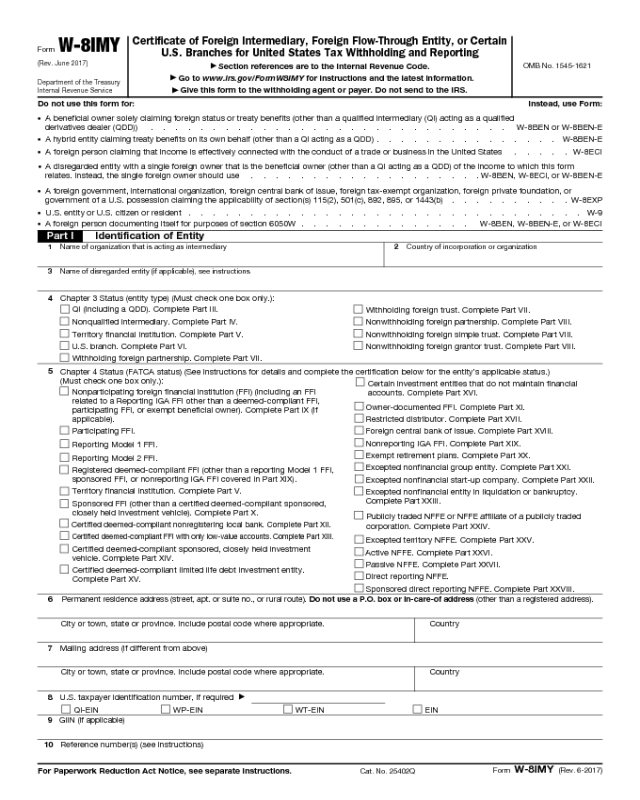

Form W 8Imy Instructions

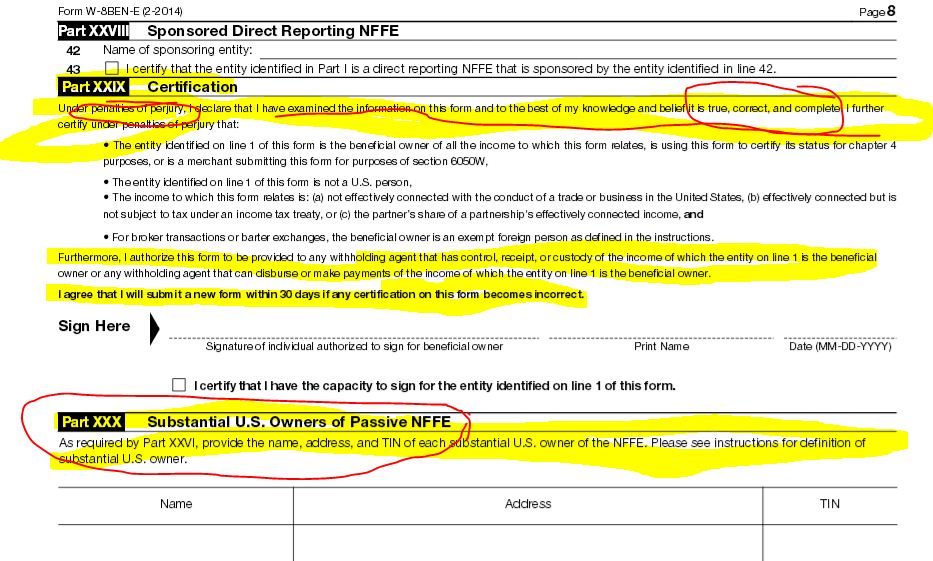

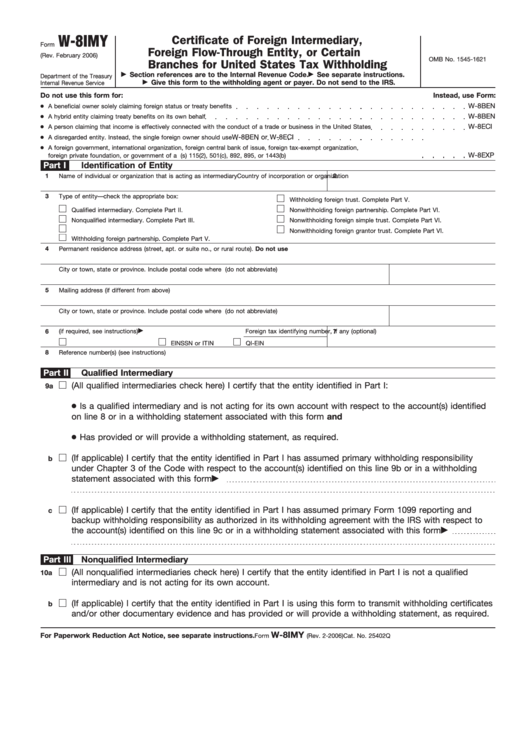

Form W 8Imy Instructions - The updates were necessary, in part, due to the 2017 tax law (pub. Branches for united states tax withholding and reporting. Represent that a foreign person is a qualified intermediary or nonqualified. Who needs to complete this form? Section references are to the internal revenue code unless otherwise noted. Web instructions for the withholding agent, see the instructions for the requester of forms. Web including instructions for completing: October 2021) department of the treasury internal revenue service. Branches for united states tax withholding and reporting, including recent updates, related forms, and instructions on how to file. Branches for united states tax withholding and reporting.

Represent that a foreign person is a qualified intermediary or nonqualified. Who needs to complete this form? Branches for united states tax withholding and reporting. Web including instructions for completing: October 2021) department of the treasury internal revenue service. Section references are to the internal revenue code. Web instructions for the withholding agent, see the instructions for the requester of forms. The updates were necessary, in part, due to the 2017 tax law (pub. Section references are to the internal revenue code unless otherwise noted. Branches for united states tax withholding and reporting.

October 2021) department of the treasury internal revenue service. The updates were necessary, in part, due to the 2017 tax law (pub. Section references are to the internal revenue code. Web including instructions for completing: Who needs to complete this form? Represent that a foreign person is a qualified intermediary or nonqualified. Branches for united states tax withholding and reporting, including recent updates, related forms, and instructions on how to file. Branches for united states tax withholding and reporting. Web instructions for the withholding agent, see the instructions for the requester of forms. Section references are to the internal revenue code unless otherwise noted.

W 8 imy instructions

Branches for united states tax withholding and reporting. Branches for united states tax withholding and reporting. Section references are to the internal revenue code. Section references are to the internal revenue code unless otherwise noted. Web instructions for the withholding agent, see the instructions for the requester of forms.

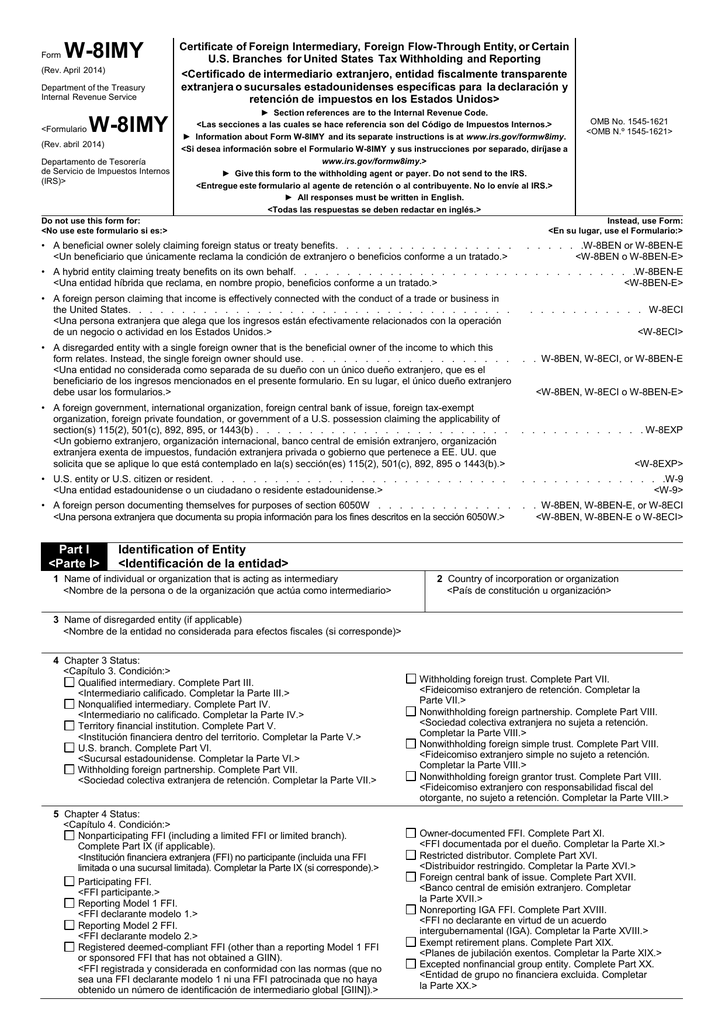

W 8imy Instructions 2016

Branches for united states tax withholding and reporting, including recent updates, related forms, and instructions on how to file. Represent that a foreign person is a qualified intermediary or nonqualified. Who needs to complete this form? Branches for united states tax withholding and reporting. Section references are to the internal revenue code.

Form W8IMY Edit, Fill, Sign Online Handypdf

Web instructions for the withholding agent, see the instructions for the requester of forms. Section references are to the internal revenue code unless otherwise noted. Section references are to the internal revenue code. Branches for united states tax withholding and reporting. Web including instructions for completing:

W 8imy Instructions 2016

Branches for united states tax withholding and reporting, including recent updates, related forms, and instructions on how to file. Represent that a foreign person is a qualified intermediary or nonqualified. Web instructions for the withholding agent, see the instructions for the requester of forms. Section references are to the internal revenue code. Who needs to complete this form?

Fillable Form W8imy Certificate Of Foreign Intermediary, Foreign

Section references are to the internal revenue code. Branches for united states tax withholding and reporting. Web including instructions for completing: Who needs to complete this form? Branches for united states tax withholding and reporting.

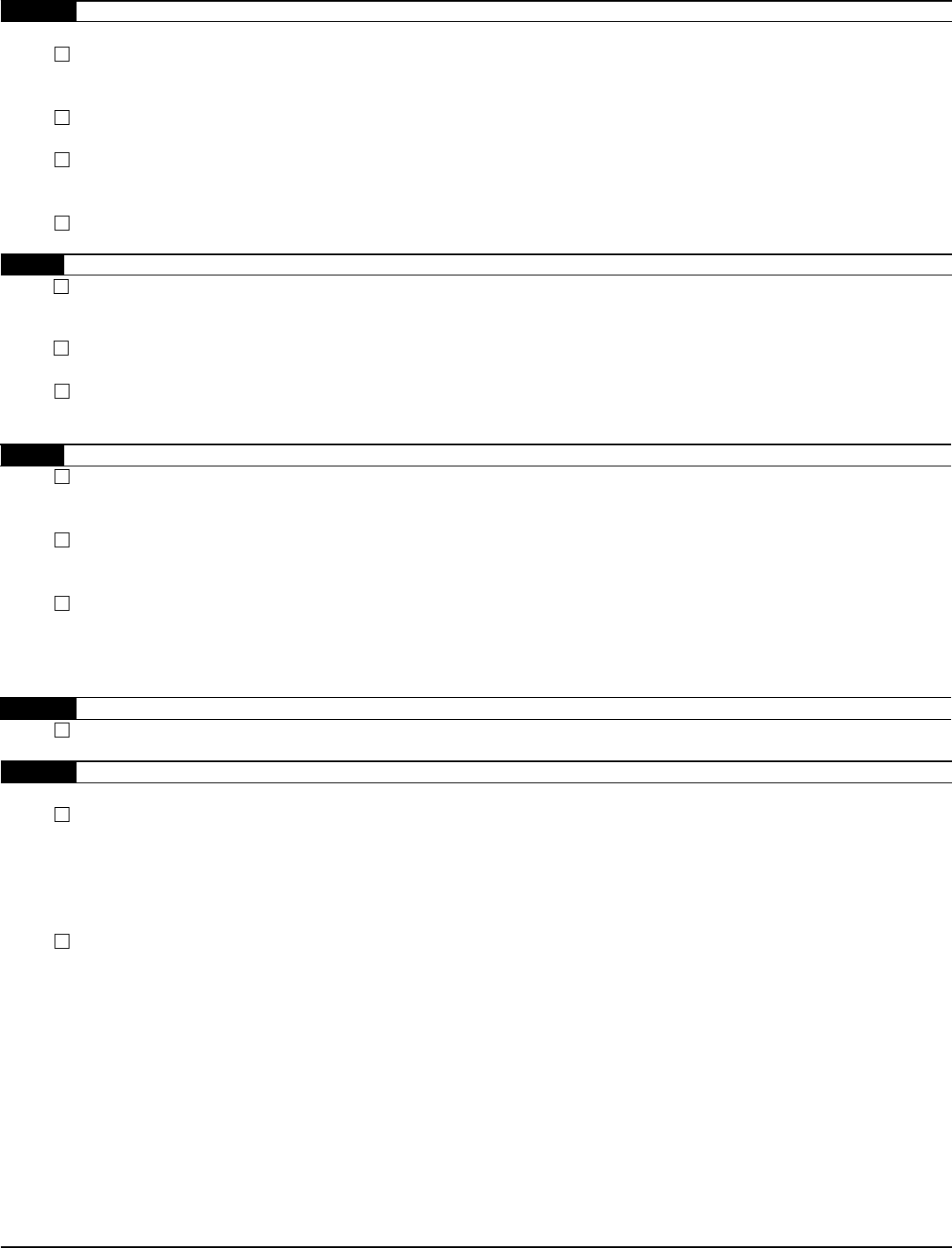

Form W8IMY Edit, Fill, Sign Online Handypdf

Branches for united states tax withholding and reporting, including recent updates, related forms, and instructions on how to file. Section references are to the internal revenue code. Branches for united states tax withholding and reporting. Section references are to the internal revenue code unless otherwise noted. Who needs to complete this form?

W8 imy instructions tikloodd

Branches for united states tax withholding and reporting. Branches for united states tax withholding and reporting. Represent that a foreign person is a qualified intermediary or nonqualified. Section references are to the internal revenue code. Section references are to the internal revenue code unless otherwise noted.

Form W8IMY Edit, Fill, Sign Online Handypdf

Branches for united states tax withholding and reporting. Web including instructions for completing: Web instructions for the withholding agent, see the instructions for the requester of forms. Branches for united states tax withholding and reporting. Section references are to the internal revenue code unless otherwise noted.

classification « TaxExpatriation

Branches for united states tax withholding and reporting. Branches for united states tax withholding and reporting. Web including instructions for completing: October 2021) department of the treasury internal revenue service. Section references are to the internal revenue code.

W 8imy Instructions 2016

Web including instructions for completing: Represent that a foreign person is a qualified intermediary or nonqualified. October 2021) department of the treasury internal revenue service. The updates were necessary, in part, due to the 2017 tax law (pub. Web instructions for the withholding agent, see the instructions for the requester of forms.

Web Including Instructions For Completing:

Branches for united states tax withholding and reporting. Branches for united states tax withholding and reporting. Branches for united states tax withholding and reporting, including recent updates, related forms, and instructions on how to file. Who needs to complete this form?

Web Instructions For The Withholding Agent, See The Instructions For The Requester Of Forms.

Represent that a foreign person is a qualified intermediary or nonqualified. October 2021) department of the treasury internal revenue service. The updates were necessary, in part, due to the 2017 tax law (pub. Section references are to the internal revenue code unless otherwise noted.