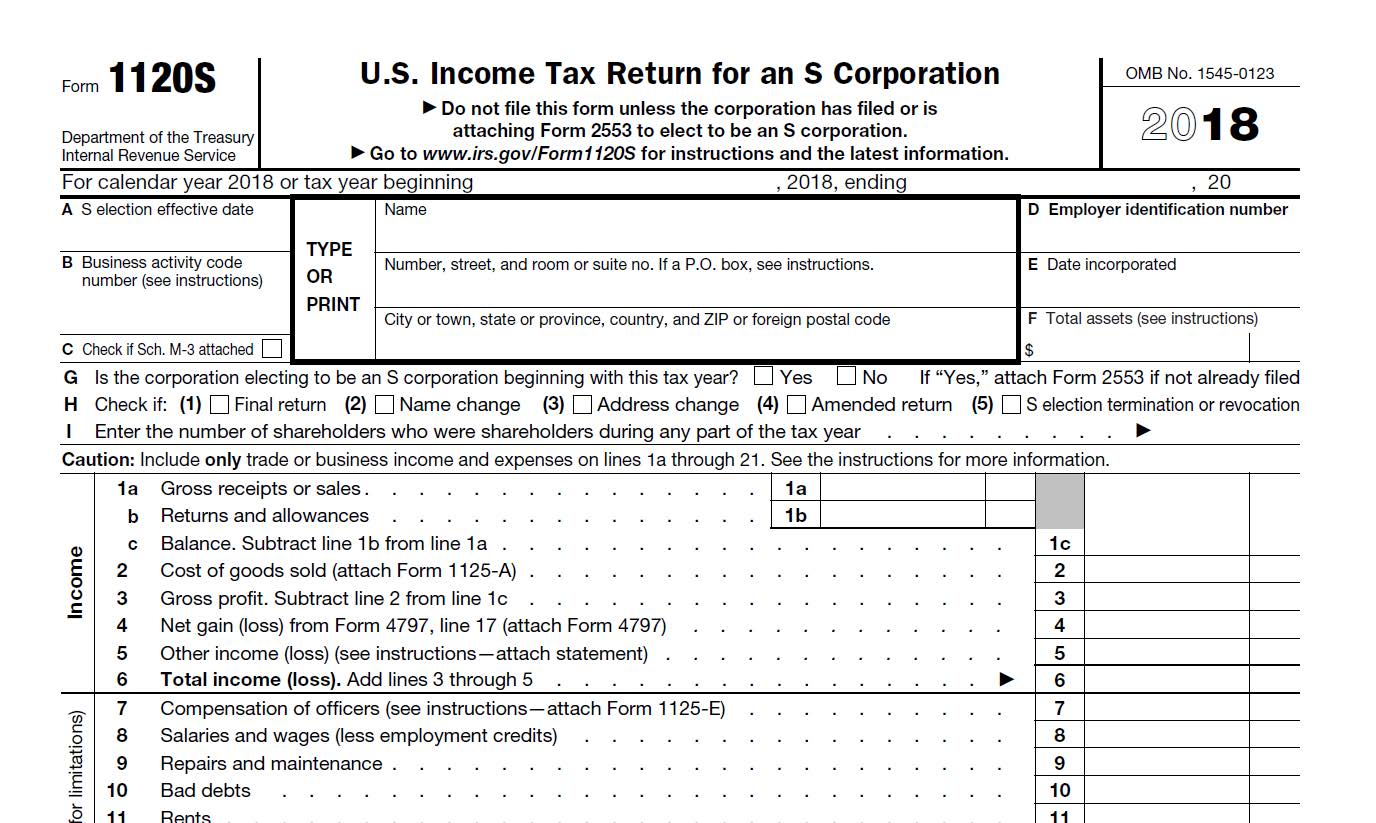

Web thus, an llc that has been treated as a partnership for several years may be able to prospectively change its classification to be treated as a corporation by filing. To convert your llc to a west virginia corporation, you'll need to: Web a corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362 (a) to be an s corporation. Keep your llc compliant w/ a registered agent, operating agreement, and business licenses. Our trusted & experienced business specialists provide personal customer support. Choose to be an s corporation by filling out form 2553; Web if your business is operating as a sole proprietorship, and you’re a u.s. Web change in kone corporation's holding of treasury shares. Ad protect your business from liabilities. But this time it's different, with levels taking a sharp downward turn at a time of year when sea ice usually.

Web to have your business treated as an s corporation, you must file form 8832 to inform the irs that you no longer want your llc to be taxed as a partnership or sole. Keep your llc compliant w/ a registered agent, operating agreement, and business licenses. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Web if your business is operating as a sole proprietorship, and you’re a u.s. Ad 10 minute filing & fast turnaround time with swyft filings®. A corporation receives a new charter from the secretary of state. Web you can change your limited liability company (llc) to an s corporation (s corp) by filing form 2553 with the internal revenue service (irs). Citizen or equivalent, converting to an s corporation is relatively simple. Cancel the llc while filing with the state for a new. Web dissolving a corporation to form an llc need a new llc?

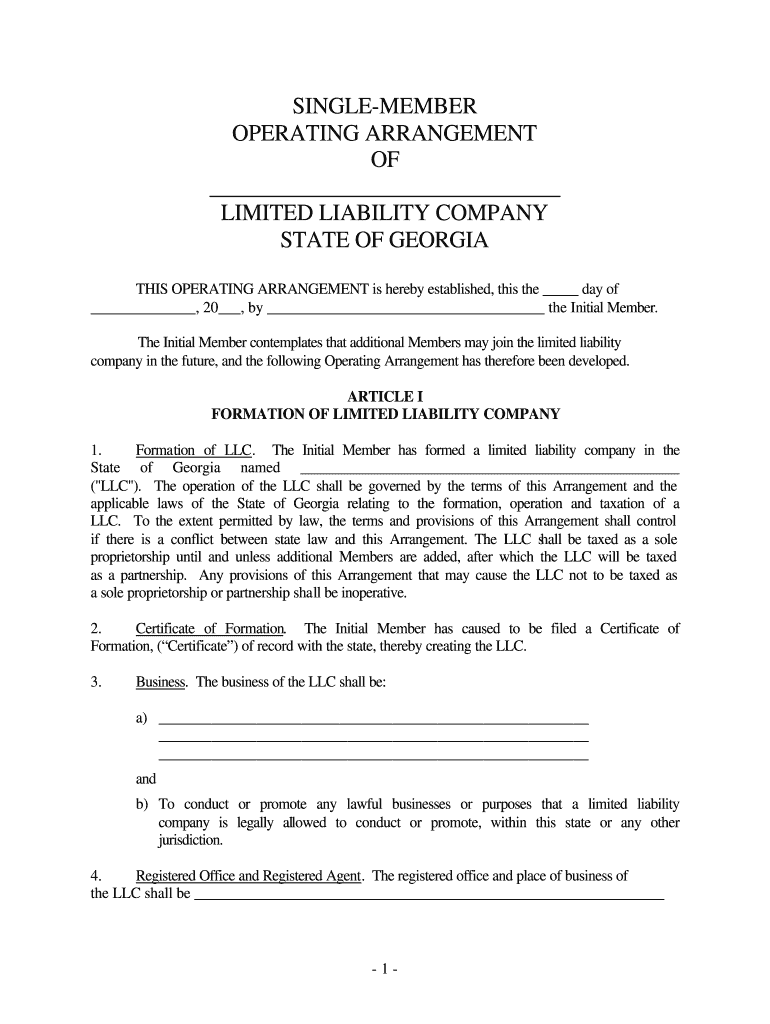

30 plantillas profesionales de acuerdos operativos de LLC Mundo

Web up to 25% cash back west virginia law currently only allows for statutory mergers. Ad 10 minute filing & fast turnaround time with swyft filings®. Web change in kone corporation's holding of treasury shares. Home of the $0 llc. Web to change an llc to an s corp (s corporation) is a move that intelligent business proprietors looking to.

S Corp vs. LLC Q&A, Pros & Cons of Each, & More

Web if your business is operating as a sole proprietorship, and you’re a u.s. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Kone corporation has assigned a total of 18,485 kone class b shares to two key employees. Web you can change your.

What Is the Difference Between S Corp and C Corp? Business Overview

Incfile can help converting s corp to an llc involves planning out the conversion in detail, gaining. It may take a few steps, but it is by no means complicated. Choose to be an s corporation by filling out form 2553; Web send the irs a letter informing them of the structural change; Web watch newsmax live for the latest.

LLC vs. SCorp Which One is Right for You? Filenow

Web to change an llc to an s corp (s corporation) is a move that intelligent business proprietors looking to reduce tax liability might consider. Choose to be an s corporation by filling out form 2553; Web to have your business treated as an s corporation, you must file form 8832 to inform the irs that you no longer want.

Llc Operating Agreement Pdf Fill Online, Printable, Fillable

It may take a few steps, but it is by no means complicated. Web antarctic sea ice has usually been able to recover in winter. You need to file a. Start your s corporation now. Keep your llc compliant w/ a registered agent, operating agreement, and business licenses.

An SCorp Gift Charitable Solutions, LLC

Web to have your business treated as an s corporation, you must file form 8832 to inform the irs that you no longer want your llc to be taxed as a partnership or sole. After all, it is only a filed form. You need to file a. Our trusted & experienced business specialists provide personal customer support. Web in order.

Limited Liability Company LLC Operating Agreement Fill out

Choose to be an s corporation by filling out form 2553; This transaction can be complicated. Web to change an llc to an s corp (s corporation) is a move that intelligent business proprietors looking to reduce tax liability might consider. You need to file a. Start yours for $0 + filing fees.

81 [PDF] FORM 8832 APPROVAL FREE PRINTABLE DOCX 2020 ApprovalForm2

Trusted by over 1,000,000 business owners worldwide since 2004. Web to have your business treated as an s corporation, you must file form 8832 to inform the irs that you no longer want your llc to be taxed as a partnership or sole. Cancel the llc while filing with the state for a new. Web change in kone corporation's holding.

Printable Irs Forms 1040ez 2017 Form Resume Examples qeYzK8WV8X

Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Web a corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362 (a) to be an s corporation. Web send the irs a letter.

Convert Your Tax Status From LLC To S Corp In 7 Steps

Web thus, an llc that has been treated as a partnership for several years may be able to prospectively change its classification to be treated as a corporation by filing. Web send the irs a letter informing them of the structural change; This transaction can be complicated. Web in order to become an s corporation, the corporation must submit form.

You Will Be Required To Obtain A New Ein If Any Of The Following Statements Are True.

Ad 10 minute filing & fast turnaround time with swyft filings®. Start your s corporation now. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Incfile can help converting s corp to an llc involves planning out the conversion in detail, gaining.

Keep Your Llc Compliant W/ A Registered Agent, Operating Agreement, And Business Licenses.

Web if your business is operating as a sole proprietorship, and you’re a u.s. You need to file a. Web antarctic sea ice has usually been able to recover in winter. Web dissolving a corporation to form an llc need a new llc?

Web In Some States, You Must First Form Your Llc And Then Merge The S Corporation Into The Existing Llc.

Kone corporation has assigned a total of 18,485 kone class b shares to two key employees. After all, it is only a filed form. Citizen or equivalent, converting to an s corporation is relatively simple. Trusted by over 1,000,000 business owners worldwide since 2004.

Web Change In Kone Corporation's Holding Of Treasury Shares.

Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Our trusted & experienced business specialists provide personal customer support. Web to have your business treated as an s corporation, you must file form 8832 to inform the irs that you no longer want your llc to be taxed as a partnership or sole. This transaction can be complicated.

![81 [PDF] FORM 8832 APPROVAL FREE PRINTABLE DOCX 2020 ApprovalForm2](https://www.llcuniversity.com/wp-content/uploads/IRS-CP277-Form-8832-Approval.jpg)